Plainview Weekly: Bridger Buys Caliber Bakken Assets to Feed Guernsey Long-Haul Expansion; P66 Billings Refinery Set for Wider Canadian Crude Discounts

Bridger grabs Caliber Bakken assets to feed Guernsey; P66 Billings poised for fatter Canadian heavy discounts as egress tightens.

Bridger Pipeline Acquires Strategic Assets from Caliber Midstream - Announces Mainline Expansion

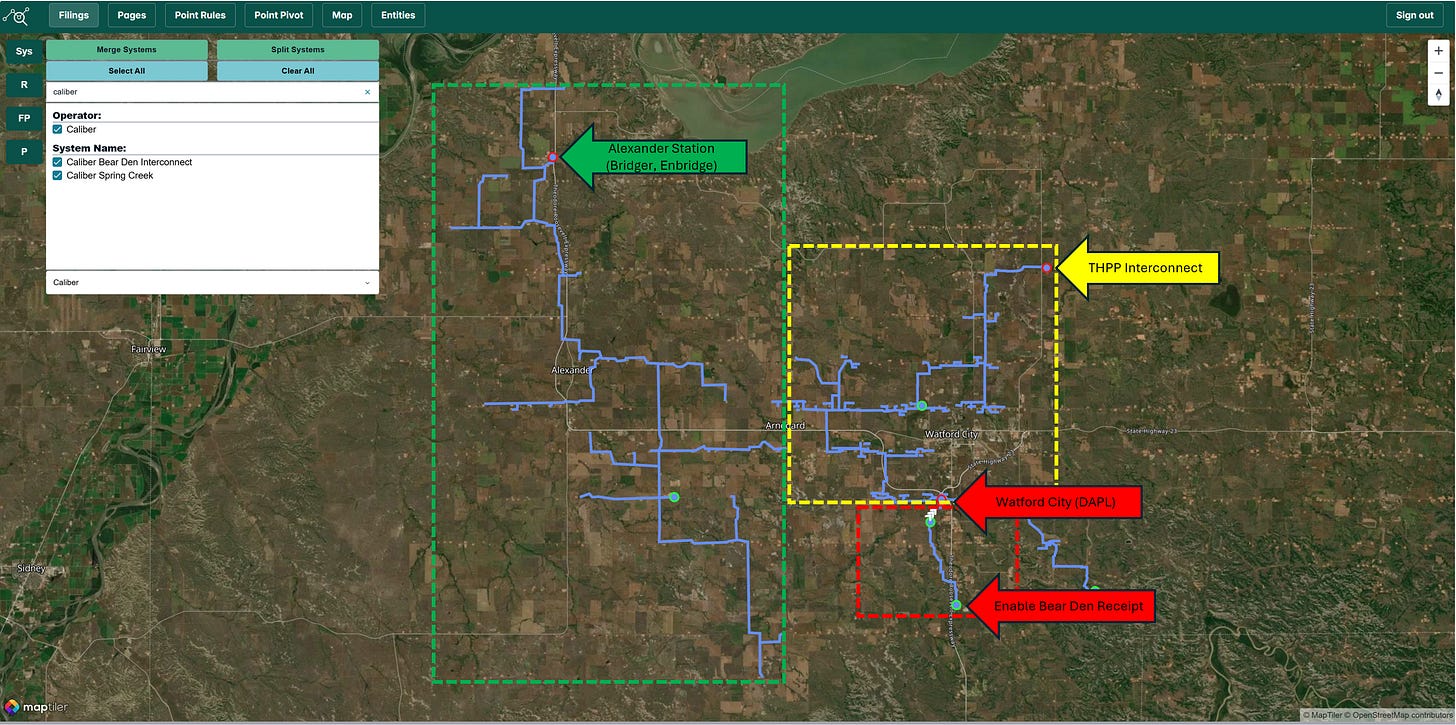

Bridger Pipeline LLC announced on Tuesday that it is acquiring Caliber Midstream’s Bakken assets in McKenzie County, North Dakota. The crude oil assets consist of three distinct systems:

Caliber Bear Den Interconnect (red box on map below): A 6-mile, 12-inch transport pipeline extending from a receipt point on the Enable Bakken Crude system (Energy Transfer) to a delivery point on the Dakota Access Pipeline (DAPL) south of Watford City. System capacity is ~50,000 bpd but throughput was only approximately 14,000 bpd in Q2 2025.

Spring Creek Gathering System (yellow box on map below): A smaller gathering system consisting of 4- to 10-inch pipelines that collect crude from wellheads and deliver to the Tesoro High Plains Pipeline (MPLX) north of Watford City. Recent throughput data is not available; however, the system reported volumes of approximately 15,000 bpd in early 2023.

