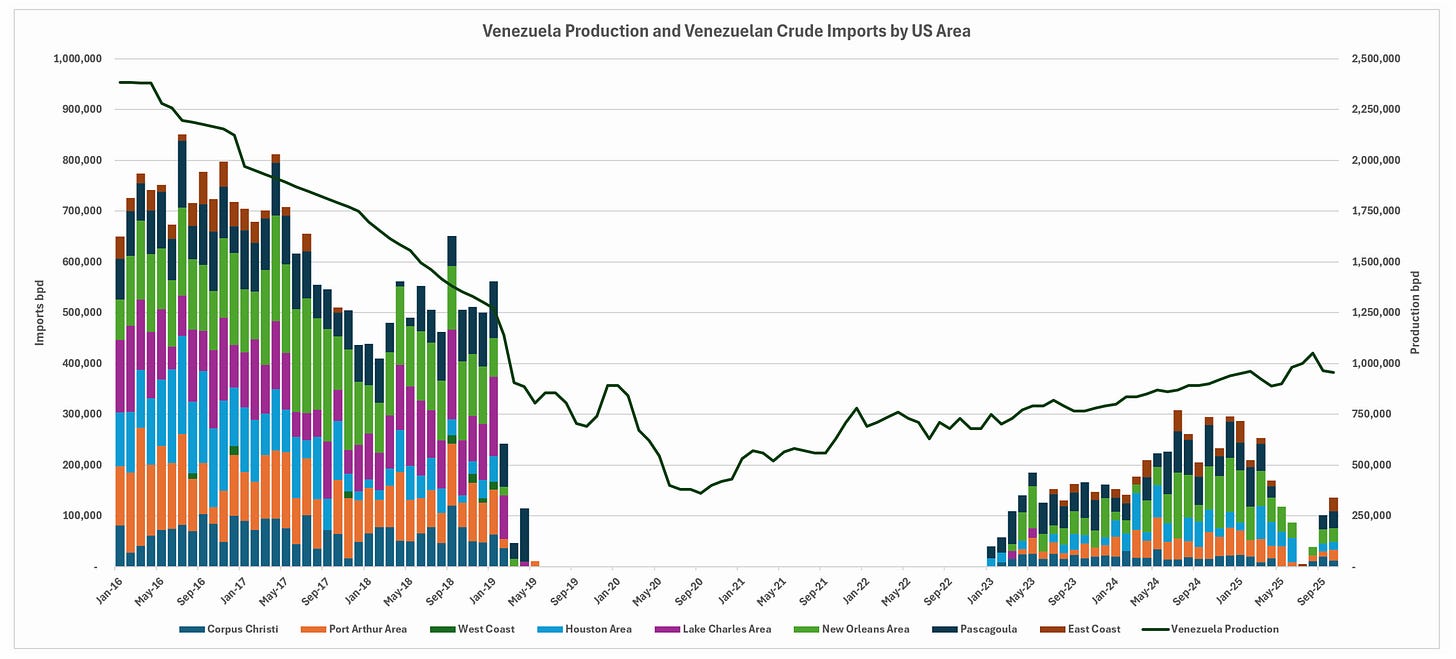

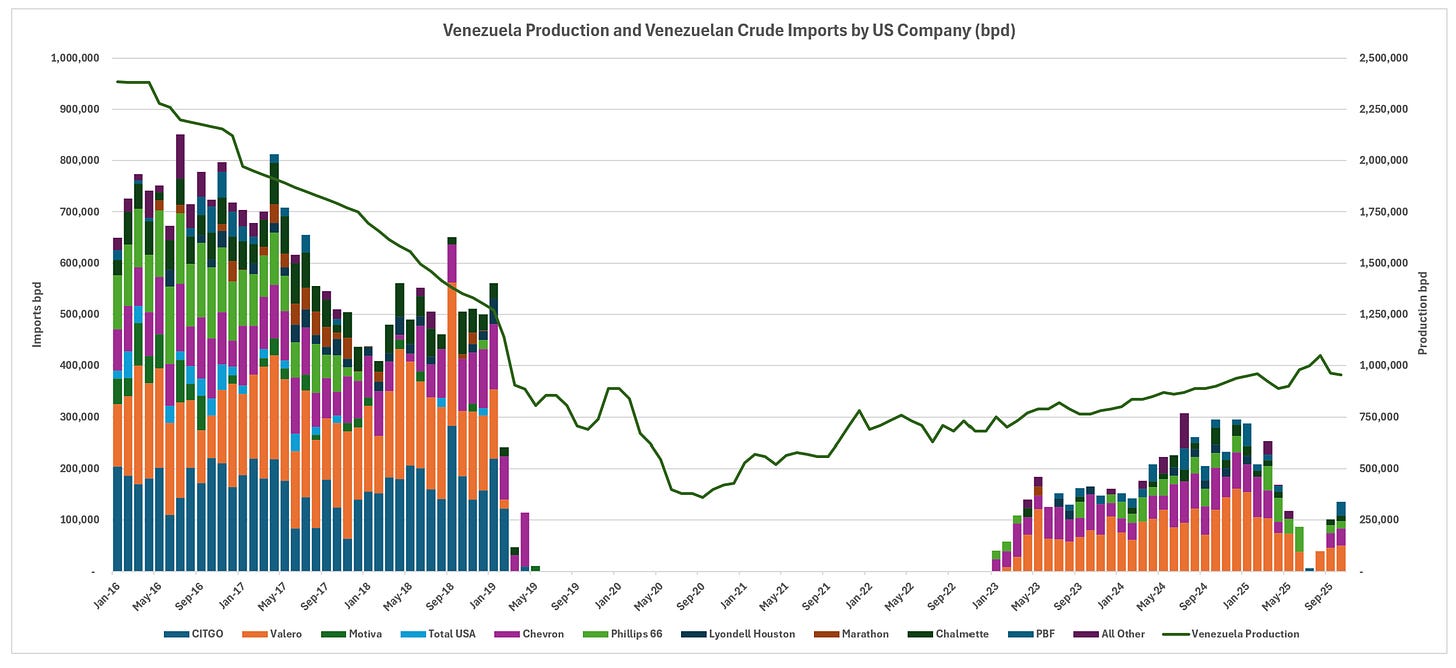

U.S. imports of Venezuelan crude oil have followed a dramatic trajectory over the past decade, shaped by sharp declines in Venezuela’s overall production and periods of U.S. sanctions. Venezuelan production fell from nearly 2.5 million barrels per day around ten years ago to a low of under 500,000 barrels per day near 2020, driven by political instability, mismanagement, and an embargo that virtually eliminated imports to the United States for several years. Imports, which once averaged around 700,000 barrels per day in 2016-2017, dropped to zero during the embargo but began recovering modestly in recent years, reaching 200,000 to 300,000 barrels per day at times as limited sanctions relief allowed some flows to resume.

