Questions - Email us at matthew.lewis@plainview-energy.com

Overview of Enbridge’s Platte Pipeline and Guernsey Hub Series

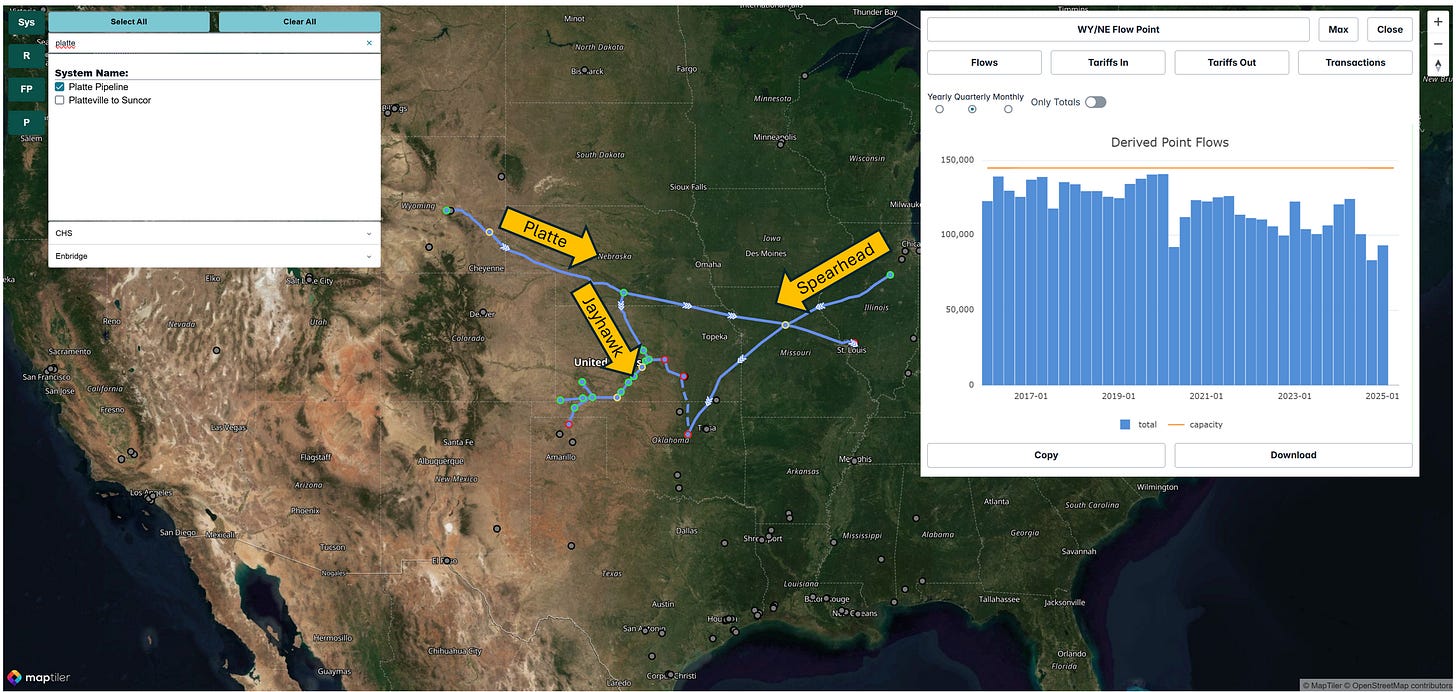

The Platte Pipeline, operated by Enbridge, is an important conduit for Rockies and Canadian oil production, originating in Casper, Wyoming, and extending to the Wood River Refinery in Illinois. This analysis is part of a three-part series focusing on the Guernsey hub, a key crude oil distribution point. Previous discussions covered the Cheyenne Pipeline, where increased marketing volumes may be possible due to Plains' acquisition of full ownership, and Suncor's Rocky Mountain Pipeline, which saw significant capacity expansion through the addition of a new pipeline on the southern portion of their system. The focus here is on the Platte Pipeline, exploring its current operations, potential for increased flows, and the implications of the Southern Illinois Connector project for market dynamics.

