Questions?: Email: matthew.lewis@plainview-energy.com

Phillips 66’s Strategic Refinery Acquisition

On September 9, 2025, Phillips 66 announced a $1.4 billion acquisition to gain full ownership of the Borger refinery in Texas and the Wood River refinery in Illinois by purchasing the remaining 50% stake in WRB Refining LP from Cenovus Energy. This acquisition increases Phillips 66’s net refining capacity by approximately 250,000 barrels per day (bpd). Amid a recent proxy battle with Elliott Investment Management advocating for a focus on downstream operations, this article (and video) explores the integrated and third-party pipelines supplying the Borger, Texas refinery.

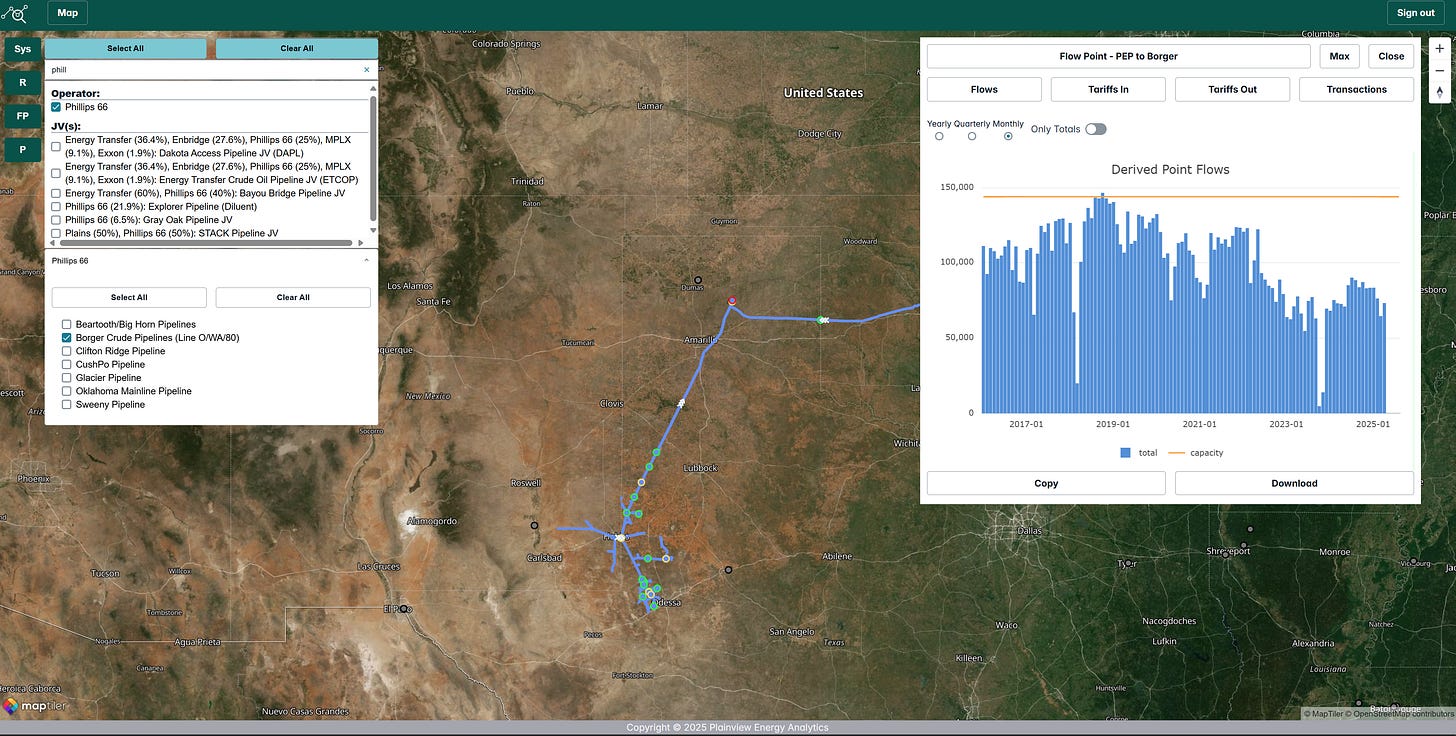

Optimizing Borger’s Crude Oil Pipeline Supply Chain

The Borger refinery’s crude oil supply chain is powered by two primary sources: the Permian Basin and the Cushing storage hub in Oklahoma. Historically, Phillips 66’s Line WA and Line 80 pipelines delivered 120,000 to 130,000 bpd of light and medium-grade crude from the Permian, utilizing a combined capacity of 144,000 bpd. The Permian’s diverse API gravity profile, particularly in the Midland Basin, enables Borger to process cost-effective light and medium-grade crude, enhancing supply chain efficiency. Phillips 66’s Sentinel marketing arm further optimizes this midstream network by trucking crude from wellheads to pipeline terminals, ensuring a seamless and reliable crude oil supply to the Borger refinery.