Source - EIA Company Level Import Data

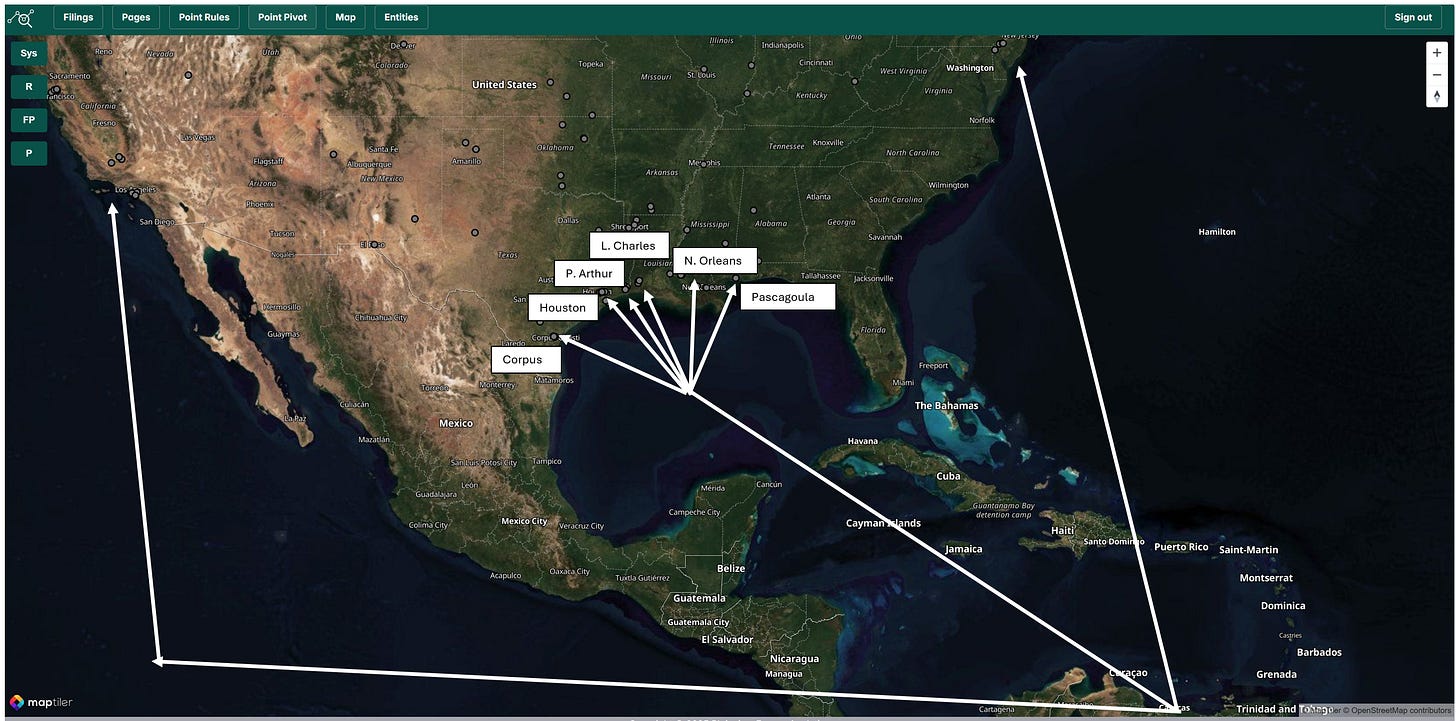

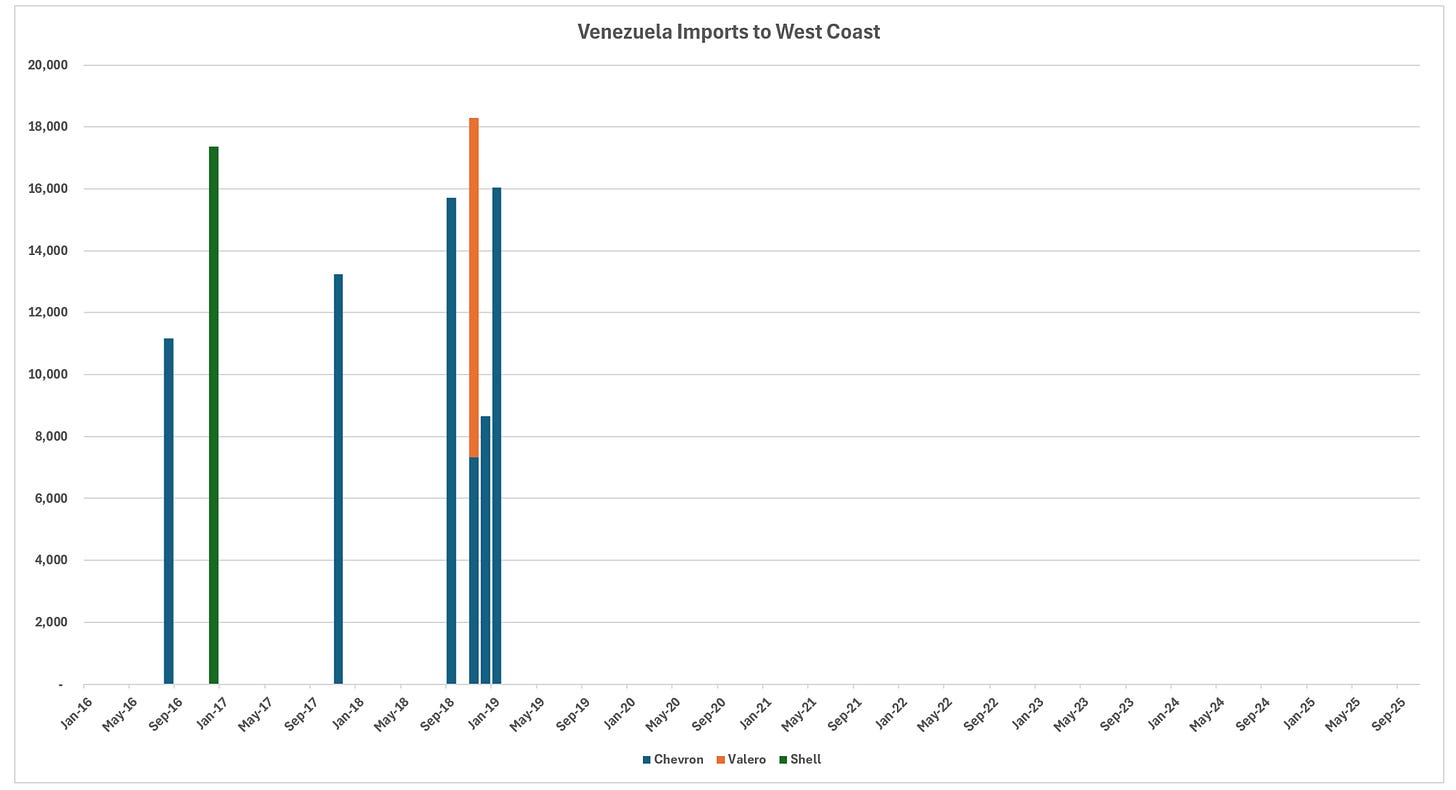

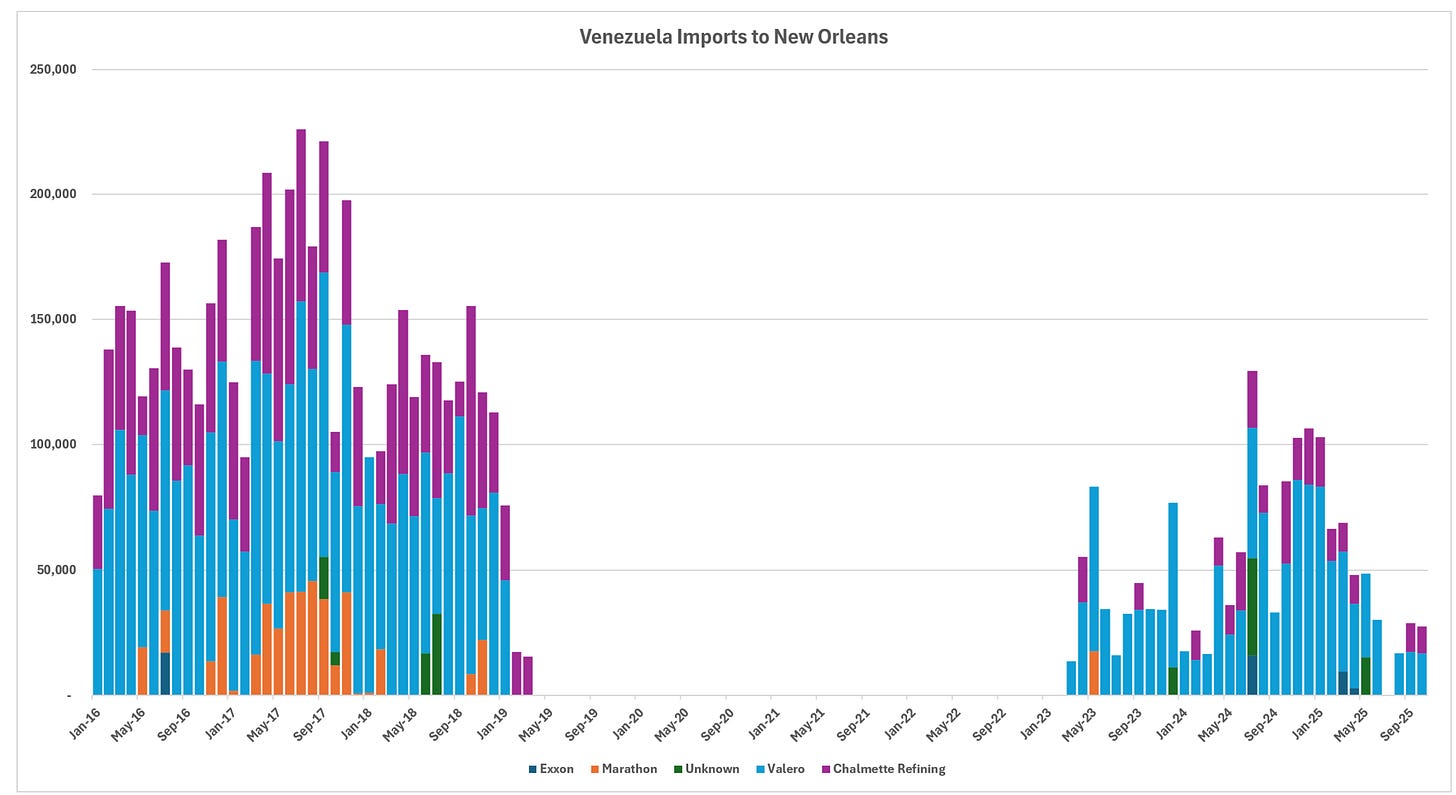

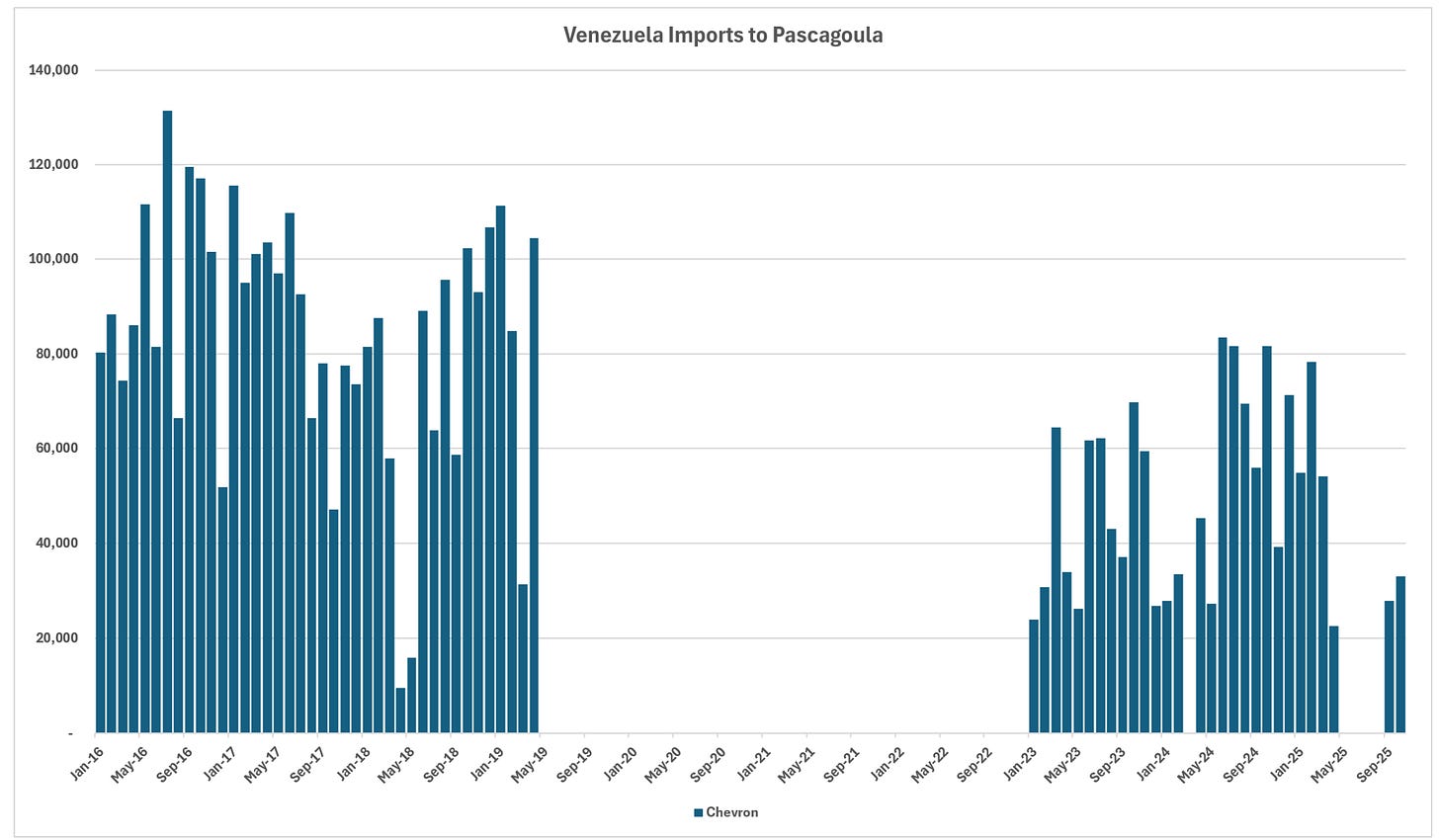

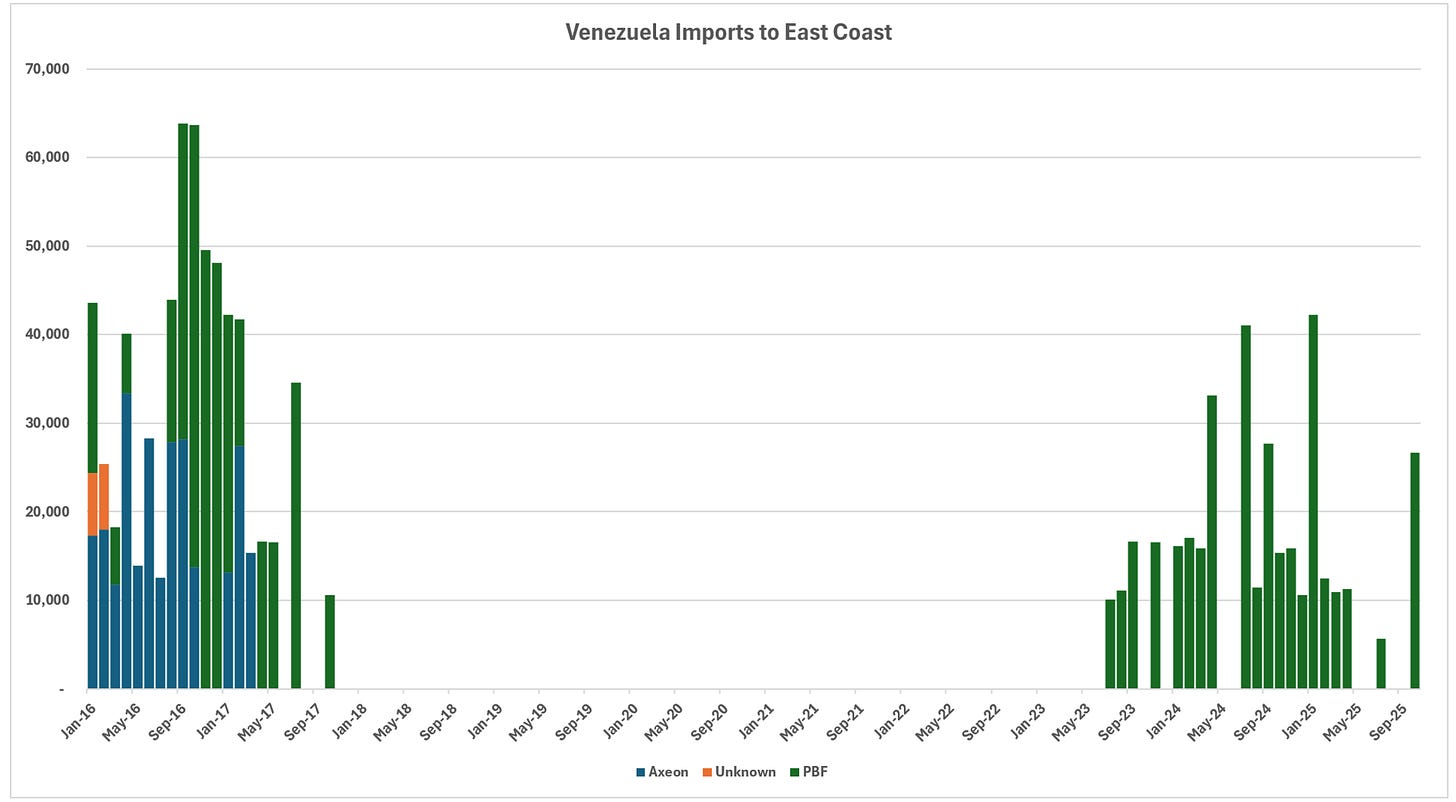

The vast majority of Venezuelan crude has historically entered the United States through Gulf Coast refineries, which are designed to handle its heavy grades. Key destinations include Pascagoula in Mississippi, where Chevron’s refinery receives significant volumes; the New Orleans and Southern Louisiana area; Port Arthur and Houston regions in Texas, encompassing facilities like Sweeny; Lake Charles; and Corpus Christi. Smaller amounts have gone to the East Coast and, infrequently, the West Coast via extended shipping routes. In earlier periods, distribution across the Gulf Coast locations was relatively balanced, but recent patterns show more concentration among a few major players and sites.

