Recent developments in North American crude pipeline infrastructure are poised to reshape takeaway dynamics for both the Bakken and Western Canada and have ripple effects across the U.S. Three interconnected announcements (Enbridge’s Mainline Optimization Phase 2, DAPL’s preemptive recontracting open season, and Bridger Pipeline’s expansion plans) have created a rare moment of direct competition that will determine which barrels secure long-term egress and at what cost. Here’s how the pieces fit together and what it means for producers and shippers over the next two years.

Enbridge Launches Mainline Optimization Phase 2: Up to 250,000 b/d of New Canadian Takeaway

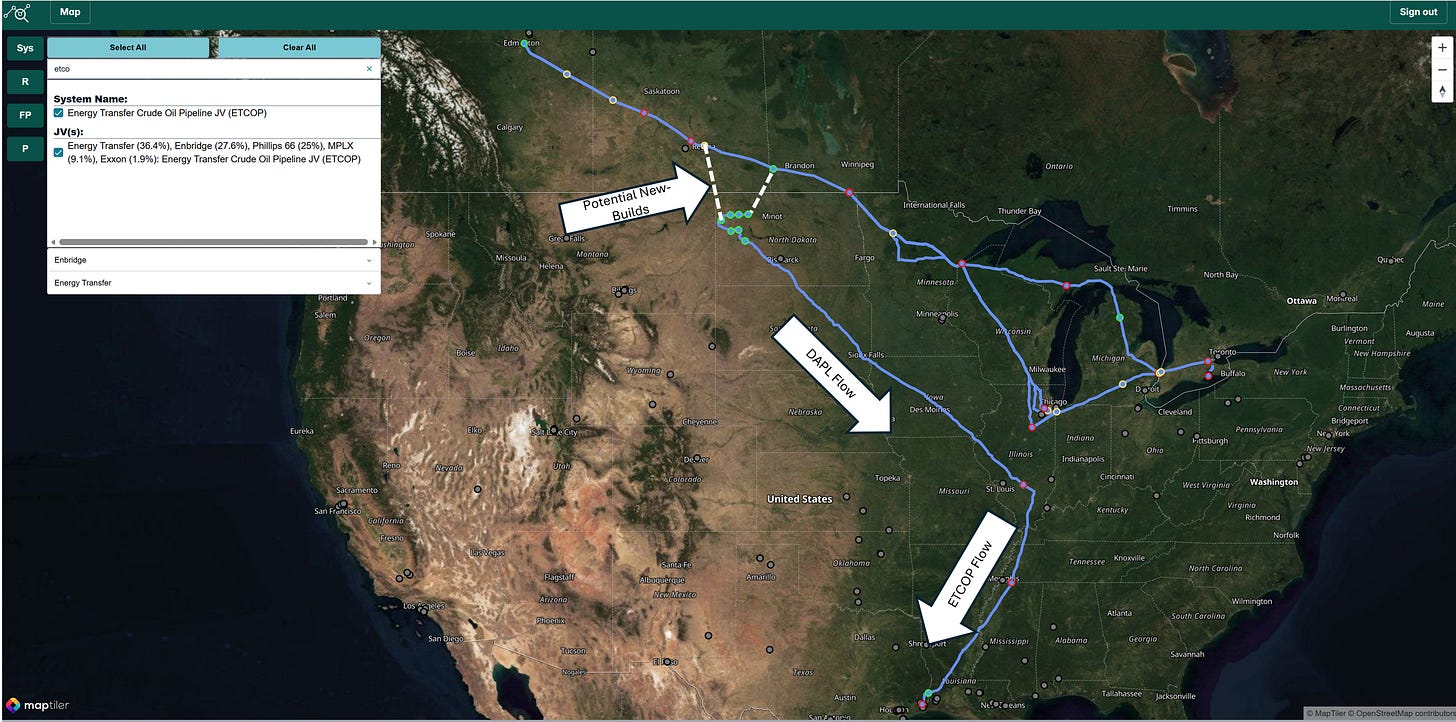

Enbridge recently announced development of Mainline Optimization Project 2, a 250,000 b/d expansion of its Canadian Mainline system that will deliver additional Canadian barrels into the U.S. and, critically, directly into the Dakota Access Pipeline (DAPL). The project will involve new pipeline construction or major reversals between Regina, Saskatchewan, or the Cromer, Manitoba area to feed DAPL in North Dakota.

