Project Overview and Timeline

Energy Transfer disclosed the Dakota Access North project during its recent earnings call, partnering with Enbridge to develop up to 250,000 barrels per day of new Canadian crude oil egress capacity. This initiative likely focuses on routing additional volumes from Enbridge’s Mainline system into the existing Dakota Access Pipeline (DAPL), addressing underutilized assets amid growing demand for reliable Canadian transport. The project builds on Energy Transfer’s strategy to fill idle capacity on DAPL and the Energy Transfer Crude Oil Pipeline (ETCOP), which currently offer over 200,000 bpd of available space. A final investment decision is planned for mid-2026, with more details expected from Enbridge’s upcoming earnings call.

Infrastructure Analysis and Potential Configurations

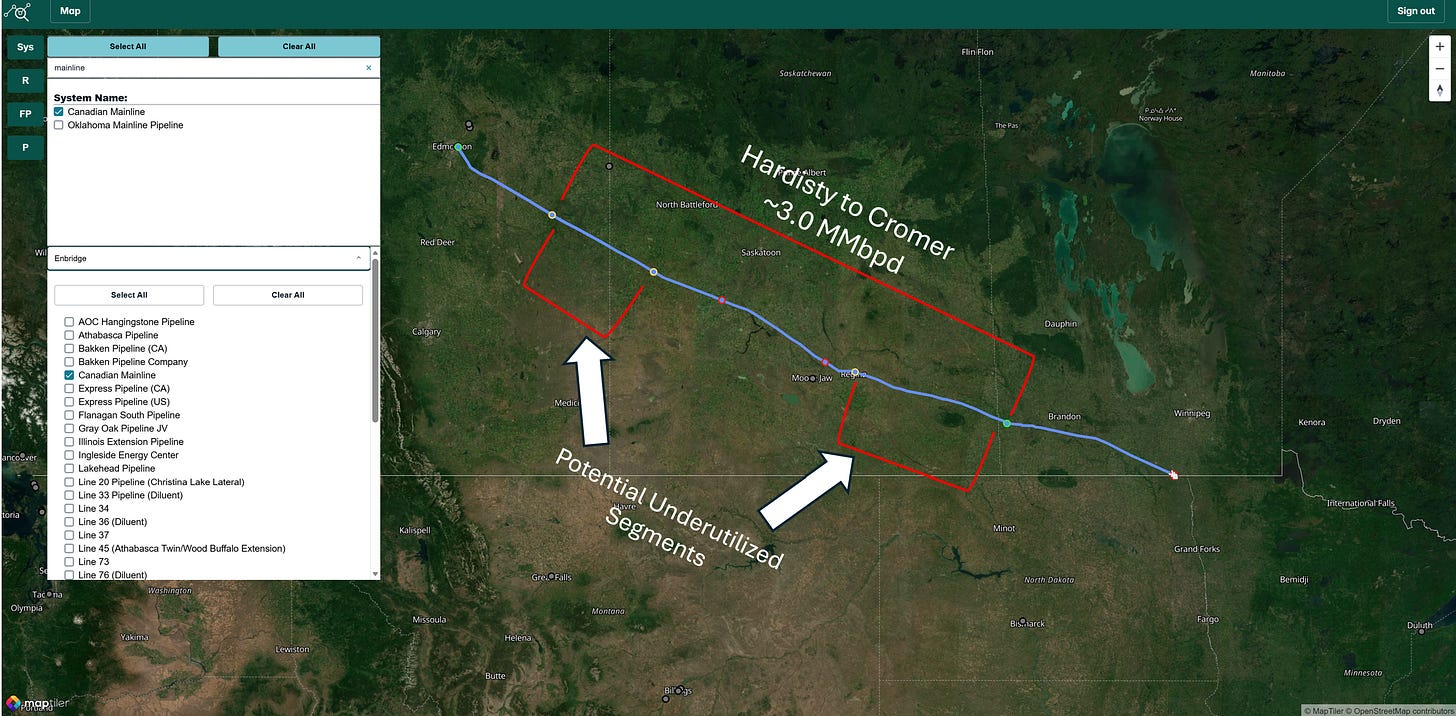

Although specifics remain limited, a likely configuration involves connecting DAPL to Enbridge’s Mainline. While the Mainline generally operates near full capacity, certain segments likely hold pockets of open space, such as from Hardisty to Kerrobert and Regina to Cromer. These underutilized areas could enable optimizations like pump station upgrades or drag-reducing agents across the Mainline’s five parallel lines, minimizing the need for extensive new construction.

