Questions? - matthew.lewis@plainview-energy.com

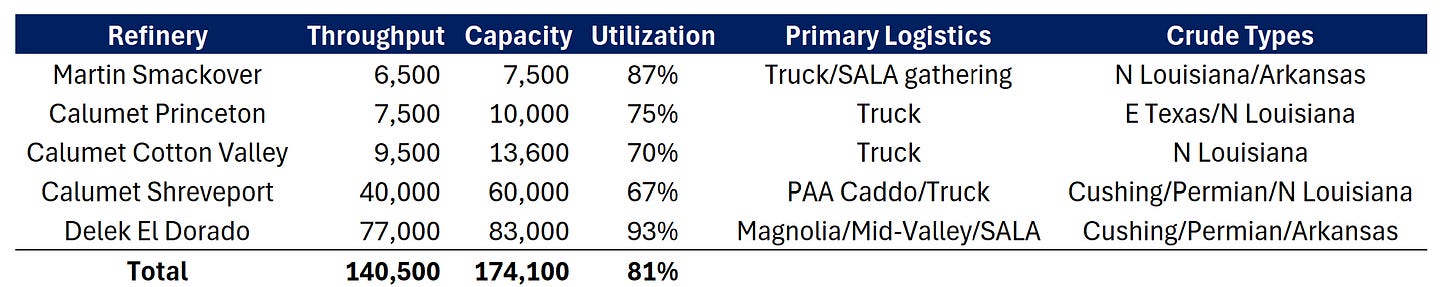

The northwest corridor of Louisiana, extending slightly into southern Arkansas, plays a significant role in the state’s crude oil market, characterized by a mix of small and large refineries with distinct supply dynamics. This area, while interconnected with other parts of Louisiana, operates as a relatively distinct market with its own pipeline infrastructure and supply sources. The primary focus is on two major refineries—Calumet Shreveport and Delek El Dorado—alongside three smaller refineries that collectively shape the region’s supply and demand fundamentals.

Calumet Shreveport’s Supply Chain and Emerging Competition

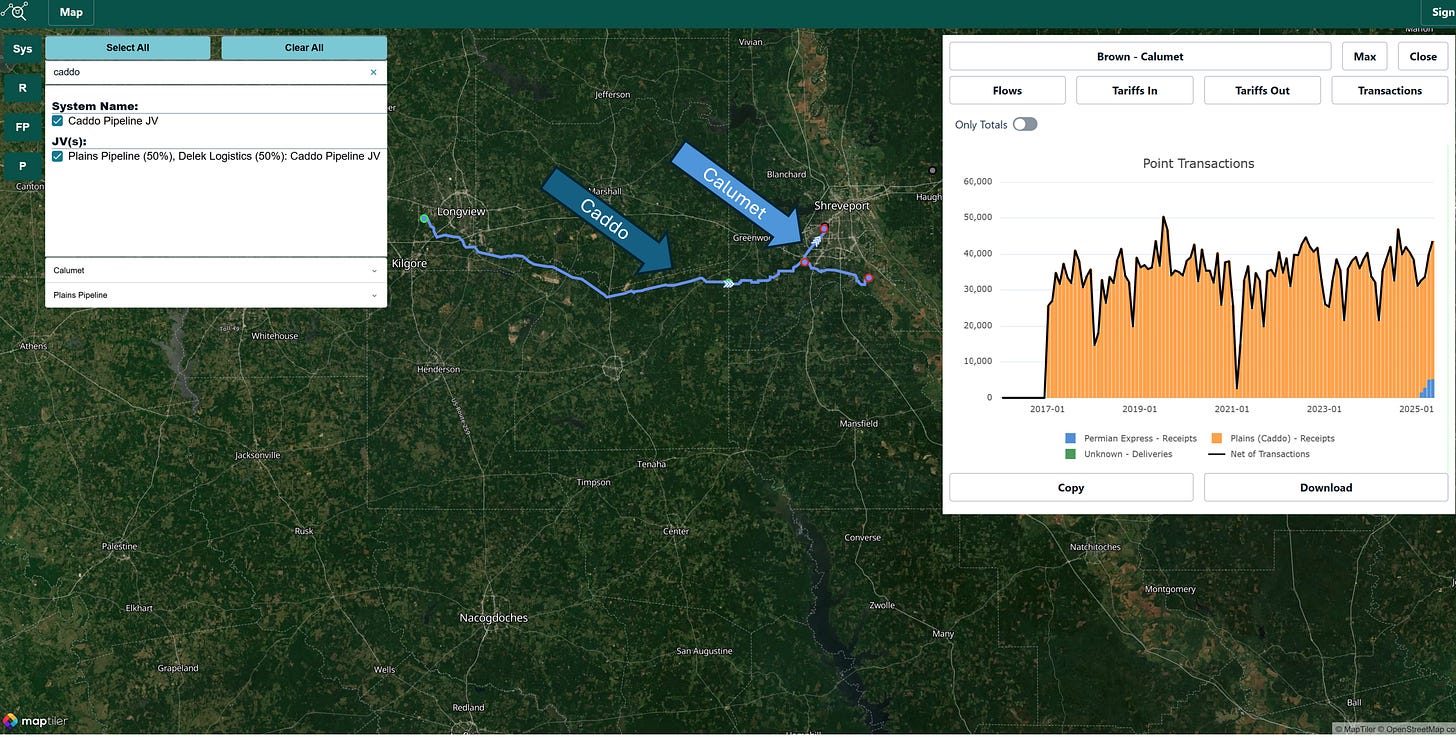

The Calumet Shreveport refinery, with a capacity of approximately 60,000 barrels per day, typically operates at 65–70% utilization, a consistent trend over the past decade. Its supply primarily comes from a last-mile pipeline owned by Calumet, delivering 35,000 to 40,000 barrels daily, supplemented by local production transported via trucks. The pipeline is predominantly fed by Plains All American’s Caddo pipeline, which moves crude from the Longview, Texas, area to Shreveport. Recent data indicate emerging competition, with Permian Express beginning to deliver small volumes to Calumet, potentially challenging Caddo’s dominance. Longview serves as a key hub, providing access to diverse crude sources, including Permian and Cushing barrels, via pipelines like Permian Express, West Texas Gulf, and Red River.

