Questions? Please email me: matthew.lewis@plainview-energy.com

EPIC Crude Pipeline Sale: Ownership and Market Interest

According to Reuters, the EPIC Crude Pipeline, a major Permian crude oil egress pipeline, is under consideration for sale by its owners: Ares Management, which holds a 45% stake, and Kinetic and Diamondback Energy, who collectively own the remaining 55%. Investment bankers have been engaged to explore potential buyers, with indications pointing toward a company with existing Permian oil assets as the most likely purchaser. Discussions remain preliminary, and sources emphasize that no deal is guaranteed, maintaining anonymity due to the sensitive nature of the negotiations. During recent Q2 conference calls, Diamondback expressed interest for selling its stake, while Kinetic indicated openness to a deal if the price aligns with their expectations.

Valuation Insights: EPIC Pipeline’s $2.5–$3.5 Billion Price Tag

The potential sale is projected to value the EPIC Crude Pipeline between $2.5 and $3.5 billion. Based on the pipeline’s 2024 EBITDA of approximately $290 million, this implies a valuation multiple of around 10 times. This valuation is reasonable given the pipeline’s likely low near-term recontracting risk. A deal last year with Diamondback and Kinetic extended and expanded their commitments through 2035 in exchange for what appear to be a discount on additional ownership stakes, securing stable revenue streams and reducing exposure to contract roll-offs in the near term.

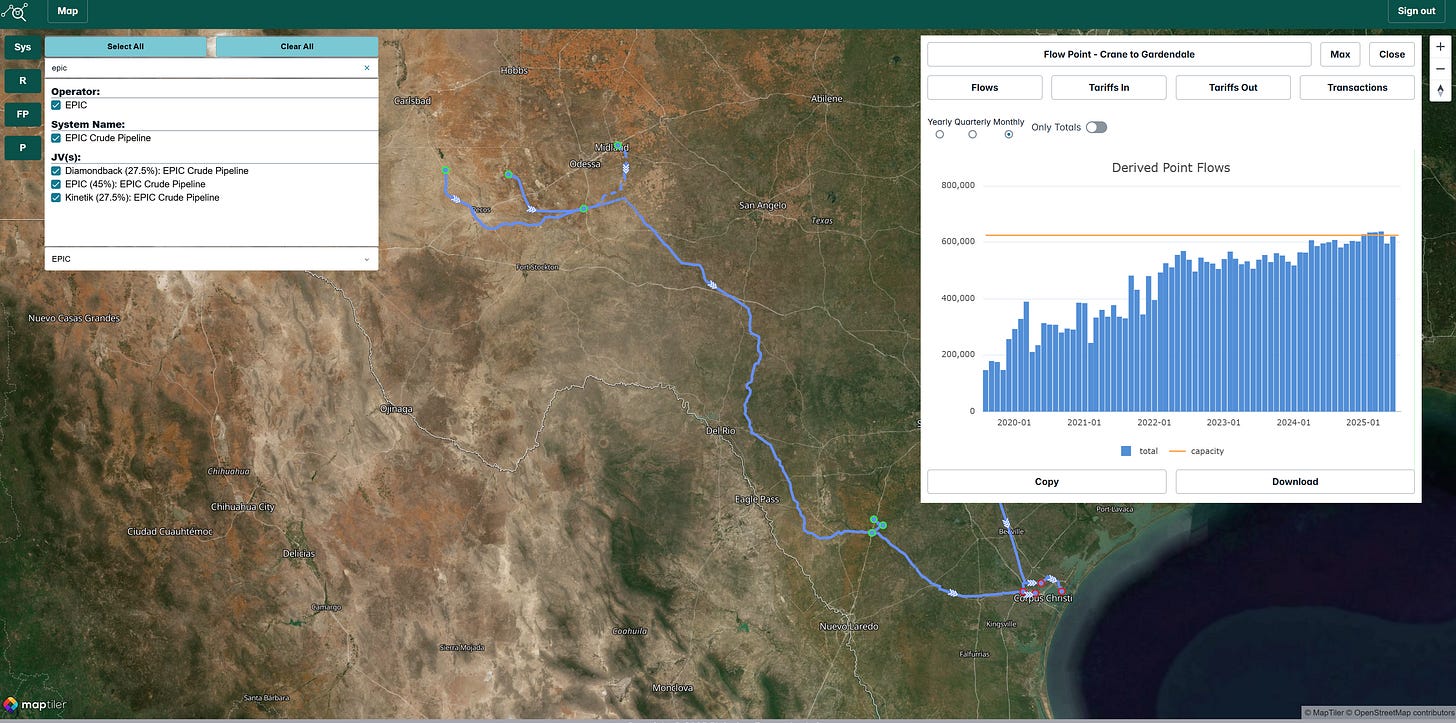

EPIC’s Operational Strength: Capacity and Permian Basin Reach

Operational since early 2020, the EPIC Crude Pipeline boasts a capacity of 625,000 barrels per day and is currently operating at full capacity. It features four primary receipt points in the Permian Basin—Orla (30,000 barrels/day), Wink (150,000 barrels/day), Midland (175,000 barrels/day), and Crane (275,000 barrels/day)—and additional minor receipt points in the Eagle Ford area. The pipeline delivers primarily to Corpus Christi (250,000 barrels/day) and Ingleside (400,000 barrels/day), with smaller deliveries to Taft and Midway. The original contract structure included a mix of five- and ten-year terms, with most contracts now likely extended to 2030 and 2035, ensuring operational stability.

