Plainview Weekly: WTI Crude Oil Prices Below $60 - Permian Records, Bakken Shut-Ins, and Canada Pipeline Chill (10/6-10/12)

Permian Surge, Bakken Sensitivity, and Canadian Pipeline Risks Amid Sub-$60 WTI

Permian Basin at Inflection Point: Record Production Surge Clashes with Falling WTI Prices and Rig Cuts

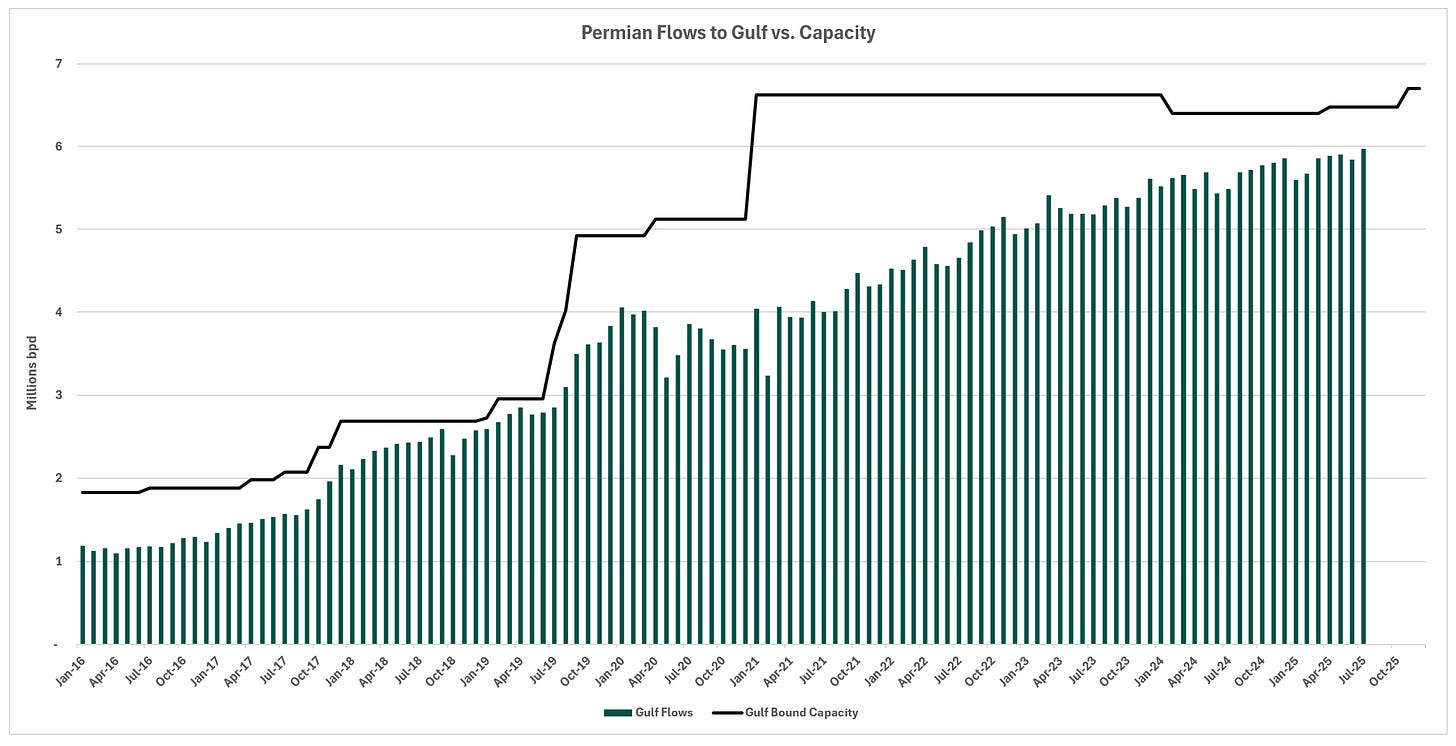

As we noted last week, based on EIA production data, our modeling suggests that the Permian Basin set a new monthly record by more than 100,000 barrels per day in July. This growth positions the basin at a critical inflection point, with egress pipelines to the Gulf Coast now estimated at approximately 92% utilization; we are approaching thresholds where Permian Gulf Coast price spreads may begin to widen. Ample intra basin connectivity and diversified export routes have kept spreads narrow even as Gulf bound utilization pushes past 90%, but the unexpectedly robust July output demands vigilant tracking.

