Questions? Please email me: matthew.lewis@plainview-energy.com

Oil Pipeline Upgrades and Acquisitions Drive Competition in Guernsey

Recent months have seen significant advancements in pipeline infrastructure around Guernsey, Wyoming, a critical hub for crude oil transportation. Plains' acquisition of a 50% interest in the Cheyenne Pipeline from HF Sinclair has sparked discussions about increased competition for Guernsey’s crude barrels. Plains has hinted at plans to market more barrels through this pipeline, which connects to the Saddlehorn Pipeline feeding into Cushing, Oklahoma. Meanwhile, Suncor’s recent expansion of its Rocky Mountain Pipeline introduces new dynamics to the region’s midstream sector, potentially reshaping market competition.

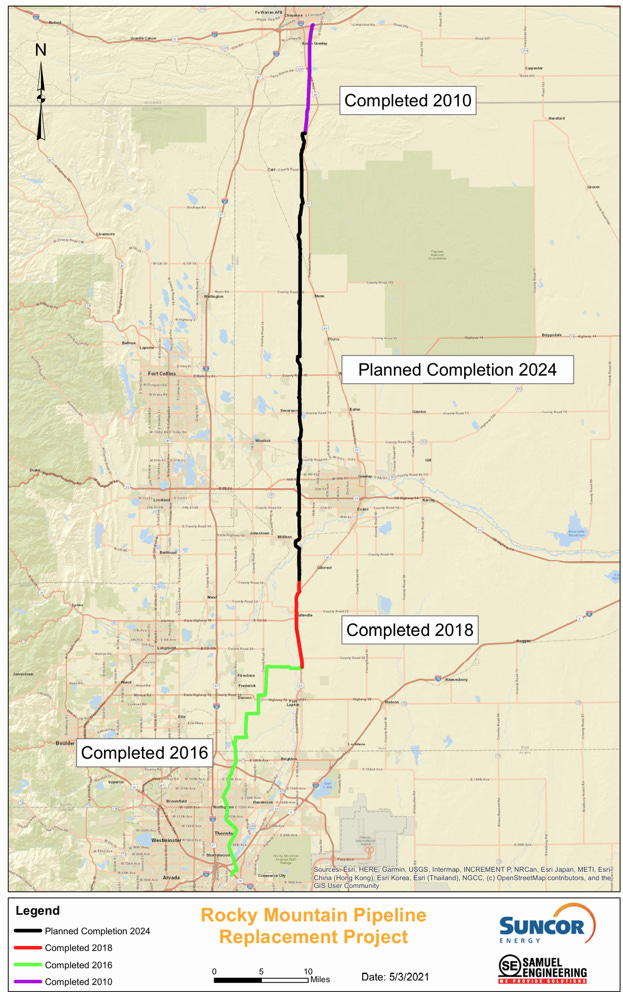

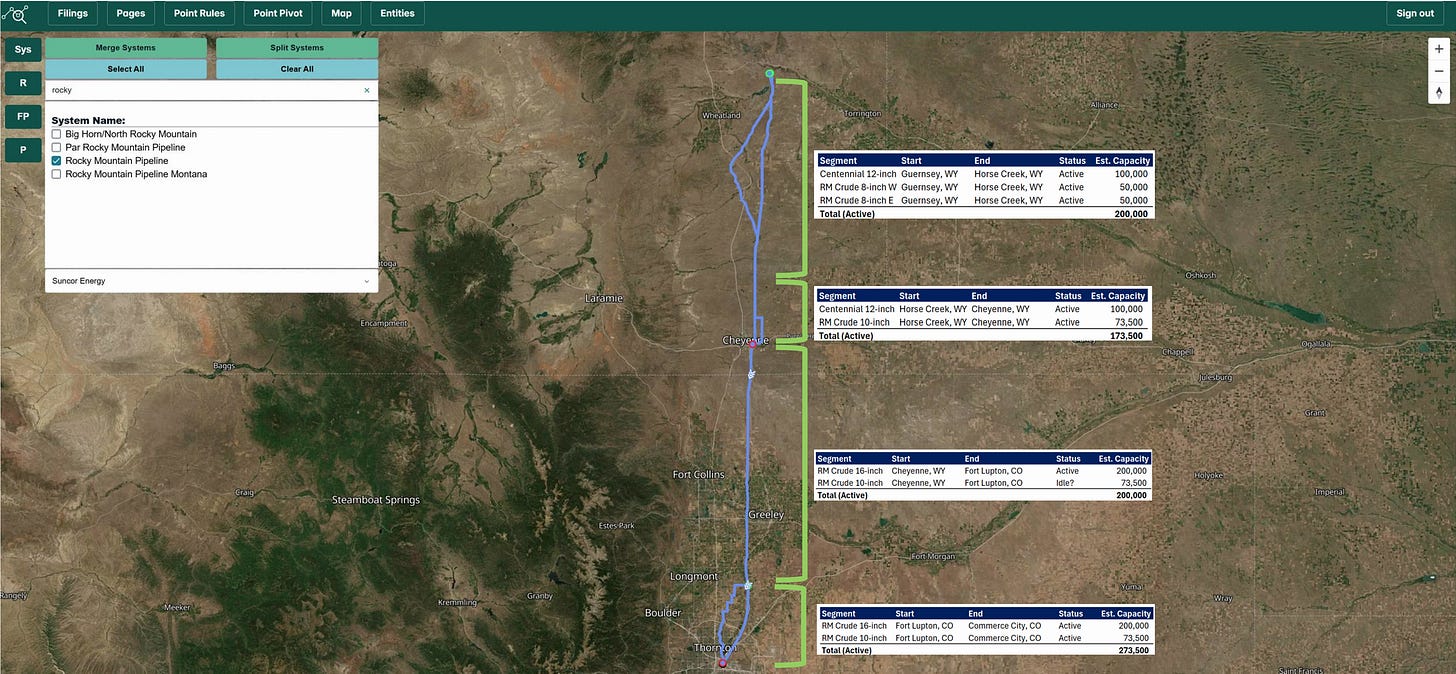

Suncor’s Rocky Mountain Pipeline Upgrade

Suncor’s Rocky Mountain Pipeline, transporting crude from Guernsey to the Commerce City refinery in Denver, has undergone a major overhaul. Over the past 15 years, Suncor replaced an aging 10-inch pipeline with a 16-inch line, significantly boosting capacity (Figure 1). The final segment of this replacement, likely completed in late 2024, eliminated a bottleneck that previously capped capacity at 73,000 barrels per day. The upgraded pipeline now supports an estimated 173,000 to 273,000 barrels per day across its segments (Figure 2), far exceeding the 100,000 barrels per day required by the Commerce City refinery. Some older 10-inch pipeline sections remain idled but not permanently decommissioned, potentially serving as backups or for future use.

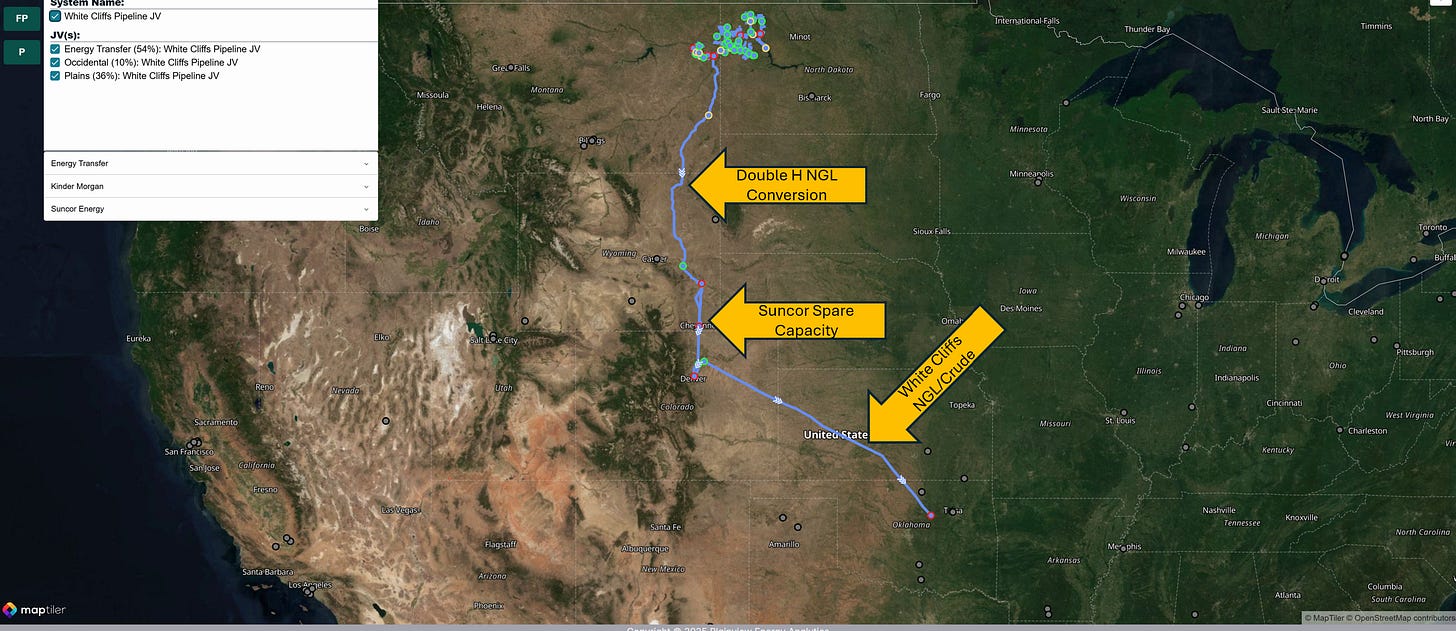

