Mainline Optimization: Boosting Alberta-to-Midwest Capacity

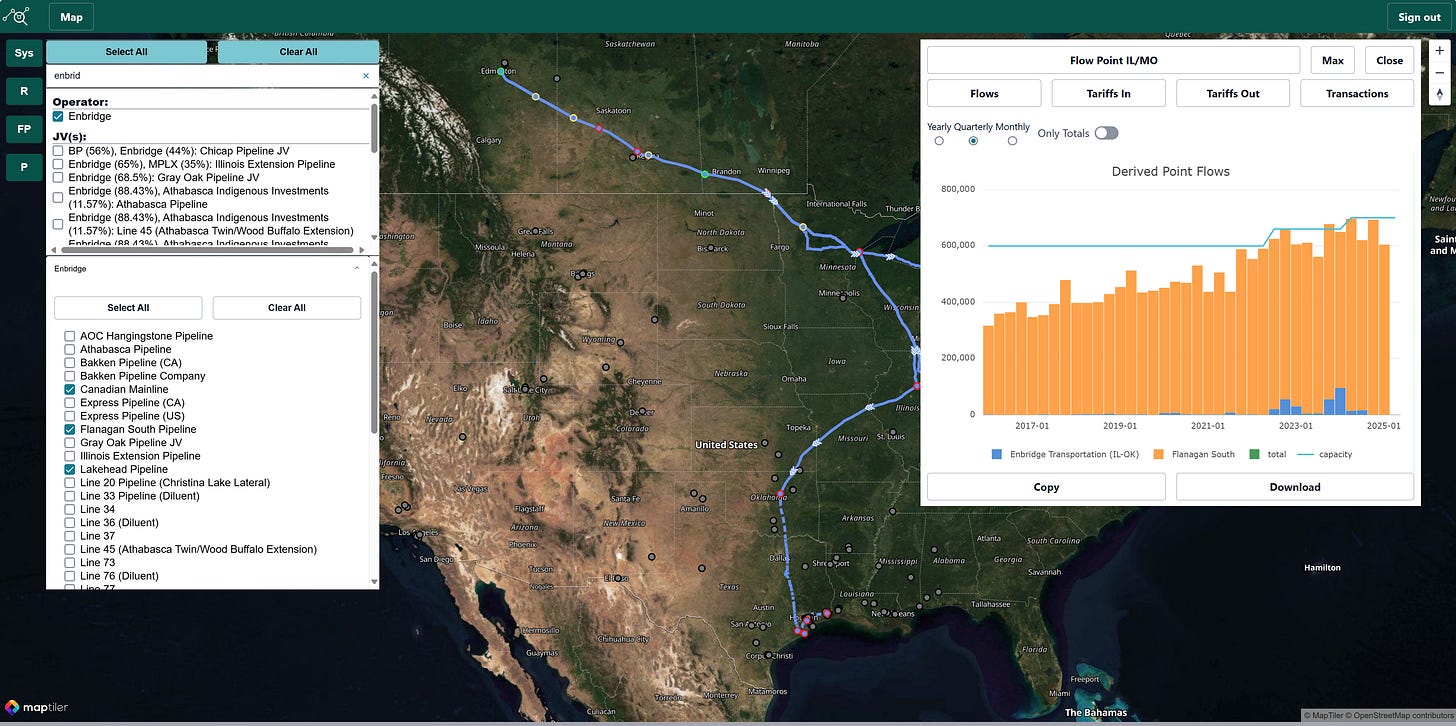

Enbridge’s recent earnings report highlights significant developments in its crude oil pipeline operations, focusing on two key initiatives: the Mainline Optimization Project and the related Flanagan South expansion, alongside the Southern Illinois Connector Project. The Mainline Optimization Project will boost 150,000-barrel-per-day egress capacity from Alberta to the U.S. Midwest, with a target completion date of 2027.

Flanagan South Expansion: Extending Reach to the Gulf Coast

The Flanagan South expansion will pair with the Mainline Optimization and add a 100,000-barrel-per-day increase, raising the pipeline’s total throughput to 800,000 barrels per day. Currently operating near its 700,000-barrel-per-day limit, Flanagan South will facilitate crude oil movement to the Gulf Coast via its lease on the Seaway Pipeline, which has sufficient capacity to handle the additional volumes. This expansion reflects Enbridge’s playbook of controlling crude oil flows across multiple segments to collect tolls, a tactic successfully employed on the Mainline/Flanagan South for over a decade to ensure growing revenue streams.

