Plainview Weekly: EIA U.S. Oil Output Hits Record 13.8M bpd as Gulf & Alaska Drive August Growth (10/27-11/2)

Efficiency Strategies Drive 2026 Growth Outlook | Bakken Spotlight: Enable Crude's New Tariff Targets Continental Amid Hiland Tensions

US Oil Production Hits Record 13.8M bpd in August 2025: Oil Companies Signal Efficiency-Driven Growth into 2026

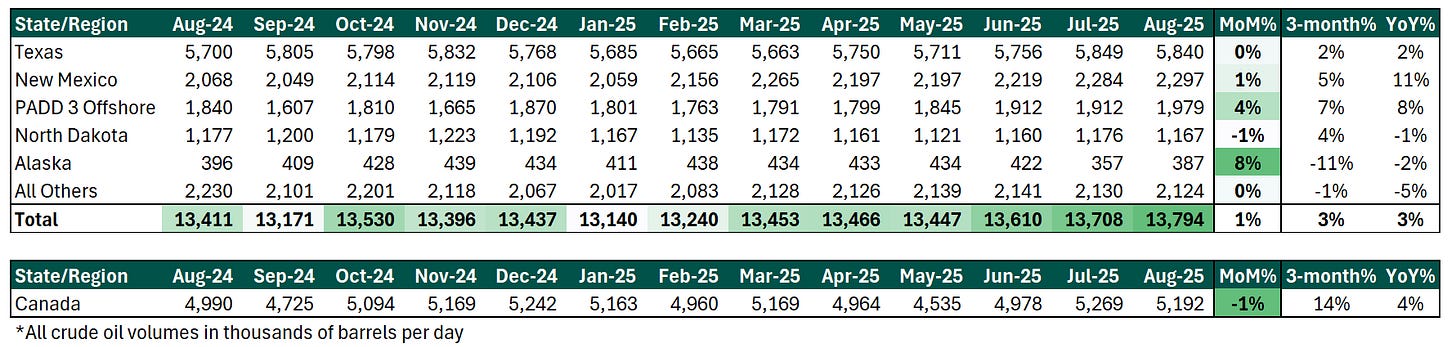

The U.S. Energy Information Administration (EIA) reported a new record for U.S. oil and field condensate production on Friday, reaching nearly 13.8 million barrels per day (bpd) in August. The uptick was driven by the offshore Gulf of Mexico, which saw a 4% month-over-month increase, and Alaska, which surged 8%, contributing a combined 100,000 bpd to the total. Meanwhile, Western Canadian production continues its steady rise, with year-over-year volumes up ~4% according to data from the CER.

