Plainview Weekly: Canadian Production Set for 3.5% Increase in 2026: Possible Pipeline Constraints Loom | Cushing Eastbound Pipelines and Enduring Midwest Demand

Modest Canadian output growth faces seasonal pipeline limits starting Q1 2026, while Cushing maintains reliable eastbound light crude deliveries to key Midwest refining centers.

Canadian Oil Production Growth 2026: Pipeline Capacity Risks and Widening Differentials Ahead

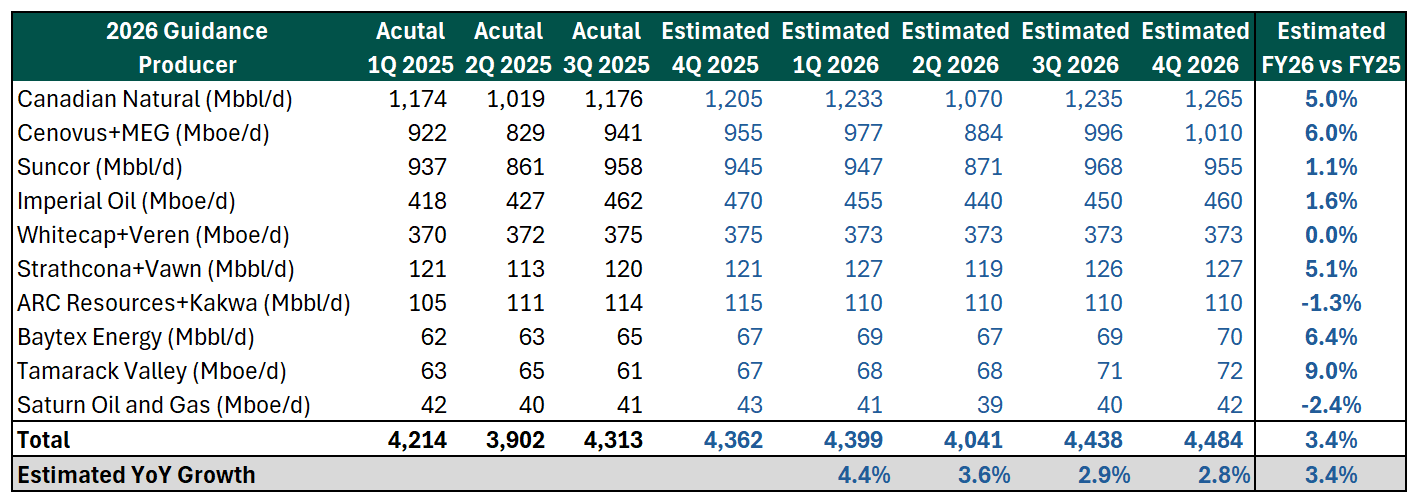

Canadian oil and gas producers have largely released their 2026 production guidance, pointing to continued modest growth in output. Modeling based on this guidance projects Canadian oil production to increase by around 3.5% in 2026 (see table below). Companies do not provide quarterly production cadence, but historically output peaks in the winter months of Q1 and Q4 due to seasonal patterns, which our quarterly forecast reflects.

