Continental Resources to Halt Bakken Drilling for First Time in 30+ Years Amid Sub-$60 Oil Prices

Continental Resources, a major operator in North Dakota’s Bakken shale play, plans to cease all drilling activity in the region for the first time in over three decades, according to recent commentary in a Bloomberg article from founder and chairman Harold Hamm. This decision stems from persistently low crude oil prices that have eroded profit margins to near zero. Hamm emphasized that the company remains a price taker rather than a price maker, leaving open the possibility of resuming operations if prices recover sufficiently. The move aligns with broader market trends where U.S. rig counts have declined in response to sub-$60 per barrel oil, though our belief is most North American producers will resist material production cuts absent extreme price signals.

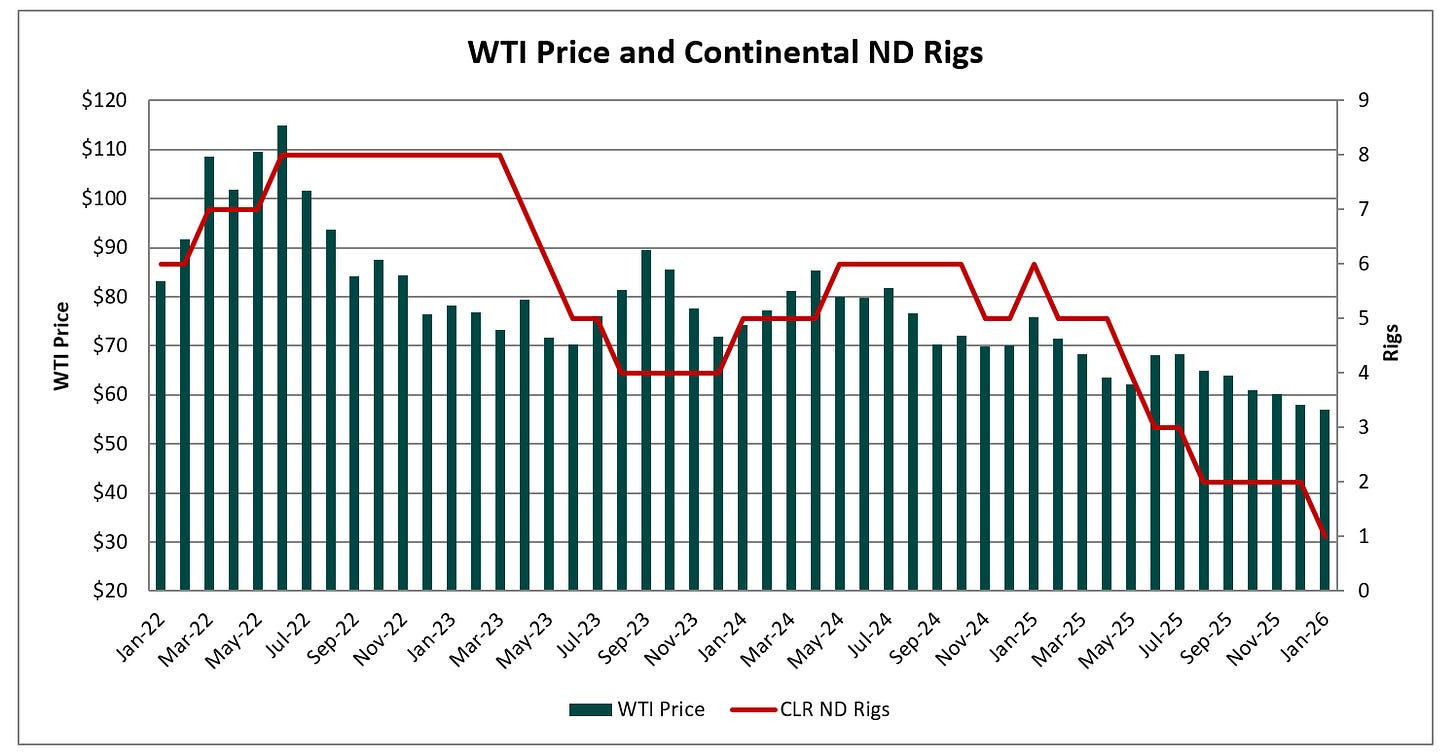

