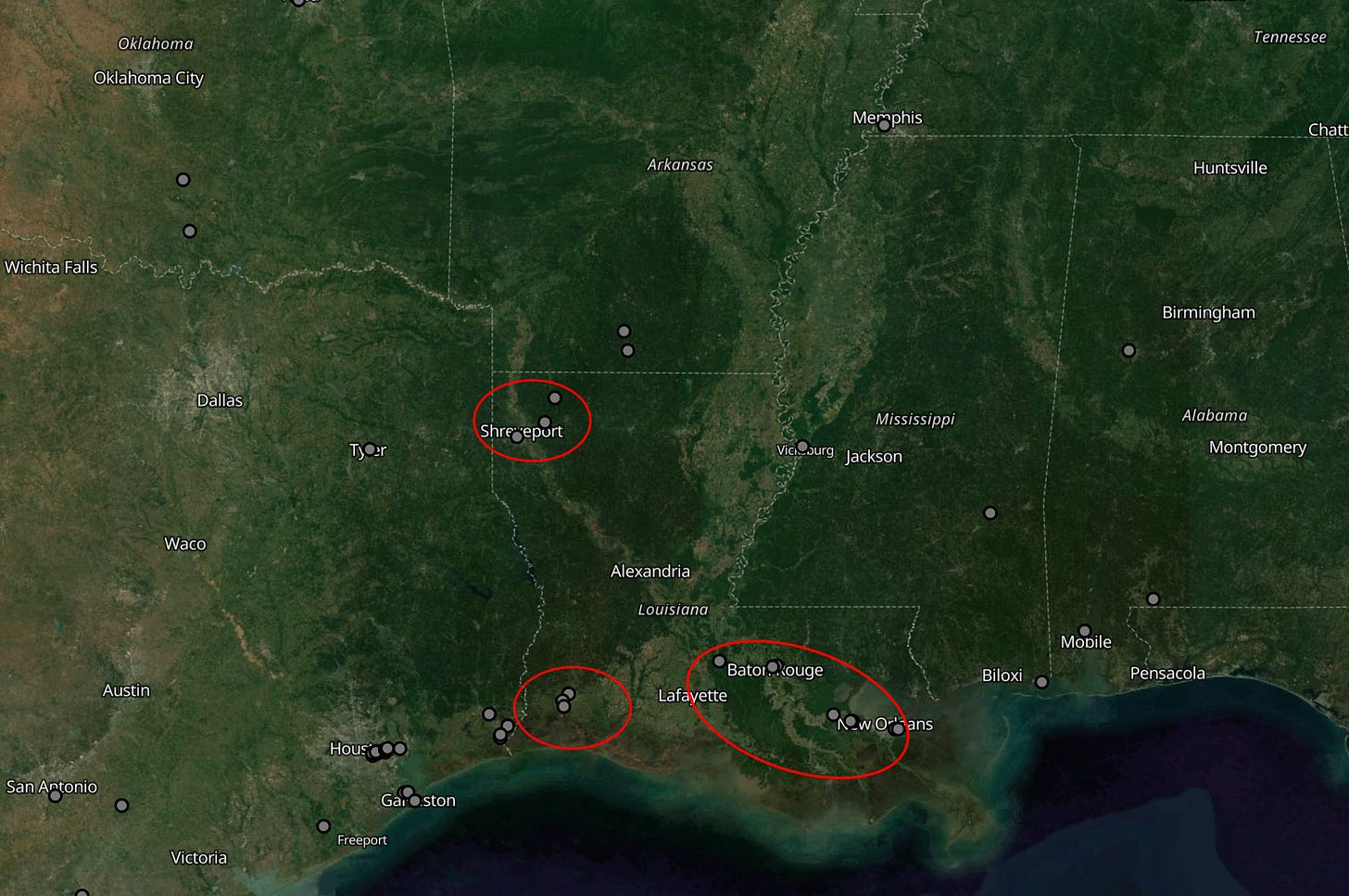

Louisiana’s oil market, characterized by its robust refining sector, relies heavily on a complex network of pipelines and offshore production to meet demand. The state’s refining inputs, totaling approximately 2.7 million barrels per day, are primarily concentrated in three clusters: the southwest corner, the northwest corner, and the southeast corner up to Baton Rouge. The southwest cluster, including major refineries such as CITGO’s Lake Charles facility (455,000 barrels per day), Phillips 66’s Westlake refinery (264,000 barrels per day), and Calcasieu Refining (135,000 barrels per day), accounts for about 850,000 barrels per day. This region depends significantly on pipeline imports from Texas and marine deliveries, as it is geographically disconnected from direct offshore Gulf production, which supplies roughly 1.4 million barrels per day to the state.