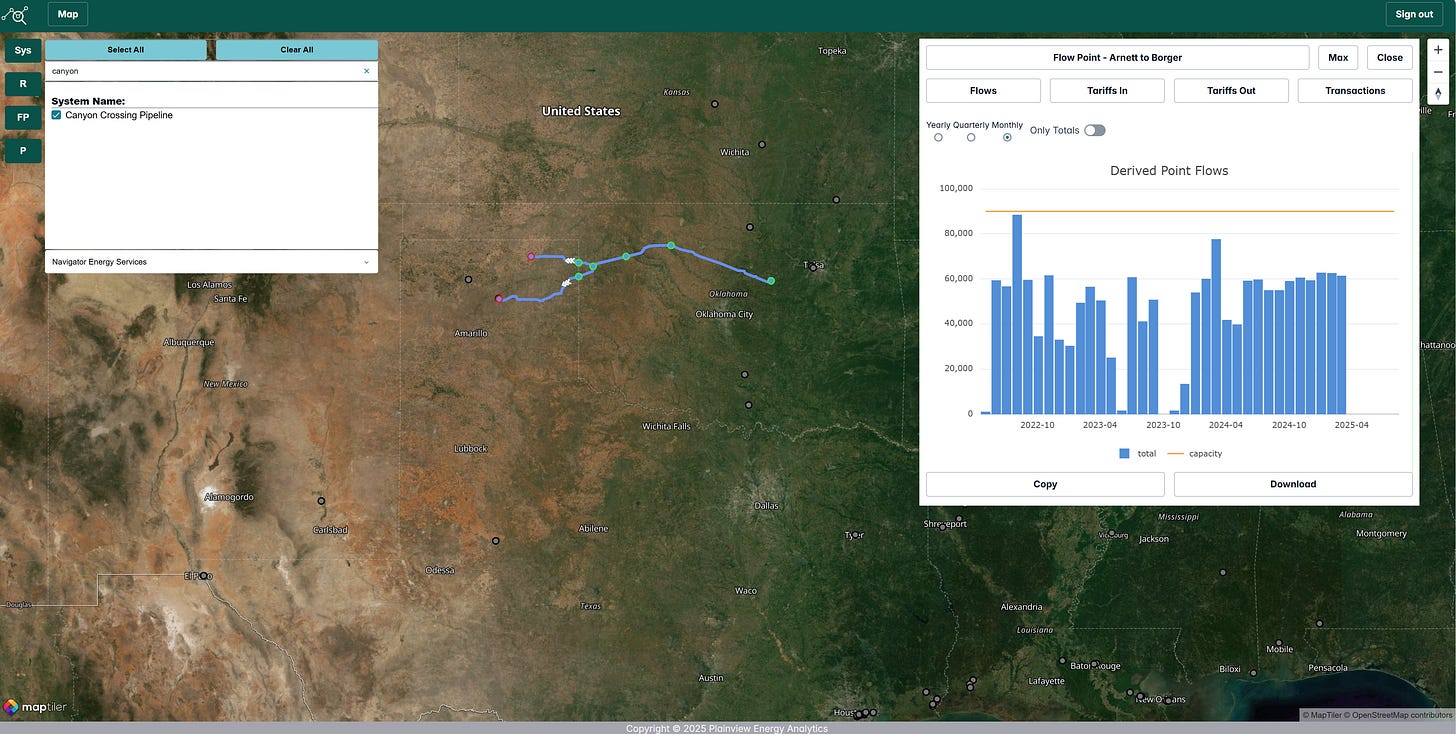

Shifting to Third-Party Canyon Crossing Pipeline for Crude Flexibility

In a pivotal midstream strategy shift, Phillips 66 idled its Line O pipeline, which previously transported 20,000 to 30,000 bpd from Cushing to Borger, in favor of the third-party Canyon Crossing Pipeline (previously named Borger Express) operated by Navigator Energy. Since mid-2022, this pipeline has supplied approximately 60,000 bpd, allowing access to heavier crude oils with API gravities as low as 18.5, likely available at discounted prices. Despite fees of approximately $1.35 per barrel, this transition enhances Borger’s crude slate flexibility and cost efficiency. The idled Line O, with a 37,000 bpd capacity, now may serve as a backup, reinforcing operational reliability in Phillips 66’s midstream crude oil transportation network.

Driving Midstream Pipeline and Refining Synergies for Future Growth

The Borger refinery acquisition significantly strengthens Phillips 66’s downstream assets, which rely on both integrated and third-party pipelines for crude oil supply. The company-owned Permian pipelines, vertically integrated to the wellhead through Phillips 66’s Sentinel trucking arm, provide critical egress capacity from the Permian Basin. The third-party Canyon Crossing Pipeline enhances Borger’s access to cost-effective heavy crude from Cushing, supporting a diversified crude slate. By leveraging these pipeline networks, Phillips 66 enhances its operational efficiency and market leadership in the U.S. refining and midstream landscape.