Plainview Weekly: Enbridge's 100K BPD Pipeline Boost & BP's $1.5B Permian-Eagle Ford Stake Sale (11/3-11/9)

Key Updates on Enbridge's Southern Illinois Connector FID and BPX Energy's Strategic Midstream Partnership with Sixth Street

Enbridge and Energy Transfer Sanction Southern Illinois Connector: 100,000 BPD Contracted to the Texas Gulf Coast

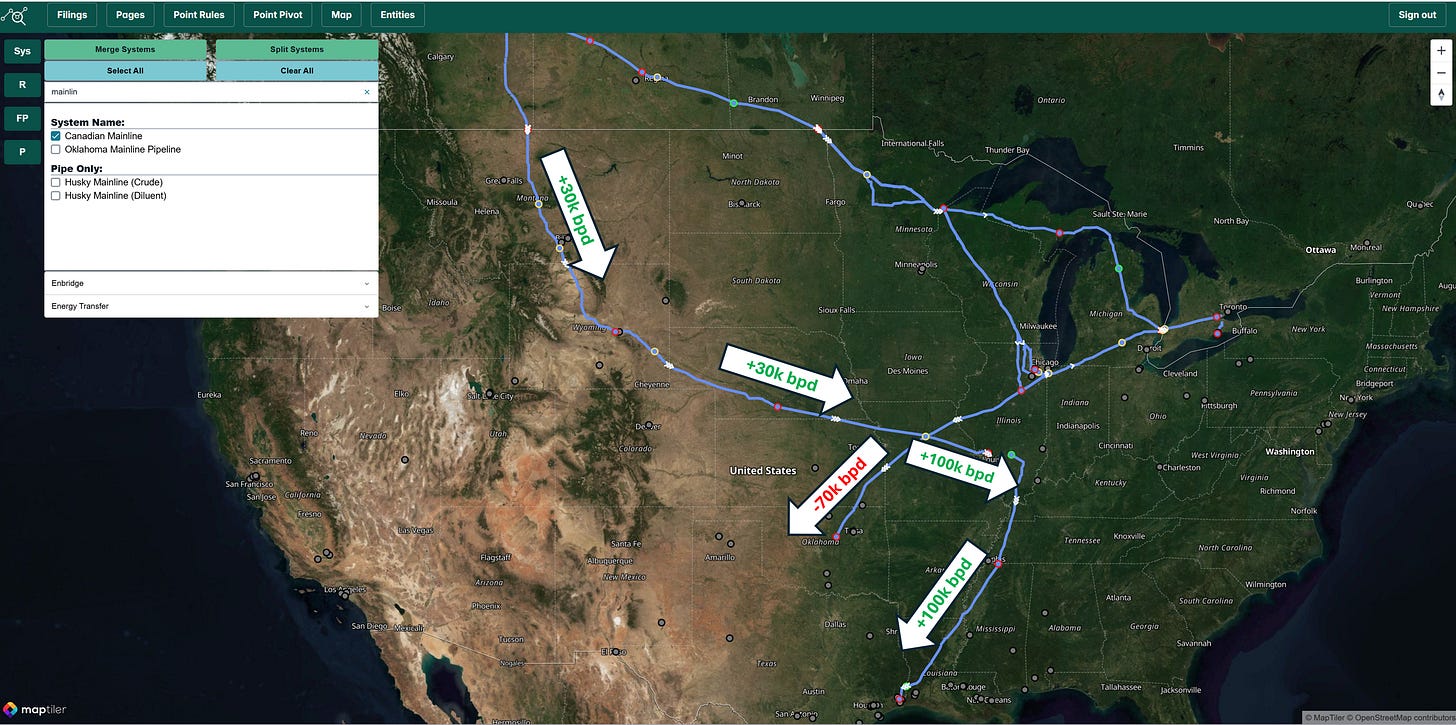

Enbridge and Energy Transfer have sanctioned the Southern Illinois Connector project, a strategic pipeline initiative that leverages existing infrastructure with minimal new construction to move Western Canadian barrels to the Gulf Coast. The project will add 100,000 barrels per day (bpd) of long-haul capacity originating from Western Canada and extending to Nederland, Texas. Notably, only 30,000 bpd represents genuine new egress capacity from Canada, achieved through an expansion of the Express and Platte Pipelines, while the remaining 70,000 bpd involves reallocating Canadian volumes that previously flowed to Cushing, Oklahoma.