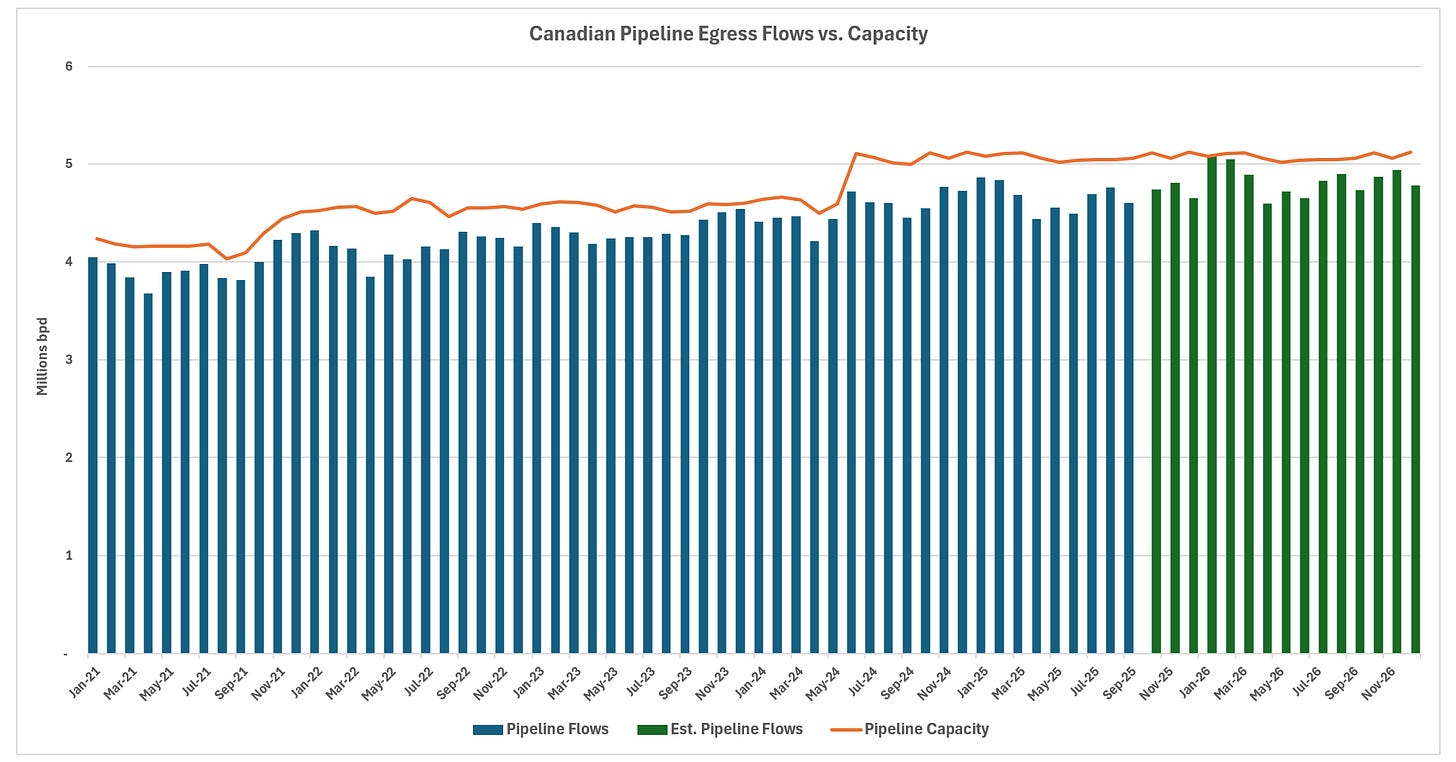

Incorporating this growth into the Canadian supply and demand balance reveals pipelines approaching capacity limits, possibly as early as Q1 2026 and almost certainly by the winter of 2026-2027. This tightness stems from continued production growth as well as higher condensate blending requirements in colder weather, which boost overall pipeline flows during those periods.

While Q1 2026 flows may push close to egress limits, sufficient storage in Canada should help prevent any significant widening of the differential between Canadian heavy crude prices and U.S. benchmarks. However, toward late 2026 and into early 2027, pipeline capacity constraints could become more persistent, potentially exerting greater downward pressure on pricing. Enbridge’s Mainline Optimization Phase 1 expansion, adding 150,000 barrels per day, represents the nearest major relief, with final investment decision already made and operations targeted for 2027. Until then, Canadian-U.S. crude differentials may widen, especially during winter months starting as early as Q1 2026 and extending through the 2026-2027 winter season.

Cushing’s Critical Role in US Oil Markets: The Three Key Eastbound Pipelines Supplying Midwest Refineries

As we’ve discussed over the past couple of weeks, Cushing, Oklahoma, remains a cornerstone of North America’s oil storage and distribution system. In addition to serving as a major staging point for southbound flows, the hub plays a vital role in moving light crude eastward to Midwest refineries.

