Questions: matthew.lewis@plainview-energy.com

Phillips 66 Acquires Remaining Stake in Wood River and Borger Refineries

Phillips 66 has solidified its control over two key refineries by acquiring the remaining 50% stakes in the Wood River and Borger facilities, achieving full ownership. As noted in our previous video, the Borger refinery, located in Texas, relies on two primary pipelines for its crude supply: the Phillips 66 owned Borger system and the third-party Canyon Crossing pipeline, which replaced an idled Phillips 66 line from Cushing. With a capacity of approximately 150,000 barrels per day, Borger is a modest but critical operation. In contrast, the Wood River refinery in Illinois, boasting a capacity of over 350,000 barrels per day, represents a larger and more complex hub within the Midwest refining landscape.

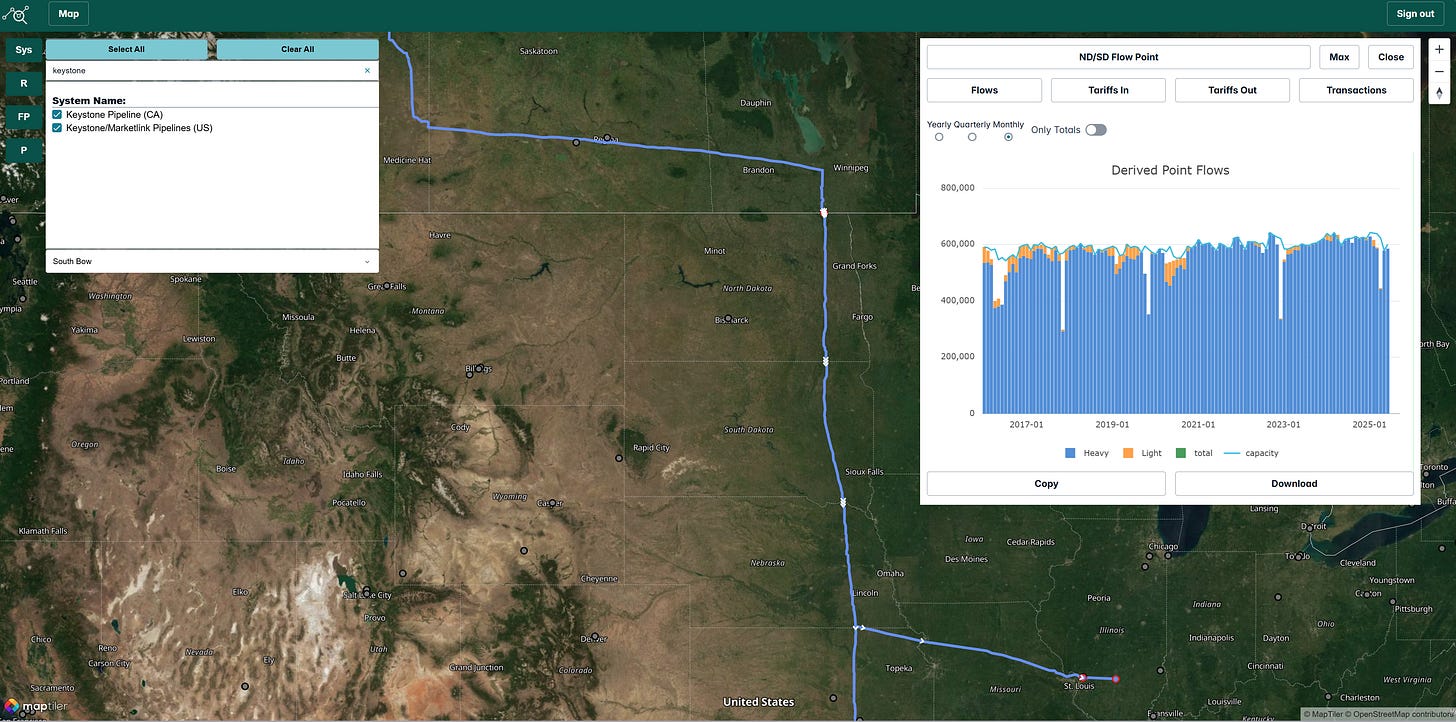

Keystone Pipeline Powers Wood River with Canadian Heavy Crude

The Wood River refinery benefits from a diverse and robust crude supply network, primarily anchored by the Keystone Pipeline, which transports around 600,000 barrels per day of mostly heavy crude from Canada. This 30-inch pipeline extends to Steel City, Nebraska, where it splits into segments serving Wood River, Patoka, and Cushing. While precise data on the split are unavailable, we estimate 150,000 to 200,000 barrels per day are delivered to Wood River, accounting for roughly half the refinery’s capacity. This heavy crude supply, likely tied to legacy commitments from Conoco (a former owner) and other partners like Husky, underscores the refinery’s strategic importance.