Platte Pipeline Operations and Crude Oil Capacity Insights

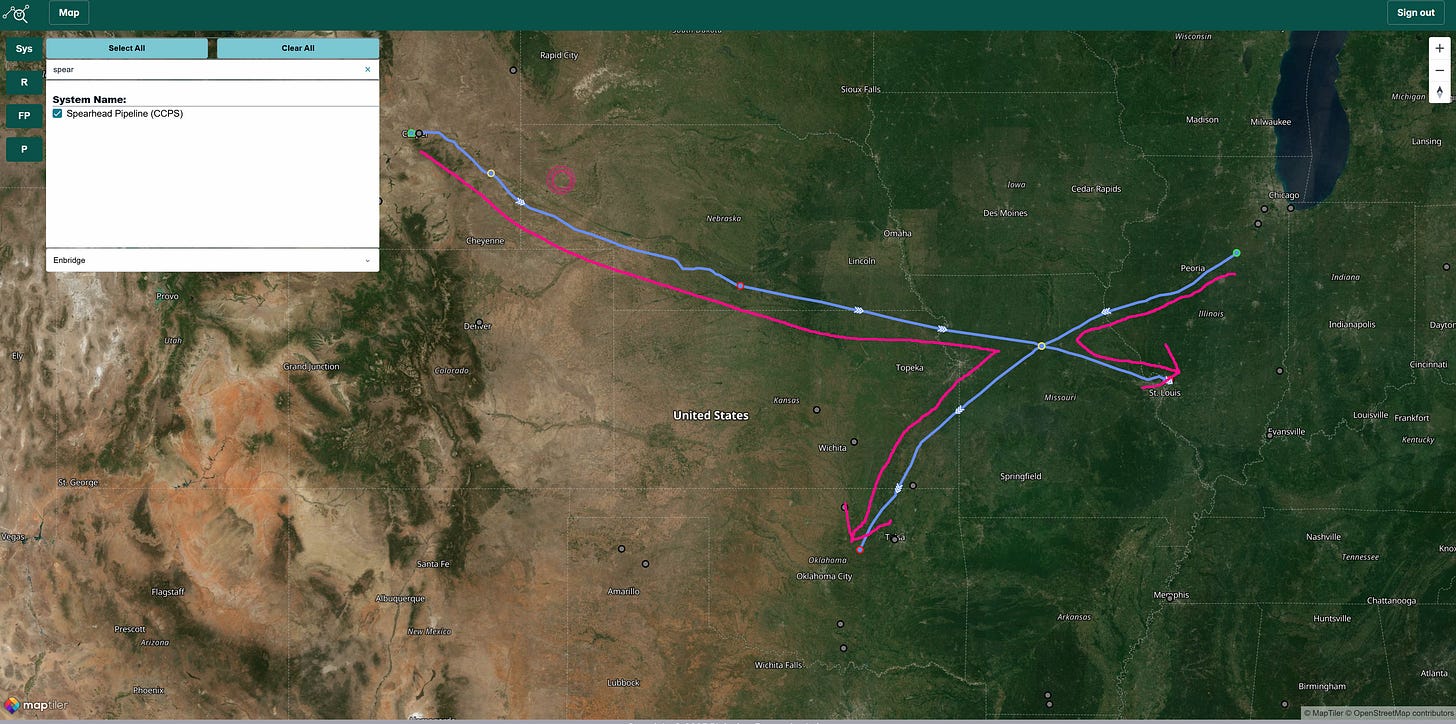

Originating in Casper, the Platte Pipeline primarily transports crude oil from the Express Pipeline, which brings volumes from Canada and Montana. It also receives and delivers barrels at Guernsey Hub. Further downstream, the pipeline delivers approximately 20,000 barrels per day to the Jayhawk Pipeline in Holdridge, Nebraska, for mid-continent refineries in Kansas, and about 5,000 barrels per day to Enbridge’s Spearhead Pipeline in Missouri, which connects to Cushing, Oklahoma. The remaining volumes, roughly 75,000 to 80,000 barrels per day, reach the Wood River Refinery. Notably, recent data indicates underutilized capacity on the Platte Pipeline, with flows from Wyoming declining over the past few years, presenting opportunities for increased utilization.

Southern Illinois Connector’s Impact on Crude Oil Pipeline Flows

The Southern Illinois Connector, a proposed joint project by Enbridge and Energy Transfer, could significantly alter the Platte Pipeline’s flow dynamics. This initiative aims to redirect flows from the Spearhead Pipeline, currently moving Canadian crude from Flanagan, Illinois, to Cushing, to a new route connecting to Patoka, Illinois, and ultimately to Gulf Coast refineries via the ETCOP pipeline. If implemented, this could free up over 150,000 barrels per day of capacity on the southern segment of Spearhead. This shift could prompt Enbridge to redirect additional volumes from Guernsey to Cushing, leveraging the Platte Pipeline’s existing capacity and the southern portion of Spearhead. Such a move might involve competitive pricing, potentially lowering the current $6 per barrel uncommitted rate to compete with pipelines like Pony Express, which charges $2.50 to $3 per barrel.

Crude Oil Market Dynamics and Guernsey Hub Opportunities

The potential expanded capacity and more aggressive marketing out of Guernsey covered in our first two videos, combined with flow shifts due to-employed Southern Illinois Connector, could reshape crude oil transportation dynamics out of the Rockies. With an open conduit from Guernsey to Cushing, Enbridge may pursue aggressive marketing to fill the Platte and Spearhead’s open capacity. This could challenge competitors like Pony Express and Saddlehorn, which also serve the Guernsey hub. Additionally, Suncor’s excess capacity on the Rocky Mountain Pipeline and Plains’ efforts to market Cheyenne Pipeline capacity more aggressively further suggest a trend of increasing competition at Guernsey. These developments could lead to lower transportation rates, benefiting shippers but pressuring pipeline operators’ margins.

Future Trends in Crude Oil Transportation and Pipeline Strategy

The Southern Illinois Connector project, if realized, could unlock significant capacity, enabling Enbridge to capture more market share by offering competitive rates and optimizing flows from Guernsey to Cushing and beyond. Stakeholders in the crude supply and demand markets should monitor these developments closely, as they could influence pricing, pipeline utilization, and regional market dynamics. For those interested in deeper insights, beta testing opportunities for our analytics platform tracking these flows are available, providing valuable data for strategic decision-making. Contact us to explore these opportunities.