Plainview Weekly: U.S. Crude Flows in Transition - Cushing Storage at Lows and Bakken Egress Rewires in Q3

How record-low inventories, resilient midcontinent inflows, and pipeline conversions are reshaping price signals and regional crude movements

Cushing Oil Storage Near Historic Lows in 2025: Why the Hub Remains Vital for U.S. Crude Markets

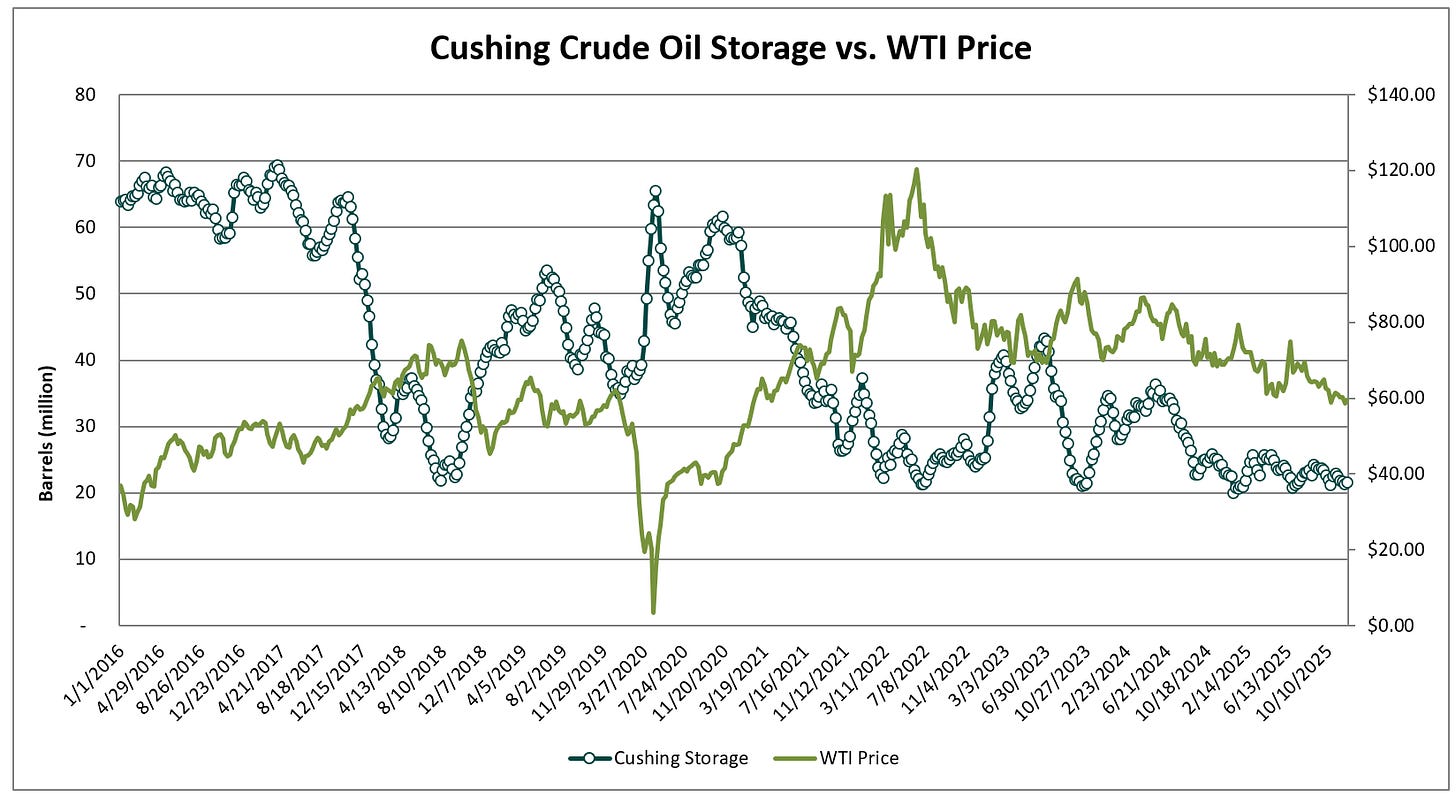

Cushing, Oklahoma storage levels have fallen to around 20 million barrels, approaching operational tank bottoms and marking the lowest point in over a decade according to recent EIA data. Historically, such low inventories signal supply tightness and typically drive crude oil prices higher amid fears of shortages. However, with WTI prices lingering below $60 per barrel, this pattern has broken, raising questions about evolving market dynamics and the enduring role of Cushing in global oil flows.

