Questions: matthew.lewis@plainview-energy.com

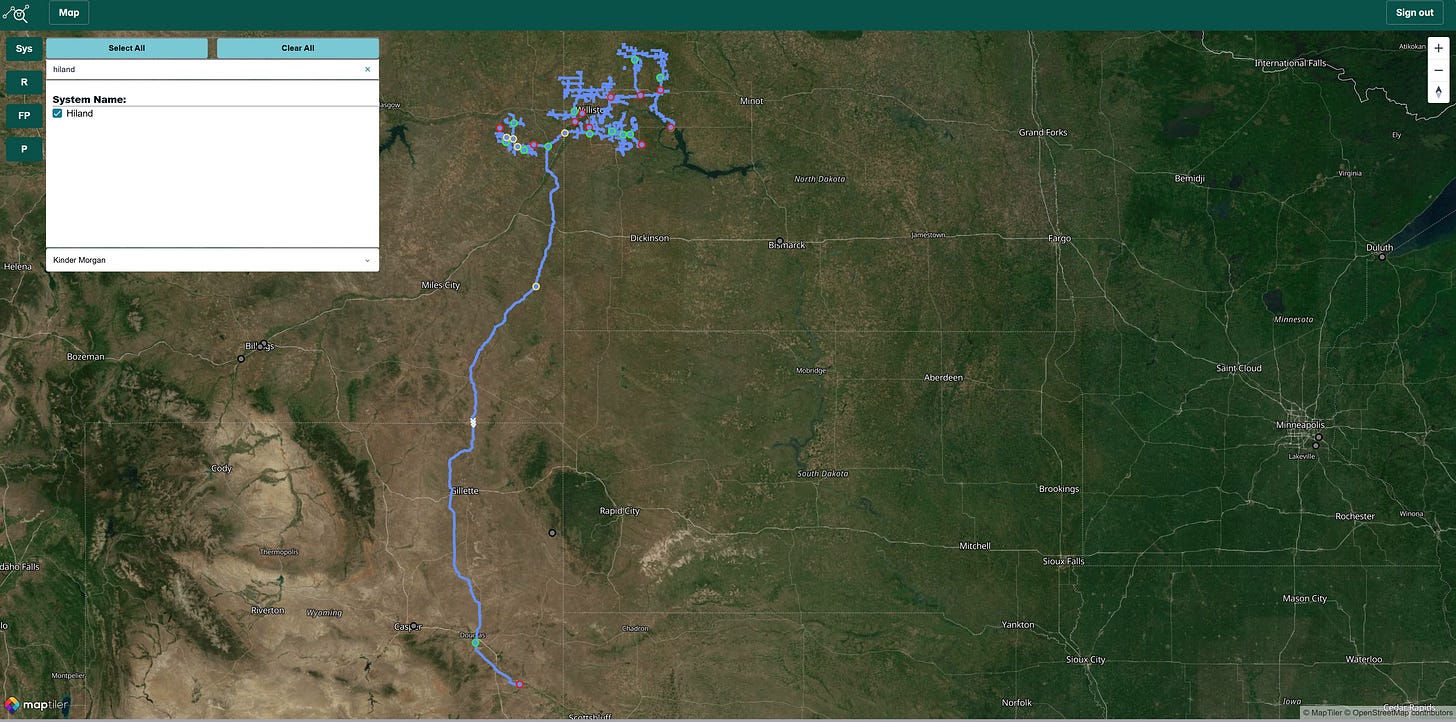

Overview of the Hiland Gathering System in the Bakken

The Hiland system, owned by Kinder Morgan, encompasses gathering pipelines in the Bakken region that collect approximately 165,000 barrels per day (bpd) of crude oil. Of this volume, only about 65,000 bpd flows southward via the Double H pipeline from the Montana-North Dakota border to Guernsey, Wyoming. The majority of the gathered oil (around 100,000 bpd) feeds into third-party egress pipelines or rail terminals, including Enbridge, Dakota Access Pipeline (DAPL), and Bridger, highlighting the system’s role as a key aggregator rather than a primary transporter to Guernsey.

Double H Pipeline Conversion: From Crude to NGL and Its Crude Implications

The ongoing conversion of the Double H pipeline from crude to natural gas liquids (NGL) service, commencing this month, eliminates this direct southern outlet for the 65,000 bpd, necessitating rerouting to alternative pipelines. Regulatory filings indicate that most of the gathering infrastructure in North Dakota will remain operational for crude. A new 12-inch NGL line is under construction from the Watford City natural gas plant northward, converting a portion of the system to handle Y-grade NGLs, while preserving crude connectivity in core areas. For context on downstream logistics of the Y-grade, a recent RBN Analysis details Kinder Morgan’s plans to move NGLs from Guernsey to markets via existing infrastructure.