Canada is likely to face future egress constraints due to growing oil-sands production, and pushing barrels onto existing U.S. infrastructure like DAPL is far cheaper and faster than building new long-haul lines to the Midwest and Gulf Coast. The project would potentially give Canada meaningful new takeaway capacity as early as 2027.

DAPL Gives Bakken Players Recontracting Opportunity with New Open Season

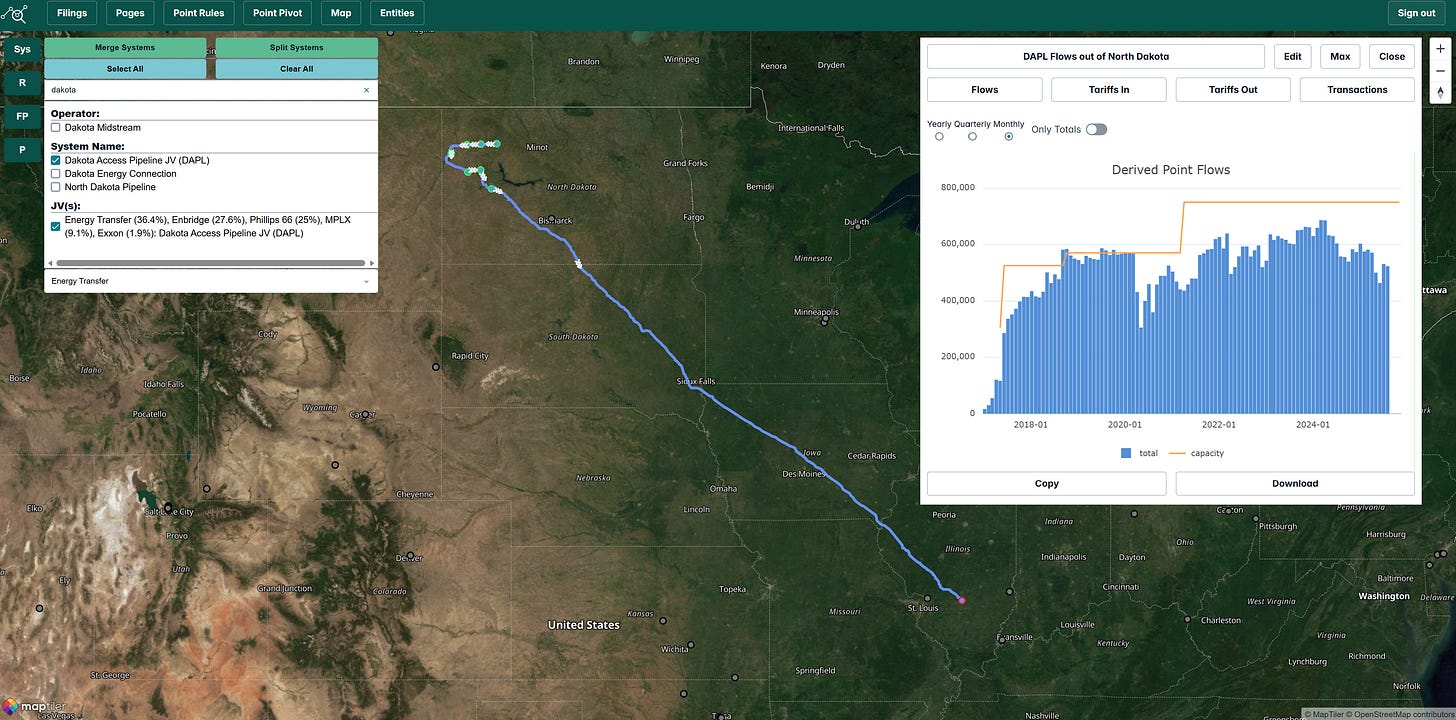

Almost immediately after Enbridge’s announcement, Energy Transfer launched an open season for DAPL capacity ahead of the 2027 expiration of its existing 10-year contracts. Current flows on DAPL have steadily declined from ~680,000 b/d to the low 500,000 b/d range over the past two years. DAPL’s open season could be viewed as a signal to Bakken shippers: recontract now to secure your spot or face the real possibility that incoming Canadian barrels will take priority when existing commitments expire in 2027.