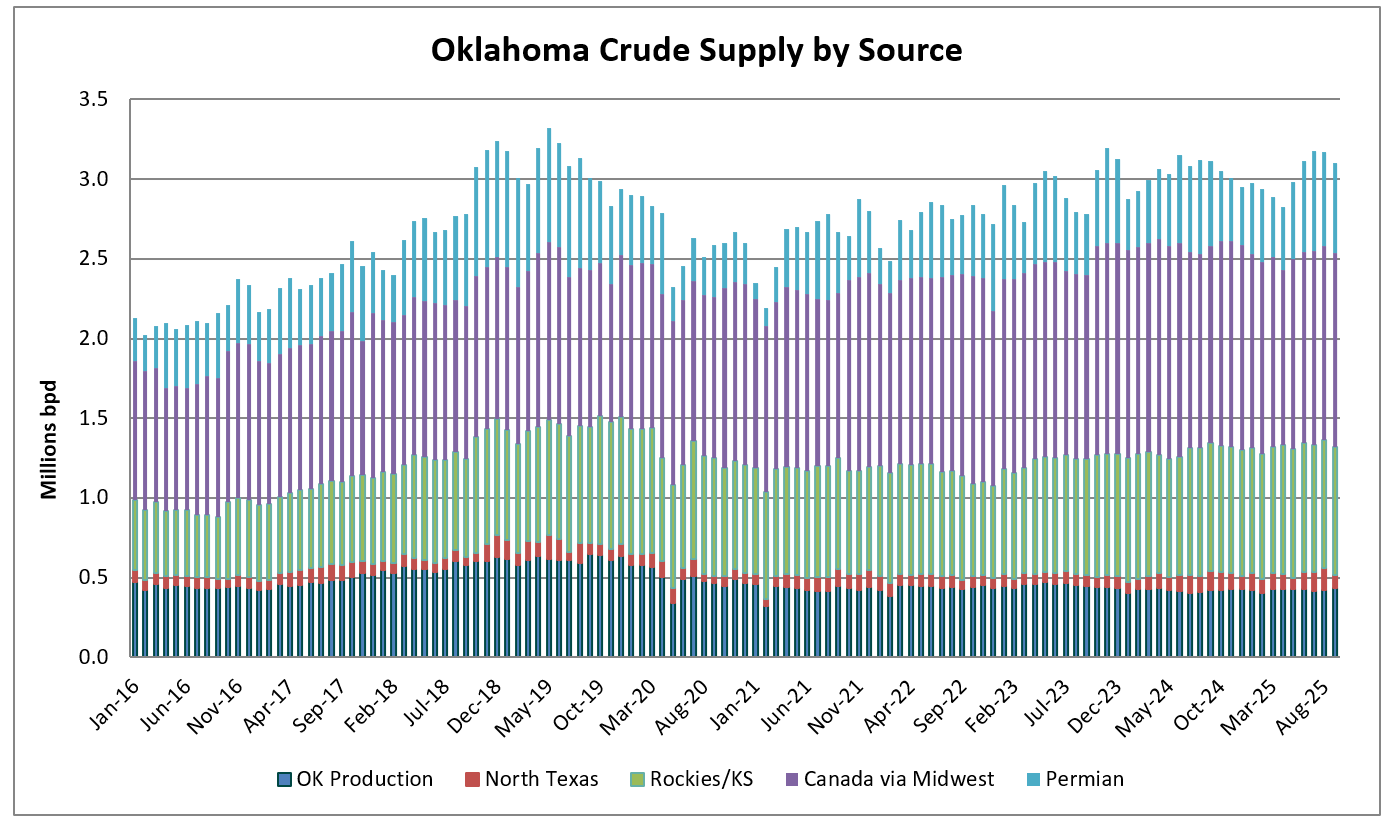

Even in the face of record low storage levels, supply inflows into Oklahoma, nearly all destined for Cushing, remain near the record highs set in mid-2019. Although Oklahoma crude production has declined by about 200,000 barrels per day since then, and significant Permian volumes have rerouted directly to the Gulf Coast via new pipelines, increased deliveries from the Rockies and Midwest, including heavy Canadian crude, have offset these losses. This robust inbound supply has kept Cushing well supplied and liquid despite the inventory drawdown.

