Is EIA Overstating New Mexico Crude Output? 2025 Gap Widens to 70 kb/d | Bakken Production Response to Low $60 Oil Prices

New Mexico state data lags EIA by large margin; resilient operators like Continental grew Bakken through dip, but shut-ins signal sensitivity for others

New Mexico Crude Production: A 70 kb/d Gap Between EIA and State Data

New Mexico has emerged as the fastest-growing crude oil producing state in the U.S. in 2025, driving nearly all of the Permian Basin’s production gains so far this year. According to EIA data, the state added approximately 240,000 barrels per day on average compared to 2024 levels. The EIA’s monthly figures rely on the EIA-914 survey, which samples operators to capture at least 85% of production in each state, providing a robust estimate with a typical two-month reporting lag. While cross-verification with state-reported data is common, New Mexico’s state submissions have historically slightly lagged EIA numbers by 6 to 9 months before converging closely.

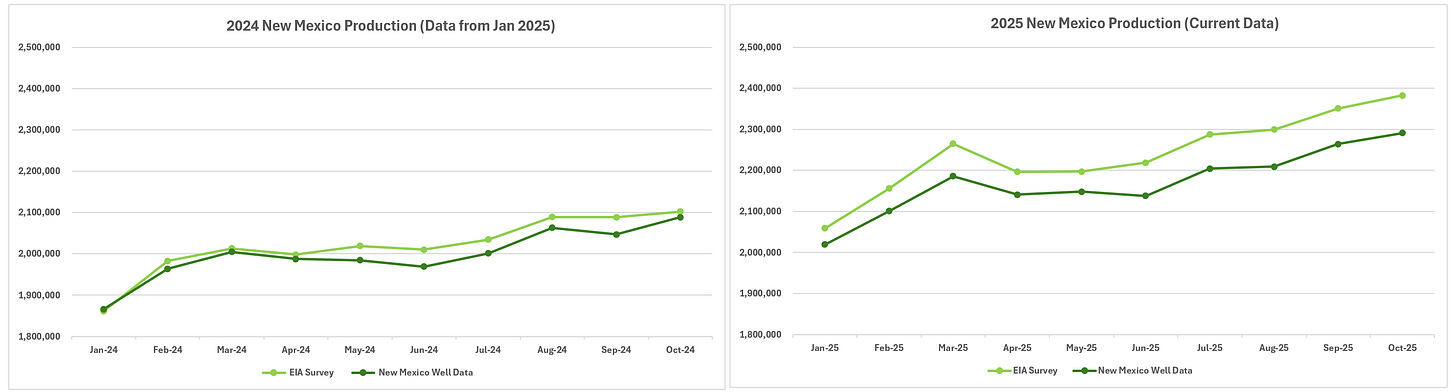

For example, in early 2025, the gap between 2024 New Mexico state-reported crude production and EIA estimates stood around 20,000 barrels per day (left graph below). These numbers converged in 2025 as state reported data slowly increased to closely match the EIA survey data. However, the discrepancy has widened significantly in 2025, with state data now underreporting EIA figures by about 70,000 barrels per day (right graph below), the largest margin in many years. This large gap raises questions about potential overstatement in EIA survey-based production or substantial understatement in state well data.