Bridger Pipeline Responds with Its Own Expansion Plans

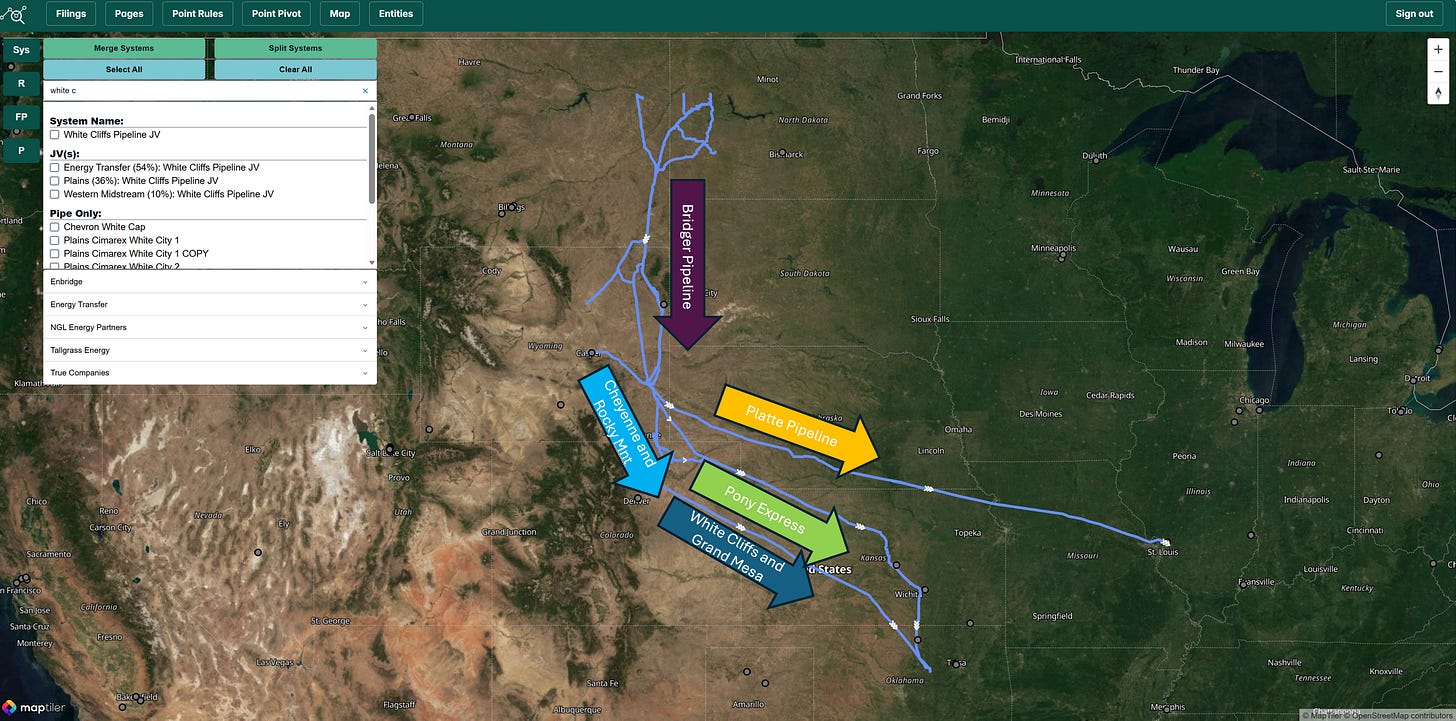

Perhaps in an effort to potentially woo away current DAPL shippers, Bridger Pipeline has countered Enbridge and Dakota Access with its own announced expanded capacity out of the Bakken. The project calls for new interim capacity as early as January 2026 and a larger expansion sometime in the future. The expansion would deliver barrels into Guernsey, Wyoming where multiple downstream options include:

Platte Pipeline where volumes could access Cushing, Oklahoma (via Spearhead) or Wood River, Illinois.

