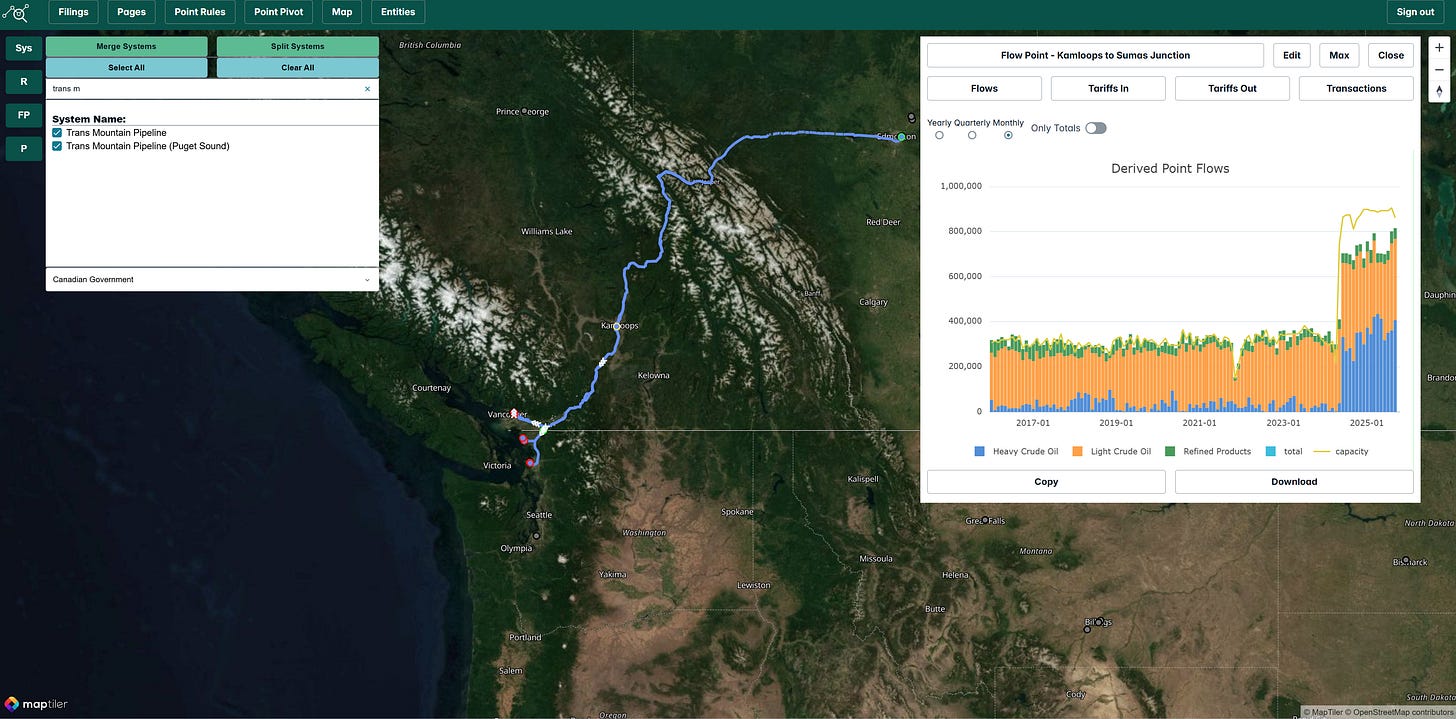

Trans Mountain Now Running Near Full Capacity

The Trans Mountain Pipeline, which expanded in mid-2024, delivered record volumes in August and September 2024. Mainline flows reached all-time highs, with the pipeline operating very close to its reported capacity (which varies slightly with batch composition and operating conditions).

Deliveries to Burnaby and Westridge export dock remain robust, though slightly lower than Q2 as more barrels shifted toward U.S. destinations.

Flows into the U.S. at Sumas recovered sharply in Q3 after refinery turnarounds in Washington State likely reduced pulls in the prior quarter.

Despite adding ~590,000 b/d of new egress capacity, TMX is already utilized at levels that exceed most pre-startup forecasts.

