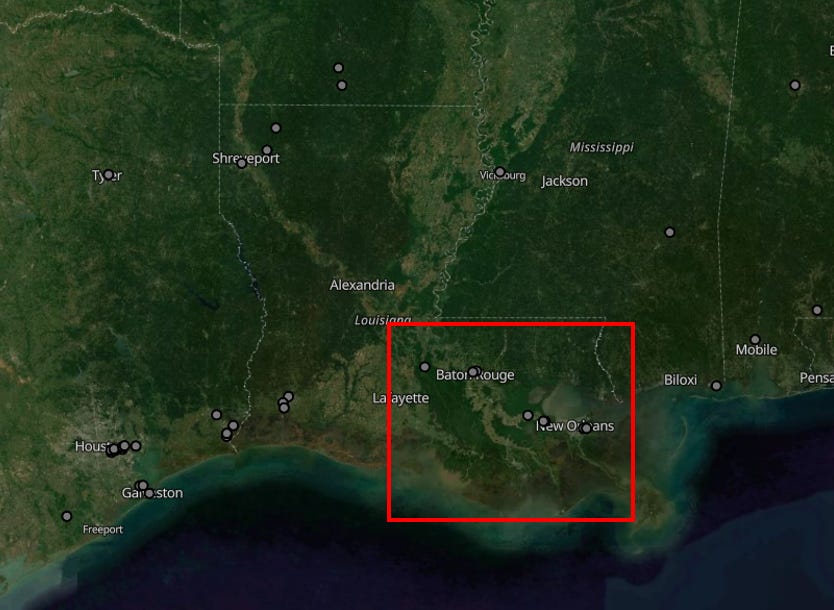

Southeast Louisiana’s Crude Oil Refining Powerhouse

The southeast region of Louisiana is a critical hub in the state's oil industry, characterized by significant refining capacity and complex supply dynamics. This area, distinct from the southwest and northwest regions, hosts some of the largest refineries in the state, including ExxonMobil’s Baton Rouge refinery and Marathon’s Garyville refinery, which together account for over 1.1 million barrels per day of refining capacity. Additional medium-sized refineries, such as Valero’s Norco, Shell’s Norco, and PBF’s facilities, contribute to a total refining demand of over 1.8 million barrels per day. This substantial demand underscores the region’s role as a key player in the U.S. energy landscape, relying heavily on a mix of offshore and onshore crude oil supplies to meet its needs.

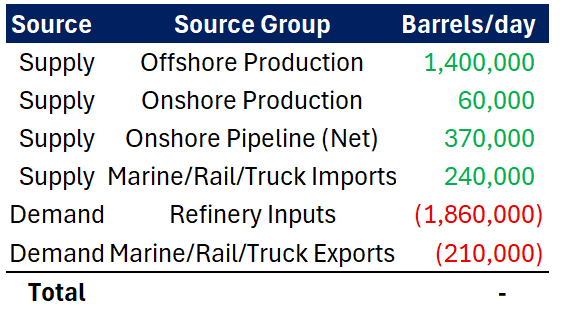

Offshore Production as the Supply Cornerstone

Offshore production from the Gulf of Mexico is the cornerstone of crude oil supply for southeast Louisiana, delivering approximately 1.4 million barrels per day to the region. This accounts for the majority of the 1.8 million barrels per day of total U.S. Gulf offshore production, with the remainder primarily directed to Texas and smaller amounts to Mississippi and Alabama. Onshore production within Louisiana, estimated at about 60,000 barrels per day in this region, provides a supplementary but minor contribution. The balance of supply and demand is further shaped by non-pipeline imports and exports, which tend to offset each other, and by onshore pipelines that play a critical role in addressing the demand not met by offshore sources.