Countering this relentless march higher in production are WTI prices, which have fallen this year. Permian rig counts and completion activities have also decelerated sharply, signaling likely production plateaus or even declines absent a price recovery. These dynamics have key implications for medium term pipeline recontracting, favoring lower rates and narrower spreads if sub $60 prices persist, while sustained output gains could lead to much more rate leverage for the pipelines (though Gulf bound capacity constraints will be closely monitored).

Bakken Production Shut-Ins Below $60: Signs of Heightened Price Sensitivity in 2025?

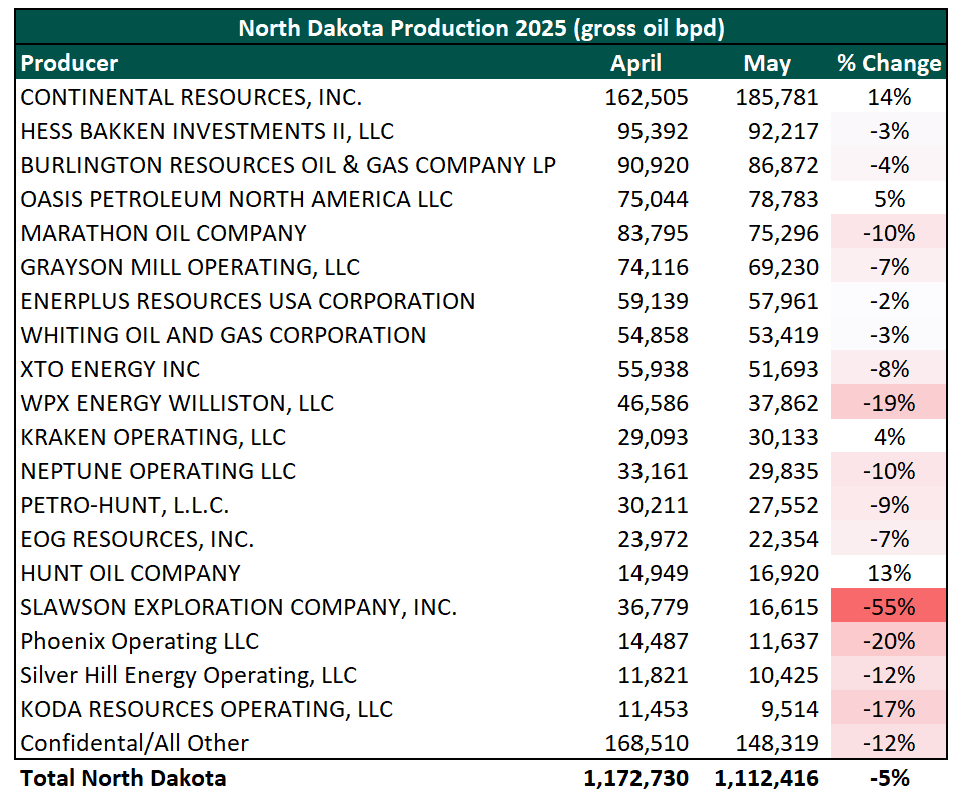

In the Bakken, a notable production trend emerged this year as operators reportedly shut in output in May amid WTI prices briefly dipping below $60 per barrel, per North Dakota’s Oil and Gas Division. This prompted questions about whether more aggressive curtailments could occur in the basin and elsewhere compared to past cycles, such as during COVID, when negative prices were required for material shut ins. These May actions, while not widespread, were conspicuous, coinciding with declines across nearly all producers from April to May, including a striking 55% drop for Slawson Exploration and smaller but material declines for other producers including WPX Energy (Devon), Silverpeak, and Koda. Seasonal factors post winter completions may contribute, but the decline magnitudes stood out.

July data indicates only partial restarts had occurred for some, like Slawson, with the basin overall registering steady output reductions for most operators from April through July except for Continental Resources and Oasis Petroleum (now integrated into Chord), which posted substantial gains. This pattern underscores close monitoring of producer responses to sustained sub $60 pricing, potentially signaling heightened sensitivity to low price environments.