Rawson Gathering System (green box on map below): The largest of the three systems being acquired, featuring 4- to 16-inch pipelines that appear to transport volumes to Alexander Station, where interconnections exist with both Enbridge North Dakota and Bridger Pipeline’s existing system. Given its size and location, Rawson likely handles the highest volumes of the three assets, though current throughput data is not available.

The acquisition is set to add material volumes and pipeline mileage to Bridger’s already sizable Bakken gathering portfolio, but the strategic rationale appears to center on feeding more barrels into the company’s long-haul pipeline to Guernsey, Wyoming. In its press release, the company highlighted that it is working on expanding mainline capacity along the existing corridor to Guernsey. The 270,000 b/d long-haul pipeline ran at approximately 250,000 b/d in Q2 2025 (see below), leaving limited headroom; however, our deep dive analysis into Bridger earlier this year indicated that further expansion could be achieved relatively inexpensively because significant portions of the route are already expanded, requiring only modest additional capital to unlock substantially higher throughput to Guernsey.

P66 Billings Refinery Margins: Impact of Canadian Heavy Crude Differentials

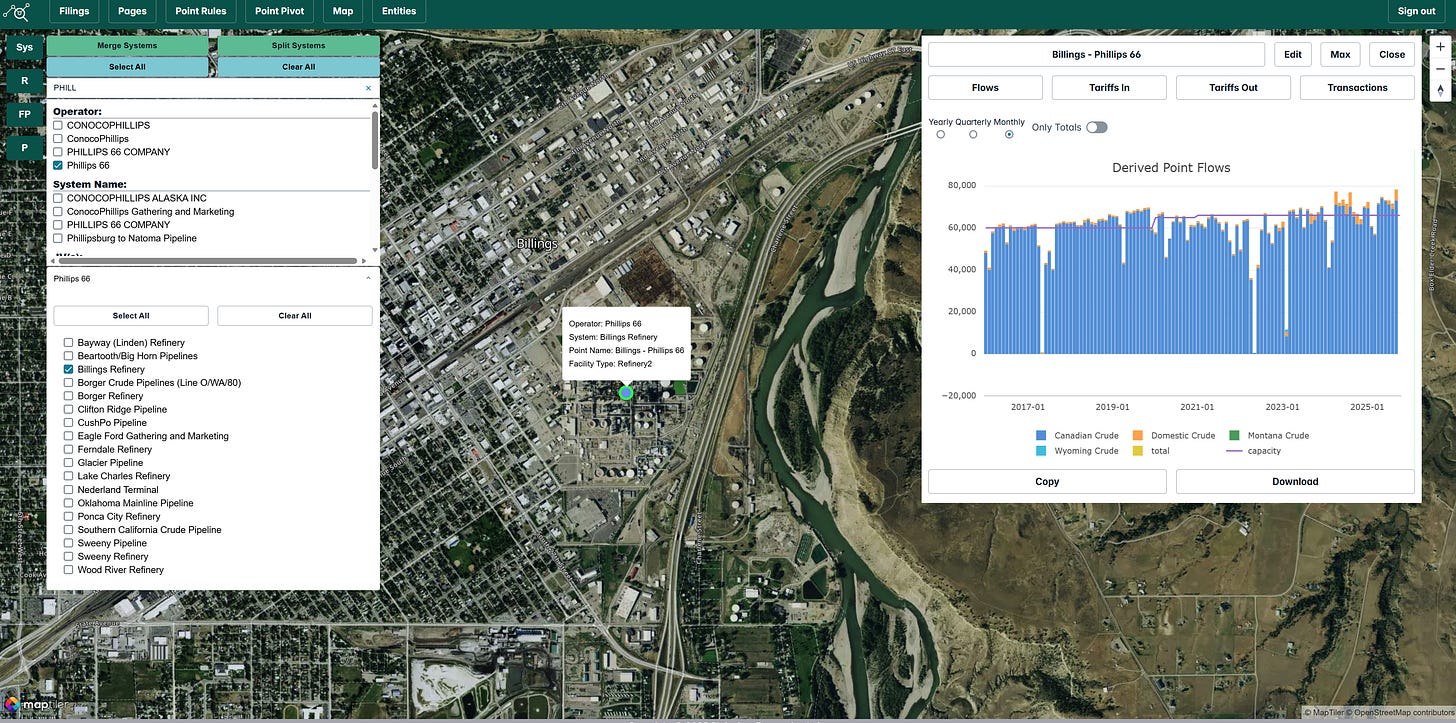

In its Q3 2025 earnings call, Phillips 66 highlighted the robust performance of its Central Corridor refineries, including the fully owned Ponca City facility in Oklahoma and Billings refinery in Montana, alongside the recently acquired 100% stakes in the Wood River refinery in Illinois and Borger refinery in Texas. These assets provide significant optionality for processing diverse crudes, but the Billings refinery, with a capacity of around 60,000 bpd, stands out for its near-exclusive dependence on Canadian heavy crude.