Strategic Implications and Future Opportunities

The enhanced capacity of Suncor’s pipeline prompts speculation about its strategic intent. One possibility is that the upgrade addresses the aging infrastructure of the original 10-inch pipeline, built in the 1940s and nearing the end of its operational life. Alternatively, Suncor could utilize the excess capacity to transport third-party barrels, generating revenue by connecting to DJ Basin egress pipelines like White Cliffs or Saddlehorn. Another scenario involves selling the idled or overbuilt pipeline sections to operators like those managing the Grand Mesa pipeline, which lacks physically owned access to Guernsey. Additionally, speculation surrounds Kinder Morgan’s potential conversion of its Double H pipeline to natural gas liquids (NGLs), which could involve acquiring Suncor’s idled lines to transport NGLs from Guernsey to DJ pipelines flowing to Oklahoma and the Gulf Coast (Figure 3).

Competitive Dynamics and Market Outlook

The pipeline upgrades and potential operational shifts could significantly alter the competitive landscape for crude oil in the Guernsey area. Increased throughput on the Cheyenne Pipeline and additional capacity on Suncor’s Rocky Mountain Pipeline may challenge existing players like Pony Express and Saddlehorn for market share. A conversion of existing oil pipelines to NGL transport could substantially tighten crude oil egress capacity from the Rockies. Although current data indicates no significant increase in flows through Suncor’s pipeline, the potential for future utilization is possible, suggesting a dynamic and evolving midstream market in the region.