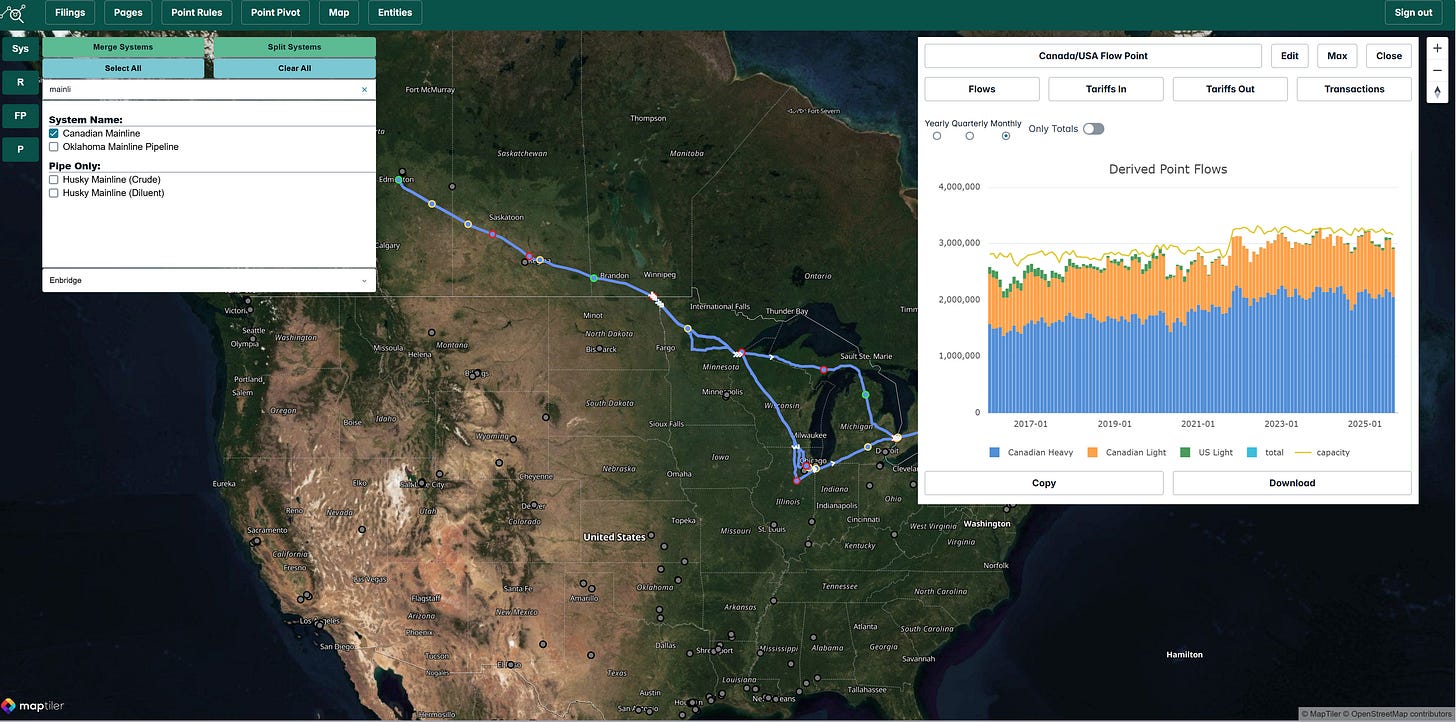

Enbridge Mainline/Lakehead System Remains Highly Utilized

The Enbridge Mainline into the U.S. continues to operate essentially full. Minor Q3 capacity reductions reflect temporary operating variances and refinery turnaround schedules rather than lack of supply. Volumes stayed tightly aligned with available capacity, confirming the system is still constrained despite the new TMX capacity coming online 18 months ago.