Bakken Rig Count Tracks WTI Prices: From 8 Rigs in 2022 to Zero in 2026

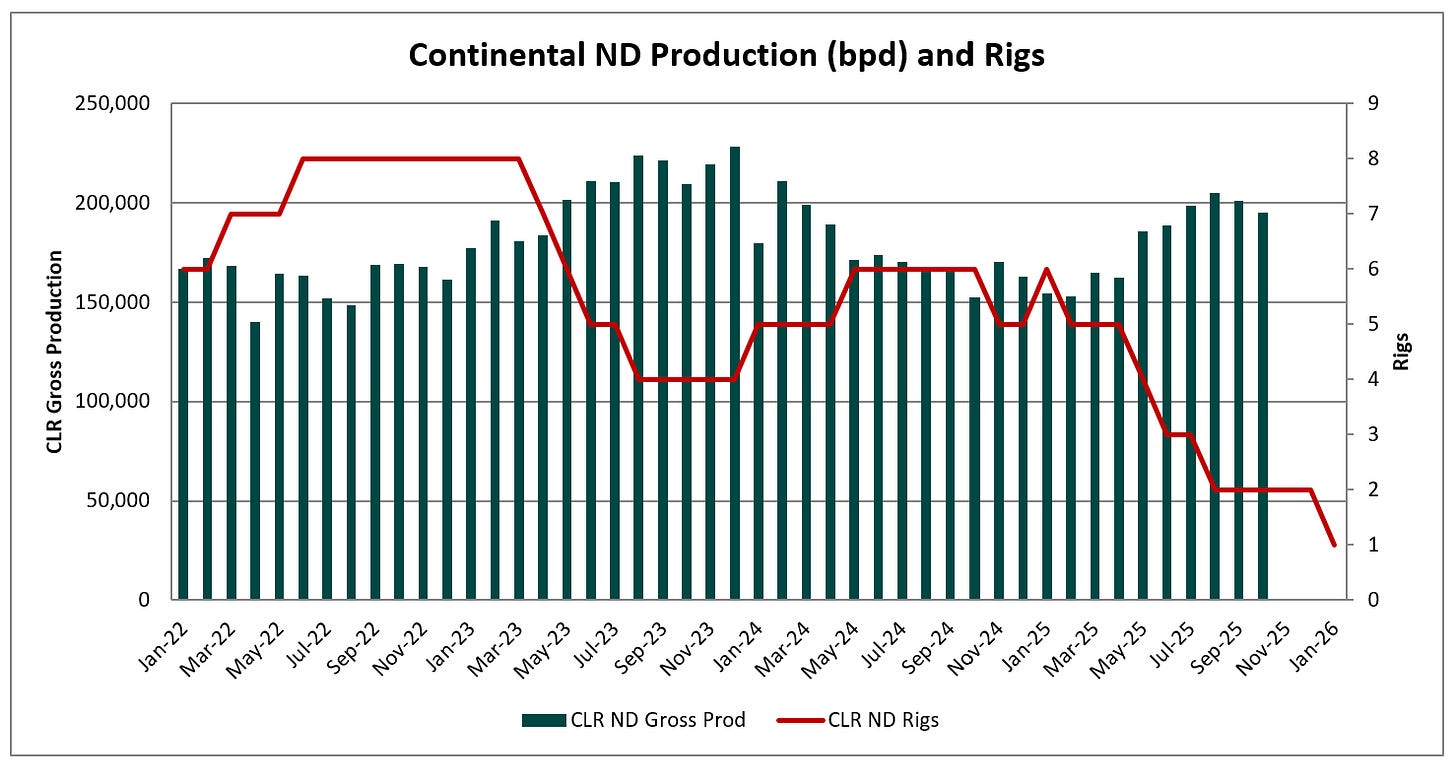

Continental’s rig activity in the Bakken has closely tracked WTI crude prices in recent years. After spiking to around eight rigs in 2022 amid post-COVID and geopolitical price surges, the count dropped to four as prices fell below $80, then briefly rose to six when prices recovered modestly between $70 and $80 through 2024. Recent declines have pushed activity lower, with the company now heading toward zero rigs, though one remained active as of mid-January 2026 per state data.

Production responses typically lag rig changes by six to nine months due to completion timelines. Continental’s North Dakota output grew significantly from around 150,000 barrels per day in 2022 to peaks above 200,000 in 2023 following rig additions, before moderating and showing recent gains in the second half of 2025 from rig additions in 2024.