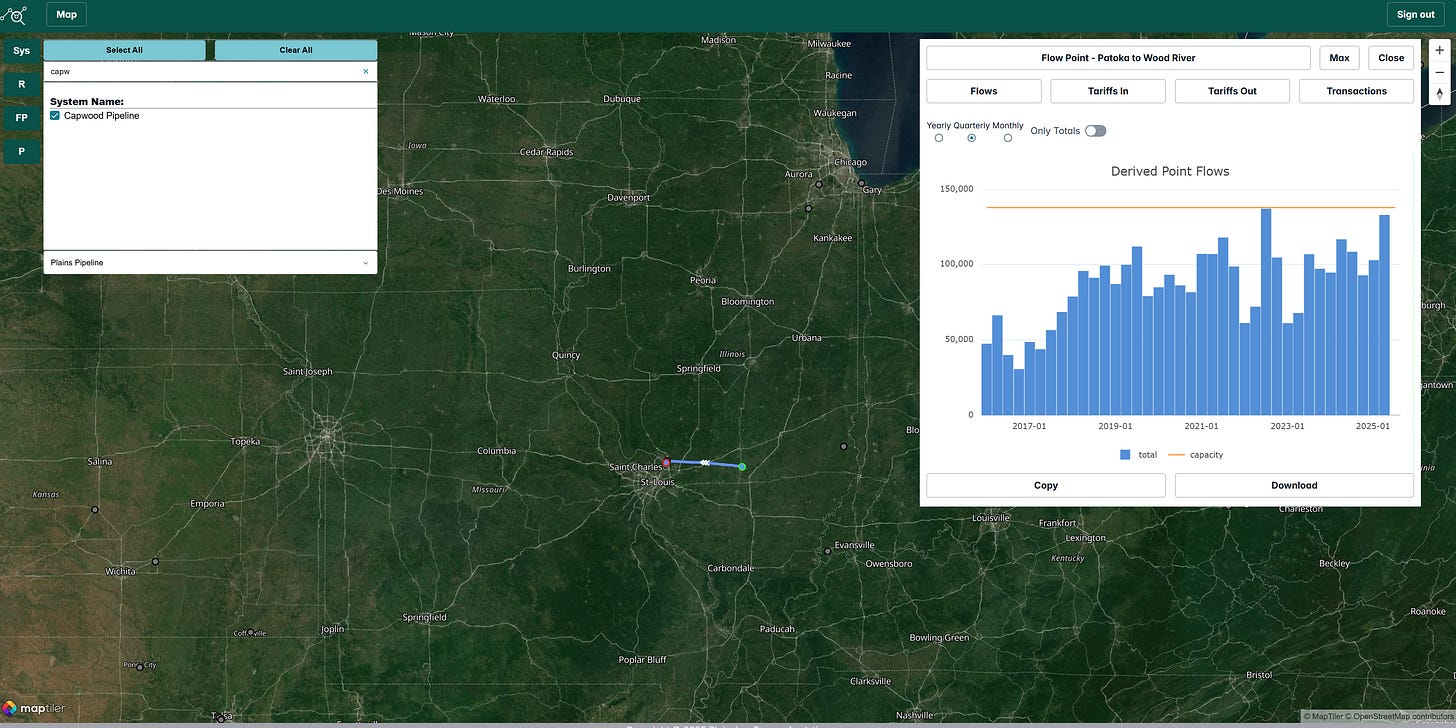

Capwood Pipeline Enhances Wood River’s Bakken Crude Supply

The Capwood pipeline, operated by Plains, further diversifies Wood River’s crude slate by transporting approximately 85,000 barrels per day from Patoka, Illinois. This pipeline likely carries a mix of crudes, with a strong possibility of lighter Bakken barrels sourced via the Dakota Access Pipeline (DAPL) into Patoka. While some flow data may reflect short-haul movements between Patoka terminals, the pipeline’s contribution to Wood River is significant, offering flexibility to process lighter crudes alongside Keystone’s heavier inputs, thus optimizing refining operations.