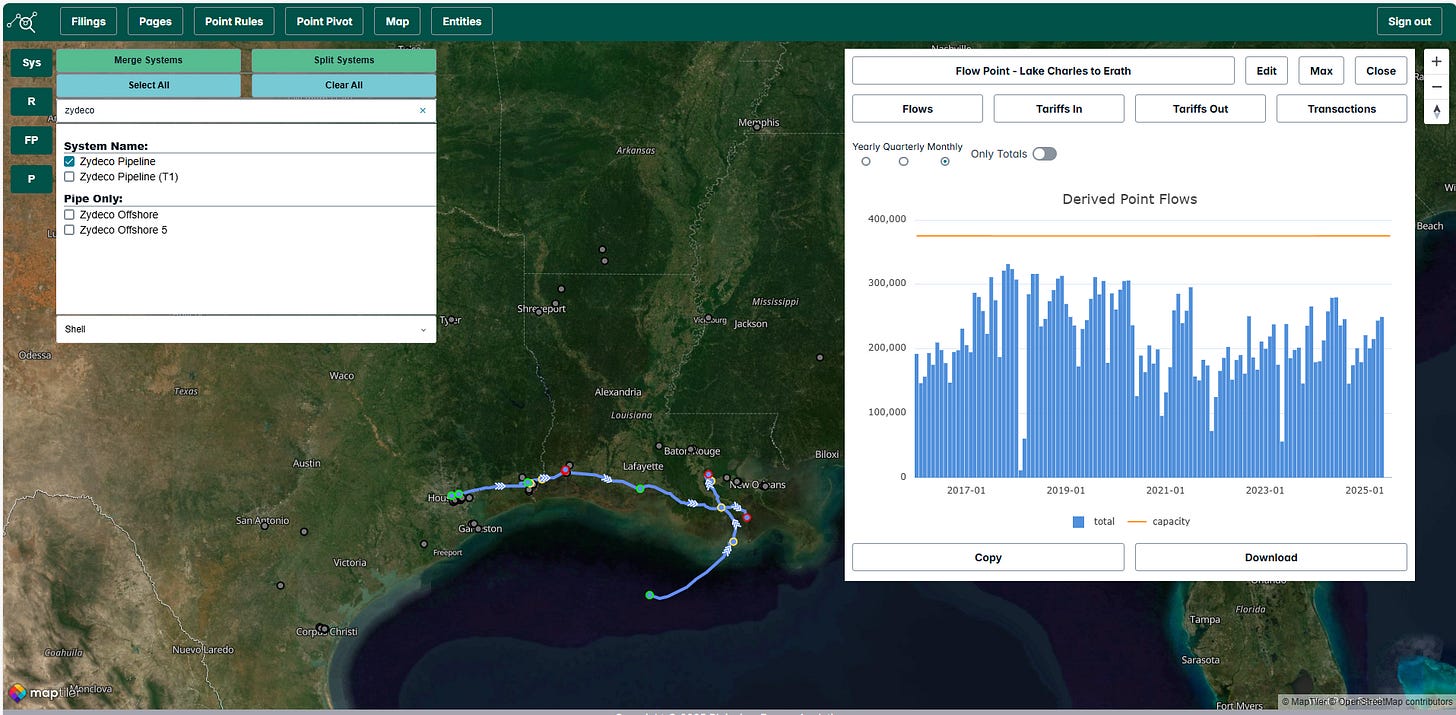

Pipeline Networks Bridging the Supply Gap

Several key pipelines feed crude oil into southeast Louisiana, collectively delivering approximately 500,000 to 550,000 barrels per day. The Zydeco pipeline supplies 150,000 to 250,000 barrels per day, primarily light crude, while the Bayou Bridge pipeline contributes around 100,000 barrels per day. Permian Express delivers about 100,000 barrels per day of light Permian crude, and the Capline pipeline, reversed in recent years, adds roughly 150,000 barrels per day. Chevron’s Cal-KY pipeline is the only major egress pipeline out of the region, moving 150,000 to 200,000 barrels per day to the Pascagoula refinery in Mississippi. The net result is approximately 370,000 barrels per day of supply imported by pipeline.