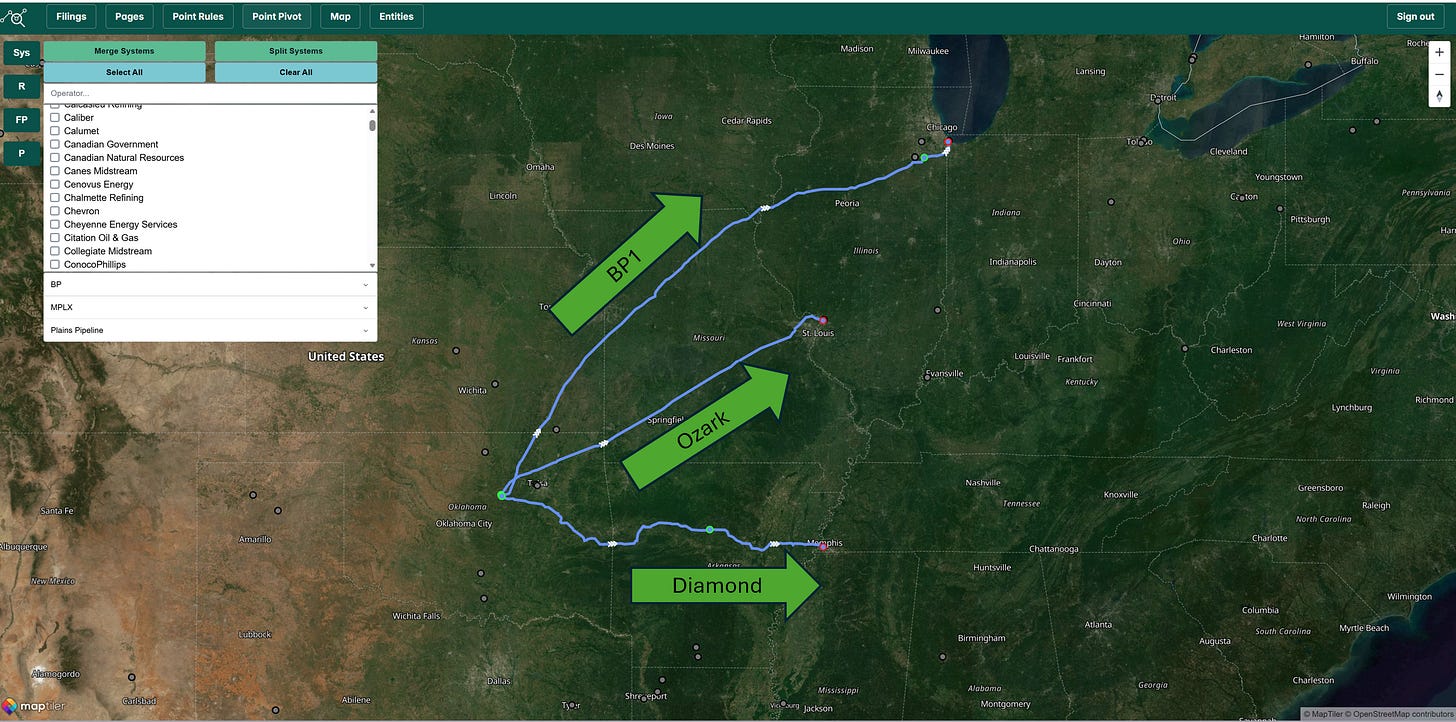

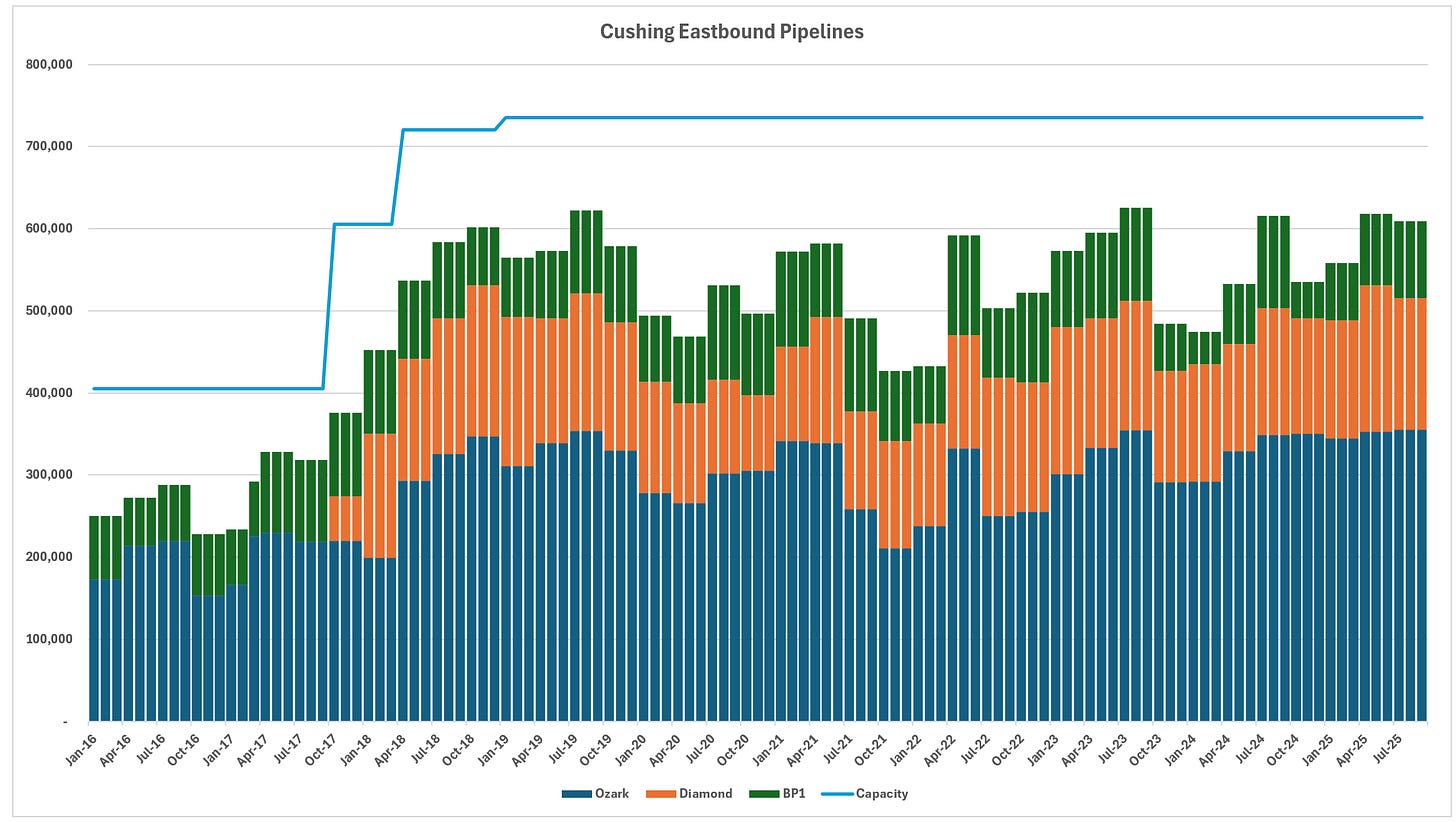

Three major eastbound pipelines provide approximately 700,000 barrels per day of capacity out of Oklahoma, with typical flows ranging from 500,000 to 600,000 barrels daily. The BP1 pipeline, owned by BP, transports lighter barrels primarily to the Whiting refinery in Indiana, which relies mainly on heavy Canadian crude but depends on this line for a significant portion of its light oil needs. Meanwhile, MPLX’s Ozark pipeline delivers crude to the Wood River, Illinois, area, where it supplies the Wood River refinery and connects to additional pipelines feeding multiple PADD 2 refineries, including those operated by Marathon. The third line, the Diamond