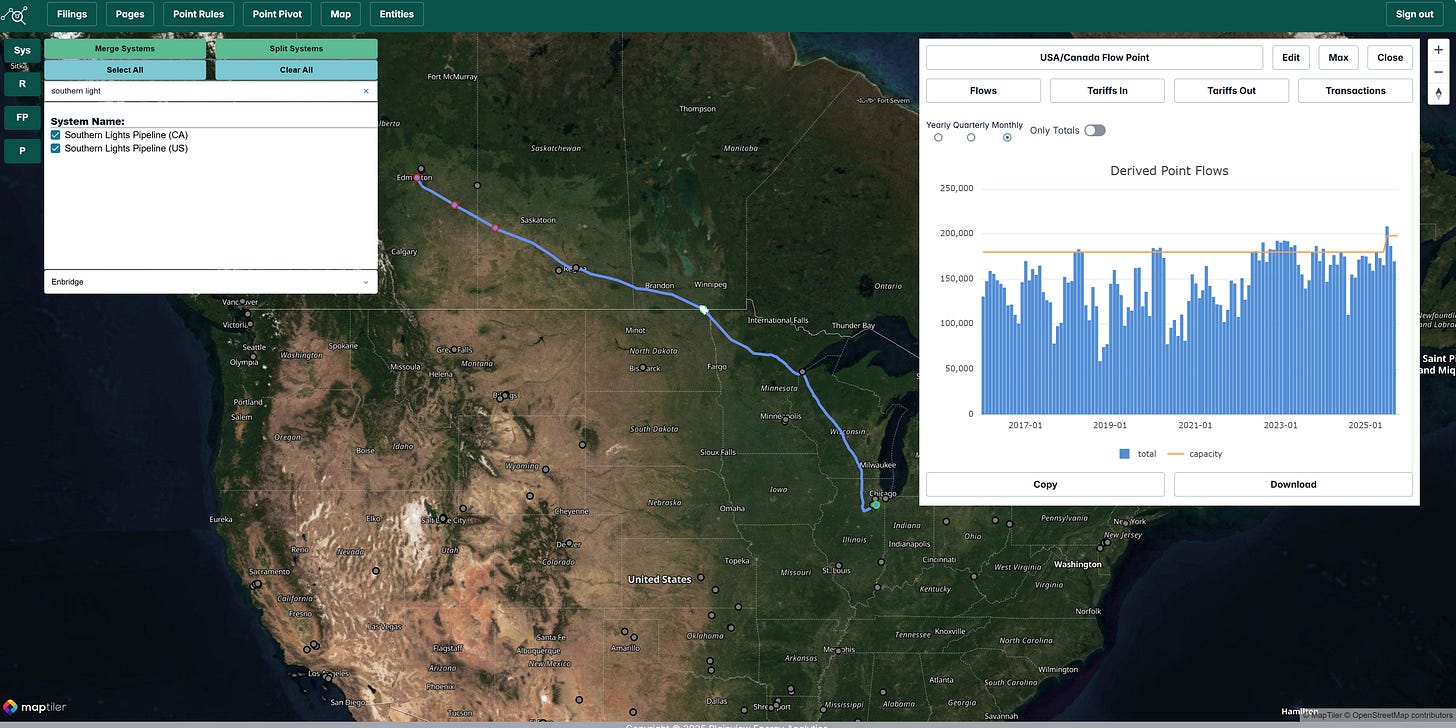

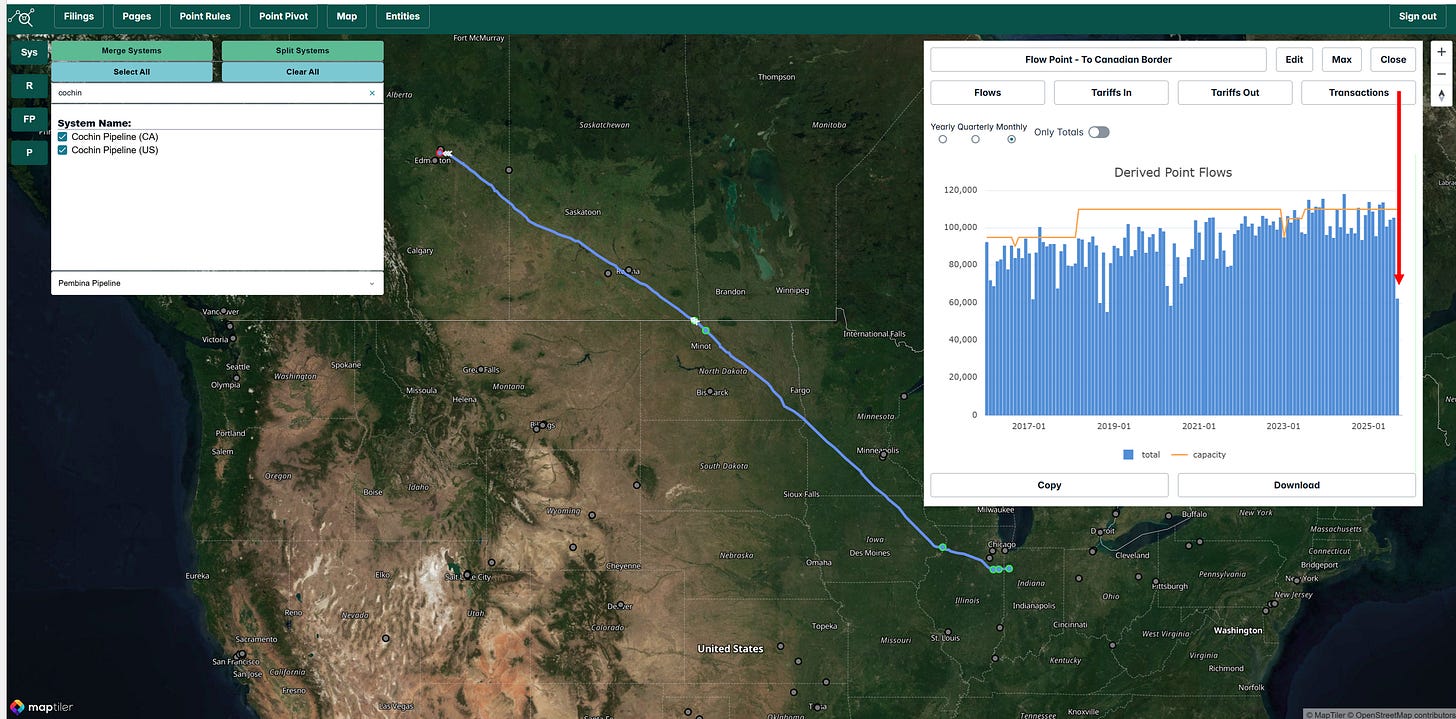

Is Supply Shifting Between Cochin and Southern Lights?

Southern Lights volumes ramped notably in July 2024 after its expansion but fell back to pre-expansion levels in September.

Cochin flows dropped significantly from August to September. The decline aligns with Pembina Q3 earnings commentary of narrower Canada–U.S. condensate price differentials and lower spot volumes. One weak month could be an anomaly but worth monitoring to see if barrels may be shifting between Cochin and the expanded Southern Lights system.

