Update 7/25

The article has been updated with new information in paragraph three regarding Trafigura’s shipper option, included in their original contract, which allows them to extend the contract with “certain rate adjustments.”

Cactus II Pipeline Tariff Cut Signals Shifting Dynamics in Permian Basin Oil Transport

Tariff Reduction Amid Strong Utilization

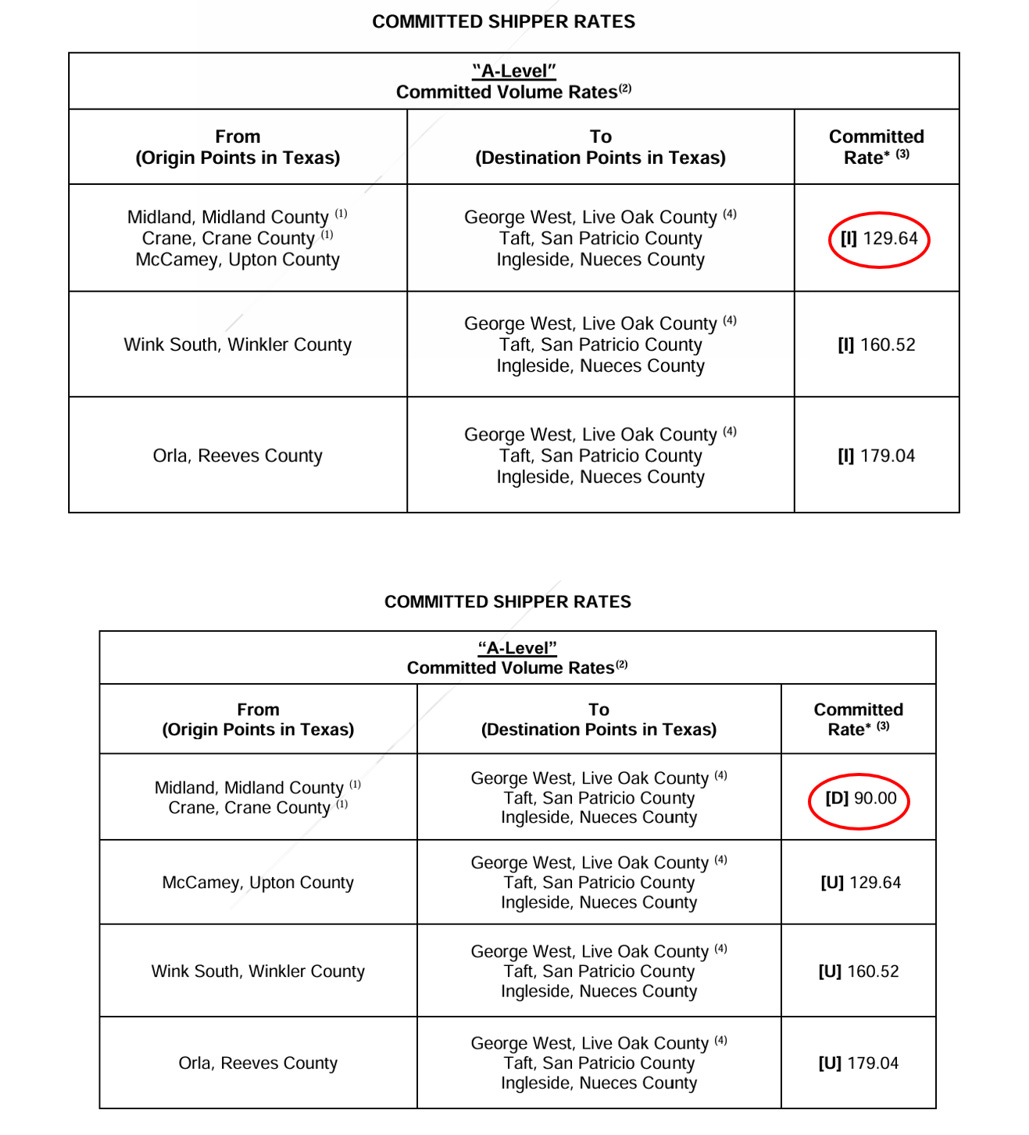

The Plains Cactus II pipeline, a critical artery for transporting crude oil from the Permian Basin to Corpus Christi, Texas, has recently filed a new tariff that could signal shifts in the region's oil transportation dynamics. Owned 70% by Plains All American Pipeline and 30% by Enbridge, the 670,000 barrel-per-day pipeline has maintained high utilization rates, recently running near full capacity. The recent tariff filing pertains to committed A-level shippers, notably Trafigura, the pipeline’s anchor shipper with a contracted capacity of 300,000 barrels per day. This filing reduces the tariff rate from $1.30 to $0.90 per barrel, prompting discussions about its financial and market implications for both the pipeline operators and the broader Permian Basin.