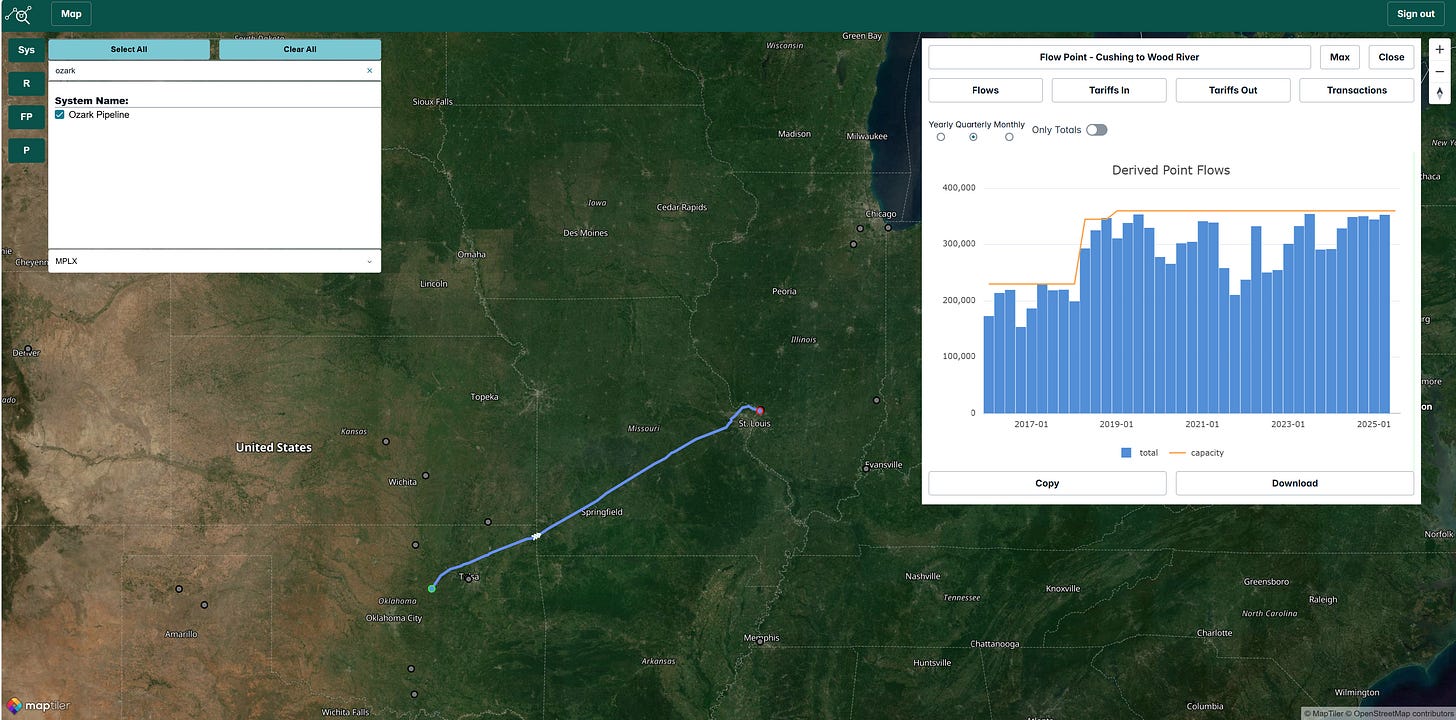

Ozark Pipeline Supplies Permian and Mid-Continent Crudes

The Ozark pipeline, owned by MPLX, moves ~350,000 barrels per day to the Wood River and Patoka areas from Cushing, Oklahoma. Expanded in 2017 and 2018, this pipeline accesses a variety of crudes, including Permian, DJ Basin, and other Mid-Continent barrels aggregated at Cushing. While most of Ozark’s flows are directed to Patoka for distribution to other regional refineries, its contribution to Wood River enhances the refinery’s access to domestic light crudes.