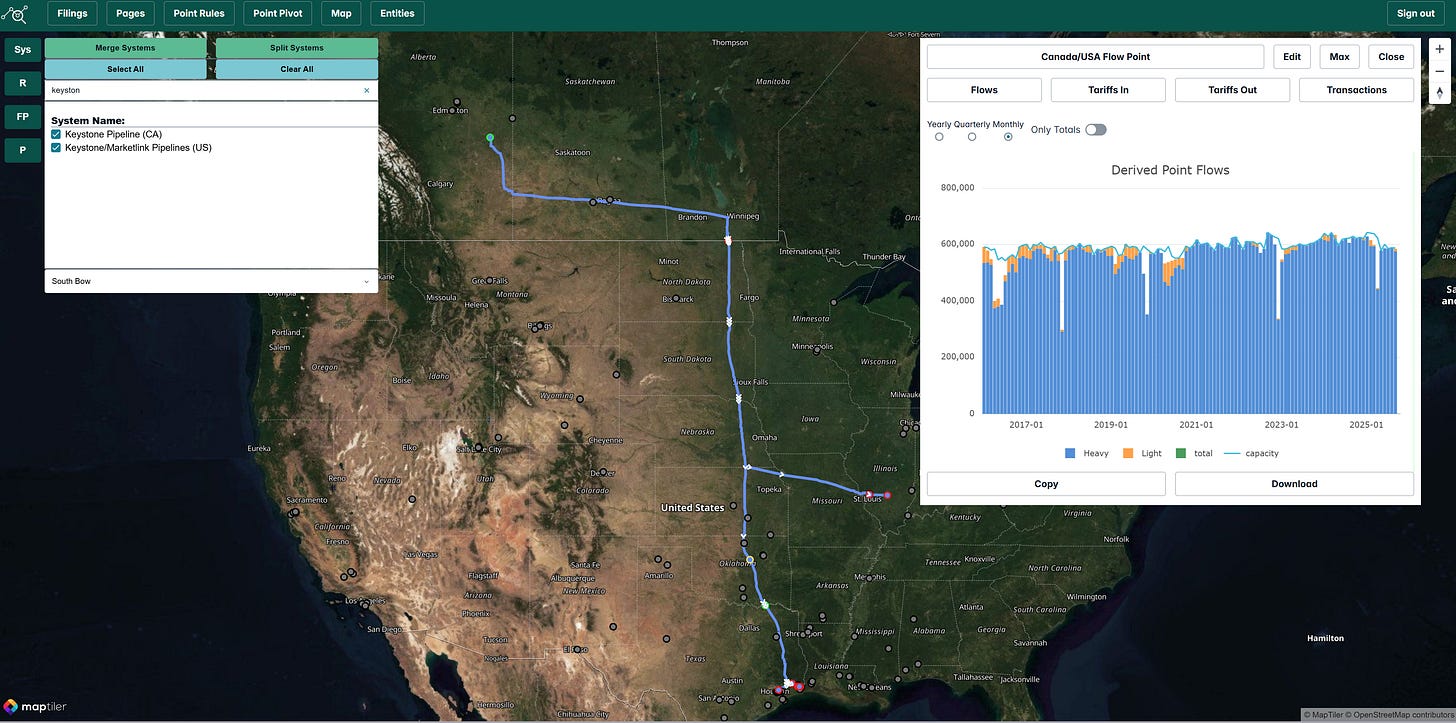

Keystone Operating Under Pressure Restrictions

Keystone volumes and capacity both declined in Q3 due to ongoing reduced-pressure operations following the Milepost 171 incident. The line continues to transport all committed volumes but has limited ability to move spot barrels until pressure is gradually restored in 2026.