Top Egress Pipelines Poised to Capture Displaced Bakken Barrels

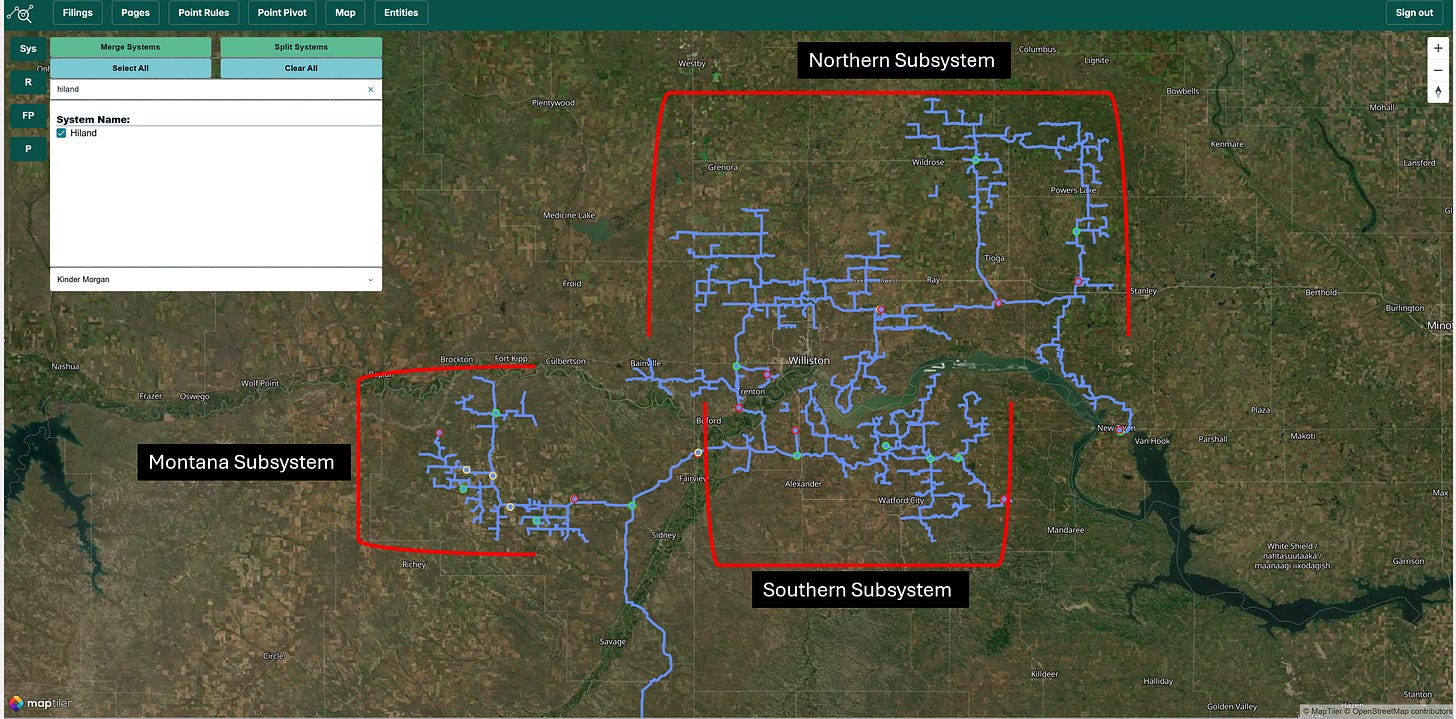

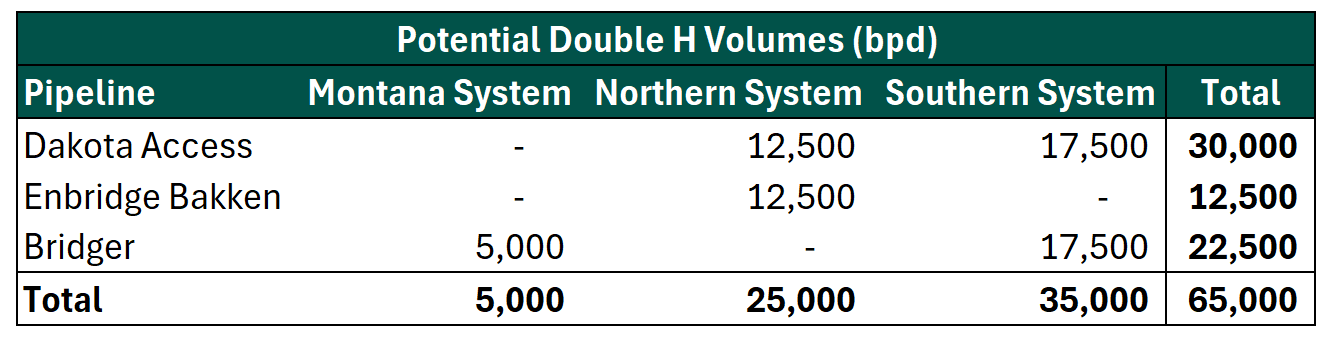

Geographically, three main egress options stand out for absorbing the displaced volumes: DAPL, Enbridge’s Bakken line, and Bridger. DAPL offers strong connectivity across both northern and southern subsystems in North Dakota, positioning it to capture barrels from areas previously routed to Double H. Enbridge’s Bakken line, with available capacity after historical competition from DAPL reduced its flows, aligns well with the northern subsystem but has limited reach into southern gathering areas. Bridger excels in the Montana (Richland County) and southern North Dakota subsystems through multiple trunk line connections, though it lacks northern access above the river.

Subsystem Breakdown: Geographic Winners for Rerouted Volumes

Breaking down the subsystems, the Montana area sees a net receipt of 3,000-5,000 bpd on Hiland, likely shifting entirely to Bridger due to its proximity and sole direct connection. The northern North Dakota subsystem, estimated at 25,000 bpd up for grabs, pits Enbridge against DAPL, with a roughly 50-50 split anticipated given Enbridge’s footprint and recent rate adjustments clawing back volumes. In the southern subsystem, around 30,000-35,000 bpd could move splitting evenly between DAPL and Bridger.

Competitive Economics Driving Balanced Redistribution in the Basin

Current economics among these options are closely competitive, unlike five to six years ago when DAPL dominated, enabling a balanced redistribution of the 65,000 bpd without favoring one pipeline overwhelmingly. This shift underscores evolving basin dynamics, with potential for further analysis on tariffs and joint ventures in upcoming discussions.