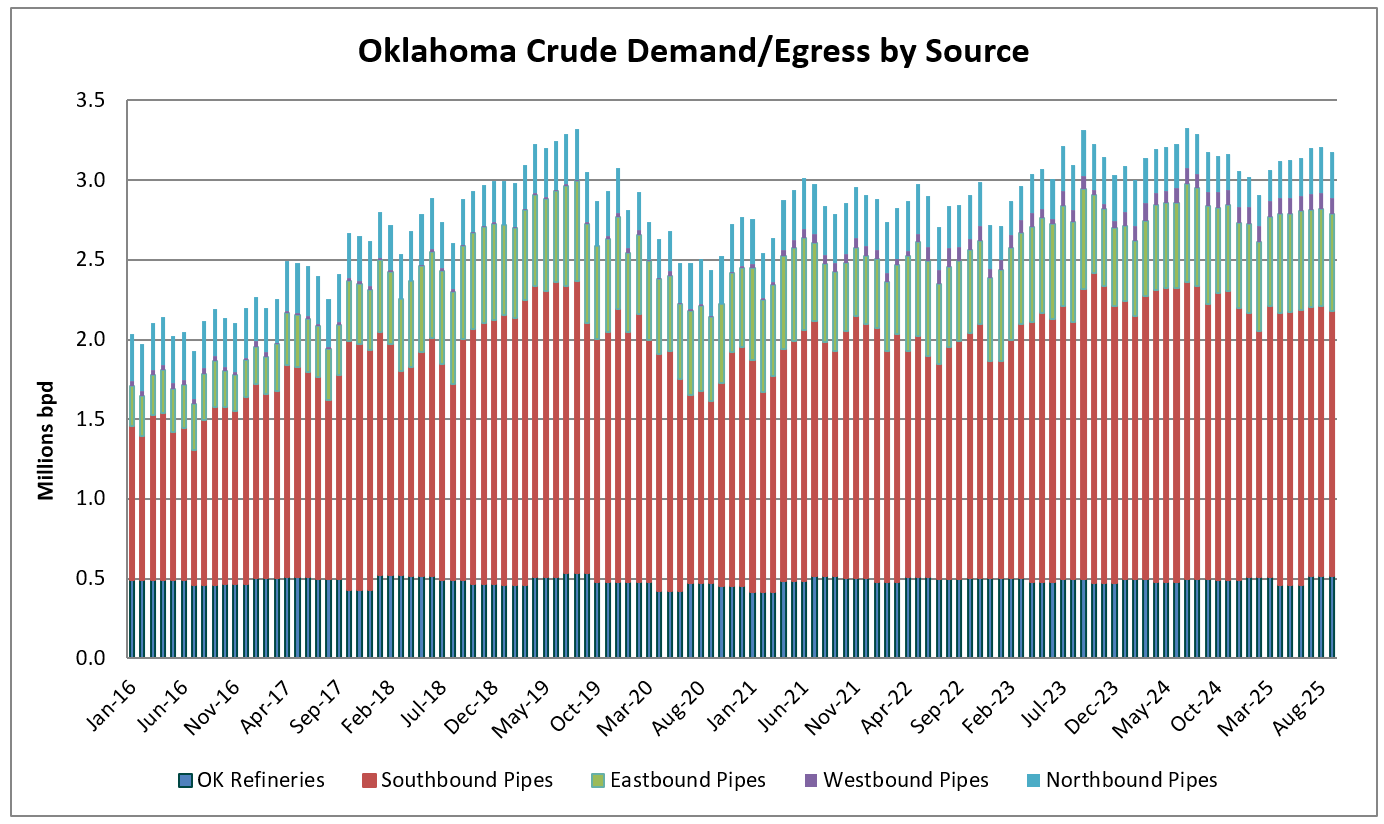

Demand-side developments underscore Cushing’s growing significance as a key storage and distribution hub for PADD 2 refineries and beyond. Newer Cushing eastbound pipelines like Diamond and the expanded Ozark have boosted shipments to Midwest refineries over the past decade, while the recently built Canyon Crossing pipeline enables westbound flows to Texas Panhandle facilities. Most critically, southbound pipelines, including Marketlink, Seaway, Red River, and Centurion’s Permian Express connection, have carried nearly 1.7 million barrels per day to Gulf Coast markets in the past year, nearing 2019 peaks and affirming Cushing’s pivotal position in connecting midcontinent supply to global export terminals.