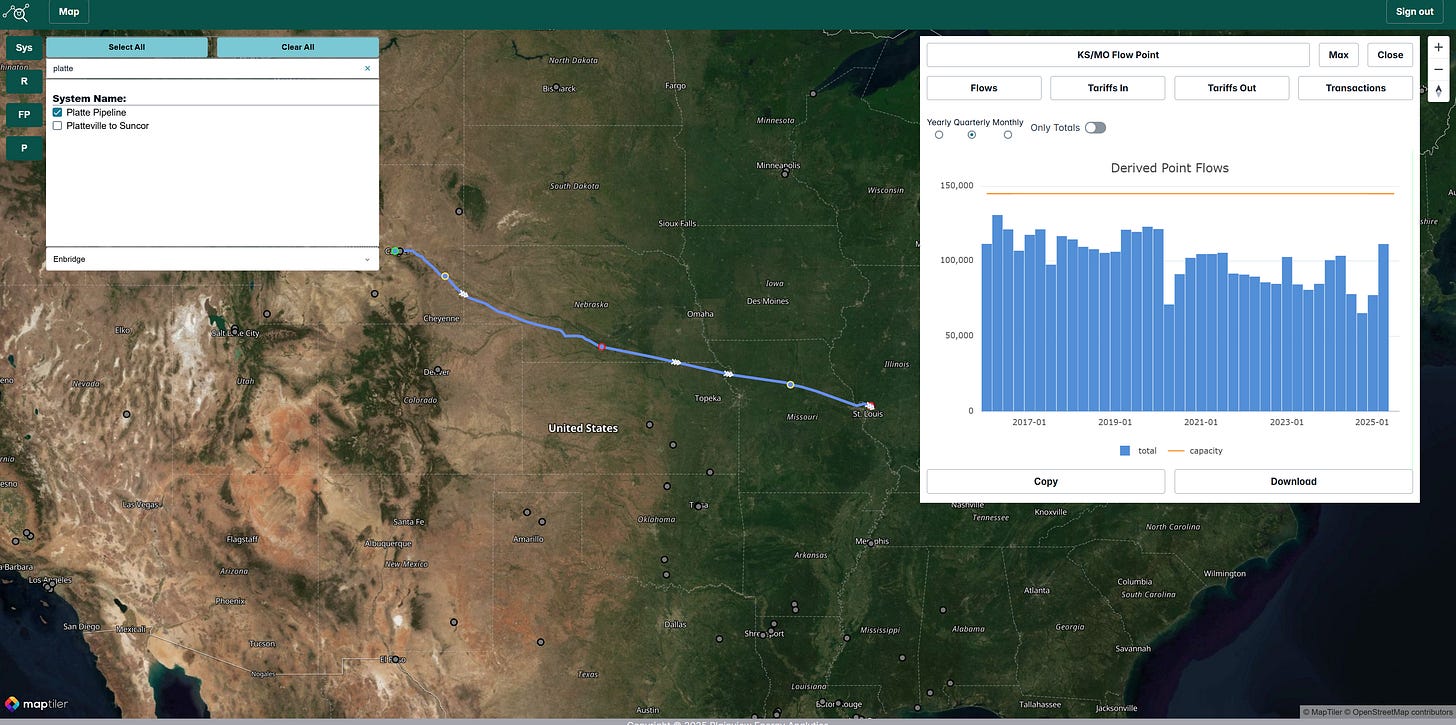

Platte Pipeline Diversifies Wood River with Bakken and Powder River Crudes

The Platte pipeline, sourcing crude from Casper and Guernsey, Wyoming, supplies an estimated 25,000 to 50,000 barrels per day to Wood River. Connected to the Express pipeline from Canada and accessing Bakken and Powder River crudes, Platte provides a diverse mix of light and medium crudes. Although the majority of its barrels historically flowed to Patoka, its role in supplying Wood River ensures additional crude variety, complementing the heavier Canadian inputs from Keystone and the mixed slate from Capwood and Ozark.

Wood River Refinery: A Strategic Midwest Refining Powerhouse

Wood River’s ability to draw from multiple crude sources—Canadian heavy via Keystone, Bakken, Powder River, and Canadian crude via Platte, and Permian or Mid-Continent barrels via Ozark—positions it as a versatile refining hub. Borger, while smaller, benefits from reliable Permian and Cushing-linked supplies. This strategic move not only consolidates Phillips 66’s control but also enhances its ability to optimize crude inputs based on market dynamics, reinforcing its competitive edge in the refining sector.