Infrastructure Challenges: Expanding EPIC’s Ingleside Capacity

The pipeline’s infrastructure includes a 30-inch line to Corpus Christi, but the segment to Ingleside is a smaller 20-inch pipeline, currently handling 400,000 barrels per day, which may limit its expansion potential. Ingleside, viewed as a more advantageous export point due to its proximity to the sea, may be a key consideration for potential buyers. However, with 600,000 to 800,000 barrels per day of open capacity from the Permian to the Gulf Coast and competitive short-term volume bids at low rates, securing commitments for expansion may be challenging in the near term unless oil prices rise significantly.

Top Buyers for EPIC: Enbridge, Plains, and ONEOK Synergies

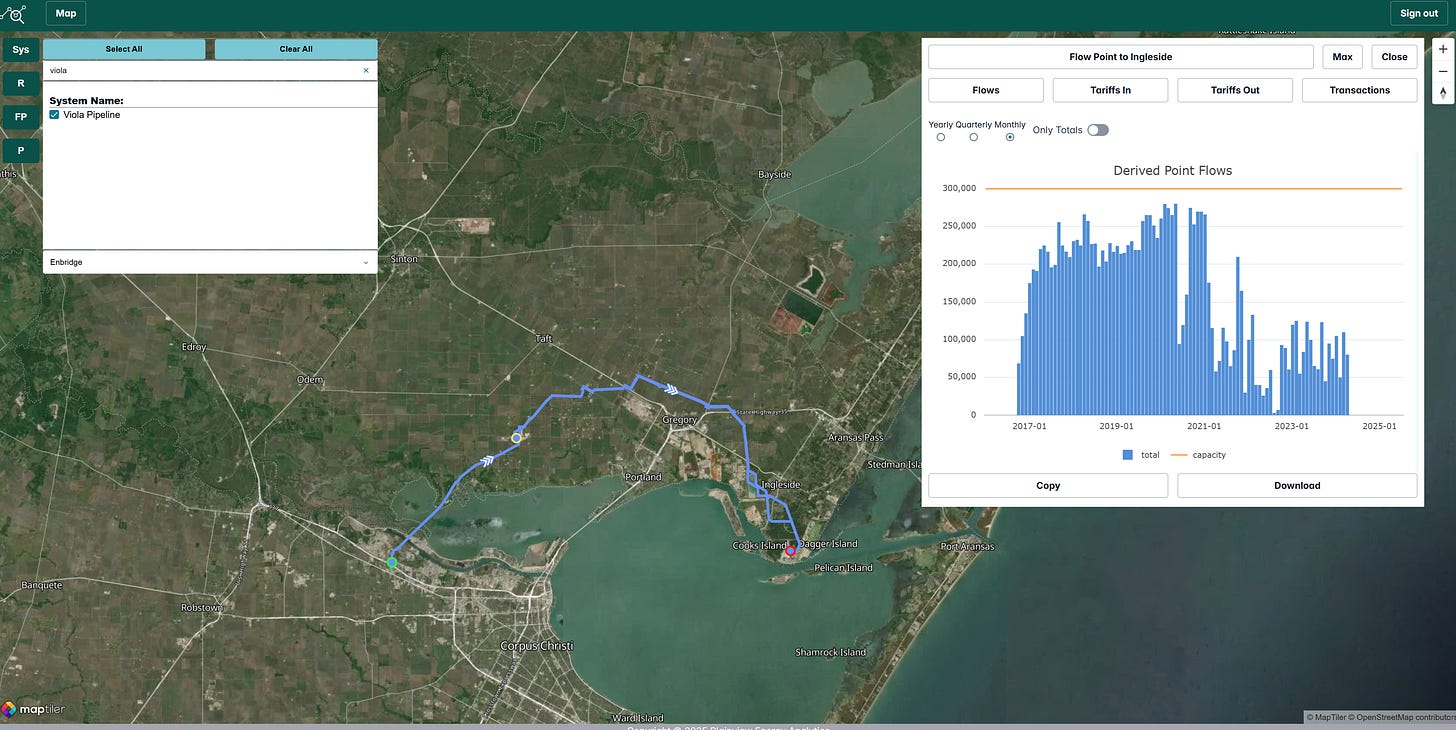

Several companies with Permian assets are potential buyers due to operational synergies. Enbridge is a strong contender, leveraging its Ingleside Energy Center, the largest U.S. export terminal, handling over 1.2 million barrels daily, and its underutilized Viola Pipeline, with 300,000 barrels per day of capacity, which could enhance EPIC’s flow to Ingleside. Plains All American Pipeline, with its extensive Permian gathering system and Eagle Ford JV pipeline (100,000–150,000 barrels/day spare capacity), could integrate EPIC to bolster Corpus Christi exports. ONEOK, a major contributor at Crane via its Medallion gathering system and Magellan assets, could diversify to Corpus Christi using its Double Eagle pipeline, though its primary downstream focus is Houston.