Trafigura’s Contract Shift Lowers Cactus II Pipeline Revenue

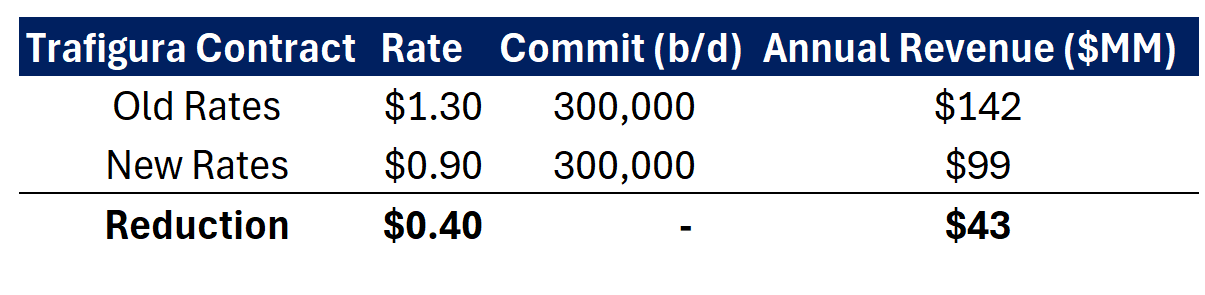

Originally, Trafigura’s five-year contract, starting in 2019, was extended in 2021 due to the oil market downturn caused by the COVID-19 pandemic. This extension adjusted the contract to maintain the same aggregate committed barrels over a longer period, estimated to conclude around 2026. However, the tariff filing suggests Trafigura may have fulfilled its committed volume earlier than anticipated, likely due to shipping rights that allowed them to transport volumes exceeding the contracted amount. The new rate, if applied to the same 300,000 barrels per day, reduces annual trunk revenue from Trafigura’s contract by approximately $43 million, from $142 million to about $99 million. This translates to a quarterly EBITDA reduction of roughly $10 million, or a 14-15% drop for the pipeline, which generates ~$280 million in annual trunk revenue. While this reduction is notable, it is not significantly impactful for large operators like Plains and Enbridge.