Delek El Dorado’s Complex Pipeline Network

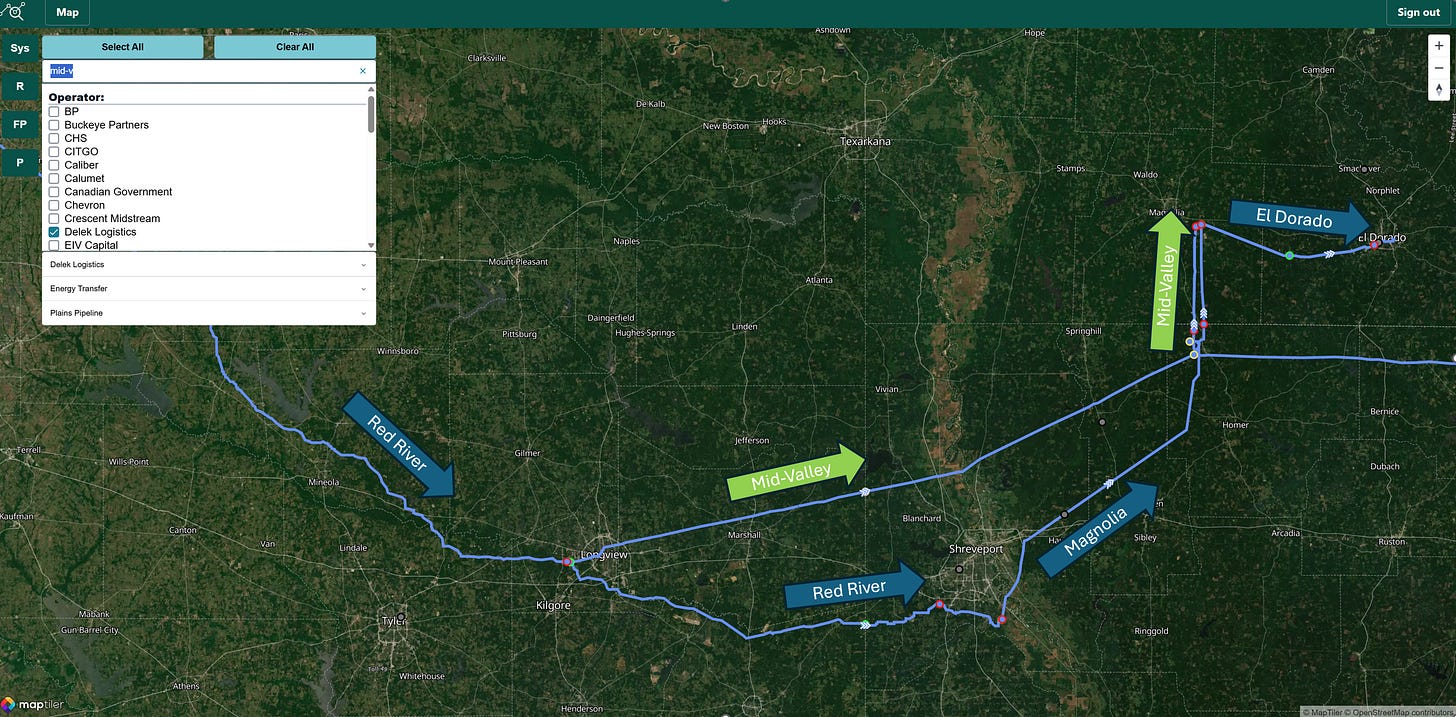

The Delek El Dorado refinery in southern Arkansas, the largest in the corridor at 80,000 barrels per day, operates near full capacity and relies on a more complex supply chain. Approximately 35,000 barrels daily are sourced through the Magnolia pipeline, which connects to Caddo and is partially owned by Delek. Caddo, in turn, draws crude from Longview, where Delek also secures barrels from the Red River pipeline (via Cushing), a joint venture formed with Plains in 2019. The remaining 35,000 to 40,000 barrels needed to meet El Dorado’s capacity are supplied via Energy Transfer’s Mid-Valley pipeline, which moves substantial volumes from Longview to Louisiana and the Midwest. A portion of these Mid-Valley barrels appears to be transported into Arkansas via leased capacity by Energy Transfer’s marketing arm.

Minor Refineries’ Limited Role in Regional Flows

The three smaller refineries—Smackover in southern Arkansas, Cotton Valley, and Princeton in northwest Louisiana—have minimal impact on regional pipeline flows. With capacities significantly lower than the major refineries, they primarily rely on local production delivered by trucks, consuming most of southern Arkansas’s 11,000 barrels per day output and northwest Louisiana’s 10,000 barrels per day of local crude. These facilities typically operate below full utilization, limiting their influence on broader supply and demand dynamics.

Future Dynamics and Plains’ Dominance in the Corridor

Looking ahead, the northwest Louisiana corridor remains a niche but critical component of the state’s crude oil infrastructure. Plains’ strong ownership stakes in key pipelines suggest continued control, though Permian Express’s recent inroads at Calumet hint at potential shifts in market share. The stability of El Dorado’s supply, anchored by Delek and Plains joint venture pipelines, contrasts with the competitive dynamics at Calumet, where Plains and Energy Transfer may vie for influence.