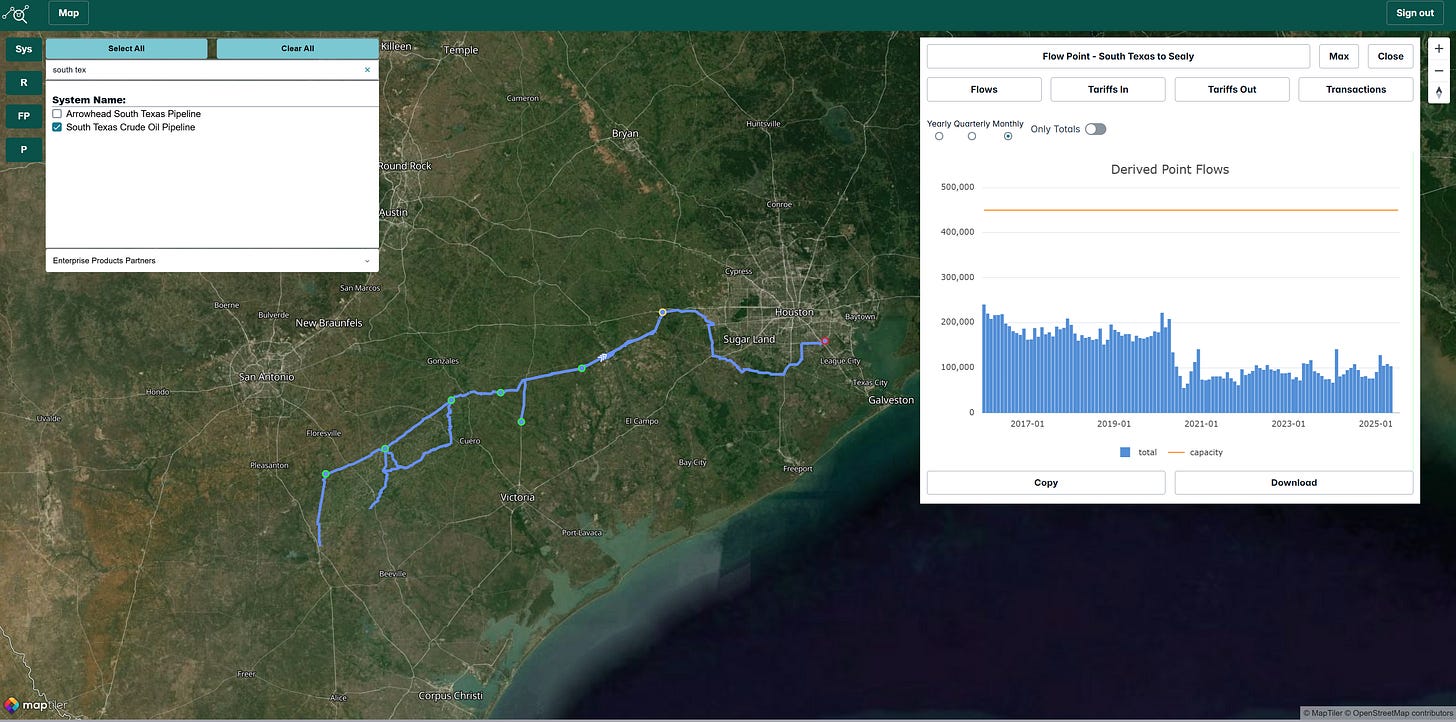

Other Contenders: Enterprise, Energy Transfer, and Gibson’s Play

Enterprise Products Partners is another potential buyer, with its South Texas system offering significant spare capacity to move EPIC barrels from the Eagle Ford area to Houston, aligning with its extensive Houston Ship Channel infrastructure. However, challenges in contracting its offshore terminal may temper its bidding aggression. Energy Transfer, with a vast footprint but a focus on Nederland, may find limited synergies unless diversifying to Corpus Christi. Gibson Energy, despite lacking long-haul pipelines, could be a dark horse, leveraging its South Texas Gateway terminal at Ingleside and Wink terminal to enhance upstream and downstream integration.

Market Trends Impacting EPIC’s Sale: Permian Pipeline Dynamics

The sale of the EPIC Crude Pipeline occurs in a market with ample Permian-to-Gulf Coast capacity, which may suppress short-term expansion prospects unless rates are significantly lowered or oil prices increase. Buyers valuing future expansion potential, particularly to Ingleside, will likely drive the bidding, with those holding underutilized assets gaining a competitive edge. Enbridge’s strategic advantage with its Viola Pipeline and Ingleside terminal positions it favorably, while Plains, ONEOK, and Enterprise offer compelling cases through their existing infrastructure. The outcome of this sale will hinge on how buyers assess EPIC’s long-term contract stability against the challenges of expanding capacity in a competitive market.