Questions: matthew.lewis@plainview-energy.com

What Are Oil and Liquids Pipeline Tariffs?

Liquids pipeline tariffs, regulated by the Federal Energy Regulatory Commission (FERC), determine costs for transporting oil and other liquids. New pipelines submit initial rates through cost-of-service filings, outlining expected returns, or provide affidavits from unaffiliated shippers agreeing to proposed rates. After this, pipelines use rate structures like index rates, settlement rates, market-based rates, or cost-of-service rates. Index rates, used by most liquids pipelines, allow annual adjustments based on a FERC-set inflation factor, setting a maximum tariff ceiling that may increase over time.

How FERC Calculates Pipeline Tariff Index Rates

Every five years, FERC reviews the liquids tariff index by analyzing pipeline cost changes per barrel transported over distance. It trims outliers (top/bottom 25% for middle 50% dataset or 10% for middle 80%) and averages the mean, median, and weighted mean to determine a cost trend. This is compared to the Producer Price Index for Finished Goods (PPI-FG). For example, if pipeline costs over the previous five years rise 2% while PPI-FG is 3%, the adjustment is set at PPI-FG minus 1%, capping future rate hikes.

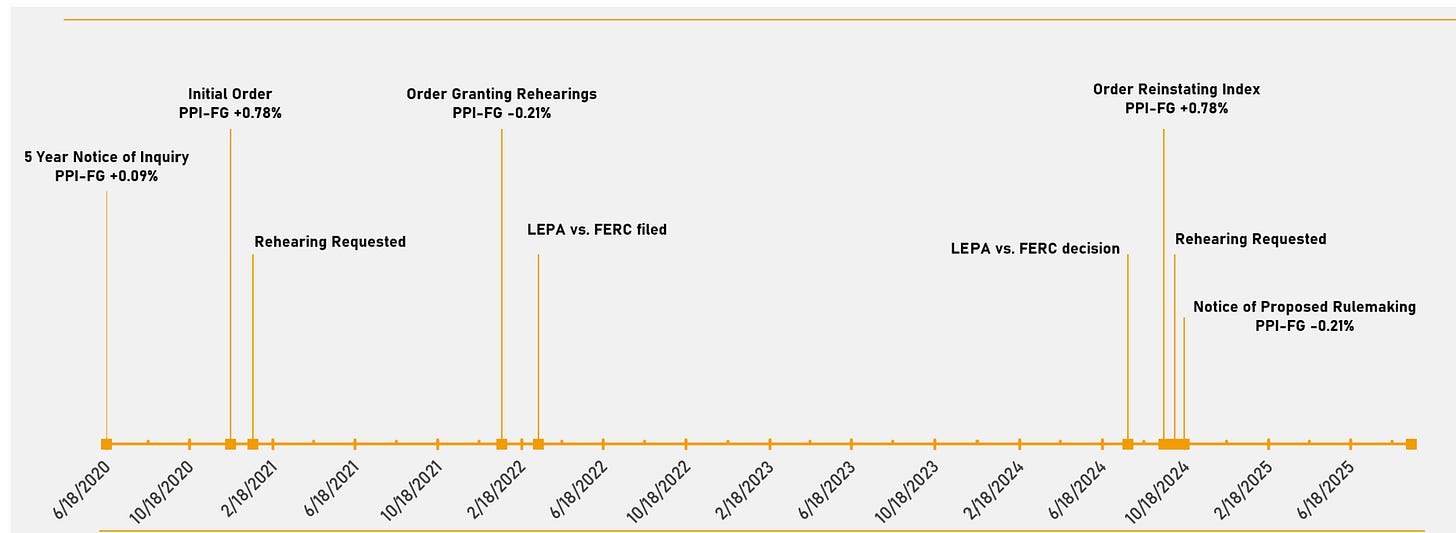

2020 FERC Tariff Review and Industry Disputes

The 2020 FERC review sparked debate over trimming datasets to the middle 50% or 80%. FERC initially proposed PPI-FG plus 0.09% (middle 50%), but pipeline operators’ lobbying led to PPI-FG plus 0.78% (middle 80% with other adjustments). Shippers protested, and in 2022, new FERC commissioners reversed it to PPI-FG minus 0.21%. In 2024, the LEPA v. FERC court ruling found FERC violated comment period rules, reinstating PPI-FG plus 0.78%. A late-2024 rulemaking proposes reverting to the lower rate for 2025, but FERC’s wording suggests it is unlikely to apply retroactively.

