Plainview Weekly: Bridger Pipeline Expansion Heats Up and Canadian Oil Sands Egress Has Long-Term Hope

New Bakken-to-Guernsey capacity, possible major 200k bpd upgrade in planning, while Canada signs pipeline MOU but egress stays tight until 2030+

Bridger Pipeline Files New Tariff: Significant Bakken-to-Guernsey Expansion May be Coming Soon

Fresh off its acquisition of Caliber Midstream, Bridger Pipeline filed a new tariff last week revealing “interim capacity” from the Bakken to Guernsey, Wyoming starting January 2026. The filing also confirms the company is working with a downstream partner (most likely Pony Express/Seahorse) on a larger expansion that will add even more takeaway capacity.

Current flows on Bridger are already robust: Q2 data showed the pipeline moving just over 250,000 bpd of Bakken crude into Wyoming, and volumes have likely grown since then as Kinder Morgan converts its Double H Pipeline from crude to NGL service, pushing more barrels onto Bridger.

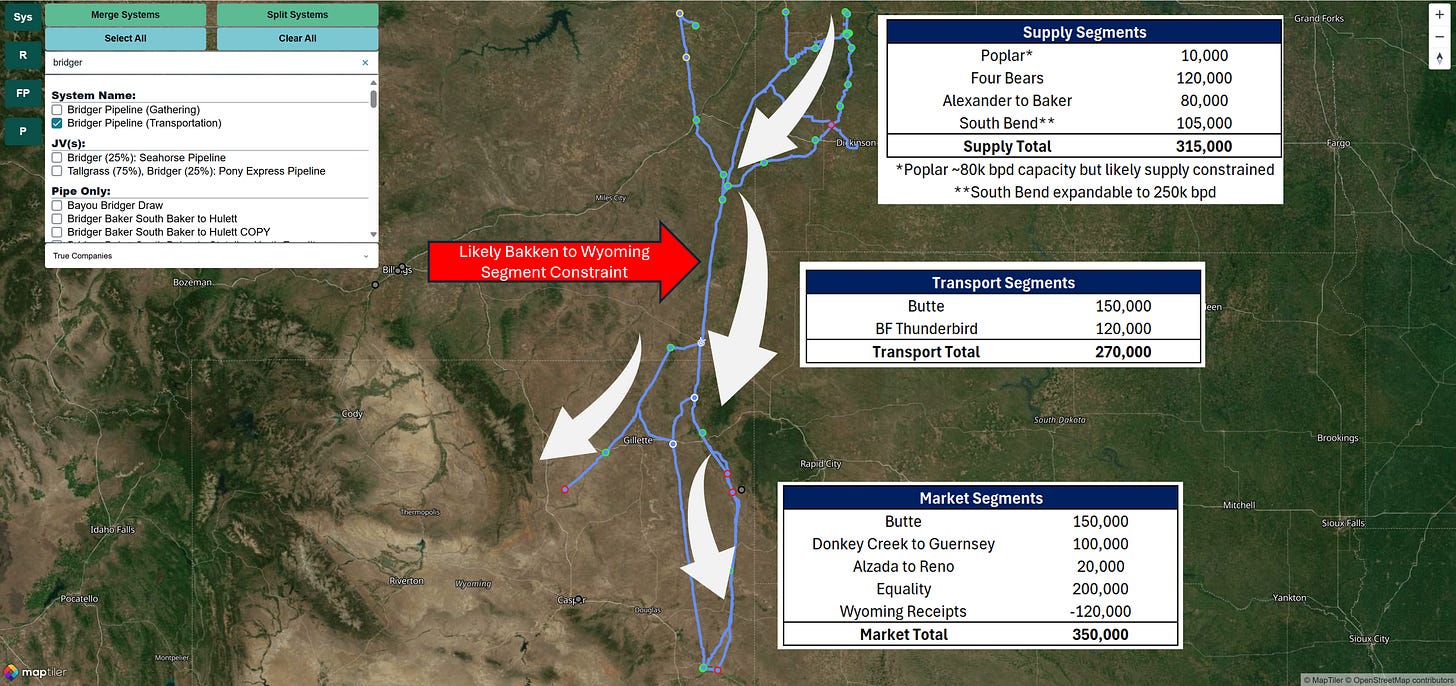

Our March deep dive on Bridger Pipeline showed the Baker, MT to northern Wyoming segment (red arrow in figure below) is the tightest part of the system, with capacity of only ~270,000 bpd. Upstream and downstream sections, however, have significant headroom thanks to expansions built from 2020–2022.

Upstream of the bottleneck: ~315,000 bpd effective capacity today; can grow by +145,000 bpd with just two new pump stations on the 16-inch South Bend line (see top table in figure below).

Downstream of the bottleneck: ~350,000 bpd available after adjusting out Wyoming receipts (see bottom table below), also likely expandable with pump stations on the 20-inch Equality line.

A larger-scale expansion (up to ~200,000 bpd) looks like it could be plausible if Bridger can attract additional Bakken barrels. Most of the extra capacity can come from low-cost pump-station additions on newer, larger-diameter pipe. The only segment that likely needs new pipe laid is the current Baker–northern Wyoming bottleneck. The timing may surprise some given flat Bakken production and soft oil prices, but recent developments around Dakota Access Pipeline appear to be creating a clear opportunity for Bridger to capture more barrels. We’ll break down that dynamic in a video post this coming week.

Canada and Alberta Sign Pipeline MOU: New Oil Sands Takeaway Hope, But Egress Stays Tight Until 2030

Last week marked a meaningful step forward when the Government of Canada and the Government of Alberta signed a Memorandum of Understanding to work together on a new large-scale crude oil pipeline out of the oil sands region. Full details appear in our “News that Caught our Eye” section below. While the agreement is encouraging, the project still has to clear significant regulatory, environmental, and political hurdles. If the pipeline is built, most realistic timelines point to an in-service date post-2030.