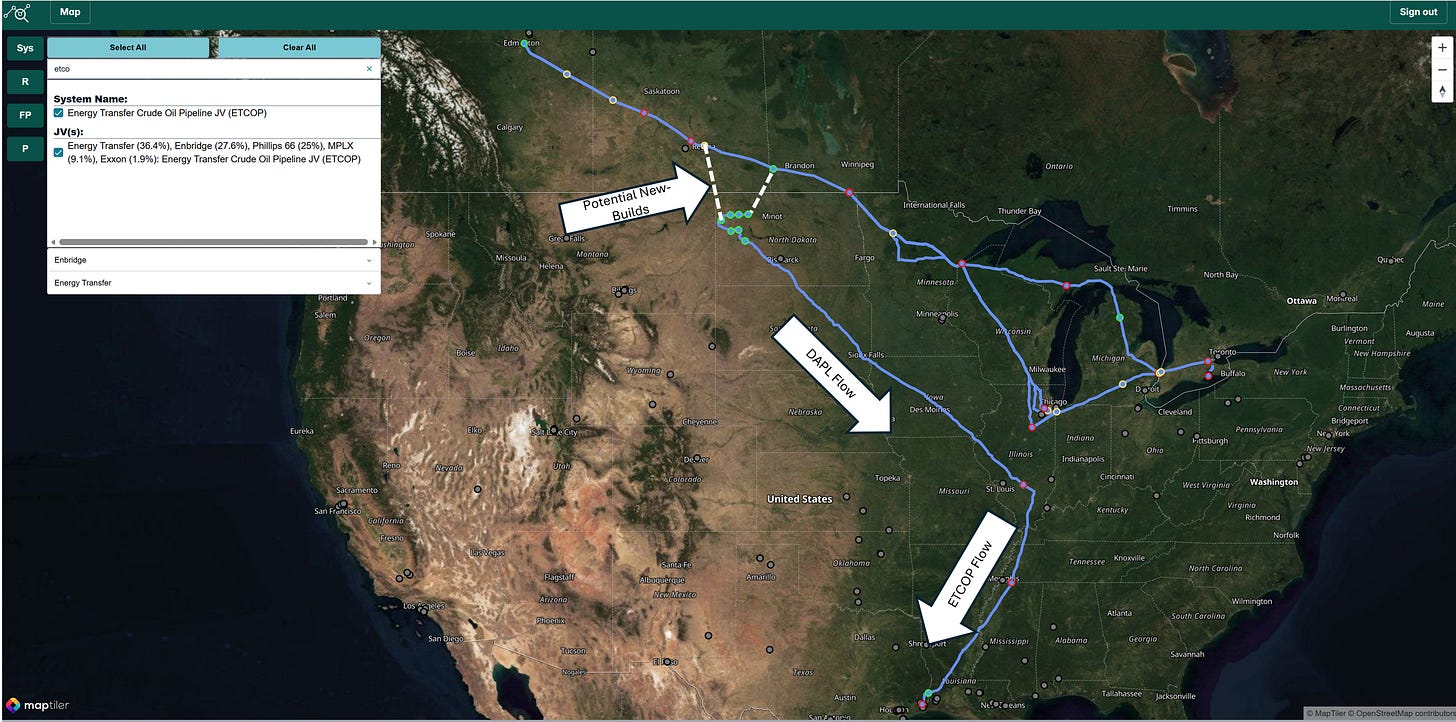

For the DAPL tie-in, options include building a short segment north to Cromer, Manitoba, or Regina, Saskatchewan; reversing Enbridge’s underutilized North Dakota line (currently handling 150,000 bpd of light oil northbound); or leveraging bi-directional routes like Plains’ Wisconsin and Montana pipelines (with under 50,000 bpd of southbound capacity). Given the differing capacity requirements for heavy versus light oil, a short new-build line emerges as the most probable solution. From this new Canadian tie-in, volumes would flow southeast on DAPL to ETCOP in Illinois, which boasts significant open capacity to the Gulf Coast. Although both DAPL and ETCOP are underutilized, transporting heavy Canadian crude may necessitate some capital investment, including batching infrastructure to alternate light and heavy barrels.

Tariff Structure and Cost Advantages Versus Mainline Routes

A core advantage of this project lies in leveraging existing infrastructure, with DAPL and ETCOP offering underutilized capacity and scalability through low-cost brownfield expansions if required. Tariff rates position it competitively: DAPL light oil from the Bakken to Nederland runs under $7 per barrel, implying the potential for an all-in joint rate from Edmonton to the Gulf Coast of around $9 to $10 per barrel, closely rivaling the $8 to $9 rates on the now-saturated Mainline-Flanagan South-Seaway route. This structure outperforms other rumored, more greenfield heavy-oil alternatives.

Strategic Outlook and Capital Considerations

Dakota Access North stands as a highly competitive avenue for future Canadian egress, capitalizing on the post-Trans Mountain need for additional capacity. Capital outlay remains uncertain, potentially encompassing Enbridge Mainline expansions in bottlenecked segments, DAPL/ETCOP adjustments for heavy oil volumes up to 250,000 bpd, and enhanced batching facilities. Yet, the project’s emphasis on monetizing idle capacity through targeted brownfield optimizations highlights its low-risk profile and potential for solid returns. For Energy Transfer, it is particularly key: it mitigates downside risks from an increasingly competitive Bakken egress market while potentially driving earnings growth through sustained throughput and long-term contracts.