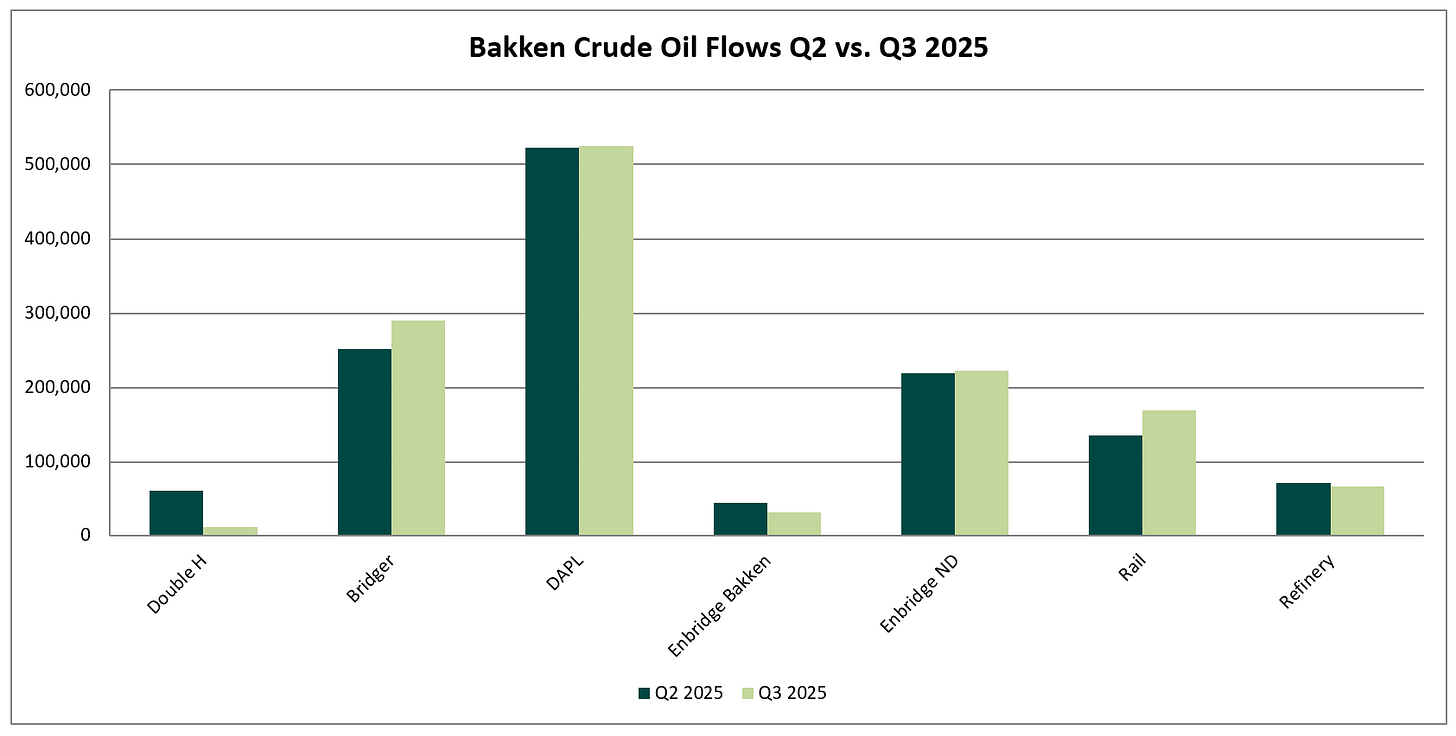

Bakken Crude Egress Shifts: Double H Pipeline Conversion Drives 40,000 bpd to Bridger Pipeline in Q3