Smaller and Regional Lines

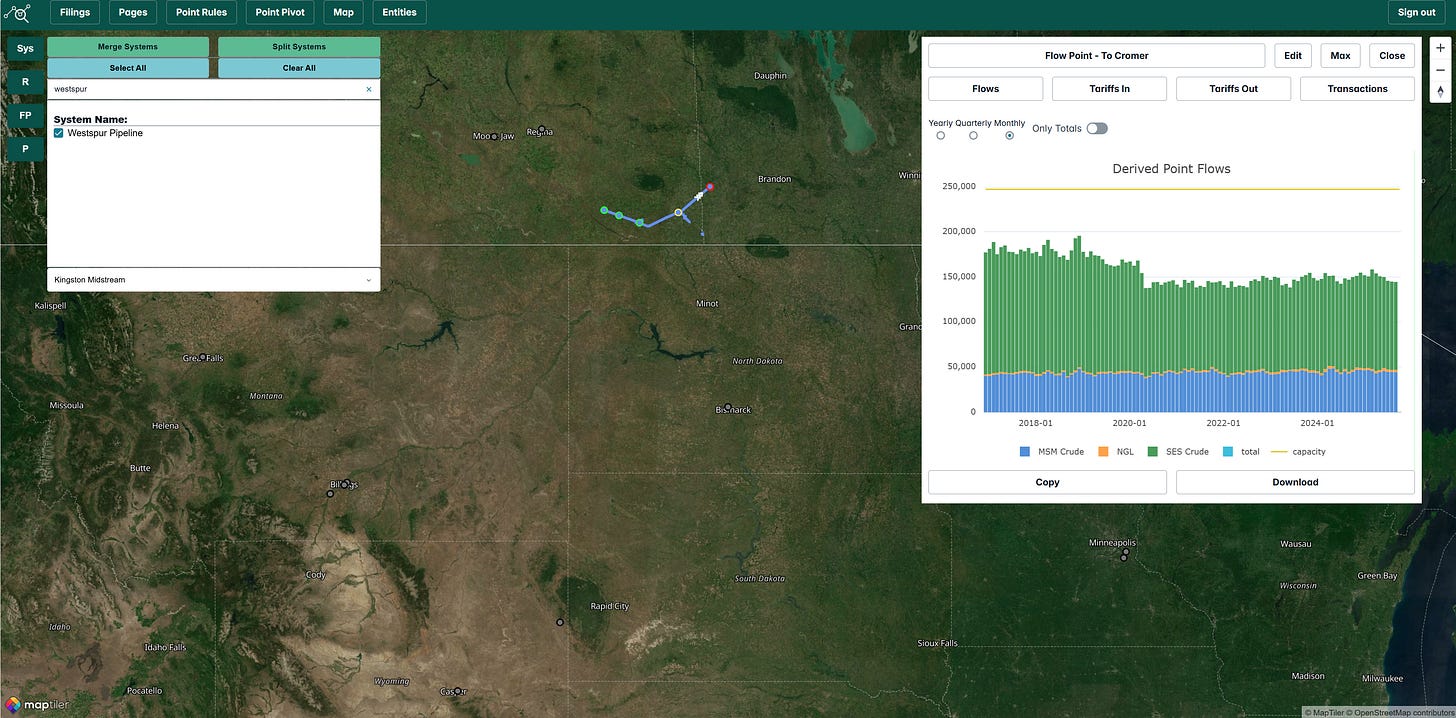

Westspur (Canadian Bakken-to-Enbridge Mainline connector): Steady volumes tracking slow post-COVID recovery in the play.

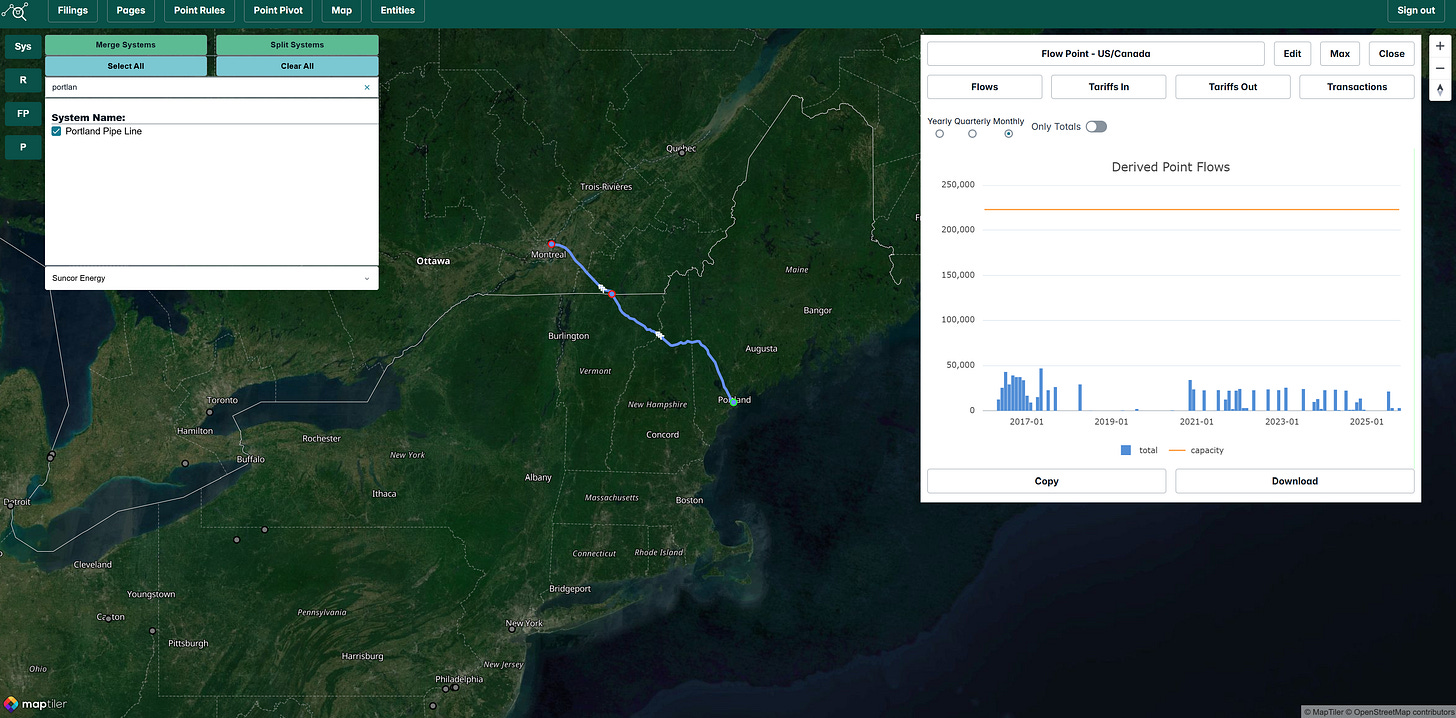

Montreal and Portland–Montreal lines (Suncor-operated): Very low utilization; Eastern Canadian refineries continue to favor cheaper Western Canadian barrels via Enbridge Line 9.