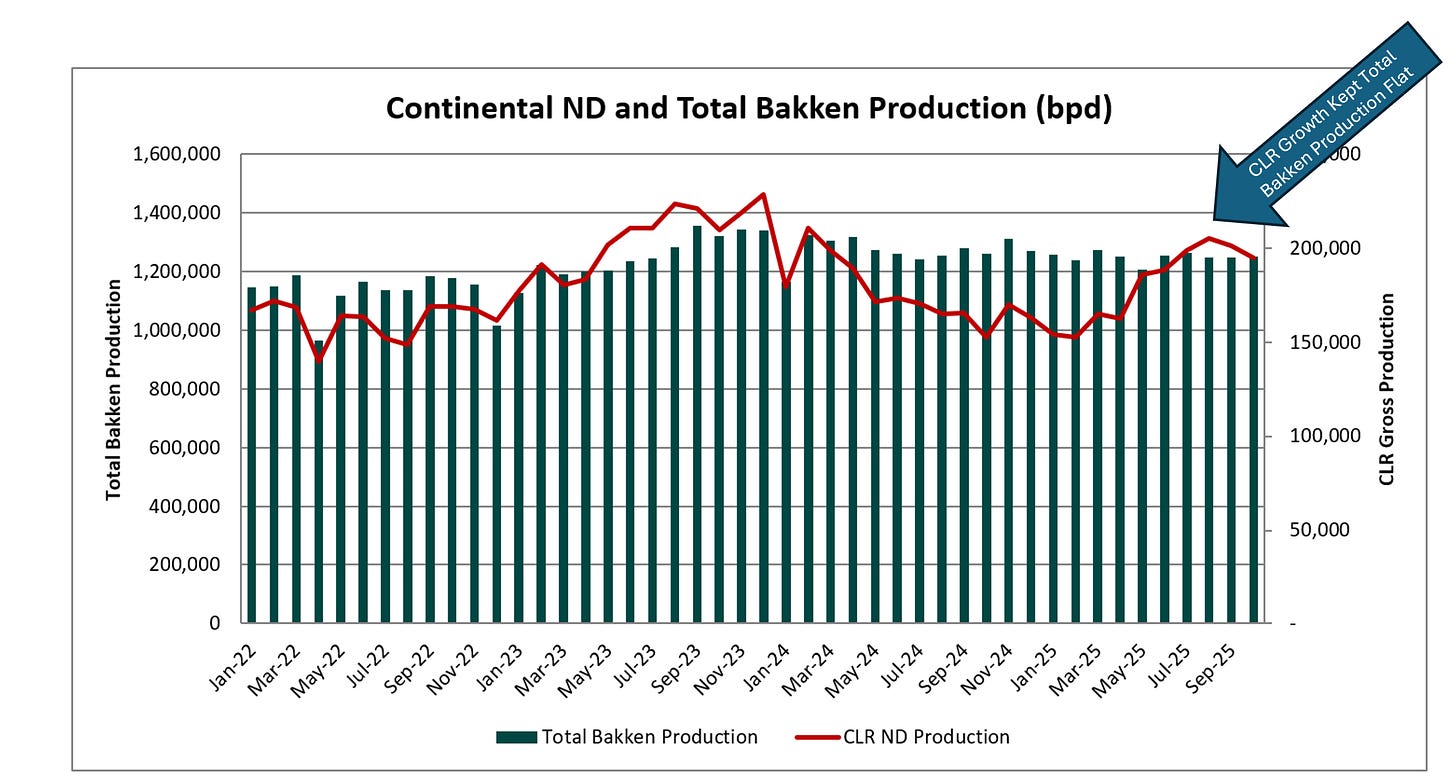

Large Market Share Drives Bakken Stability: 50K BPD Growth Masked Basin Declines in 2025

Continental is the second largest Bakken producer and accounts for approximately 16 to 17 percent of total basin production, making its pullback noteworthy for the basin’s overall trajectory. The play’s total output has hovered around 1.2 million barrels per day in recent periods, with stability in 2025 largely attributable to Continental’s growth of about 50,000 barrels per day in the latter months offsetting declines of others. Without this contribution, the basin would have faced material downturns. While other operators have maintained more stable rig counts, with the total basin only showing mild reductions from 34-35 in late 2024 to 28-29 currently, Continental’s exit from drilling could lead to moderate Bakken crude oil declines in 2026, particularly if low prices persist and limit completions from existing inventory.