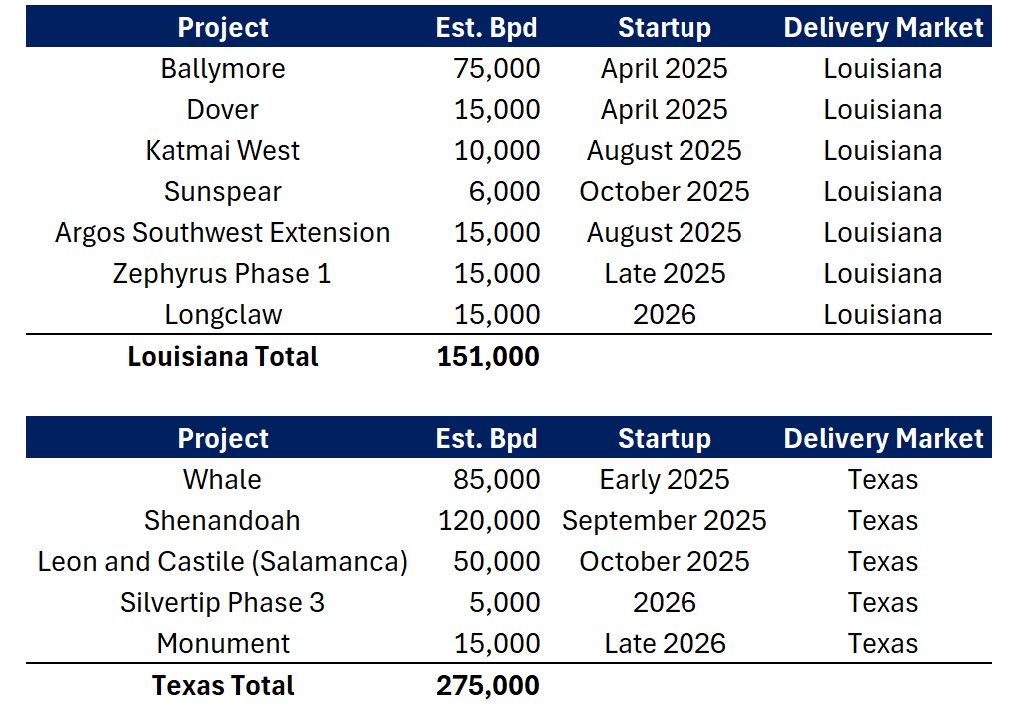

This slow but persistent growth is likely to continue, as data and industry commentary now indicate multiple tailwinds heading into the end of the year. Data from the Alyesaka Pipeline indicates Alaska production has fully recovered from summer upstream maintenance, with volumes currently up ~100,000 bpd from the reported August EIA number. Additionally, offshore Gulf projects continue to ramp up, with Shenandoah, Salamanca, and several small projects now coming online. Combined, these projects could add ~200,000 bpd to Gulf oil production by the end of 2025.

Additionally, commentary from oil producers in third-quarter earnings calls reveals a theme: while overall activity has slowed, targeted efficiencies are sustaining low single-digit production growth in many areas. Executives emphasized potential growth pockets into 2026, including the Gulf of Mexico, Permian Basin, and Canada, even as basins like the Bakken, DJ, and Powder River may plateau or experience minor declines. These improvements appear to stem from operational optimizations, allowing output to remain stable or slightly expanding despite lower rig counts. The data and commentary alike point to a continued trend in the North American energy landscape, where technological and efficiency-driven strategies could buffer against broader slowdowns.

Enable Bakken Crude’s New Tariff: Targeting Continental Amid Hiland Tensions?

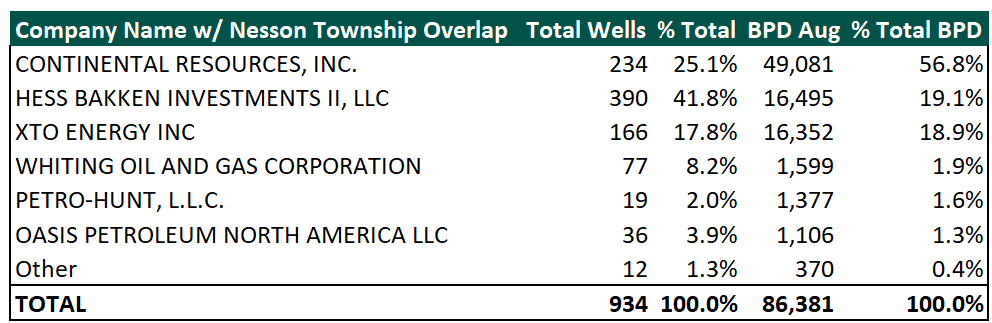

Enable Bakken Crude Services (subsidiary of Energy Transfer) recently posted a new committed shipper rate for the gathering and transportation of crude petroleum from Mountrail and Williams counties to Tioga, North Dakota (connections to Dakota Access, Hiland, Enbridge North Dakota, and Tesoro High Plains). The new tariff calls for a 10-year acreage dedication and mirrors the existing committed tariff rate ($1.3155 per barrel), which is currently utilized by anchor customer XTO (Exxon). The filing indicates Enable Bakken Crude may have, or be seeking, a new customer on its Nesson system. As shown in the table below, top producers there include Continental, Hess, and XTO. Chord also has a small amount of production there via their ownership of Whiting and Oasis.

Continental Resources stands out as a strong candidate for the new customer given its largest production share in the region and a potentially strained relationship with their primary gatherer Hiland. Continental filed a FERC complaint against Hiland on September 19, 2025, regarding rate increases on the Hiland crude gathering system. The two were also embroiled in a legal battle from 2017 to 2022 regarding a gas purchase agreement.

Hess remains a possibility, given its status as the second-largest producer there, but it already owns an extensive gathering system in the region that it would likely prefer using over a third-party option. Another possibility, but less likely given the small production there, is Chord (via Whiting/Oasis). The company recently purchased a large chunk of Exxon’s acreage in the Bakken; however, that acreage is well outside of the Enable Nesson gathering system footprint. Still, the company has other acreage in the region and may be looking to develop it.

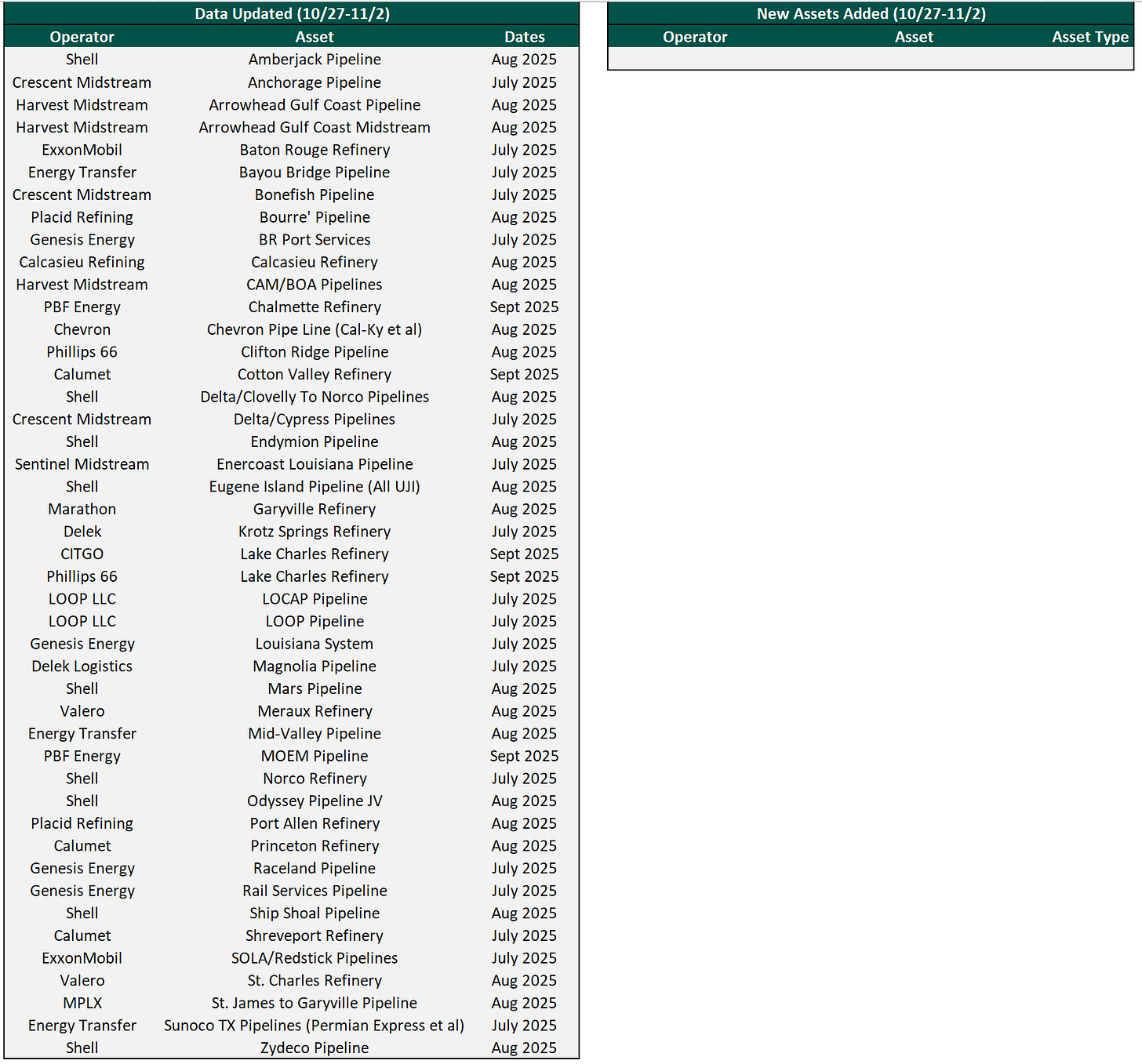

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 250 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Three injured after fire at HF Sinclair Navajo refinery in New Mexico

XTO's position as anchor customer on Enable's Nesson system at $1.3155 per barrel demonstrates Exxon's operational focus on locking in favorable long term midstream economics. The fact that Exxon divested Bakken acreage to Chord while maintaining its core gathering commitments shows strategic capital reallocation toward higher return projects like the Permian and Guyana. Continental's potential switch from Hiland to Enable could signal broader midstream competitiveness pressures in the basin, especially as producers seek rate stability amid the efficiency-driven producton environment you outlined. The irony is that even as operators slow activity and optimize rather than grow aggressively, these gathering systems still need to compete hard for committments from remaining high volume shippers like XTO.