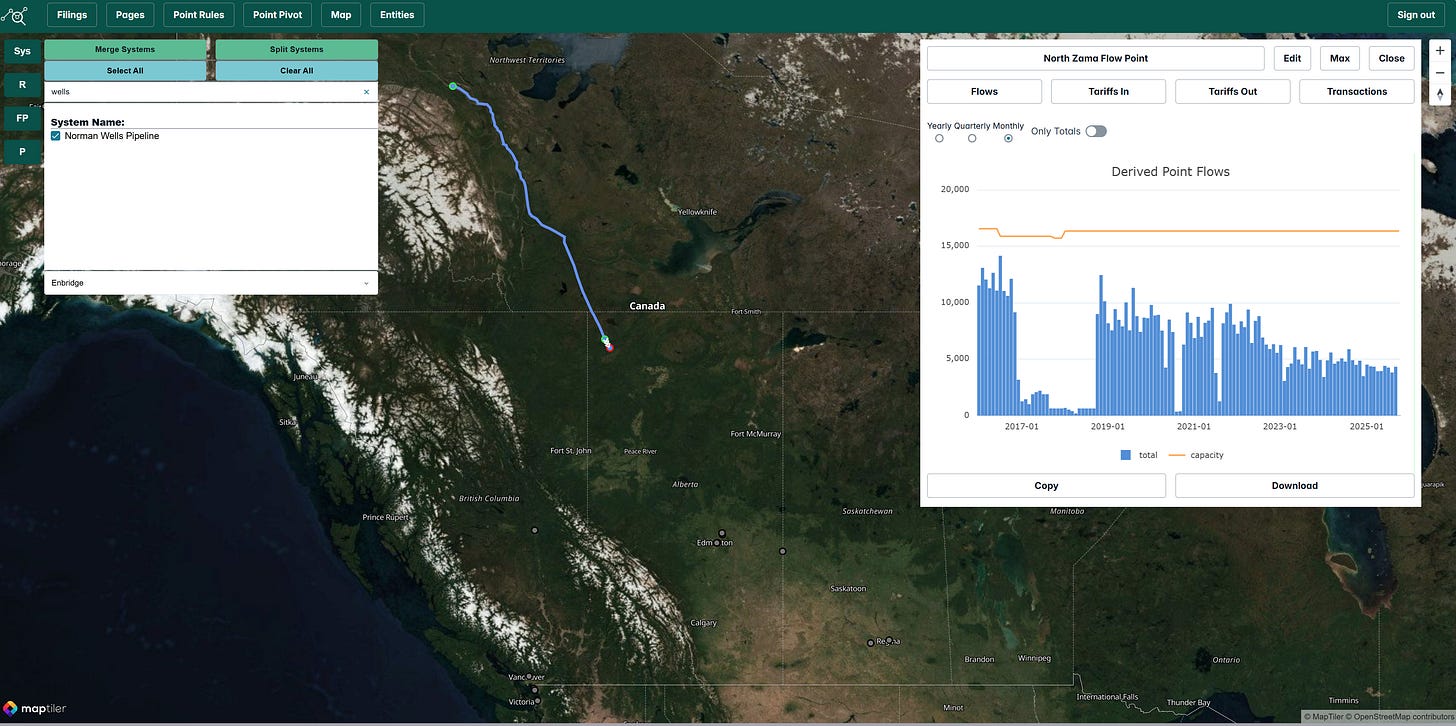

Norman Wells pipeline: Ongoing slow production decline in the remote Northwest Territories field; long-term viability increasingly uncertain.

Key Takeaway: Canadian Egress Getting Tight Again

Just 18 months after TMX added substantial new capacity, most major export pipelines (Trans Mountain, Enbridge Mainline, Keystone) are operating at or very near full utilization. Rapid heavy-oil production growth has absorbed the new capacity far faster than many analysts (including Plainview) anticipated.

Upcoming Enbridge Mainline optimization projects and potential additional expansions appear increasingly justified over the 2–5 year horizon. The Canadian oil sector is demonstrating sustained production momentum that continues to pressure existing takeaway infrastructure.