Plainview Weekly: Basin Pipeline Hits Highest Throughput Since 2019; ExxonMobil Escalates War on Zinc Contaminated Oil (10/19-10/26)

Permian crude flows surge on Basin Pipeline amid summer demand, while ExxonMobil presses FERC for swift tariff enforcement on contaminated Mars deliveries

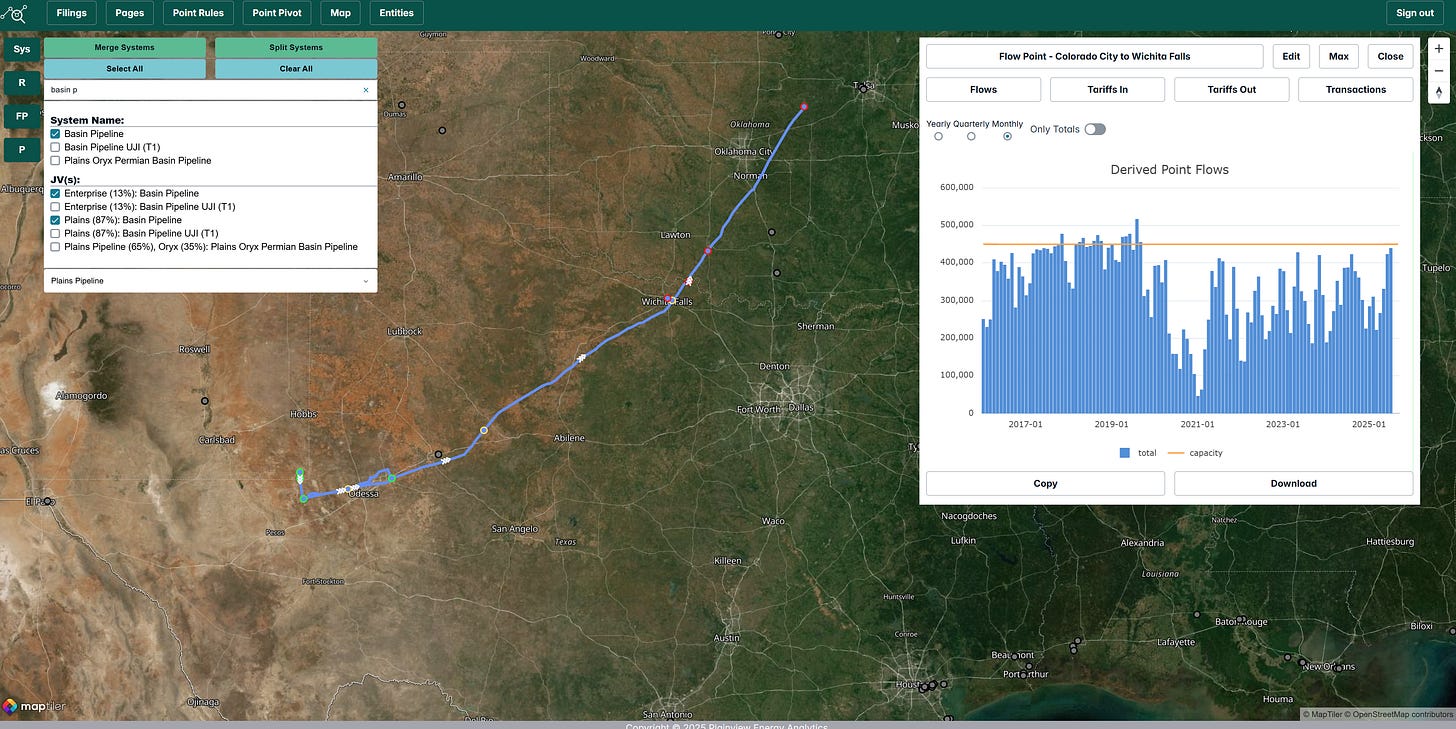

Basin Pipeline June-July 2025 Egress Throughput Hits Highest Since 2019: Boosting Permian Flows to Cushing

In June and July 2025, Basin Pipeline achieved its highest Permian egress throughput since 2019, averaging approximately 430,000 barrels of oil per day, marking the first and third highest monthly volumes since 2019 and pushing the line nearly to full capacity. This surge aligns with typical summer seasonality, as Mid-continent refineries ramp up draws of Permian crude to Cushing, though two consecutive months of such intensity is unprecedented post-2019. No tariff reductions were noted, and the elevated utilization may stem from higher refinery demand or more aggressive marketing by owners Plains and Enterprise. Amid skepticism over the EIA’s July Permian production figures, our analysis of the pipeline data appears to corroborate the reported uptick, with flows mirroring the EIA production increases. We will speak more in depth on this issue in a deep dive video this week.