Southern Illinois Connector: Enbridge Discloses Planned Route

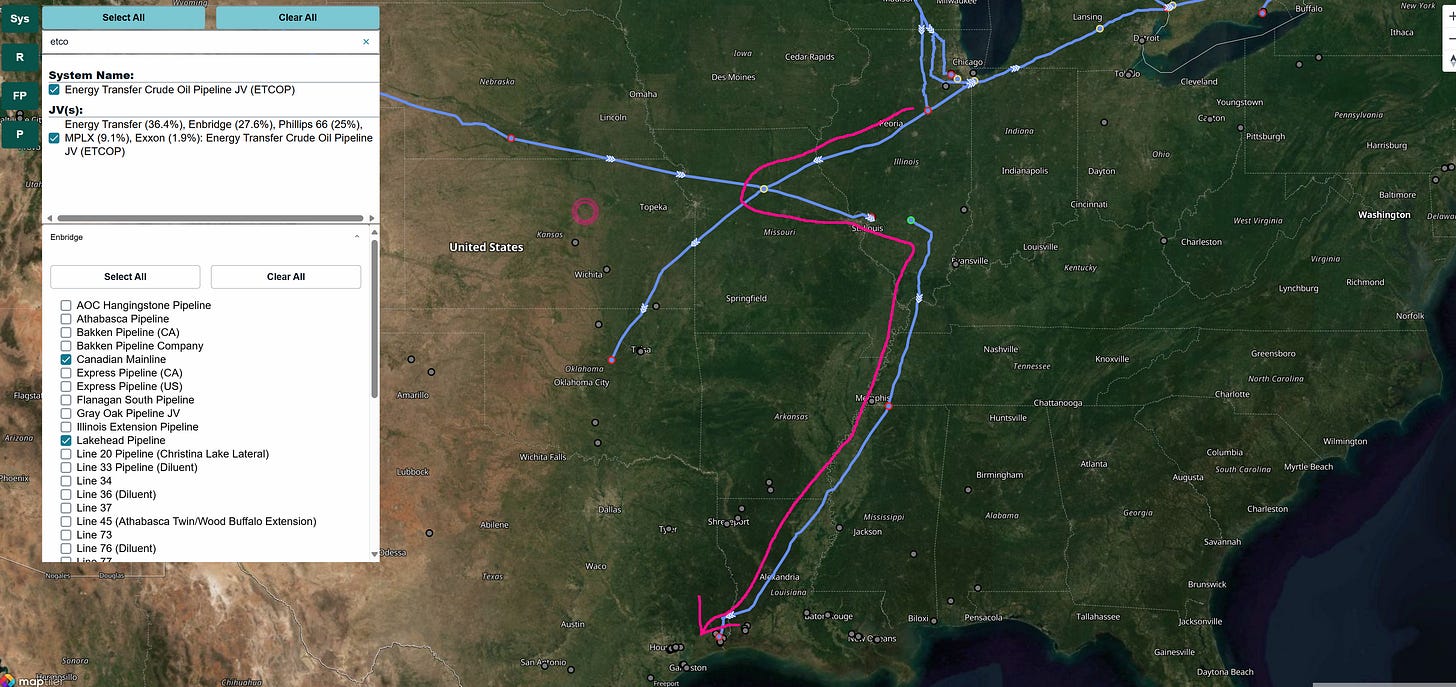

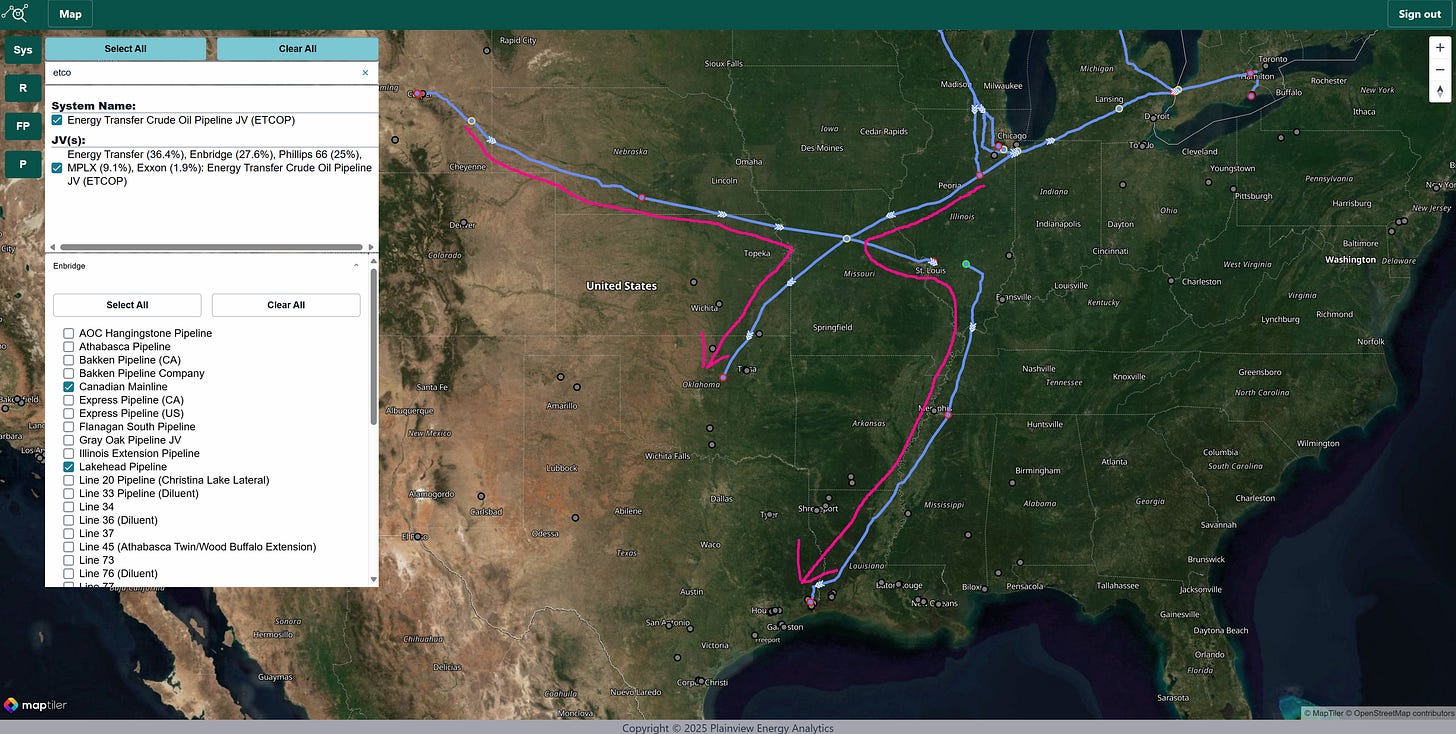

The Southern Illinois Connector Project takes a complex approach, with a proposed route from Flanagan to a Missouri terminal via the Spearhead CCPS system, then east via the Platte Pipeline. A new-build pipeline will connect to Patoka, Illinois, linking to the Energy Transfer Crude Oil Pipeline (ETCOP) and targeting Louisiana refineries, likely via Bayou Bridge Pipeline. This circuitous path deviates from a more direct route via the Southern Access Extension Pipeline, which Enbridge partially owns but may face constraints due to Marathon’s role as the primary shipper and potential contractual limitations, such as a most-favored nations clause limiting rate adjustments.

Circuitous Route Raises Economic and Competitive Questions

This unconventional routing strategy has sparked economic and operational considerations. The Southern Illinois Connector’s route may feature high rates due to the stacking of multiple tariffs across pipeline segments, potentially affecting its competitiveness. The Spearhead Pipeline, operating at or above its 193,000 bpd capacity with long-term agreements expiring in 2026, is a highly utilized artery to Cushing, and rerouting could reduce revenue through lower rates for shorter segments. Lost revenue could be mitigated by project volumes filling spare capacity on the Platte Pipeline and ETCOP. Revenues from the new-build pipeline would also offset losses, albeit with significant capital outlay.

With Southern Illinois Connector shifting flow dynamics on Spearhead and Platte, Enbridge could also explore a strategy to compete on rates for alternative routes, such as from Guernsey to Cushing on a Platte-Spearhead joint tariff. These volumes would also offset revenue losses and challenge competitors like the Saddlehorn and Pony Express pipelines.

Market Dynamics and Future Outlook

Enbridge’s expansions highlight the limited options for moving heavy crude to the Gulf Coast, with its mainline system remaining the primary conduit. Competing routes, such as the Southern Access Extension combined with Capline, face current tariffs exceeding $5 per barrel, potentially making Enbridge’s solution more attractive despite its multi-segment approach. As Enbridge refines its strategy, further details from upcoming earnings reports, including insights from partners like Energy Transfer, will be critical in assessing the project’s competitiveness. These strategic moves position Enbridge to maintain its dominance in crude oil transport, though their success will hinge on navigating competitive pressures and optimizing tariff structures.