Plainview Weekly: OPEC Forecasts US Liquids Dip in Q4 vs. EIA Stability and Grand Mesa's 31% Volume Jump

Weekly Energy Digest: Unpacking conflicting US liquids forecasts, seasonal production trends, and key pipeline gains in the DJ Basin.

OPEC’s Bold Call for a Q4 US Production Dip: Reality Check Against EIA, Historical Trends, and Producer Guidance

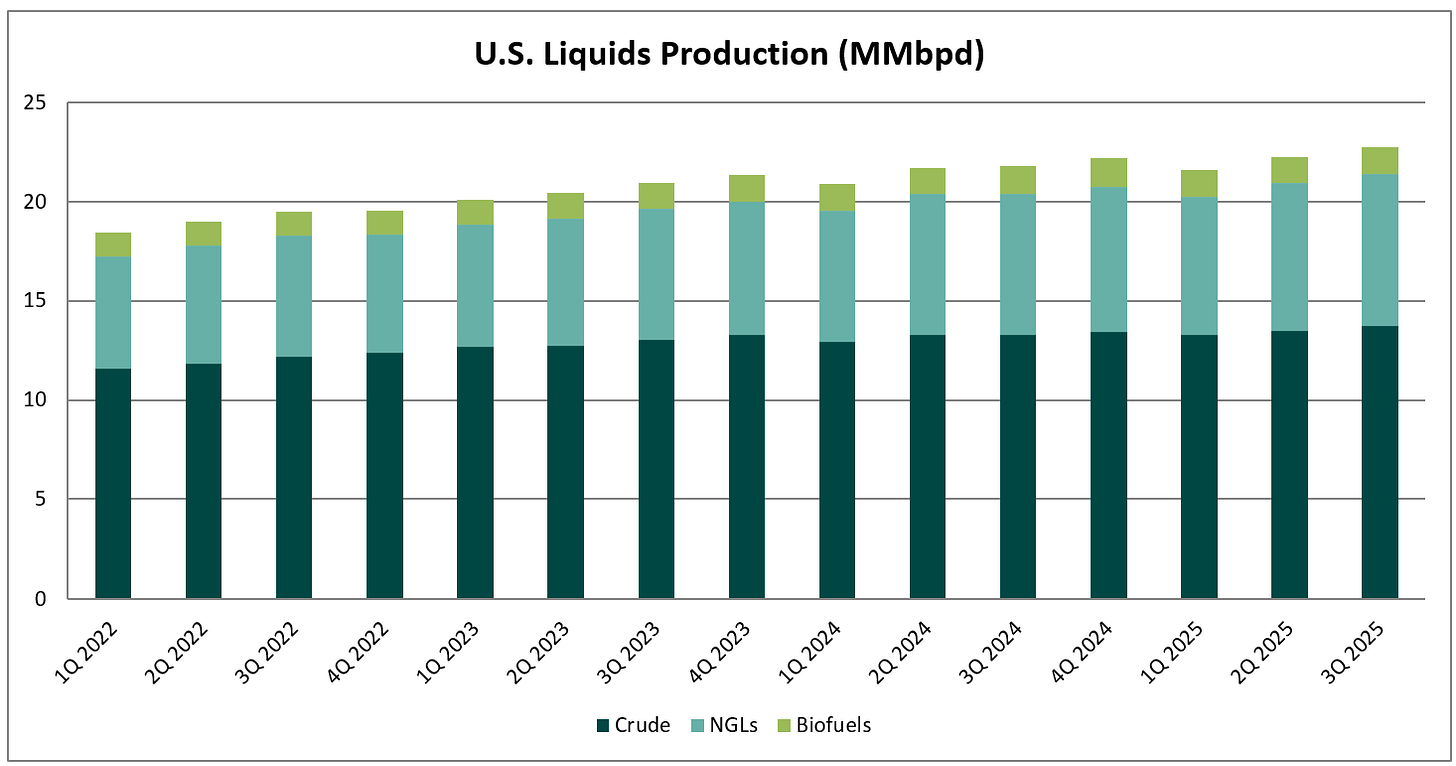

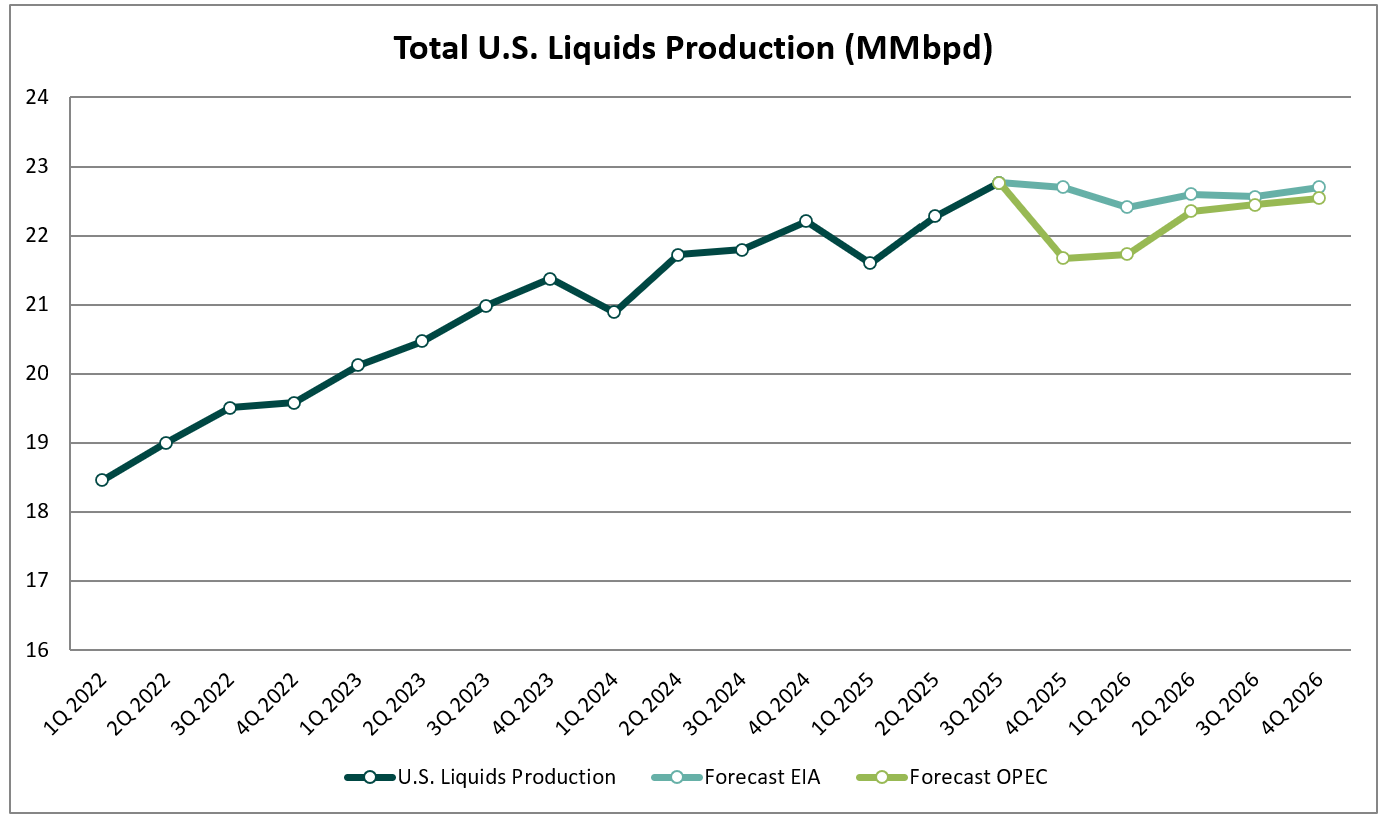

Since the COVID-19 pandemic, U.S. liquids production, which encompasses crude oil, natural gas liquids, and biofuels, has demonstrated robust growth, expanding at annual rates of 4-8%. However, this momentum has moderated in recent years, with 2024 and 2025 seeing more tempered increases at the lower end of that range. With recent liquids pricing pressure, a notable divergence has emerged in forward-looking estimates: OPEC’s latest Monthly Oil Market Report projects a nearly 5% decline in US liquids output from Q3 2025 to Q4 2025. This starkly contrasts with the US Energy Information Administration’s (EIA) Short-Term Energy Outlook, which anticipates relatively flat production during the same period, highlighting a growing rift in global energy forecasting amid volatile market dynamics.