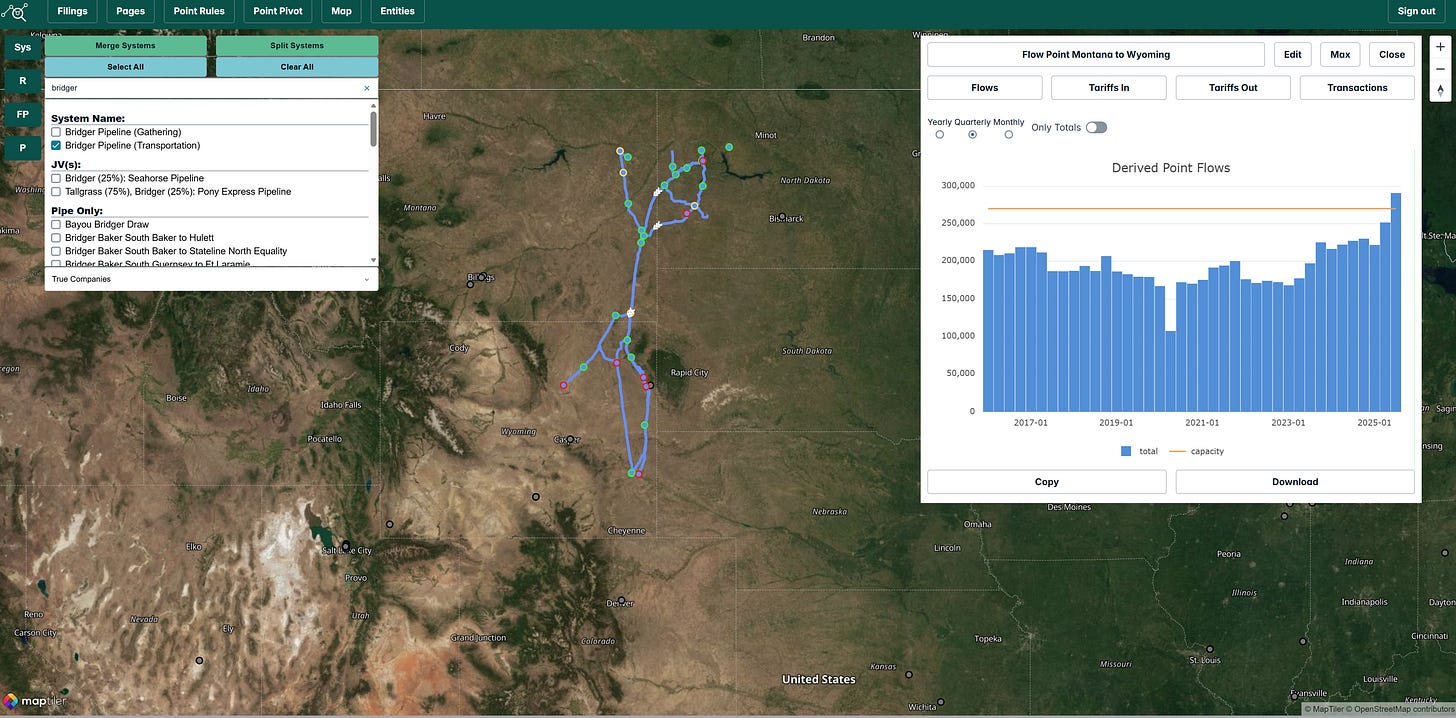

New Q3 2025 data reveals the first clear impact of Kinder Morgan’s Double H pipeline conversion from crude to NGL service. Previously transporting 60,000–70,000 barrels per day of Bakken crude to Guernsey, Wyoming, Double H volumes fell by approximately 50,000 bpd from Q2, leaving only about 10,000 bpd in Q3. Most of these displaced barrels shifted to the Bridger pipeline, which added roughly 40,000 bpd quarter-over-quarter and pushed flows above our estimated nameplate capacity of 270,000 bpd. Bridger’s gains are likely attributable to its competitive tariff rates and superior netbacks relative to other egress options.

Other Bakken pipelines showed minimal or no benefit from the Double H drawdown:

Dakota Access added just 2,000 bpd, representing less than 0.5% growth.

Enbridge Bakken flows declined 12,000 bpd, likely due to heavy apportionment on the Enbridge Canadian Mainline restricting upstream movements.

Enbridge North Dakota gained 4,000 bpd but remains at/near full capacity.