The refinery sources its crude primarily via its own Glacier Pipeline, which connects upstream to Enbridge’s Express Pipeline and Plains’ Rangeland Pipeline, supplemented by minimal local Montana and Wyoming production. Recent refinery throughput data (see below) indicates the facility operated above capacity at over 60,000 bpd, with virtually all volumes comprising Canadian barrels, underscoring its vulnerability, and opportunity, to fluctuations in cross-border crude dynamics.

The Billings refinery, like some of Phillips 66’s other central corridor operations, has capitalized on wider differentials between Canadian heavy crude, such as Western Canadian Select (WCS), and West Texas Intermediate (WTI) pricing, which enhance margins by allowing discounted feedstock acquisition. However, these differentials narrowed markedly since the Trans Mountain Expansion (TMX) pipeline came online in mid-2024 (see below), increasing egress capacity by nearly 590,000 bpd. The WTI-WCS spread fell from an average of ~$19 per barrel in 2023 to ~$15 in 2024, and further to around ~$12 so far in 2025.

In our Canadian Q3 pipeline flows update video we highlight that the major egress pipelines are now operating at or very near full utilization. Without timely additions of new pipeline capacity, differentials could widen materially in the coming quarters and years, bolstering profitability for Canadian-crude-dependent facilities like Billings by restoring the large discounts that benefit U.S. refiners. This outlook positions Phillips 66 and other refineries favorably, as sustained or expanding discounts would amplify the economic advantages of strategically located, heavy-crude-optimized assets.

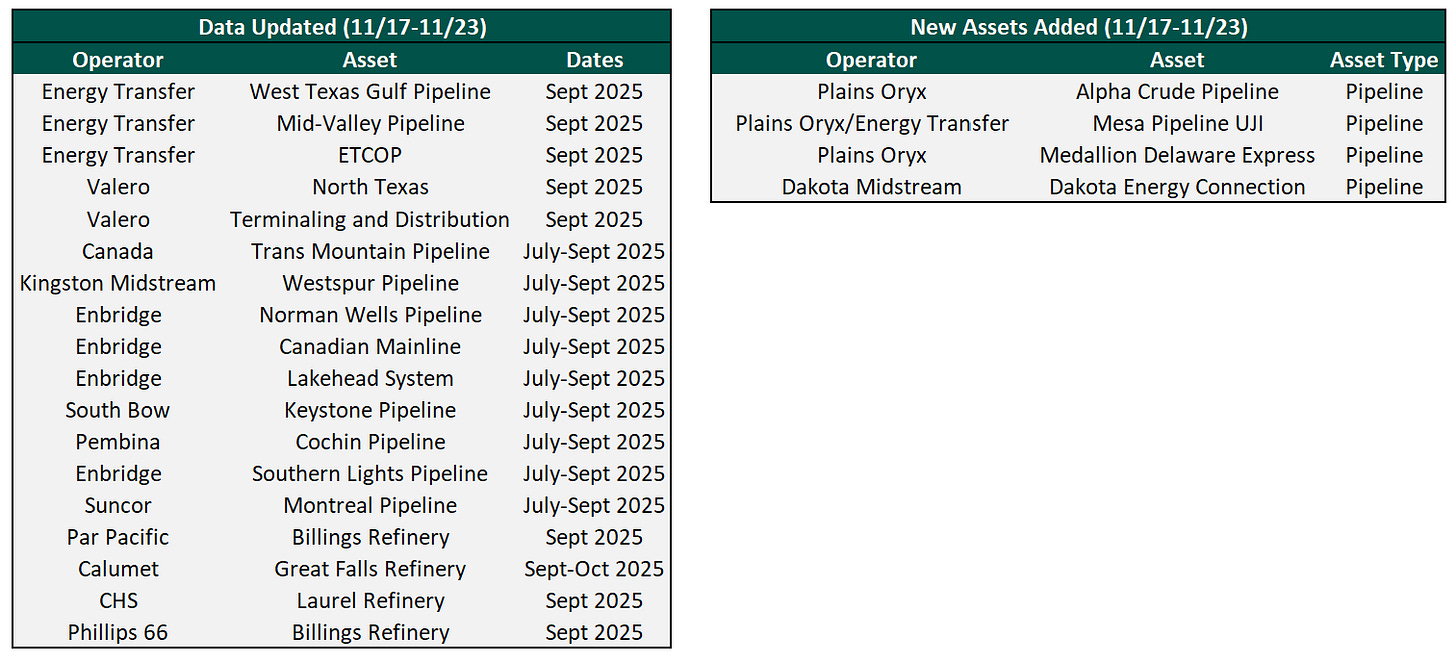

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Carney addresses ongoing talks over deal on pipeline from Alberta to BC's northern coast

Pipeline owner South Bow has ambitions to double size through M&A