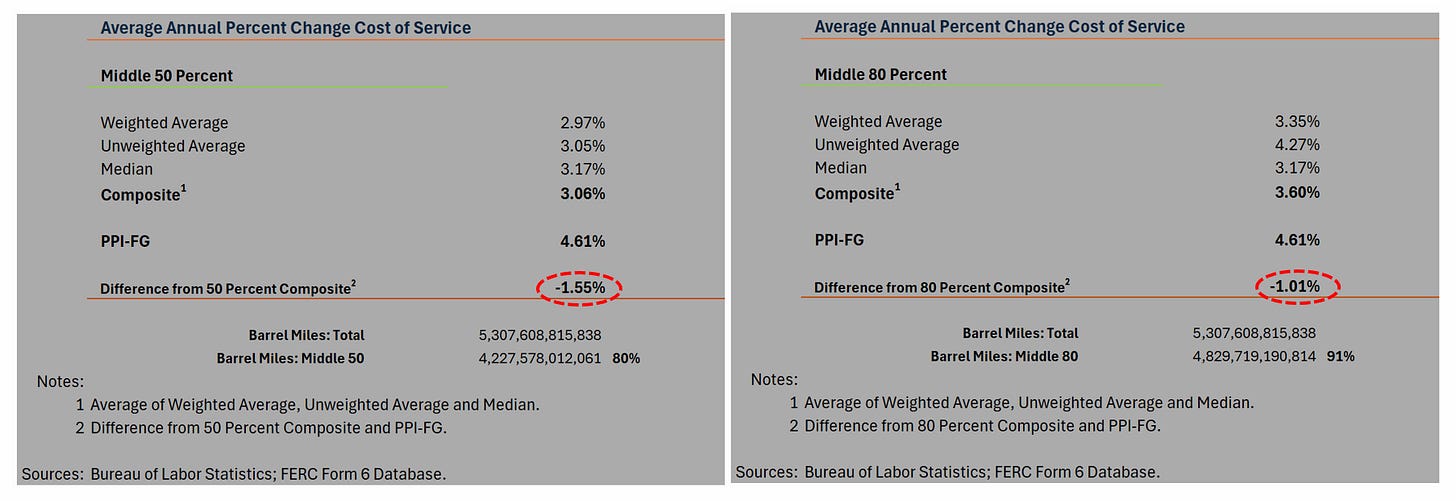

2025 FERC Tariff Review: Lower Index Rates Ahead

The 2025 FERC review is likely to lower index rates (relative to 2021-2025), as our analysis shows pipeline cost inflation (3.06%-3.60%) lagged PPI-FG (4.6%) from 2021-2025. This points to a deflator adjustment, such as PPI-FG minus 1.55% (middle 50%) or slightly higher PPI-FG minus 1.01% (middle 80%), limiting tariff increases compared to the 2021-2025 period’s PPI-FG plus 0.78%. The debate over dataset trimming persists, and new FERC commissioners, potentially a Republican majority, could favor pipelines, though the outcome remains uncertain.

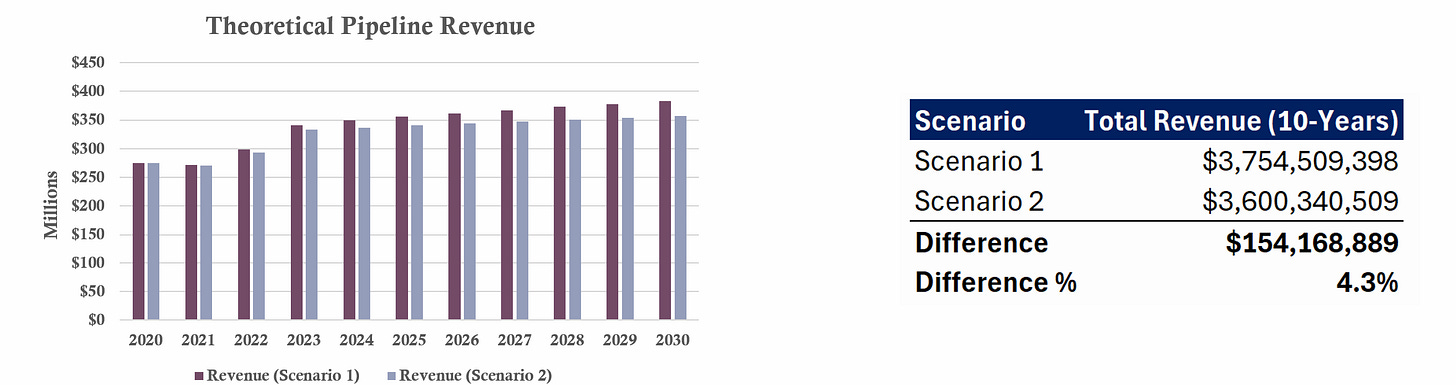

Impact of Lower Tariff Index Rates on Pipeline Profits

Lower index rates could significantly cut pipeline revenue due to compounding effects. For a medium-sized pipeline (300,000 barrels/day at $2.50/barrel), a middle 80% dataset versus a middle 50% dataset would yield a $154 million revenue gap over 10 years, or 4.3% of cumulative revenue. For major operators with extensive networks, revenue differences could scale to billions, underscoring the need for robust regulatory strategies to navigate the 2025 review.