Rail loadings increased by 34,000 bpd, though this uplift appears driven primarily by demand from West Coast refineries rather than the Double H conversion.

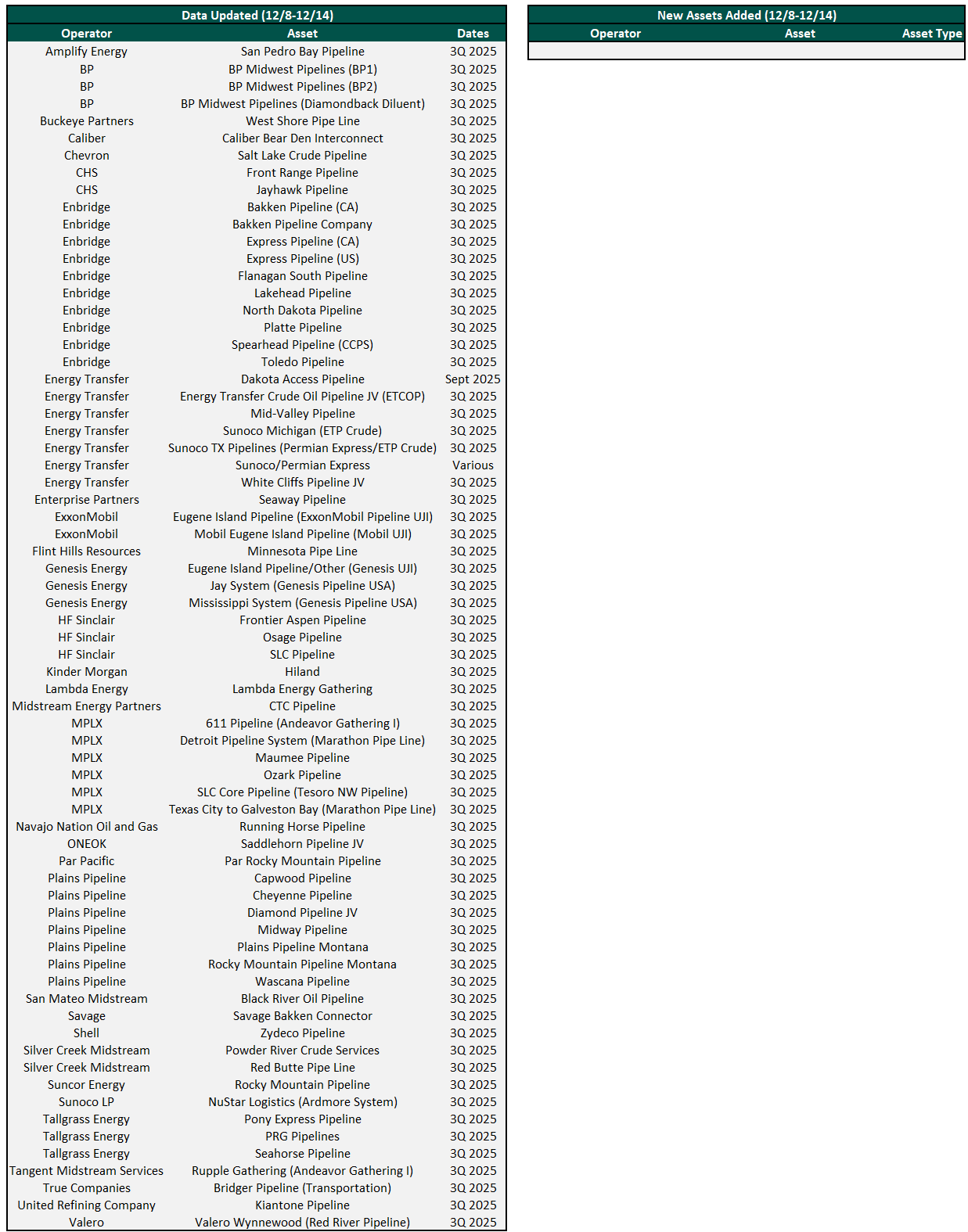

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Shell says output at two Gulf of Mexico offshore platforms temporarily shut in

Exclusive: Shell in advanced talks to buy LLOG Exploration for more than $3 billion, sources say

Discount on Western Canada Select at widest point since February