Pipeline, a joint venture between Valero and Plains that began operations in 2017, moves light barrels directly to Valero’s Memphis refinery, displacing volumes previously supplied northbound via the Capline system from the Gulf Coast.

Although some eastbound capacity remains unused, particularly on the BP1 line, flows have stayed remarkably consistent since Diamond’s startup. This steady demand underscores Cushing’s enduring importance as a storage and logistics hub, enabling Midwest refineries to access light crude reliably and cost-effectively.

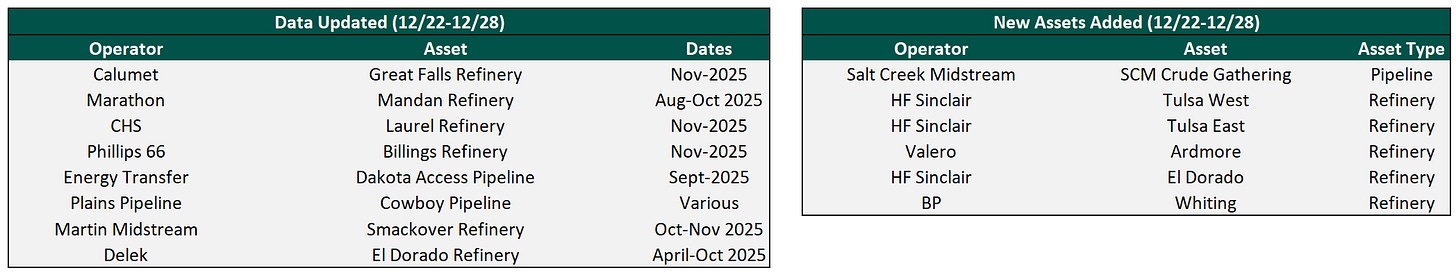

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Sable Offshore sinks as environmental groups file emergency lawsuit to stop pipeline restart