Plainview Weekly: The Launch (9/15-9/21)

West Texas Gulf Ramps Up, EPIC Pipeline Pulls Back, and CITGO's Lake Charles Refinery Sets Another Record

Questions: Email Us - matthew.lewis@plainview-energy.com

Welcome to the inaugural edition of Plainview Energy Analytics’ weekly newsletter! Through our proprietary platform, we aggregate and analyze transactional data, throughput metrics, and operational data from state, federal, and company disclosures, providing clients with actionable intelligence in the oil sector. Each week, we’ll deliver concise updates on developments in the crude oil market from the past week, while highlighting data updates on our platform. The weekly deep-dive and news update videos/articles will also continue!

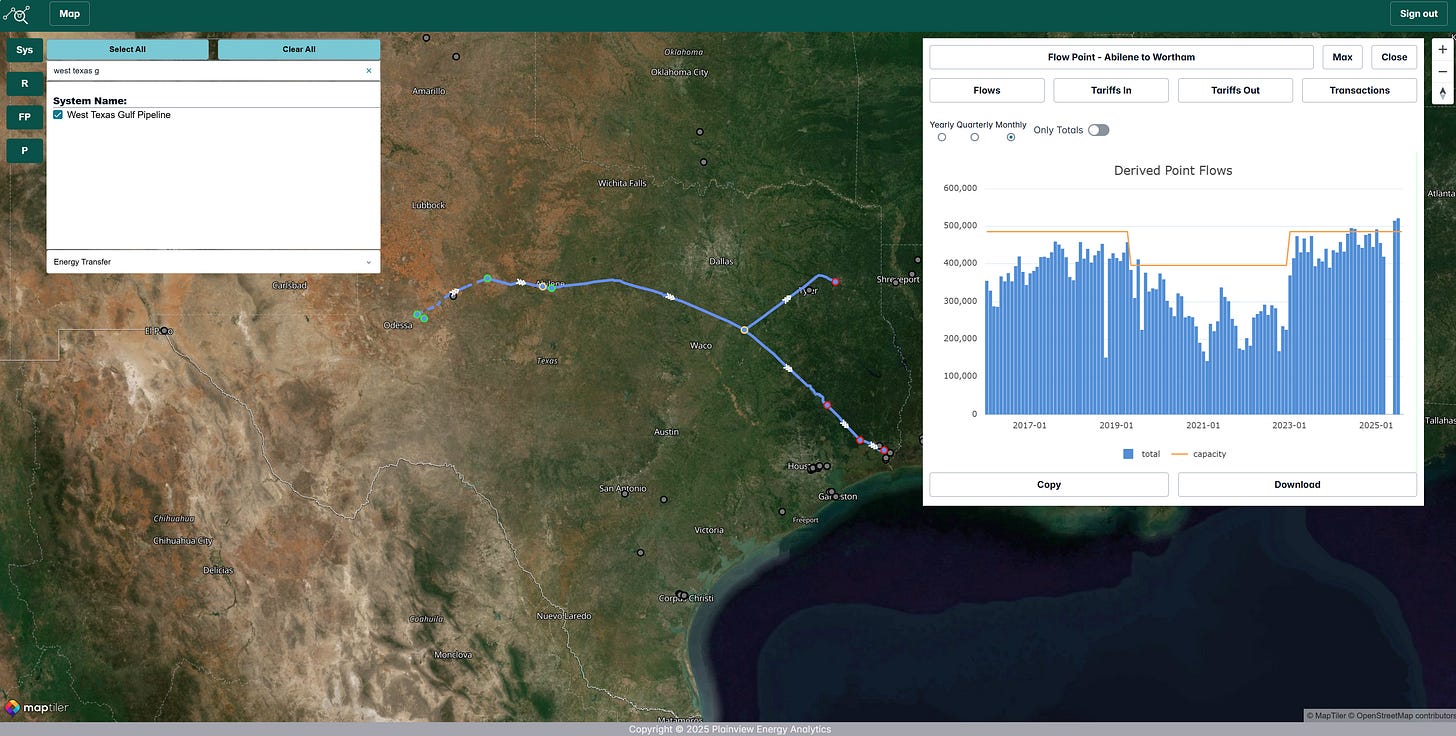

West Texas Gulf (WTG) Pipeline Eclipsing Capacity

In June and July 2025, the West Texas Gulf Pipeline operated above its nameplate capacity of 486,000 barrels per day (bpd), averaging ~515,000 bpd in June and ~520,000 bpd in July. This 6-7% overutilization is driven by heightened demand from deliveries to the Longview area in East Texas, with incremental volumes sourced from increased receipts at the Colorado City point. However, overall pipeline egress out of the Permian Basin retains ample unused capacity, which will likely limit constraints in the short and medium term.