Such a Q4 downturn would be highly atypical for the US, where producers strategically time well completions, particularly for natural gas, to ramp up output heading into winter, capitalizing on elevated seasonal prices while sidestepping harsh weather disruptions. Historical data reinforces this pattern: Q4 liquids production rarely dips compared to Q3, with declines more commonly observed in Q1 due to freeze-offs and reduced activity from extreme cold. OPEC’s pessimistic outlook appears misaligned not only with seasonal norms but also with recent guidance from US producers, who, despite adopting a cautious stance for Q4 2025 and into 2026, consistently signal stable volumes rather than contraction.

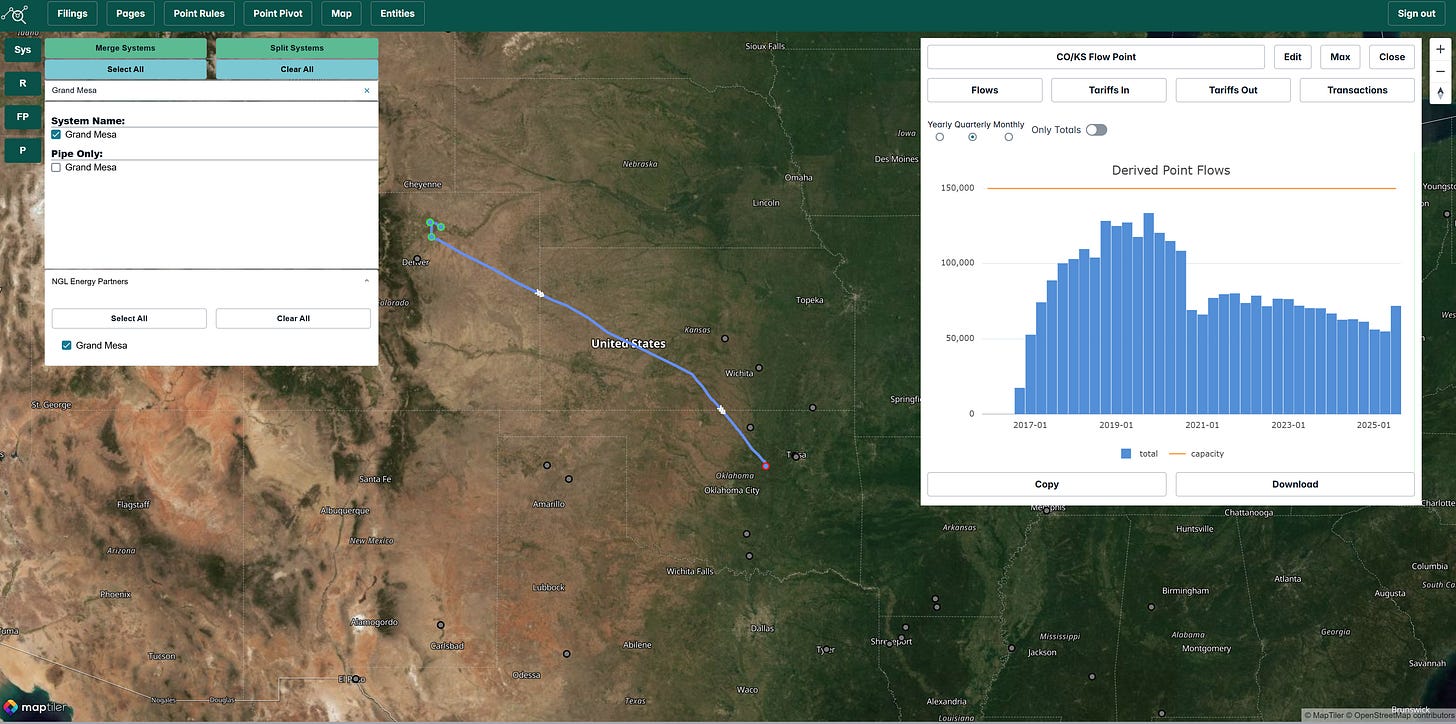

Grand Mesa Pipeline Q3 Volumes Surge 31% on New Prairie Operating Contract

Grand Mesa Pipeline, operated by NGL Energy, posted Q3 volumes of 72,000 barrels per day (bpd), marking a 17,000 bpd (or 31%) increase from Q2 levels. This uptick occurs