The reconfiguration will route the volumes partially along Enbridge’s Spearhead Pipeline before transitioning to the Platte Pipeline, ultimately feeding into the Southern Illinois Connector and ETCOP for delivery to Nederland, Texas. As we discussed in a previous video on this project, diverting these flows would free up 70,000 bpd of space on the southern segment of Spearhead, potentially unlocking capacity from Guernsey, Wyoming to Cushing, Oklahoma via Platte and Spearhead South.

BP Secures $1.5 Billion Deal: Sells Non-Controlling Stake in Permian and Eagle Ford Midstream Assets to Sixth Street

BP has finalized a strategic agreement with Sixth Street Managed Funds to divest non-controlling interests in its Permian and Eagle Ford midstream assets, operated under BPX Energy, for a total consideration of $1.5 billion.

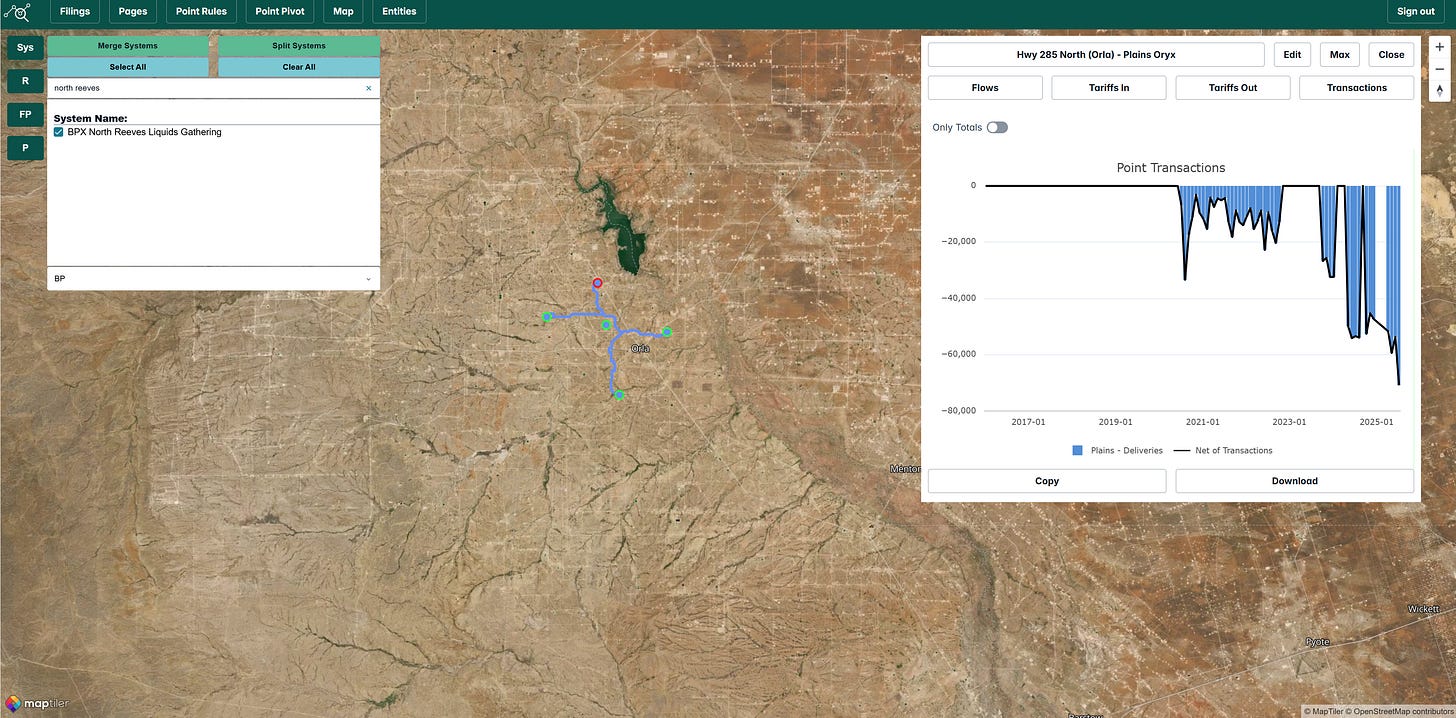