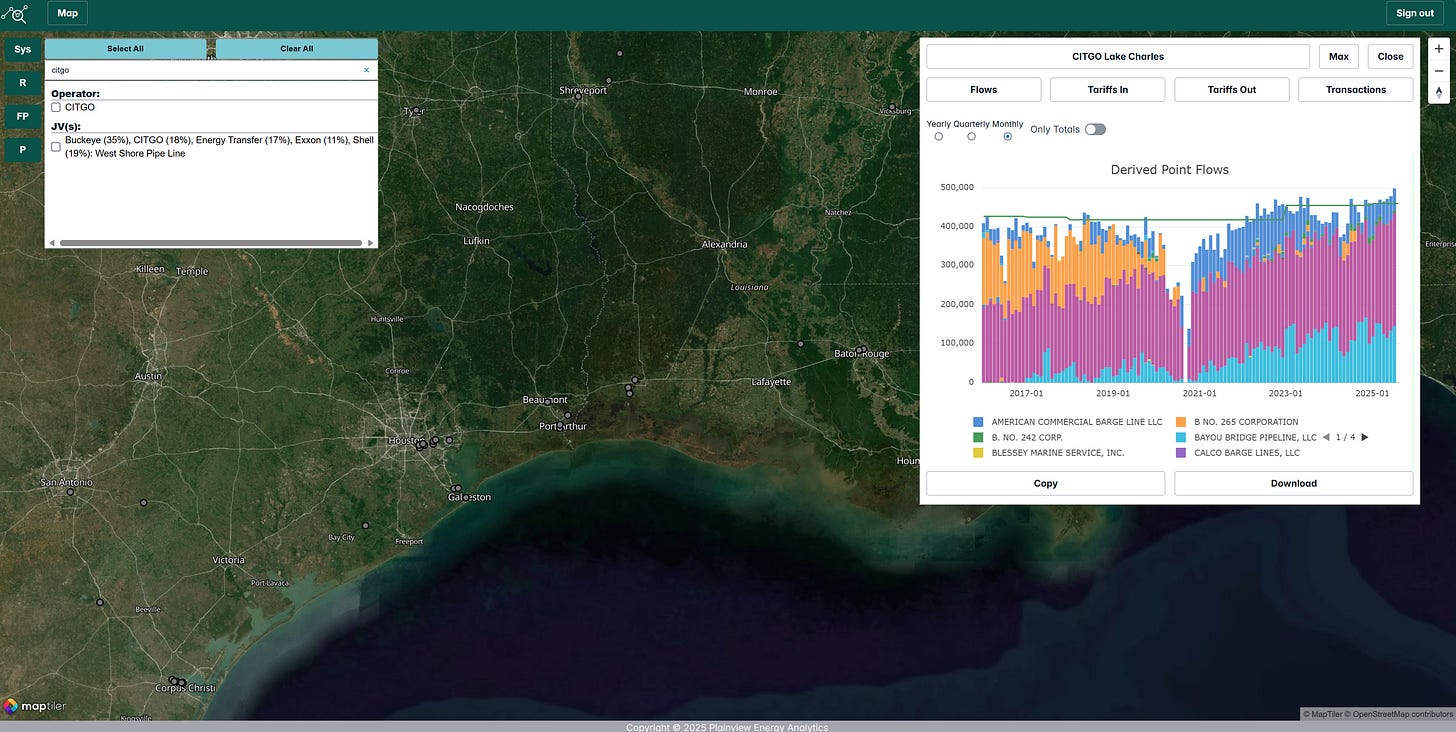

CITGO Lake Charles Refinery Hits Record 500,000 bpd Throughput

In July 2025, CITGO’s Lake Charles refinery, with a nameplate capacity of 455,000 barrels per day (bpd), achieved a record throughput of nearly 500,000 bpd according to data from the Louisiana Department of Energy and Natural Resources. This surge is primarily driven by increased volumes from CITGO’s own Sour Lake pipeline, which transports crude from the Sour Lake terminal in Southeast Texas. Sustained high throughput could further benefit pipeline systems like Bayou Bridge and Zydeco, which also supply significant volumes to the facility.