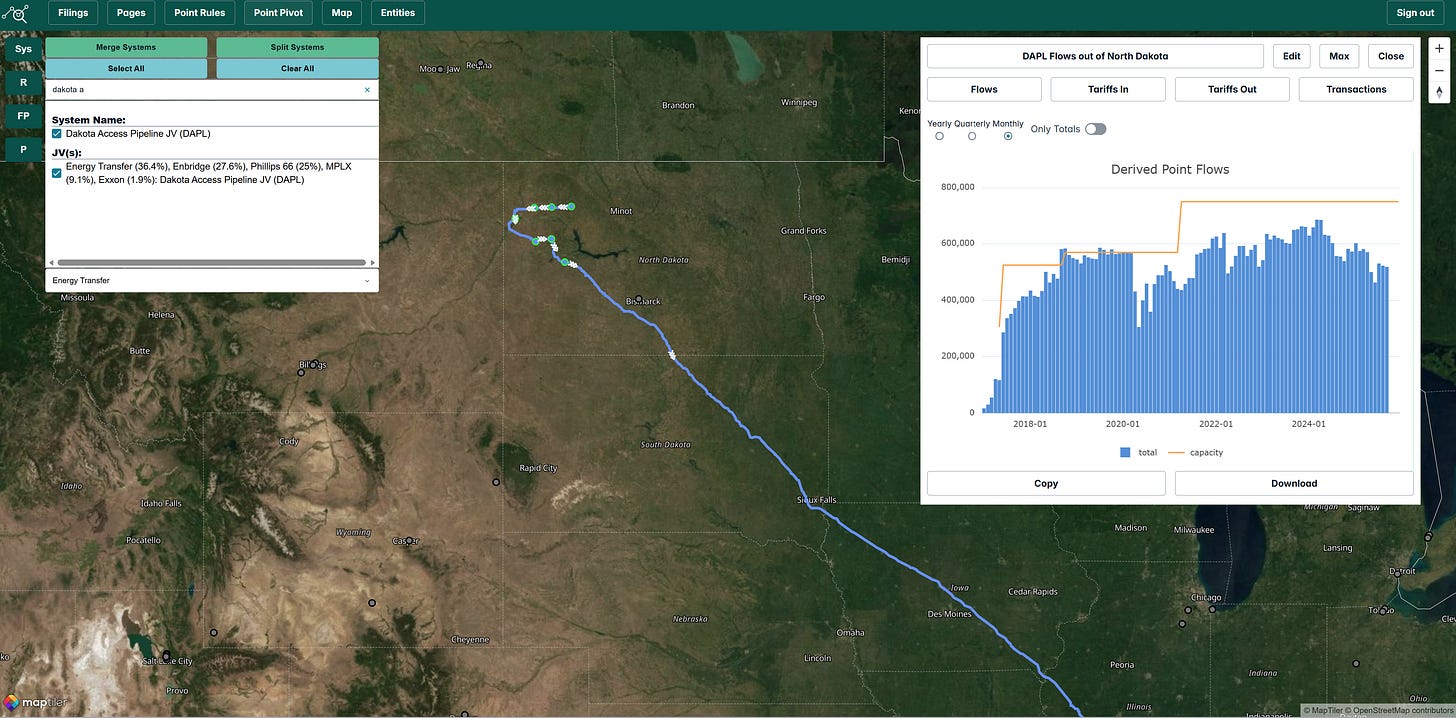

Bakken Midstream and NGL Impacts: Bearish Crude Tilt in 2026 but Limited U.S. Production Cuts Still Expected

Implications extend beyond crude to associated natural gas and natural gas liquids, which decline more slowly but face growth constraints in a flat or shrinking oil environment. Midstream crude infrastructure, including pipelines like Dakota Access (likely handling some uncontracted barrels) and Bridger (gaining share recently), could see reduced flows and potential impacts on expansion plans. Competition among NGL transport in the basin may intensify amid uncertain demand. Overall, while this development signals a bearish tilt for Bakken crude production in the near term, the prospect of widespread material U.S. production cuts remains unlikely in our view as many producers have provided soft guidance for largely stable production heading into 2026.