Acquisition Details and Immediate Impacts

Plains All American Pipeline has completed the acquisition of the remaining 45% interest in the EPIC Crude Oil Pipeline from private equity firm Ares, effective November 1, 2025, for $1.33 billion, which includes $500 million in assumed debt. This follows Plains’ earlier purchase of a 55% stake from Kinetic and Diamondback Energy announced about a month prior, granting the company full 100% equity ownership of the key Permian to Gulf Coast asset. As part of the deal, Plains has agreed to a potential $157 million earn out payment contingent on certain pipeline expansions achieved by 2028. The company plans to rebrand the pipeline as Cactus III, enhancing its existing Permian to Corpus Christi egress network.

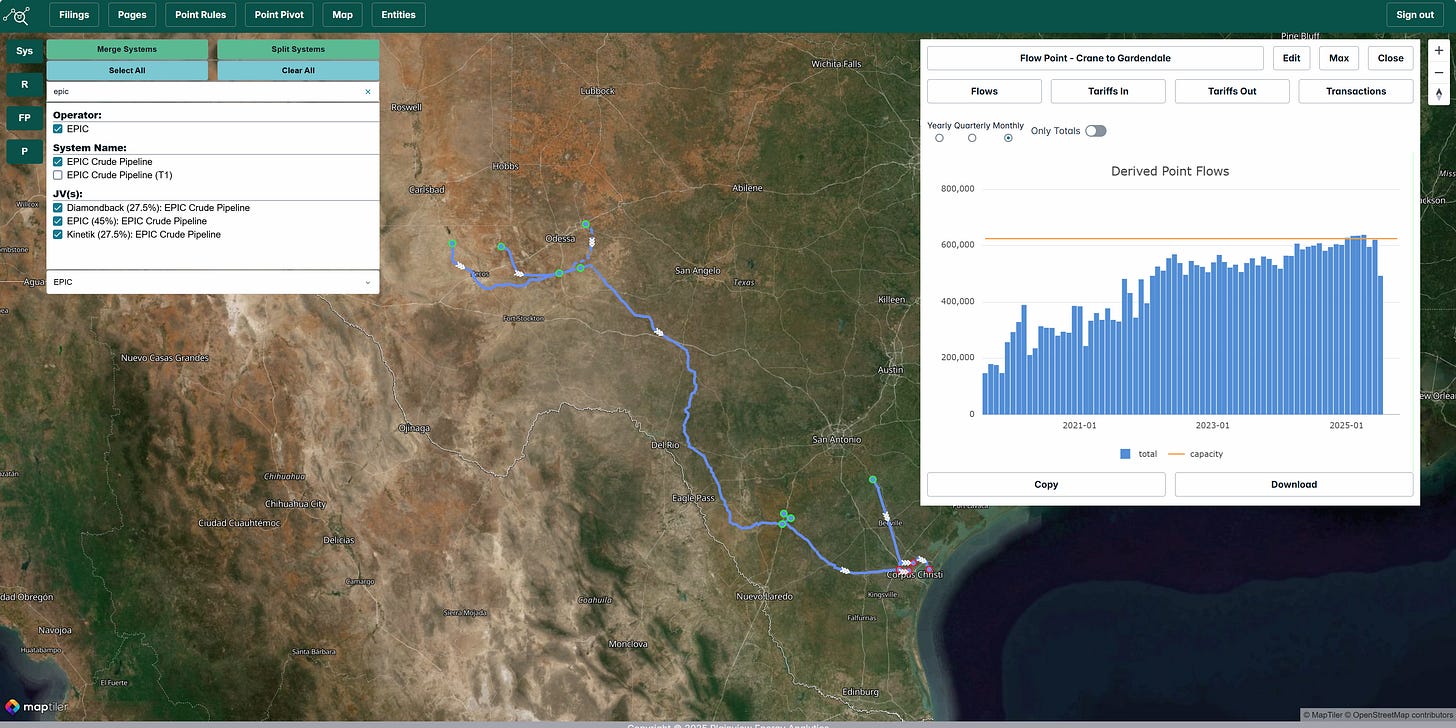

Pipeline Infrastructure and Operational Landscape

The EPIC Crude Oil Pipeline spans from production hubs in the Permian Basin and Eagle Ford Shale to export terminals in Corpus Christi, boasting a nameplate capacity of 600,000 barrels per day (bpd), with recent operations pushing above 625,000 bpd. However, flows dipped in July 2025, possibly due to reduced volumes amid rising marketing competition in the Permian. Despite this, the pipeline appears to be well contracted for the next five years, supported by long term commitments from key stakeholders like Kinetic, Diamondback, and others. Plains now controls a complementary network including the fully owned Cactus I (with a 50% owned joint venture segment to Corpus Christi shared with Enterprise) and 70% owned Cactus II (30% owned by Enbridge), both operating near full capacity. This setup positions Plains with an opportunity to optimize barrel routing across its newly purchased 30-inch diameter EPIC line, which holds expansion potential up to 900,000 to 1 million bpd.

Economic Rationale and Optimization Strategies

Plains anticipates achieving a 10x EBITDA multiple on the acquisition by 2026, with further improvements tied to operational enhancements and expansions. Based on financial disclosures from Kinetic and S&P Global ratings, we estimate the pipeline’s estimated 2025 EBITDA at approximately $255 million, implying an initial 11.4x multiple on the full purchase price.

Short term levers to potentially compress this multiple include filling underutilized capacity through increased marketing volumes, shifting barrels from partially owned lines like Cactus II and the Eagle Ford Pipeline JV to capture 100% upside, and reducing reliance on costly drag reducing agents. Plains’ expansive gathering systems, including the recent Ironwood acquisition, further enable bundled gathering transport deals to boost margins without immediate capital outlay.

Future Growth Potential and Market Outlook

Looking ahead, Plains likely envisions expansions adding 300,000 bpd+ of additional capacity to this pipeline. Our analysis examined the economics at toll rates of $1.00 to $1.75 per barrel, which could drive multiples down to 8x to 9x under bullish Permian growth scenarios. While not expecting major builds in 2026 due to ample excess gulf-bound capacity (700,000 to 800,000 bpd basin wide), we see potential expansion viability by 2028 or 2029 as production growth appears set to continue even at $60 per barrel. This deal, though priced at an initial premium, aligns with optimistic Q3 2025 guidance from producers and midstream peers signaling Permian volume increases, positioning Plains for enhanced throughput and revenue growth over the longer term.