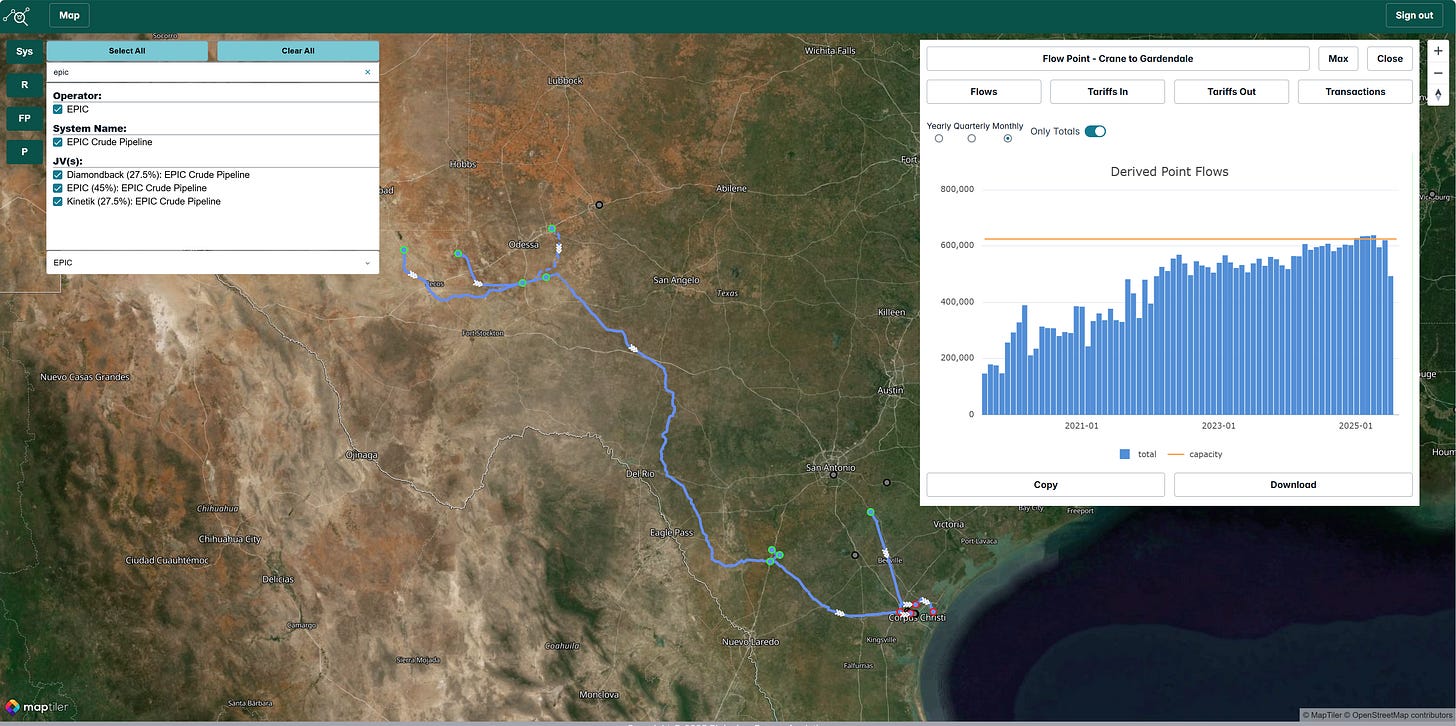

EPIC Crude Pipeline Volumes Drop 22%, but New Chickadee Supply Point Added

In July 2025, the EPIC Crude Pipeline experienced a significant decline in volumes, falling to approximately 490,000 barrels per day (bpd) from an average of approximately 630,000 bpd between January and June, when it operated above its nameplate capacity. The approximately 22% drop is primarily attributed to a 115,000 bpd decrease in receipts at its Crane terminal. Potential causes include temporary maintenance or reduced marketing volumes by EPIC due to tight Permian-Gulf Coast spreads. Additionally, tie-in activities for a new receipt point from ONEOK’s (EnLink) Chickadee system may have also impacted flows. The Chickadee system handles approximately 80,000 bpd, with about 38,000 bpd from Diamondback Energy. This new connection may signal future third-party volumes, as Diamondback, a major capacity holder on EPIC, is currently moving its Chickadee volumes to competing pipelines, including Gray Oak Pipeline and/or Enterprise’s Midland terminal.