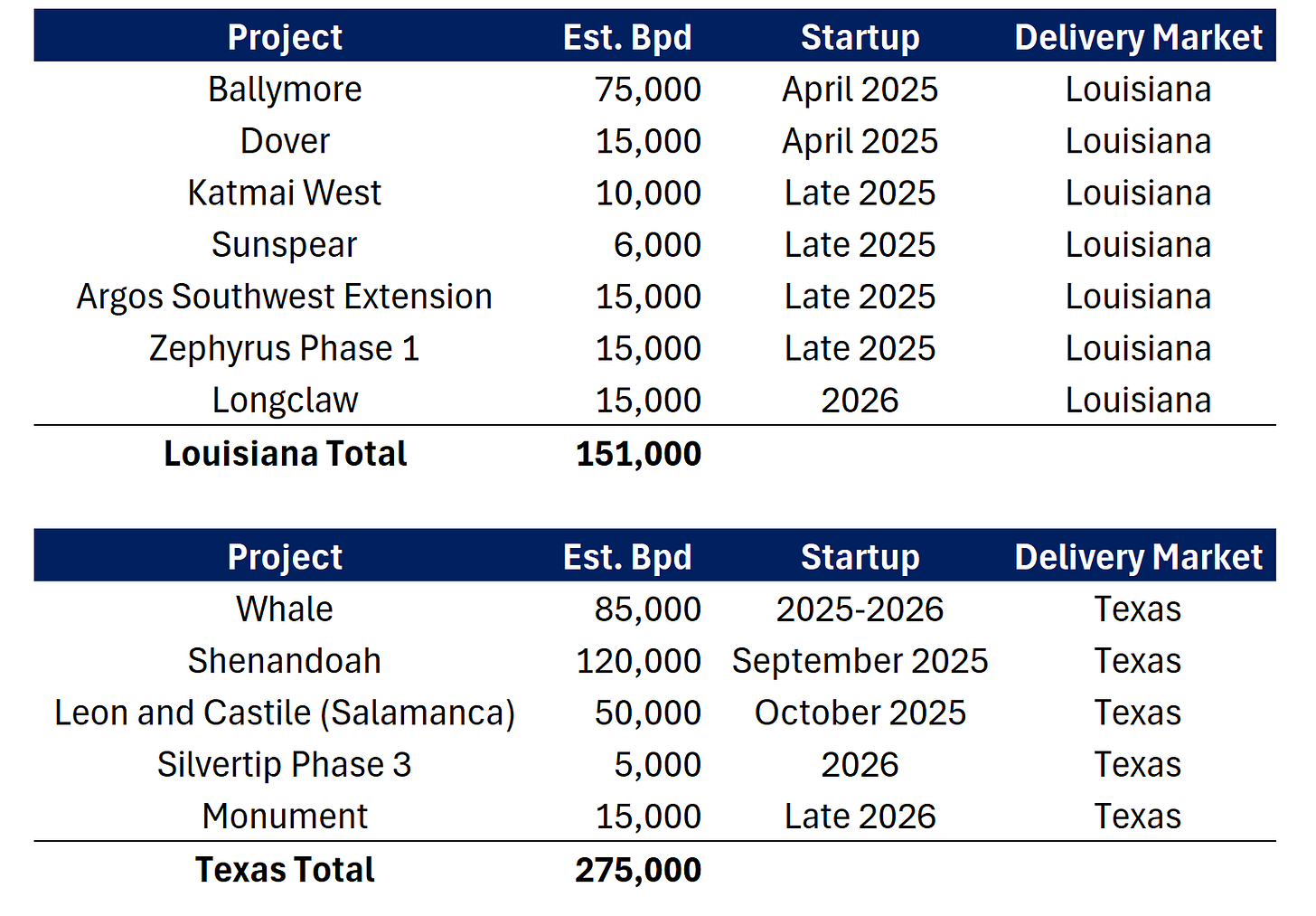

Upcoming Supply Challenges and Pipeline Opportunities

Looking ahead, the region’s supply dynamics face potential shifts due to changes in offshore production. While Gulf of Mexico production is projected to remain flat at around 1.8 million barrels per day (EIA STEO), new projects coming online in 2025 and 2026 will primarily direct their oil flows toward Texas. This could lead to a decline in Louisiana’s offshore supply, creating an imbalance that will need to be addressed. The reduction in offshore supply is likely to be offset by increased inbound pipeline flows or waterborne imports. One pipeline project aiming to capitalize on this potential gap in supply is Enbridge and Energy Transfer’s newly announced Southern Illinois Connector project, targeting heavy crude into Louisiana refineries.