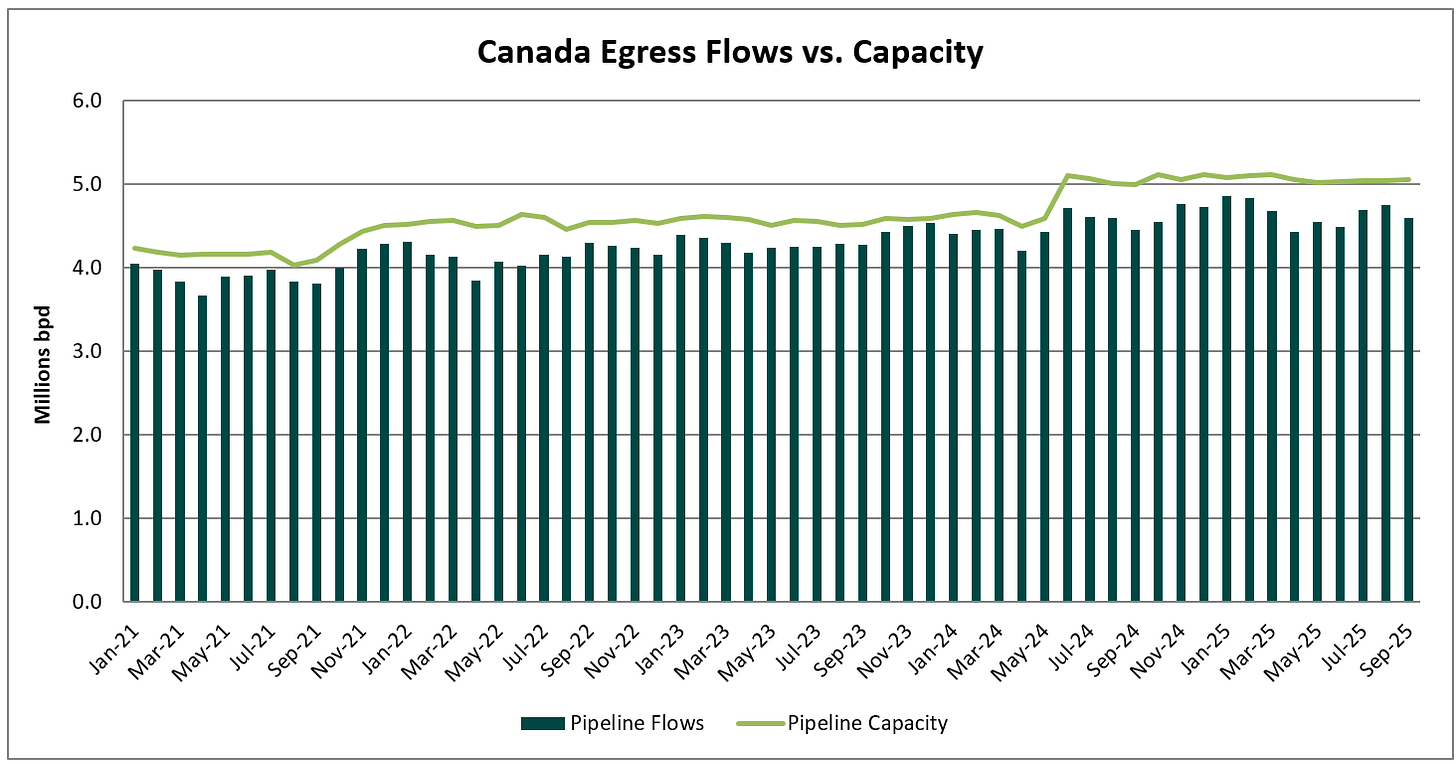

In the meantime, Canadian heavy oil producers continue to operate in a relatively tight export environment. As we highlighted in our November 21 Canadian flow update, the country’s three primary export systems, the newly expanded Trans Mountain, Enbridge Mainline, and South Bow’s Keystone, are running at or close to full capacity. In the third quarter, average spare egress across all Canadian egress pipelines was only about 350,000 barrels per day, equivalent to roughly 93% utilization.

That spare capacity is poised to shrink further this winter. Colder temperatures require more condensate to be blended with heavy oil to keep it flowing, which effectively eats into available pipeline space. Historically, once total egress utilization consistently exceeds 95%, the Western Canadian Select (WCS) to WTI differential widens sharply, and we are once again knocking on that door.