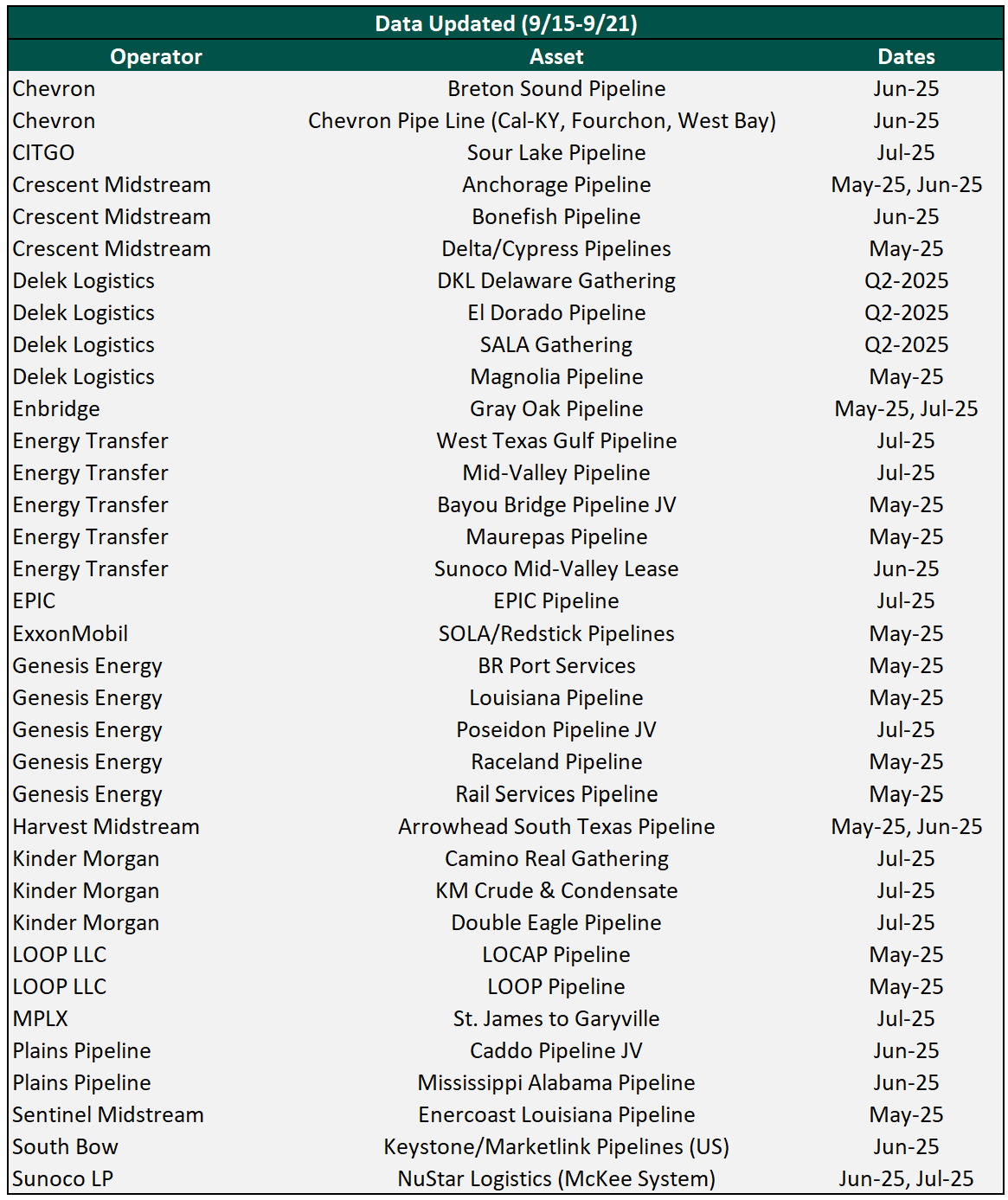

Plainview Transaction/Flow Data Updates (9/15-9/21)

We have over 170 crude oil pipelines with flow/transactional data available on our online platform. We strive to update the data as soon as it is received. The table below lists the assets with updated transactional or flow data from the past week. The "Dates" column indicates the timeframe for the newly posted data.

Plainview New Assets Under Coverage (9/15 - 9/21)

We add new assets to our platform daily. The table below lists the assets added to our platform last week. Plainview users can request specific assets by contacting us at matthew.lewis@plainview-energy.com.