Plains Cheyenne or Suncor Rocky Mountain Pipelines to the DJ basin where volumes could utilize latent capacity on White Cliffs or Grand Mesa to Cushing, OK.

Pony Express/Seahorse Pipelines (in which Bridger owns an equity interest) to Cushing, Oklahoma. However, a large-scale project utilizing this option would likely require significant new pipeline and may be costly.

Shifting Economics: Why Bridger Is Winning Barrels from DAPL Today

Since 2017 the competitive landscape has flipped. In 2017 DAPL offered lower tariffs (~$5.25–$6.00/bbl) and access to premium-priced Patoka and Gulf Coast markets, delivering superior netbacks. Today Bridger/Pony Express joint tariffs have dropped to ~$5.00/bbl, while DAPL tariffs have risen ~$1/bbl due to contractual inflation escalators. Gulf Coast premiums over Cushing have also narrowed from ~$2 to ~$1. As a result, shipping on Bridger to Cushing now frequently yields higher netbacks than DAPL to Patoka or Nederland, explaining Bridger’s recent volume gains and DAPL’s steady losses.

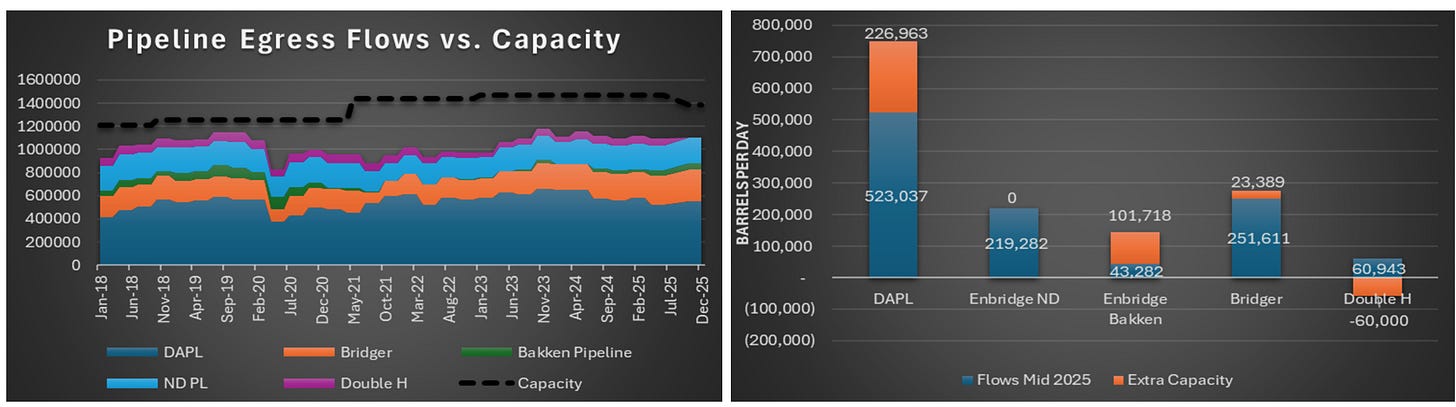

What Happens Next: A Three-Player Game with Limited Competitors

Bakken crude oil egress is now controlled by only three major entities (Dakota Access JV partners, Enbridge, and Bridger) after Double H converted to NGL service in late 2024. Total basin takeaway capacity sits roughly 250,000–300,000 b/d above current flows, creating competition but not the brutal oversupply seen in some other basins.

The key 2026–2027 questions are straightforward: Will DAPL discount rates aggressively to retain Bakken barrels, or simply backfill with Canadian volumes? Can Bridger keep its attractive $5 tariff while funding a meaningful expansion, or will capex force higher rates? The outcome will directly influence future flows out of Canada and the Bakken and likely have ripple effects across the entire U.S. crude oil transport market.