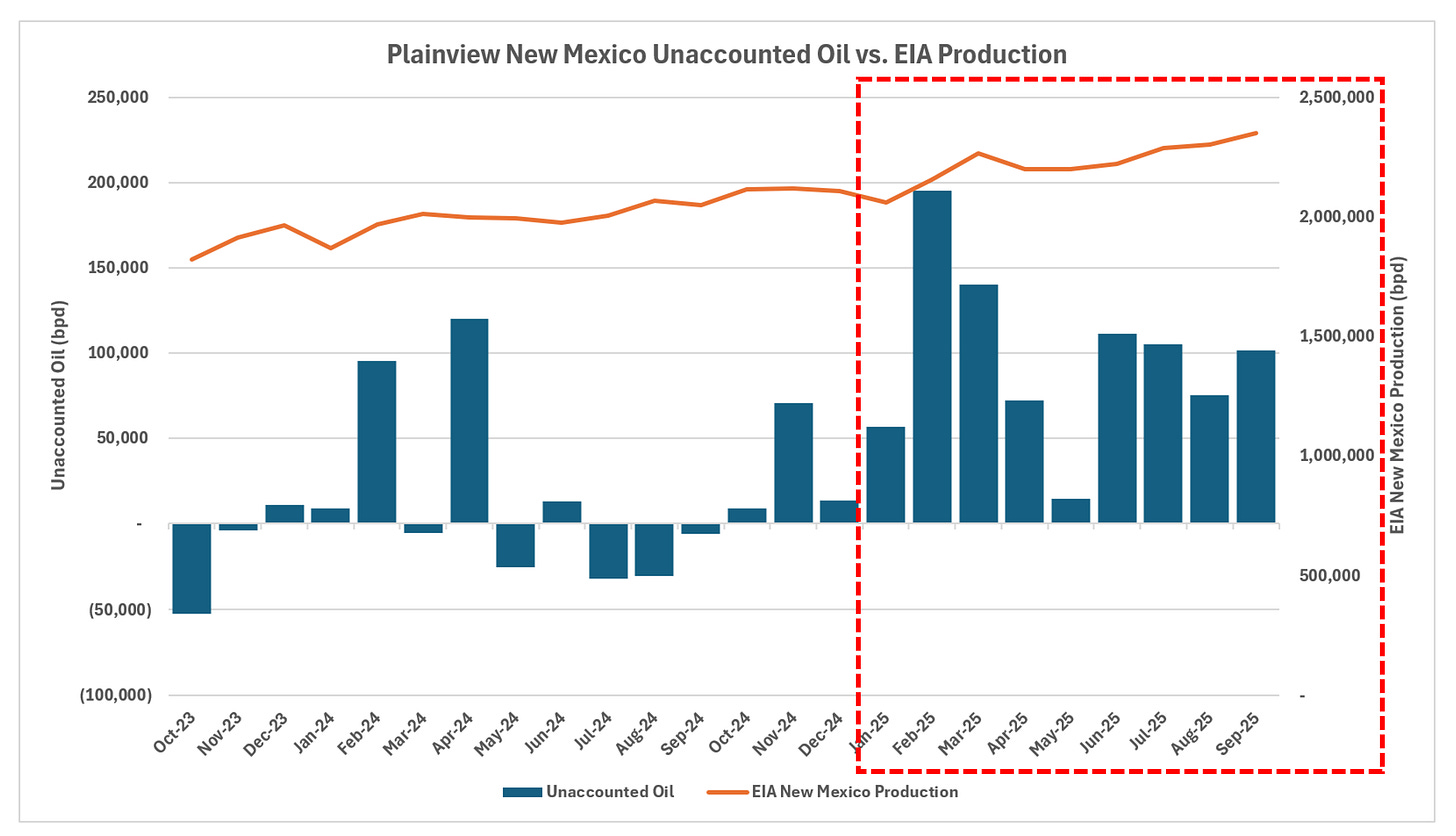

To assess the balance, Plainview incorporates EIA supply estimates alongside reported pipeline flows and refinery runs in New Mexico as a demand proxy. This methodology creates a supply and demand model intended to balance supply (primarily production) against demand (pipeline egress plus refinery runs). The resulting supply surplus in our New Mexico balance (blue bars in the graph below) has grown from 20,000 barrels per day in 2024 to 85,000 barrels per day in 2025, lending support to the notion that EIA’s reported New Mexico production may be overstated. As the end of 2025 production reporting approaches, ongoing monitoring of both state and EIA data will reveal which set undergoes significant revisions.