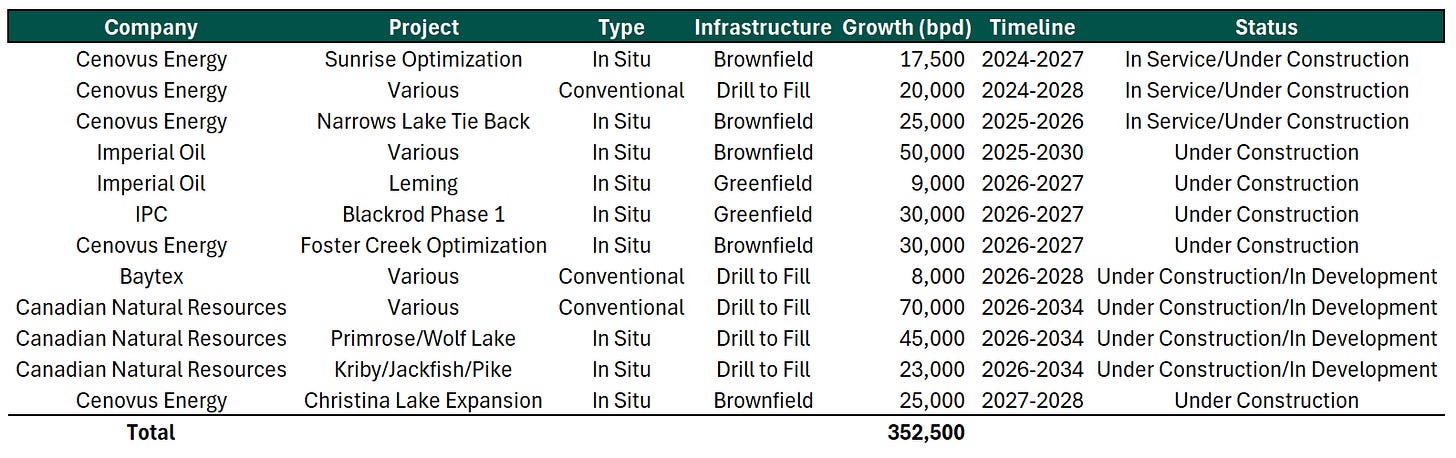

Despite the tight takeaway picture, Canadian producers continue to bring new supply. A number of oil sands projects are either starting up now or will ramp over the next several years (see table below). Many companies also have much larger growth phases in the planning stages that are targeted for the 2030s, when the new Canadian pipeline could be online.

The only announced near-term relief on the horizon is Enbridge’s Mainline Optimization program, which is scheduled to add incremental capacity starting in 2027. Until a major new pipeline is actually built and filled, however, Canada will be heavily reliant on Enbridge’s Mainline to continue squeezing out incremental capacity. The new federal-provincial MOU is a welcome signal of intent, but for the balance of this decade, Canadian heavy oil is likely to remain one of the most pipeline-constrained barrels in North America.

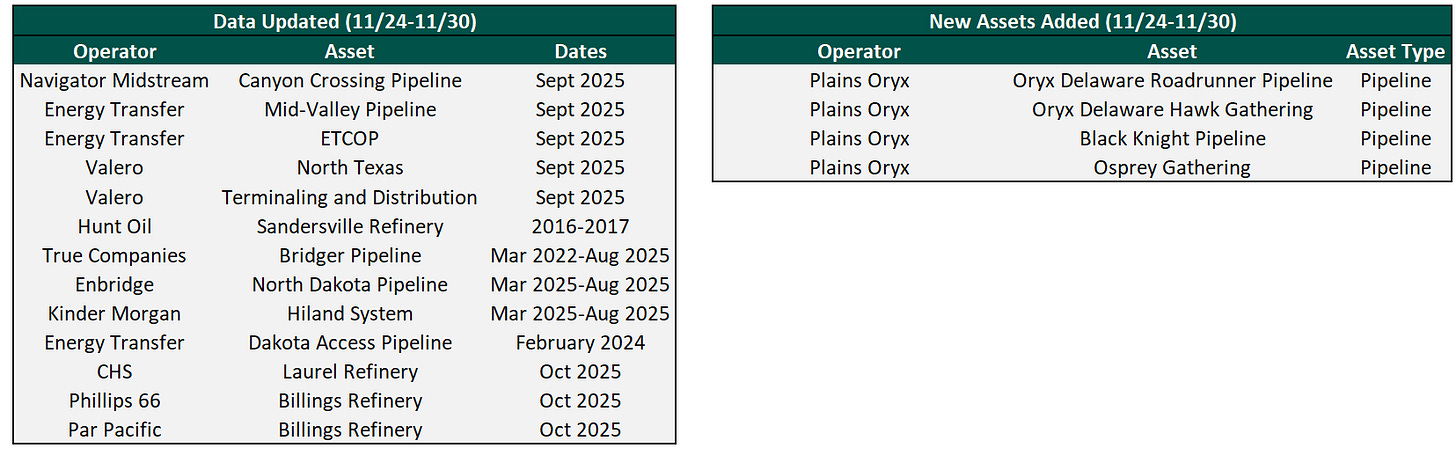

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.