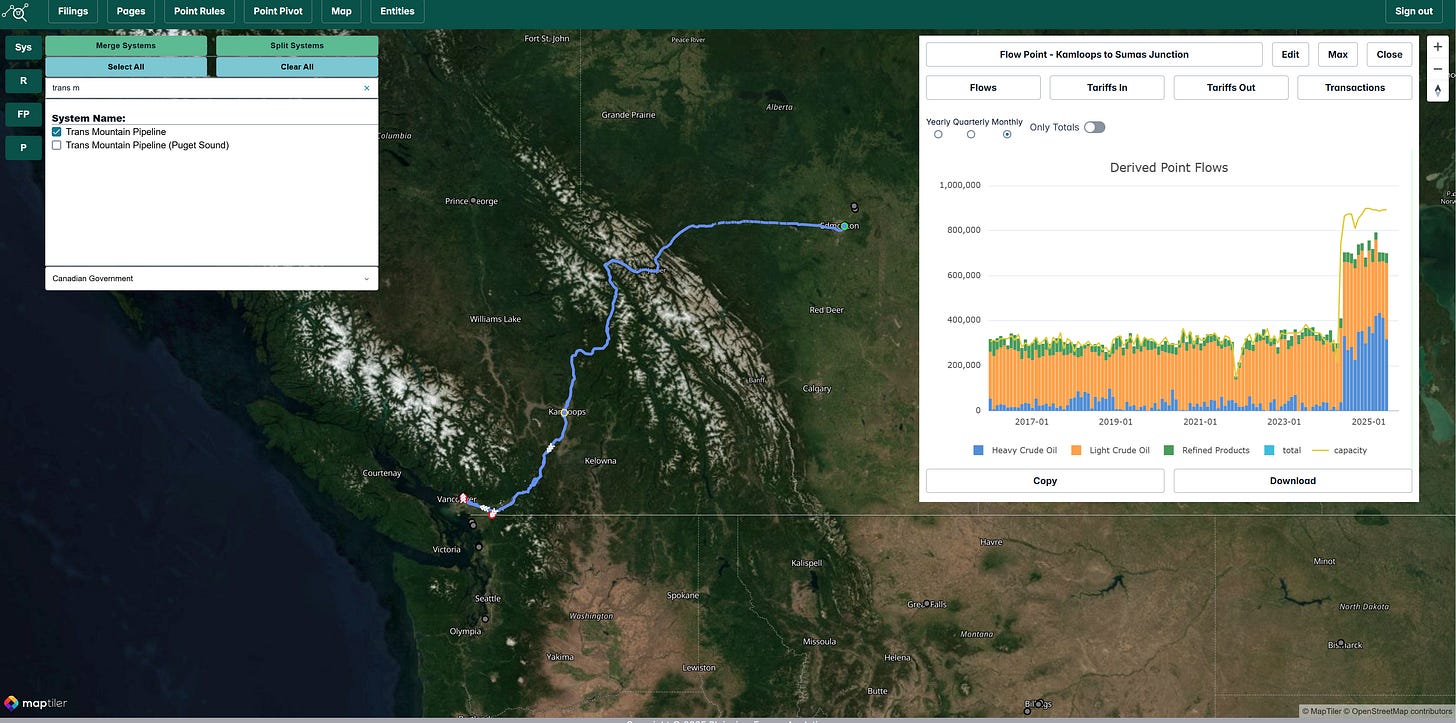

Canada Oil Pipeline Expansions Face Chill from Sub-$60 WTI Prices After Trans Mountain Relief

Falling crude prices below $60 per barrel could significantly impact Canadian oil production and infrastructure development, as the country recently alleviated longstanding pipeline constraints with the Trans Mountain expansions twin line coming online. With the new pipeline online, Canada has roughly 500,000 barrels per day of excess egress capacity. Pipeline projects typically require two to five years for permitting and construction, and recent discussions spurred by a potentially friendlier regulatory environment under the Trump administration have focused on new expansions from Canada, including Enbridge’s proposed brownfield upgrades to its Express and Platte pipelines, a Trans Mountain brownfield pumping station expansion, pitches for a new greenfield pipeline to the West Coast from Alberta, and even whispers of resurrecting Keystone XL in some form. However, with modest excess capacity available and producers likely only eyeing significant growth in higher price environments, sustained sub $60 pricing may exert a chilling effect on these ambitious plans, dampening momentum for further developments.

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 200 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

No updated data or new assets added this week - We will share exciting news on new assets and updates next week!

News that Caught our Eye

Industry experts see ‘steep barriers’ to Keystone XL revival