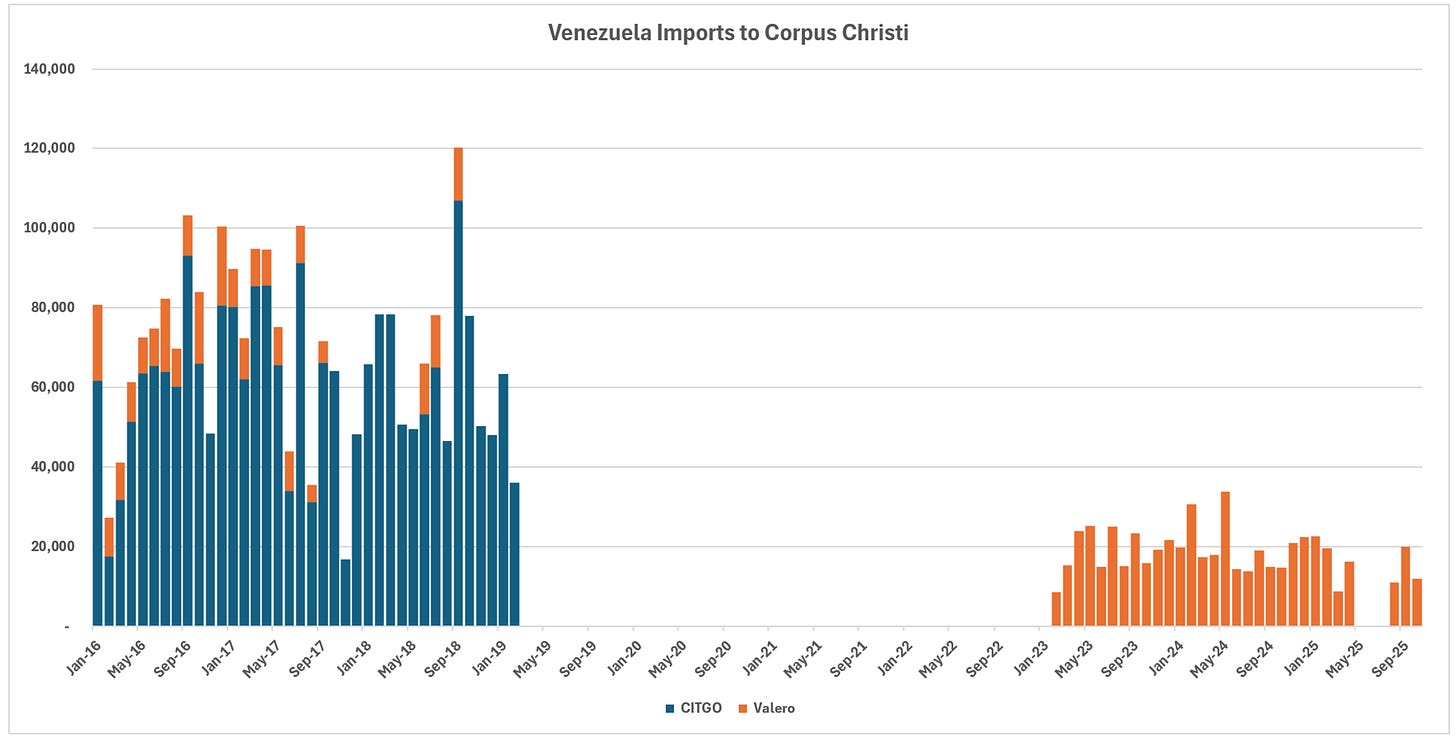

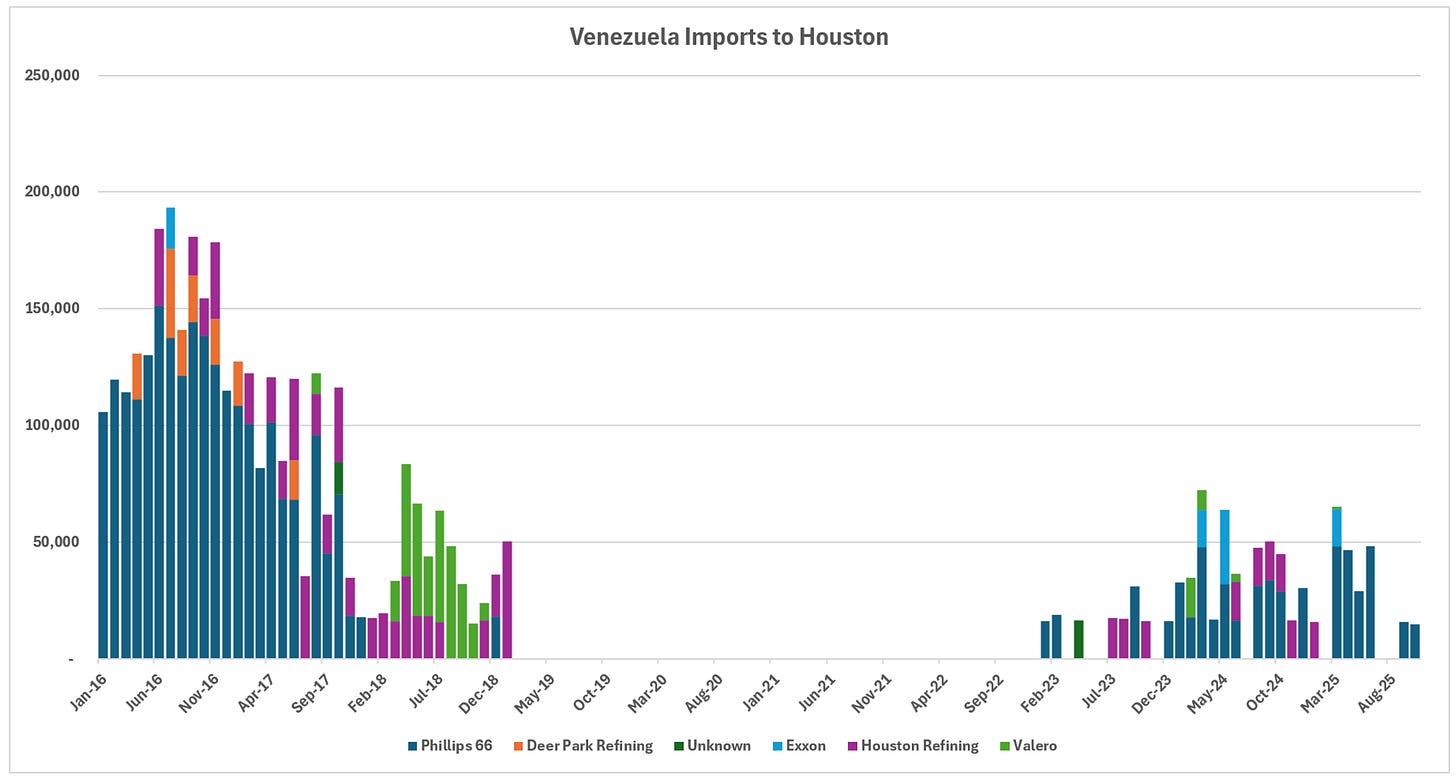

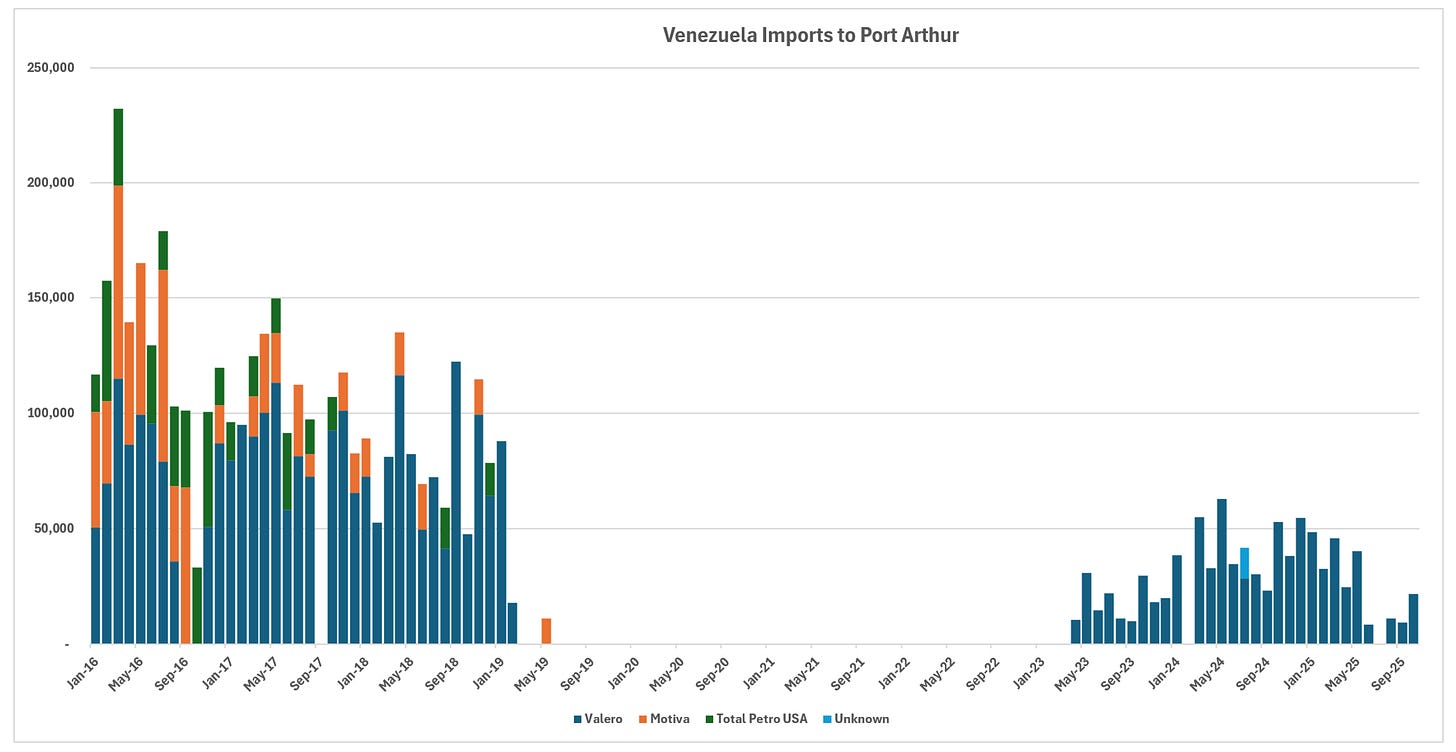

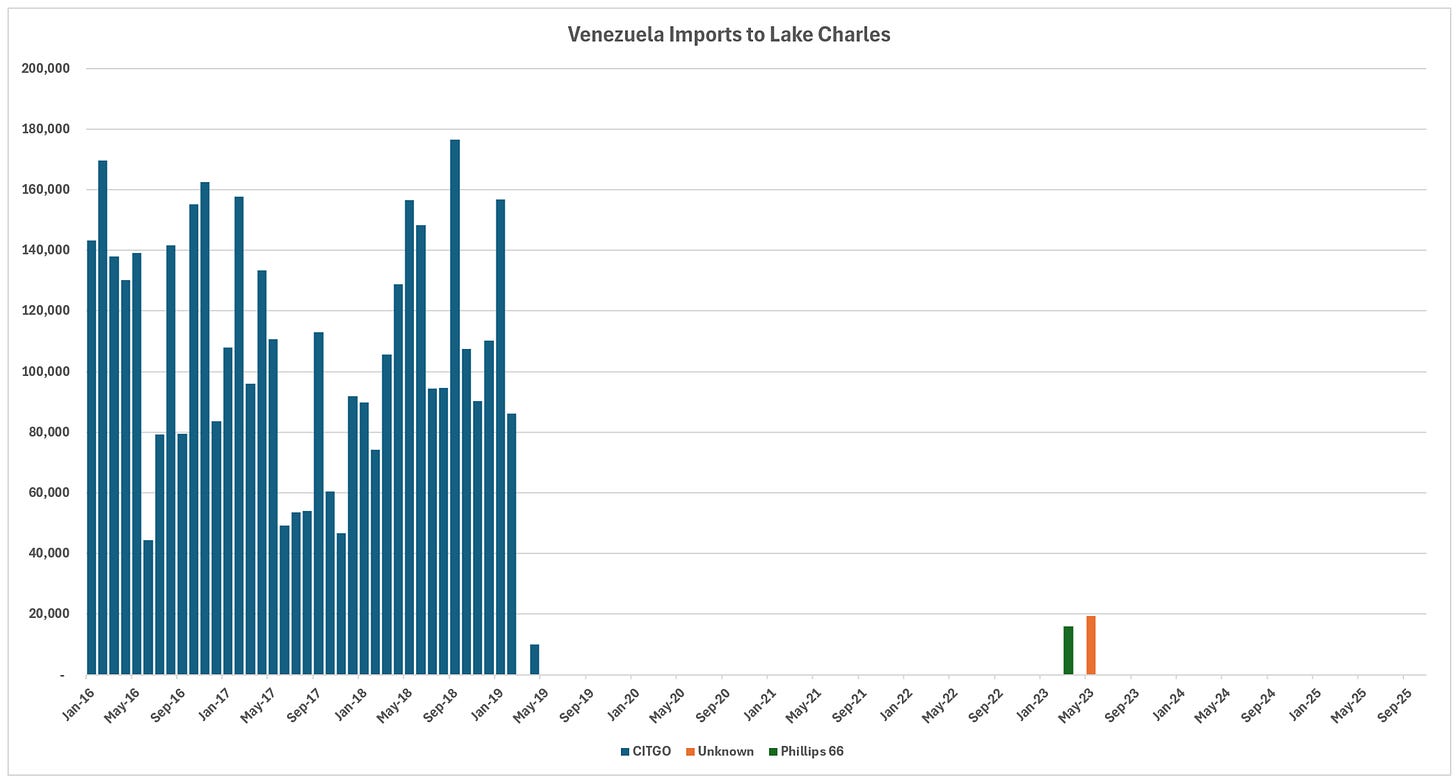

Importer profiles have evolved significantly. Prior to the embargo, CITGO and Valero dominated receipts, with substantial contributions from Chevron, Phillips 66, and others. In the post-embargo recovery phase, Valero emerged as the leading importer, drawing volumes across multiple Gulf Coast locations including Corpus Christi, Port Arthur, and New Orleans areas. Chevron has focused primarily on its Pascagoula refinery, leveraging its upstream presence in Venezuela. CITGO refineries no longer appear to process Venezuelan crude in recent data, while smaller volumes reach entities like PBF on the East Coast.

The recent developments between the US and Venezuela have introduced both instability and uncertainty, likely limiting material near-term upside for Venezuelan oil output. While a bullish longer-term production scenario has now emerged, potentially following political transition and sanctions relief, ongoing political risks, infrastructure decay, and evolving U.S. policy continue to create substantial hurdles for major investments.

Regarding competition between Venezuelan and Canadian heavy crudes, Venezuelan supply growth has unfolded gradually over the past five years without overwhelming Gulf Coast markets, which have successfully accommodated both rising Venezuelan and Canadian heavy crude volumes. Although additional heavy barrels could exert modest downward pressure on prices for comparable grades, rapid or large-scale increases remain unlikely in the short to medium term amid persistent political, infrastructural, and policy constraints.

Drill downs into specific Venezuelan crude import locations:

US West Coast:

Corpus Christi, Texas Area:

Houston, Texas Area:

Port Arthur, Texas Area:

Lake Charles, Louisiana Area:

New Orleans, Louisiana Area:

Pascagoula, Mississippi Area:

US East Coast: