Plainview Weekly: Cushing Southbound Capacity Stays Ample with Narrow Gulf Coast Spreads | ETCOP Pipeline Flows Hit Record Lows in Q3 2025

~400k bpd of open Cushing-to-Gulf capacity keeps basis at ~$1/bbl | Energy Transfer's ETCOP volumes drop to 155k bpd in Q3 amid Bakken headwinds and Midwest refining gains

Ample Southbound Pipeline Capacity from Cushing Continues to Support Narrow Cushing-Gulf Coast Basis Spreads in 2025

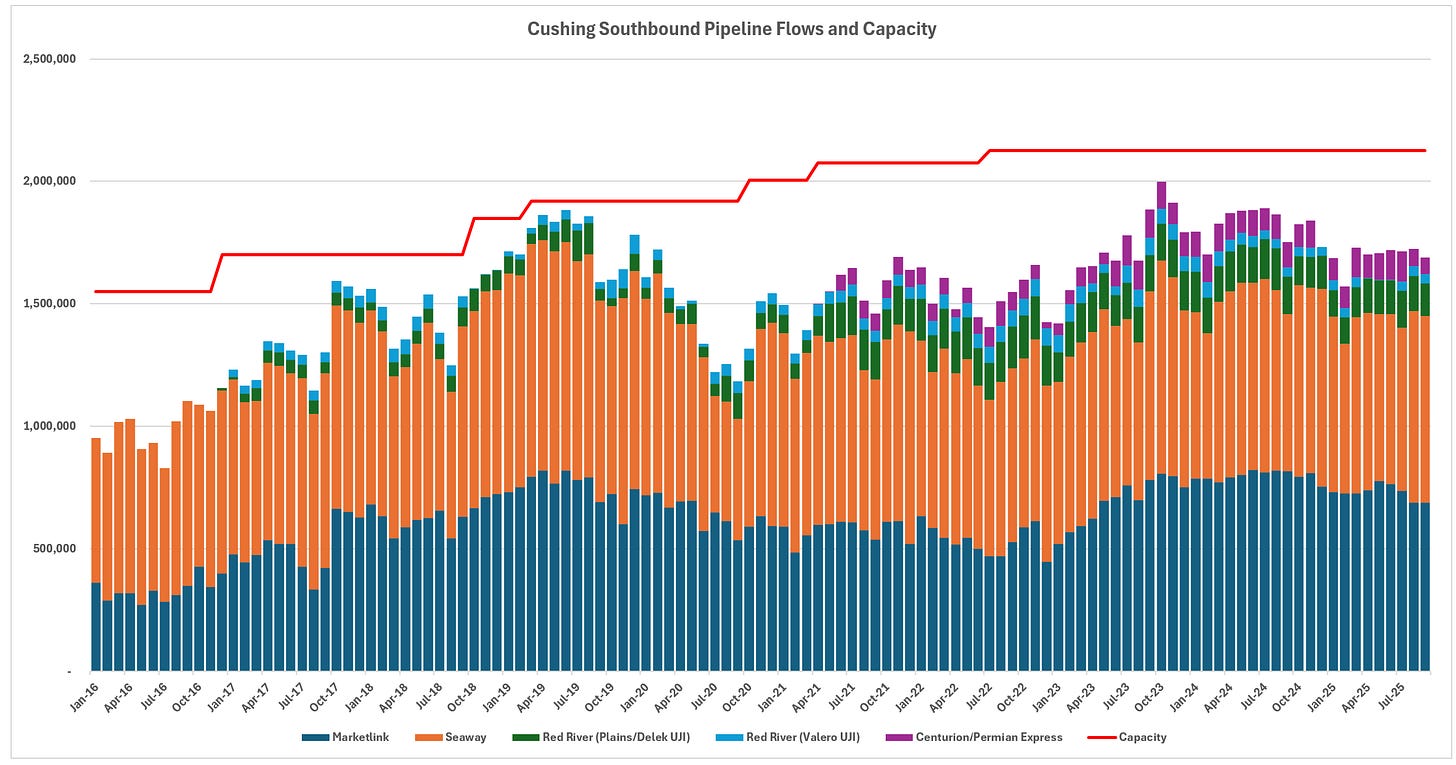

Southbound pipeline capacity out of Cushing, Oklahoma, has remained ample in recent years, with significant open space on several pipelines. While 2019 saw constraints due to increased crude flows from basins such as the DJ, Powder River, Bakken, and Permian converging on Cushing, subsequent developments eased the pressure. New pipelines from the Permian directly to the Gulf Coast redirected flows away from Cushing starting in late 2019, and multiple southbound expansions since 2018 have boosted overall capacity. Key projects include small upgrades to the two largest pipelines, Marketlink and Seaway; the Red River pipeline expansion by Plains All American; and the new route created by the Centurion reversal combined with Permian Express 1.

This infrastructure growth has resulted in more than 2 million barrels per day of southbound capacity from Cushing, though actual flows have averaged only about 1.7 million barrels per day over the past 12 months. This leaves roughly 400,000 barrels per day of unused capacity, contributing to narrow price differentials between Cushing and the Gulf Coast. Basis spreads have averaged around $1.00 per barrel recently, aligning closely with the short-term incentive tariff rates charged by major operators like Seaway and Marketlink. Narrow price spreads between Cushing and the Gulf Coast are likely to persist unless significant new supply shifts toward Cushing.

Record Low Flows on Energy Transfer’s ETCOP Pipeline JV: Down to 155,000 bpd in Q3 2025 Amid Headwinds

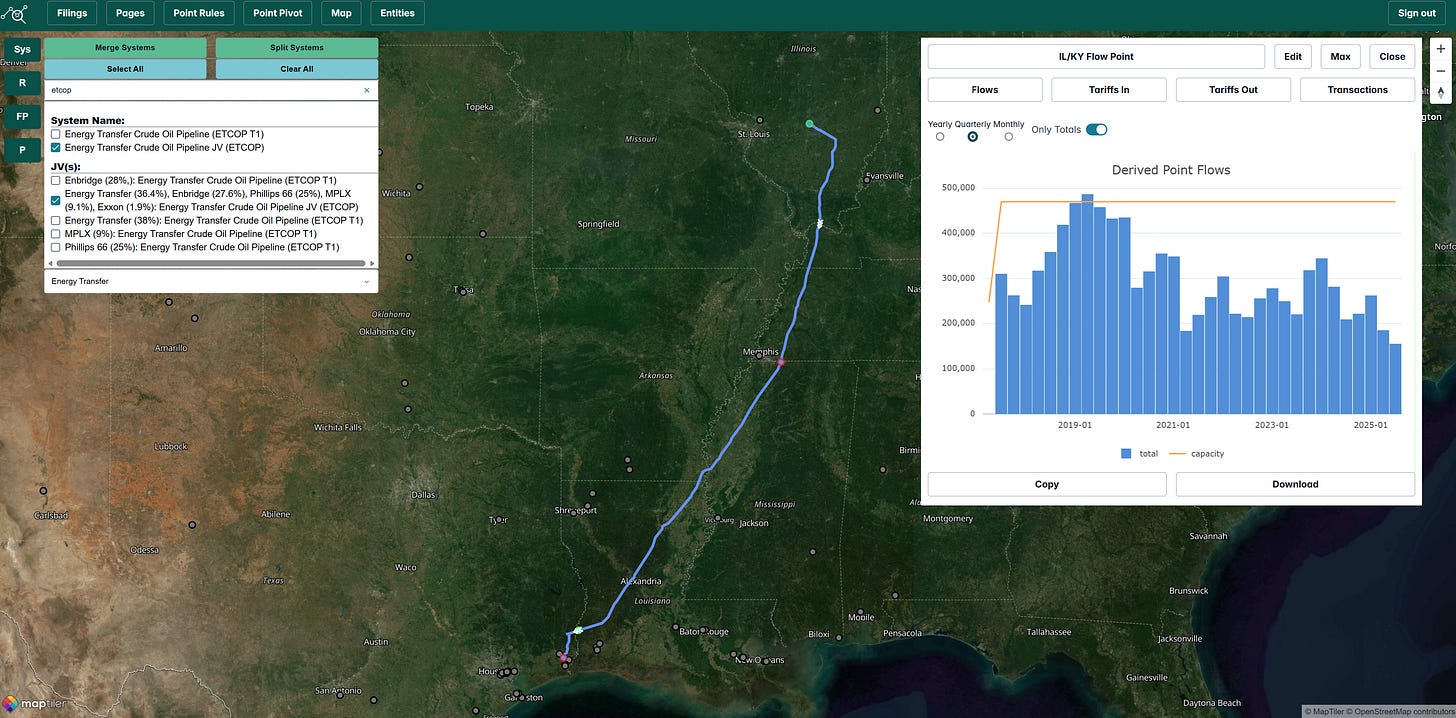

Pipeline flows on the Energy Transfer Crude Oil Pipeline (ETCOP), which transports crude from Patoka, Illinois, to Nederland, Texas, reached a record low in Q3 2025, averaging only 155,000 barrels per day according to FERC Form 6 filings. This marks a sharp decline from peak levels of nearly 500,000 barrels per day in mid-2019. Monthly data from the state of Texas further corroborates the trend, showing flows dropping below 130,000 barrels per day for several months in 2025.

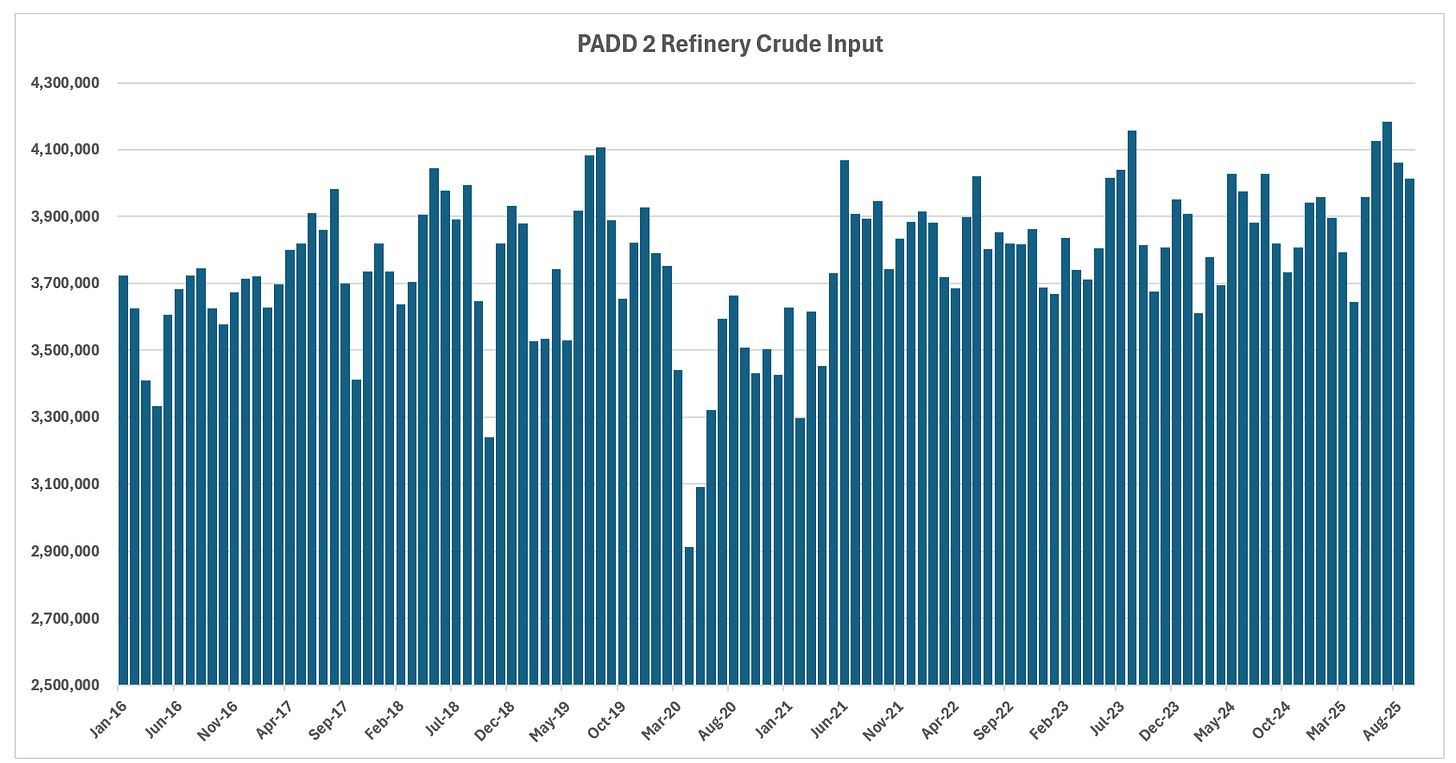

The downturn stems from multiple factors, including declining production in the Bakken shale, which has reduced volumes on the connected Dakota Access Pipeline feeding into ETCOP at Patoka. Higher refinery utilization in PADD 2 (Midwest) has also retained more crude locally, limiting southbound movements. Additionally, Bakken barrels have shifted to competing pipelines, bypassing the Dakota Access and ETCOP system. To address the open capacity, Energy Transfer has pursued backfill options, including the announced Dakota Access North/MLO2 project with Enbridge to route Canadian crude onto the system.

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Japan's JAPEX buys US tight oil and gas assets in $1.3 billion deal

Danielle Smith says she's open to shipping oil to Pacific via U.S. Northwest