The Permian oil gathering system (see below), though relatively compact, features four central processing facilities: Grand Slam, Bingo, Checkmate, and Crossroads (green dots in picture). The system is currently gathering approximately 70,000 barrels per day (bpd), a significant ramp-up from 20,000 to 30,000 bpd in 2023. It appears to gather exclusively for BP and, although small, is well positioned in a core area of the Delaware. Although specific plans for this system were not articulated, BP and its partners could expand its reach given its current foothold in the Orla area.

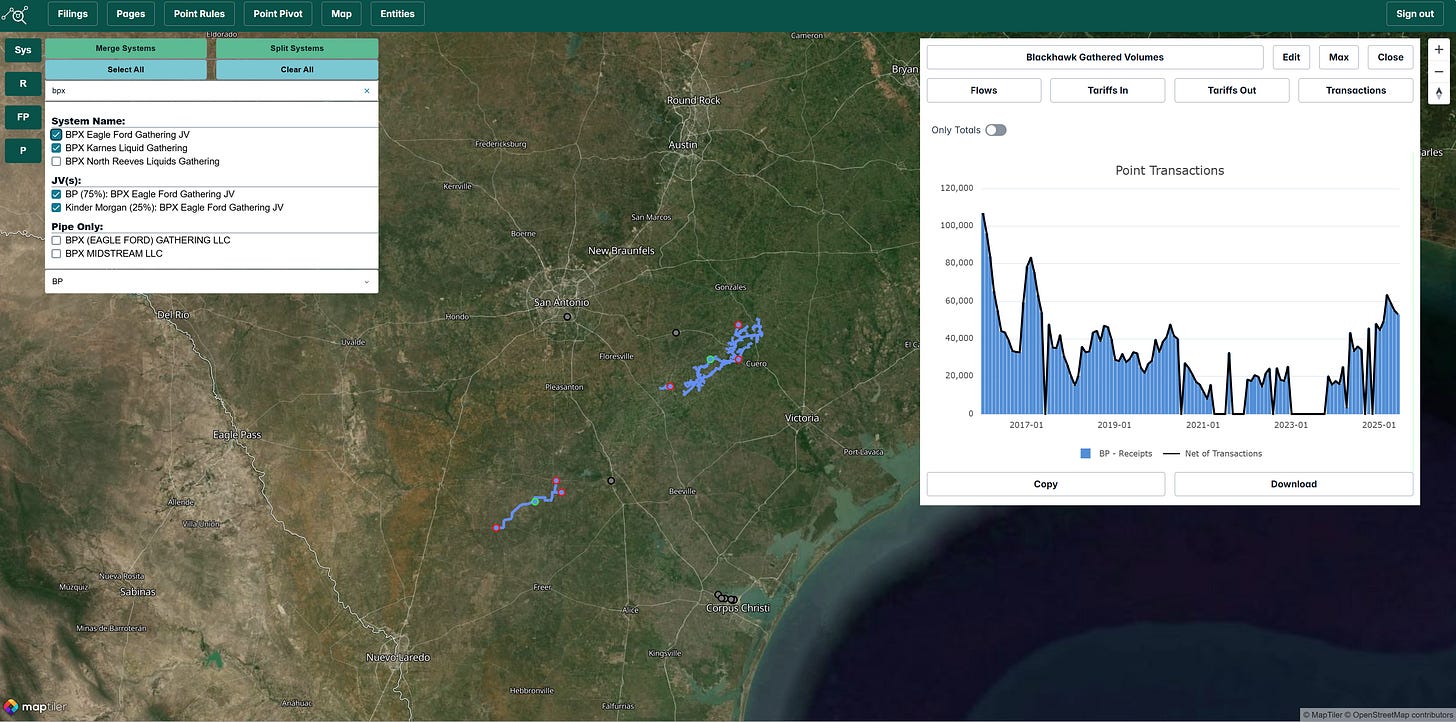

In the Eagle Ford (see below), BPX Energy manages three distinct oil gathering systems: the smaller Karnes Gathering (very small central system) at around 15,000 bpd; Hawkville (southwest system) at 20,000 bpd; and the flagship Blackhawk system (northeast system), which has surged to 50,000–60,000 bpd following a recovery from lows of about 25,000 bpd in 2022–2023. All three systems have seen significant growth in volumes the past few years as BP appears to have ramped activity in the basin.

