Questions? - Contact Us at: matthew.lewis@plainview-energy.com

Bridger Pipeline System: Structure, Growth, and Strategic Potential in the Bakken

Bridger Pipeline Overview and Its Role in Bakken Crude Transport

We have kicked off a new series aimed at demystifying some of the most perplexing pipeline systems in the oil industry. The Bridger Pipeline System, a network owned by True Companies, plays a critical role in transporting crude oil from the Bakken and Powder River Basin regions to key market hubs. This first installment focuses on Bridger’s structure, historical evolution, and current capacity, setting the stage for an exploration of its competitive dynamics in subsequent parts.

Key Routes and Segments of the Bridger Pipeline System

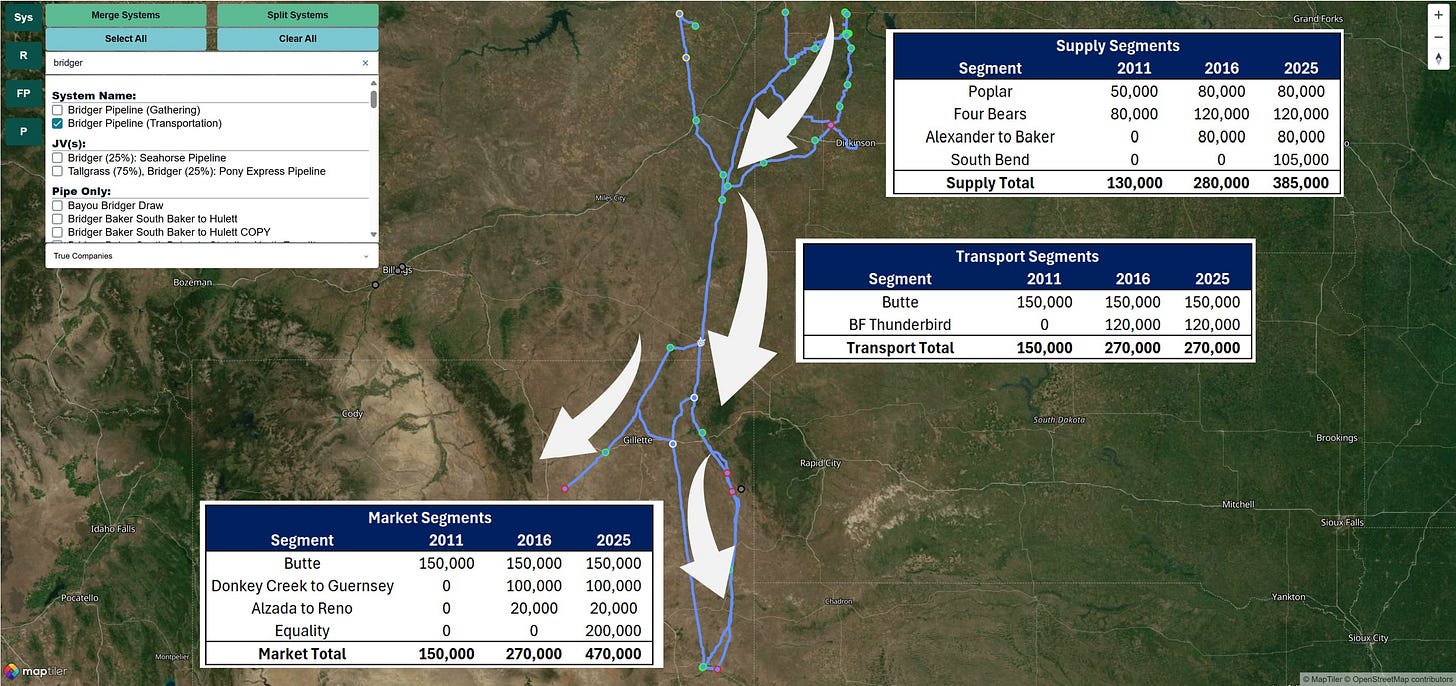

The Bridger system spans from the Bakken region in North Dakota and Montana down to Guernsey, Wyoming—a crucial junction where oil can connect to other pipelines en route to Cushing, Oklahoma. The system comprises three main sections: supply trunk lines that gather oil from production areas, transport segments that move it from the Baker/Sandstone station in eastern Montana to northern Wyoming, and market segments that deliver it to the Guernsey and Reno hubs.

Pre-2011 Bridger Pipeline Capacity and Configuration

The Bridger system’s history offers a glimpse into its adaptation to the Bakken’s oil boom. In 2011, before the region’s production surged, Bridger’s supply segments included southbound capacity on the Poplar system (50,000 barrels per day) and the Four Bears system (80,000 barrels per day), feeding into the Baker terminal in Montana. At that time, oil also flowed northward on a separate segment to the Alexander terminal, connecting to Enbridge’s network for Midwest refineries.

The transport and market segments, which at the time included only the Butte Pipeline, carried up to 150,000 barrels per day from Baker to Guernsey. This configuration, totaling around 140,000 to 150,000 barrels per day of southbound egress capacity, sufficed for pre-boom demand.

Expansion of Bridger Pipeline Capacity During the Oil Boom

As the Bakken’s production exploded in the early 2010s, Bridger underwent significant expansions between 2012 and 2015. The Poplar system’s capacity increased to 80,000 barrels per day, Four Bears rose to 120,000, and the northward flow was reversed to send another 80,000 barrels south. New infrastructure, like the Thunderbird system, extended from Baker to the Reno terminal, linking to Casper, Wyoming. Another line from Baker to the Alzada and Donkey Creek stations further boosted transport segment capacity. By 2015, Bridger’s transport segment capacity stabilized at 270,000 barrels per day—a figure we believe remains its nameplate capacity today.

Equality and South Bend Pipelines Reshape Bridger’s Supply Potential

More recent developments underscore Bridger’s ongoing evolution. In 2019, pre-COVID, True Companies sanctioned two projects: the Equality Pipeline, a near-twin of Butte running from Hewlett Station to Guernsey, completed during the pandemic, and the South Bend Pipeline, a Bakken-to-Baker line finished in 2023 after a COVID-related pause. South Bend, with a current capacity of 105,000 barrels per day, could expand to 250,000 with two pump stations, potentially bringing total supply capacity into Baker to nearly 500,000 barrels per day. However, the transport segment remains a bottleneck at 270,000 barrels per day, limiting throughput despite robust supply and market segment capacities (around 400,000 barrels per day—when deducting market capacity for assumed Powder River barrels).

Can Bridger Compete with the Dakota Access Pipeline?

Bridger’s current flows of around 222,000 barrels per day fall short of its potential, leaving Bridger uniquely positioned to compete for additional barrels, should they choose to do so. Could Bridger vie for those barrels against DAPL, the Bakken’s dominant player with long-term contracts? An expansion of the transport segment—via pumps or new pipe—could boost total capacity to approximately 400,000 barrels per day, positioning Bridger as a contender.

Future Outlook: Pony Express Joint Venture and Market Strategy

Part two will explore the Pony Express Pipeline, which Bridger feeds into and partially owns through a 2021 joint venture, while part three will analyze the broader competitive landscape.

00:00 Series Introduction/Plainview Beta Testing

02:00 Bridger Pipeline Overview

03:40 Bridger and Pony Express Alliance

06:30 Bridger Pipeline History and Flow Dynamics 2011

11:08 Bridger Pipeline History and Flow Dynamics 2015

13:55 Bridger Pipeline History and Flow Dynamics 2023

22:55 Will Bridger Compete with Dakota Access?