A notable development in the southwest cluster is the expansion of CITGO’s Sour Lake pipeline, which transports light oil from Texas to the Lake Charles refinery. Recently increased from 250,000 to 320,000 barrels per day, this pipeline exclusively serves CITGO, with no deliveries to the nearby Phillips 66 or Calcasieu refineries.

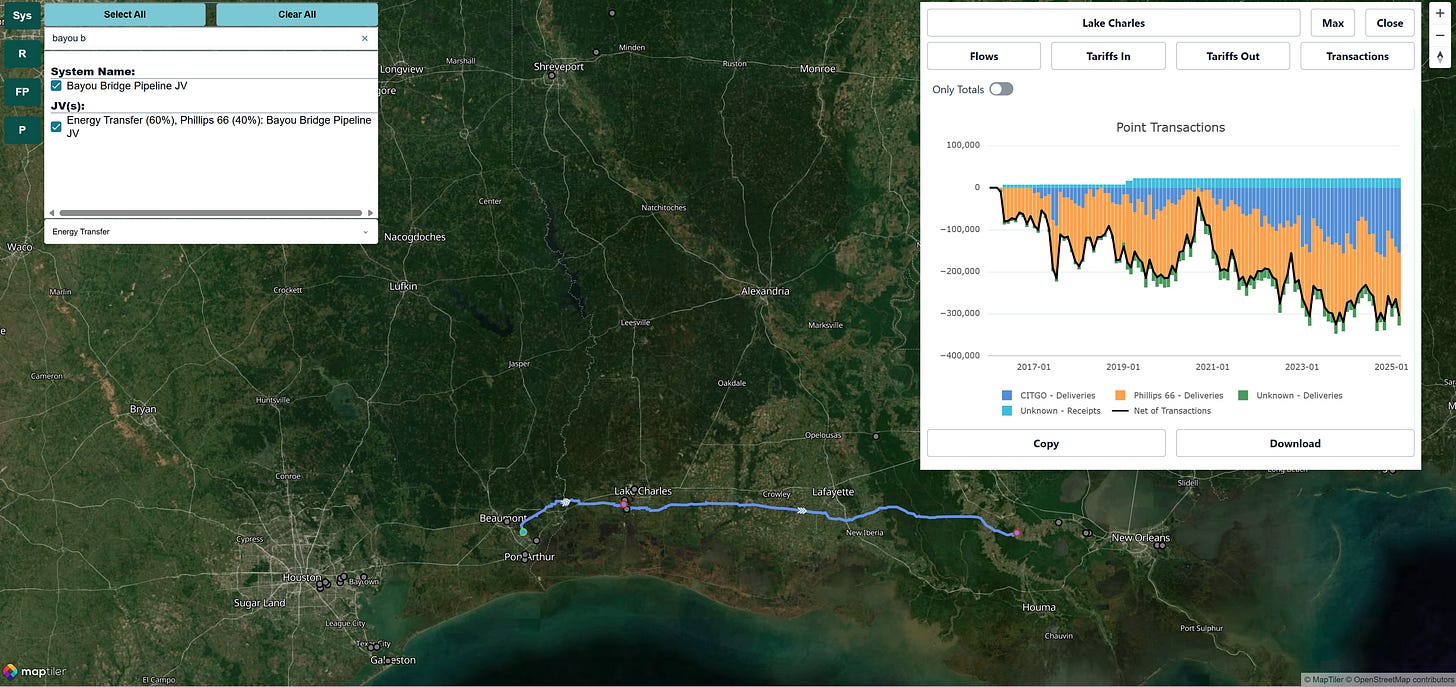

Competing pipelines, such as Bayou Bridge (a joint venture between Energy Transfer and Phillips 66) and Shell’s Zydeco, also supply the region. Bayou Bridge, operational since 2016, has seen increased flows over the past decade and can transport both heavy and light oil, offering a competitive advantage over Sour Lake and Zydeco, which primarily handle light oil.

Despite the Sour Lake expansion, data from May 2025 shows no significant decline in Bayou Bridge or Zydeco volumes, as CITGO’s refinery has ramped up to its full 460,000-barrel-per-day capacity, absorbing the additional Sour Lake supply without displacing other pipelines.

Potential expiring pipeline commitments, coupled with the Sour Lake expansion, add complexity to the competitive landscape. CITGO likely maintains minimum volume commitments on Bayou Bridge, but tariff filings indicate that some agreements may expire between 2025 and 2027. If CITGO’s refinery utilization decreases from its current nameplate capacity, Bayou Bridge or Zydeco could face reduced volumes or contracted capacity. Meanwhile, Calcasieu Refining, which relies entirely on marine imports, presents a potential opportunity for pipelines like Bayou Bridge and Zydeco to capture replacement volumes if CITGO shifts its supply dynamics.

For free beta access to our pipeline portal please email: matthew.lewis@plainview-energy.com