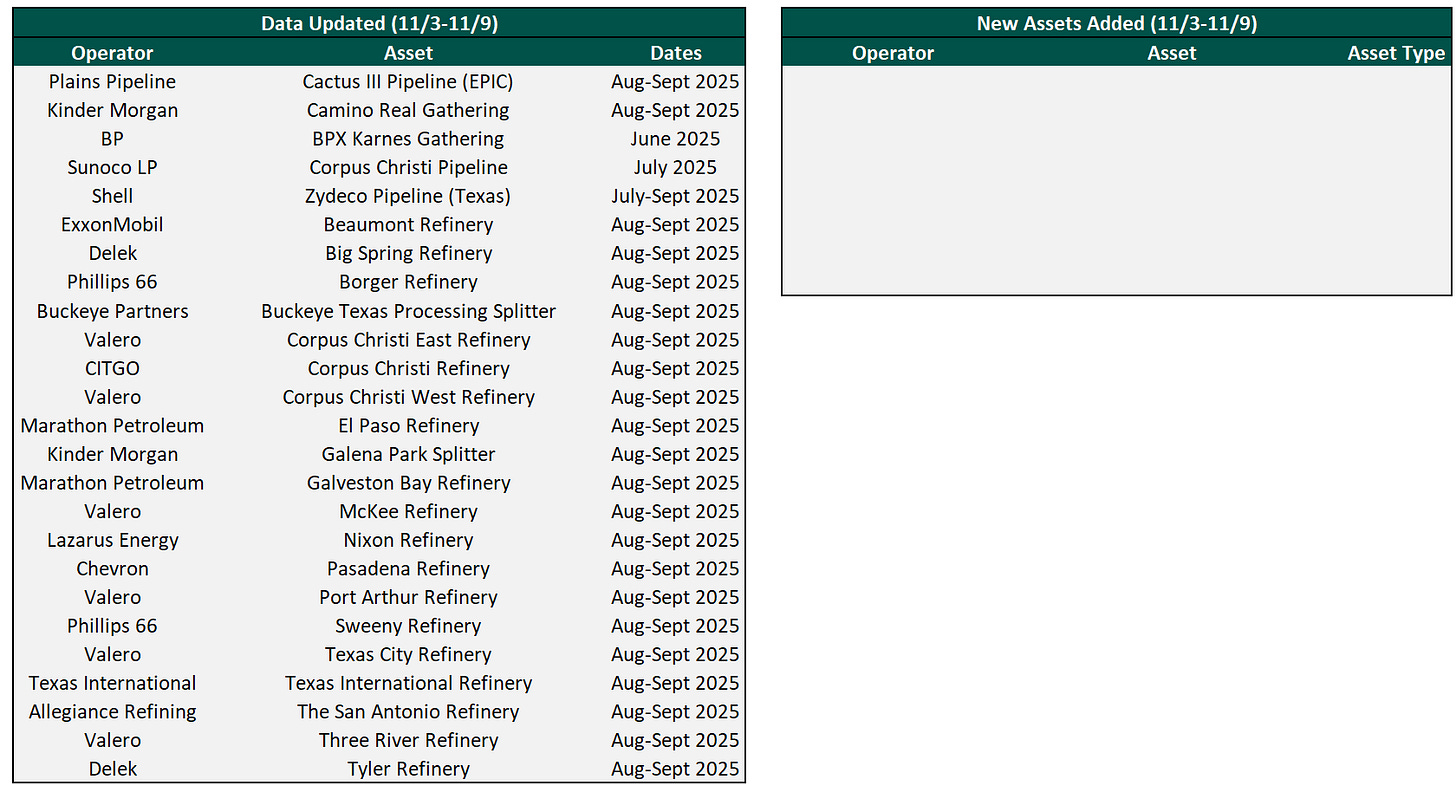

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 250 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Any news last week will be covered in our Week 3 Earnings Review which will be released on Monday November 10th.