against a backdrop of flat to modestly rising Colorado-Wyoming production, which gained just 6,000 bpd in the first two months of the quarter. The volume growth coincides with the recent activation of Grand Mesa’s new long-term acreage dedication contract with Prairie Operating Co., which secures capacity for both current output and future growth.

Prairie Operating gathers production through Chevron and Greenfield’s Black Diamond Crude Gathering system, and it recently bolstered its acreage portfolio by acquiring assets from Bayswater and Nickel Road. Notably, with no recent tariff adjustments signaling enhanced competitiveness for Grand Mesa, the surge likely stems from more aggressive marketing efforts by the operator to capture market share in the DJ Basin.

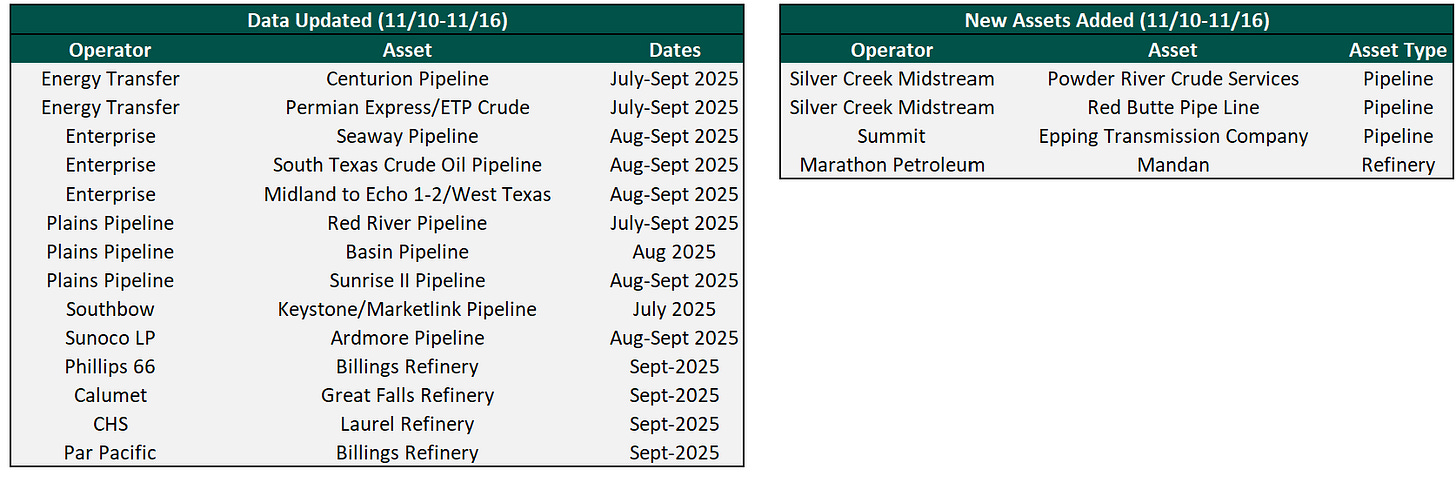

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 250 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Preliminary findings show fatigue crack caused Keystone Pipeline oil spill