Bakken Production Under Sub-$60 WTI: Shut-Ins for Some, Growth for Others

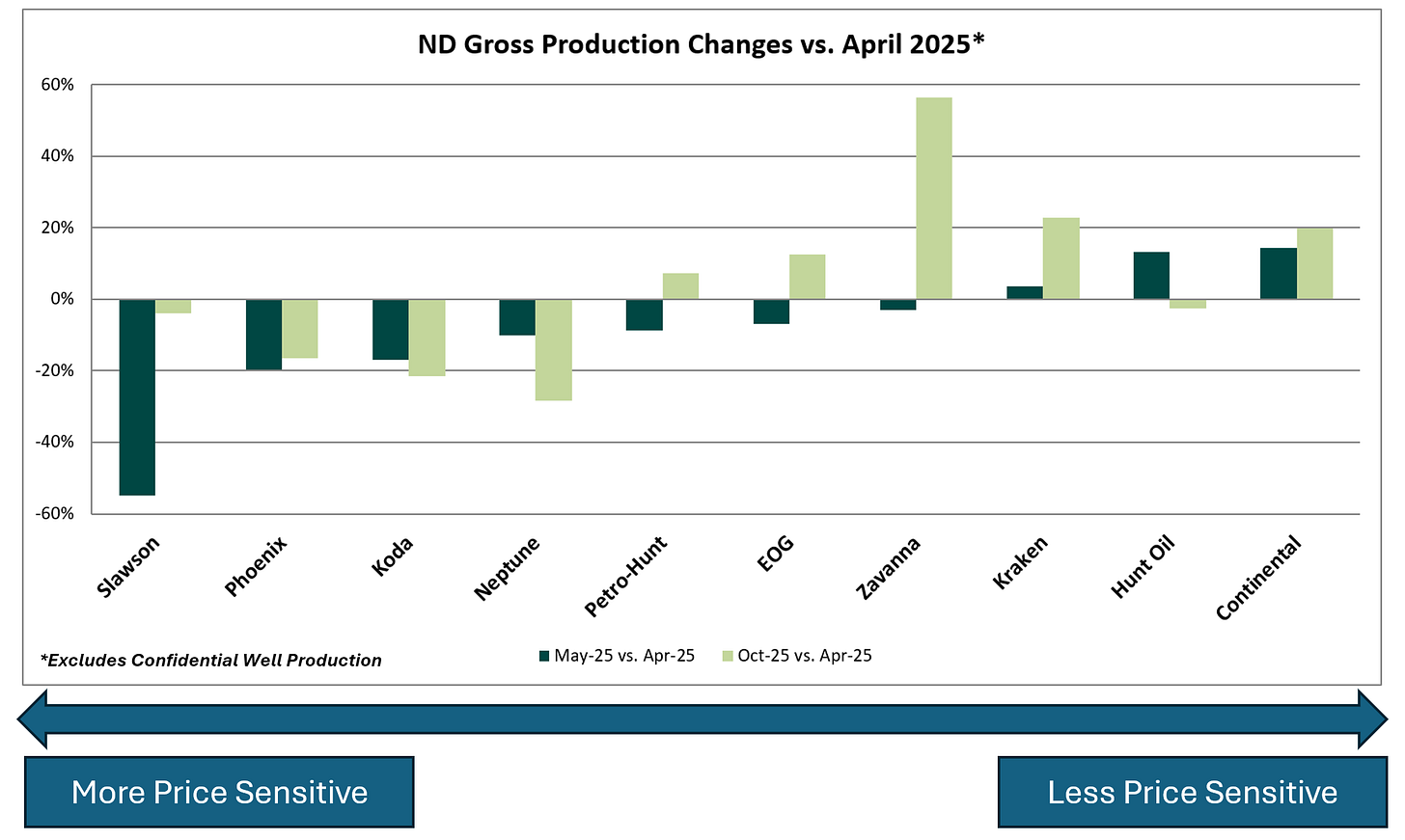

In May 2025, WTI crude prices fell below $60 per barrel for the first time in several years, prompting some Bakken producers to curtail activity or shut in production in response to weaker economics. North Dakota Oil and Gas Commission commentary in monthly reports confirmed that certain operators elected to curtail output during this period. State production data reflect this shift, with Slawson Exploration experiencing a sharp approximately 50% decline from April to May 2025, strongly suggesting shut-ins. Other notable decliners included Phoenix and Koda, each down about 20% month-over-month, along with roughly 10% reductions reported by operators such as Neptune and Petro-Hunt.

Despite the low-price environment, several producers demonstrated resilience and continued to grow output from April through October 2025. Companies including EOG Resources, Zavanna, Kraken, and Continental expanded production, likely supported by stronger well economics, financial hedges, or physical price protections that shielded them from downside risk. With WTI once again trading below $60 per barrel as of early 2026, ongoing monitoring of these operators’ monthly production reports will be key to assessing any renewed potential for shut-ins or further activity adjustments in the Bakken.

Flow/Transaction Updates and New Assets Under Coverage

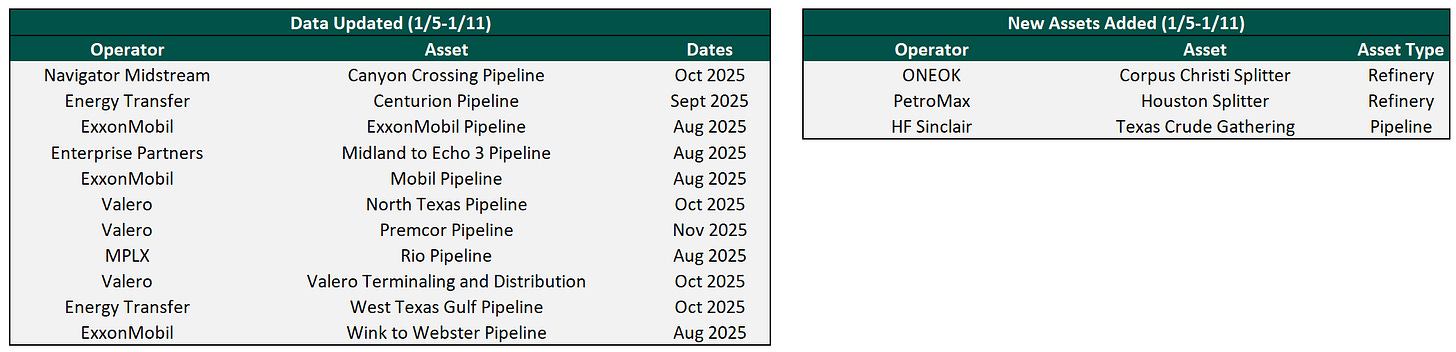

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Trump says he's "inclined to keep Exxon out" of Venezuela after CEO's remarks