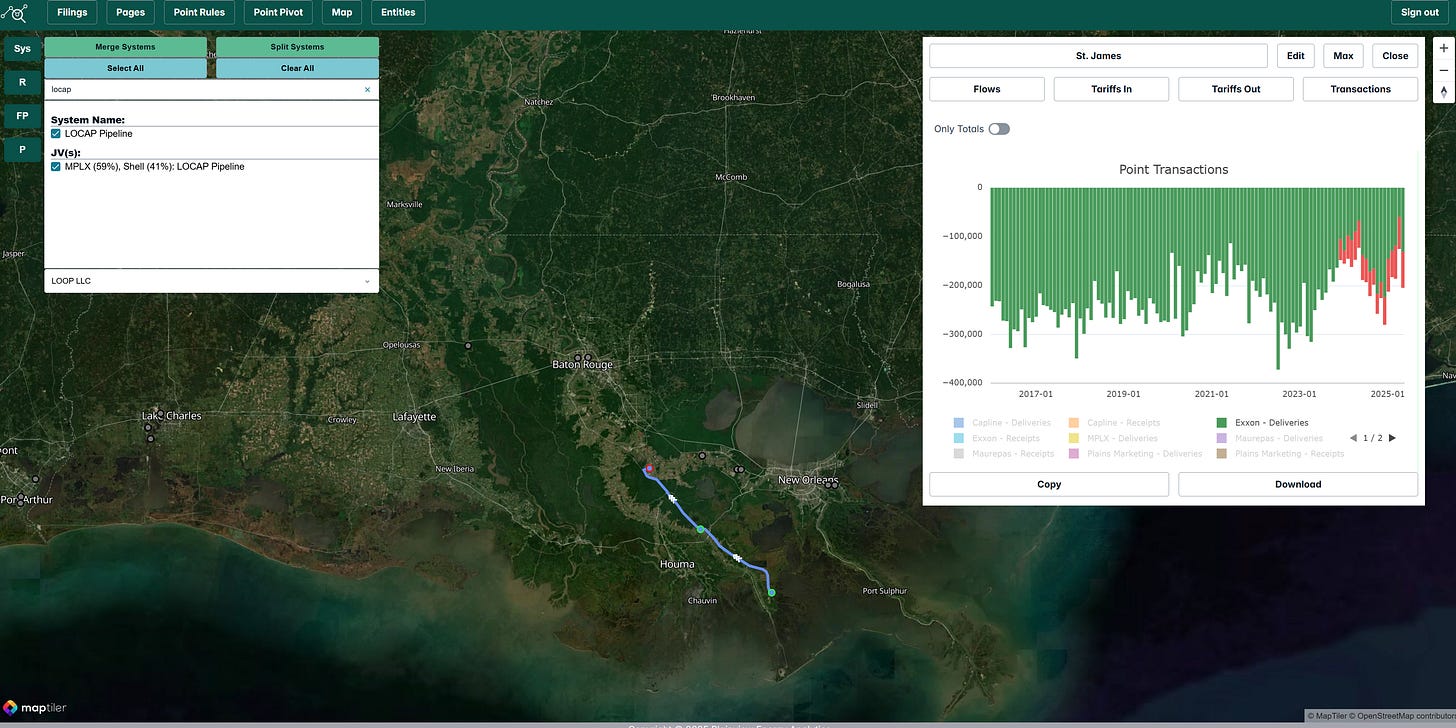

ExxonMobil’s FERC Complaint Targets LOCAP Pipeline Over Mars Crude Zinc Contamination

ExxonMobil filed a complaint with the Federal Energy Regulatory Commission (FERC) on Friday against LOCAP LLC, operator of the LOCAP pipeline system connecting offshore Louisiana production to Gulf Coast refineries, including ExxonMobil’s Baton Rouge facility. The complaint follows a September lawsuit against Mars Oil Pipeline and co-defendants. As we covered back in July, the dispute stems from zinc contamination in Mars crude deliveries via LOCAP during June and July 2025, which caused refinery upsets. ExxonMobil alleges that despite prompt notifications and shared sampling data, LOCAP delayed action for weeks, allowing contaminated crude to mix with other grades like Poseidon and Southern Green Canyon. This led ExxonMobil to halt deliveries, source alternatives, and trigger a U.S. government release of 1 million barrels from the Strategic Petroleum Reserve. Seeking a FERC order, ExxonMobil requests directives for LOCAP to prohibit contaminated shipments, hold connecting carriers accountable, enforce tariffs without delay, and, if necessary, revise the tariff for immediate quality controls.

LOCAP Pipeline, a key conduit for offshore crude into Louisiana, delivers ~200,000 barrels per day (bpd) to ExxonMobil and Sentinel Midstream (an ExxonMobil joint venture) at St. James. The dispute arises amid midstream projects aiming to expand crude flows to Louisiana, raising questions about potential competition for LOCAP’s medium-sour crude.

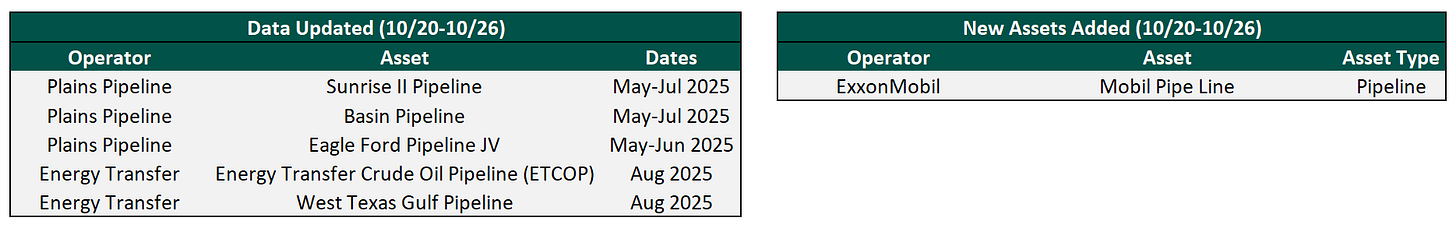

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 250 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Western Gateway Pipeline: A new corridor for American energy