Permian Basin Pipelines Face Recontracting Pressure

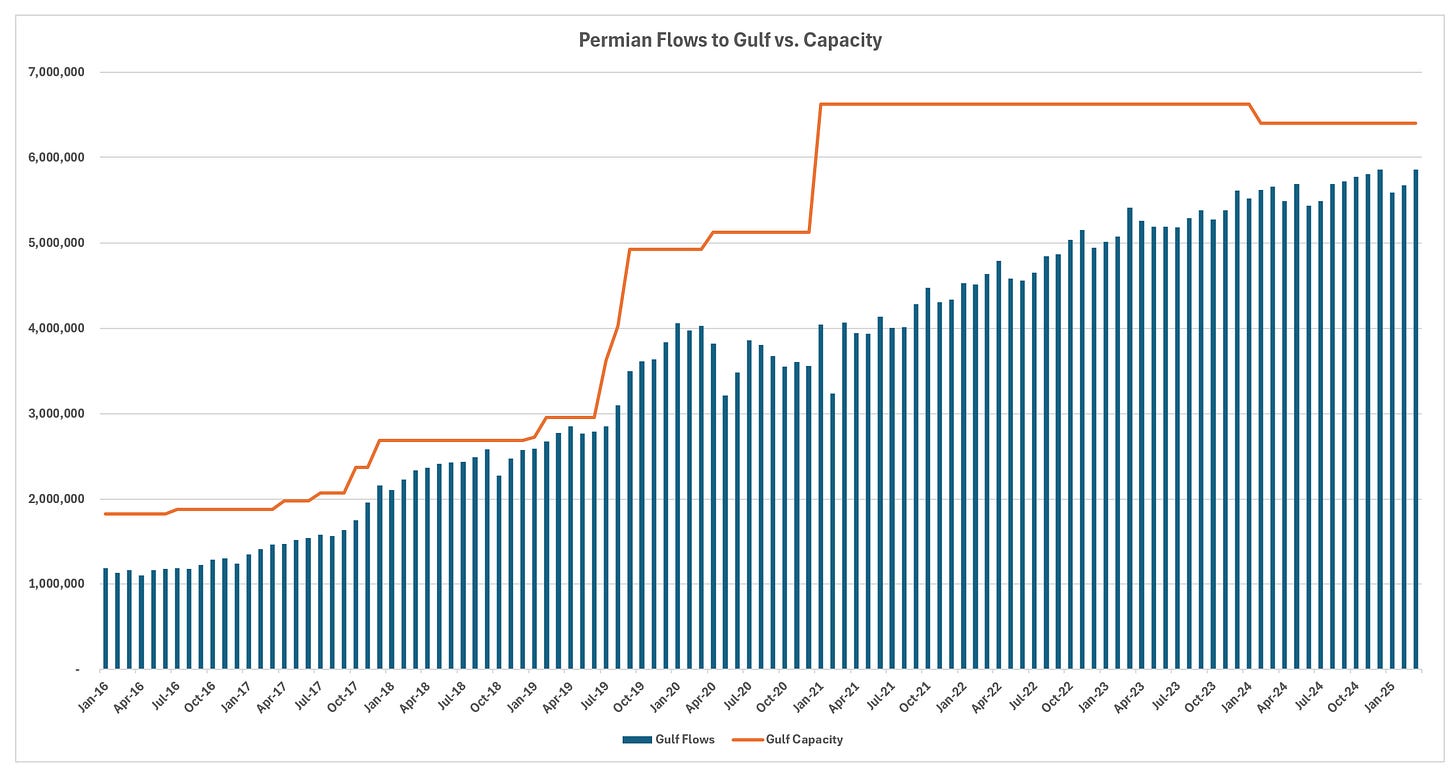

The broader significance of this tariff adjustment lies in its potential to set a precedent for recontracting rates across the Permian Basin. The region experienced a significant overbuild of pipeline capacity between 2019 and 2021, resulting in a gap of approximately 2.5 million barrels per day between available Gulf Coast capacity and actual flows. Although production has gradually increased, filling many pipelines to the Gulf Coast, the market remains competitive due to additional capacity expansions, such as those on the Gray Oak pipeline, and uncertainties like fluctuating crude oil prices around $65 per barrel. The 30% rate reduction for Trafigura, a major shipper with significant negotiating power, suggests that the recontracting market could be weak, and other pipelines may also face rate cuts. However, Cactus II’s declaratory filing on the tariff provisions included language allowing Trafigura to extend the contract for two two-year terms with “certain rate adjustments.” This provision indicates that the new rate may be based solely on a legacy contract provision and does not reflect the current market rate environment.

While midstream companies had hoped for wider price spreads between Midland and Gulf Coast hubs to support higher rates, the current market dynamics—combined with additional capacity coming online and stable production forecasts—suggest that recontracting may be challenging. The tariff reduction may not significantly impact the financials of large operators like Plains and Enbridge, but it underscores a tougher competitive landscape for the Permian’s midstream sector.