Plainview Weekly: Enbridge MLO Phase 2: 2026 FID and 2028 In-Service Could Reshape Bakken Egress Dynamics | Wyoming Production Decline Accelerates in Late 2025

Potential 2028 reversal could flood Bakken with Canadian barrels and widen local differentials; Anschutz and EOG lead declines as activity halves in Wyoming

Enbridge Mainline Optimization Phase 2: Potential Bakken Pipeline Reversal and 2028 Impact on North Dakota Crude Egress

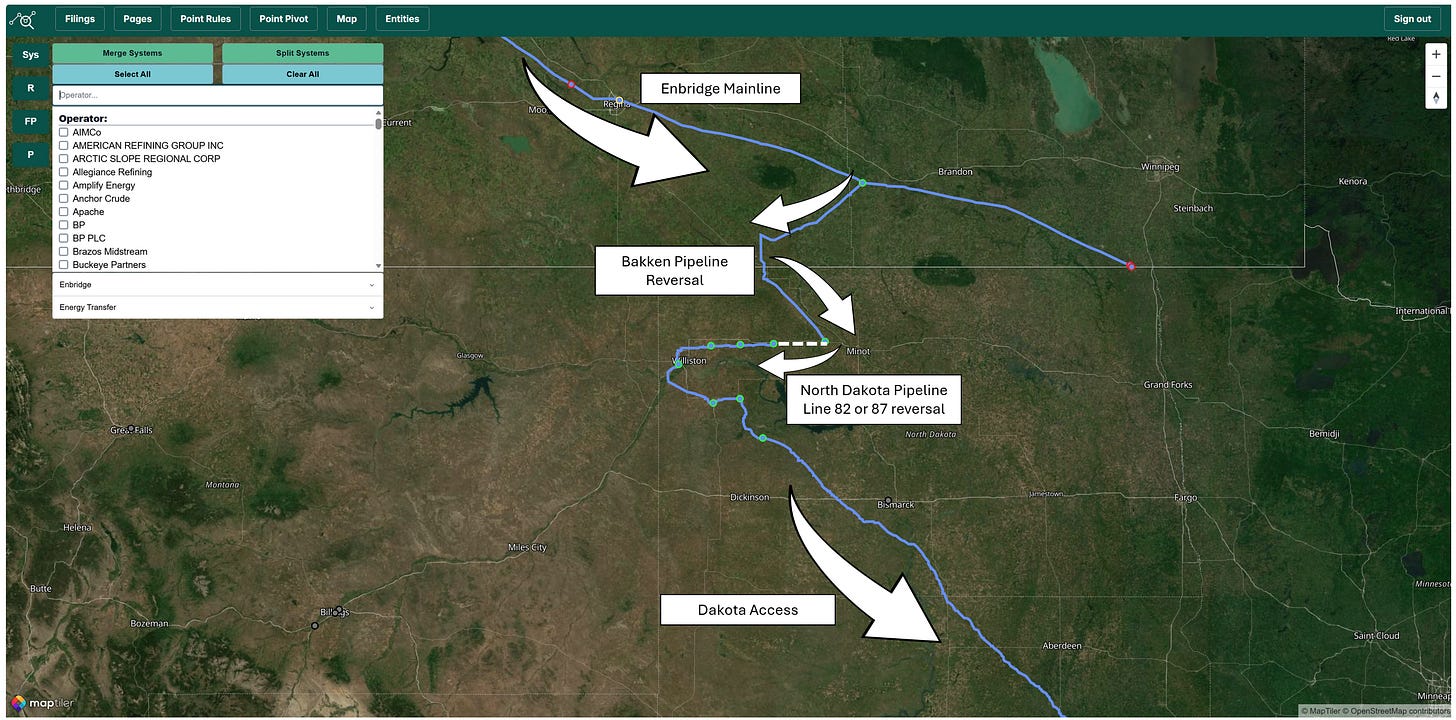

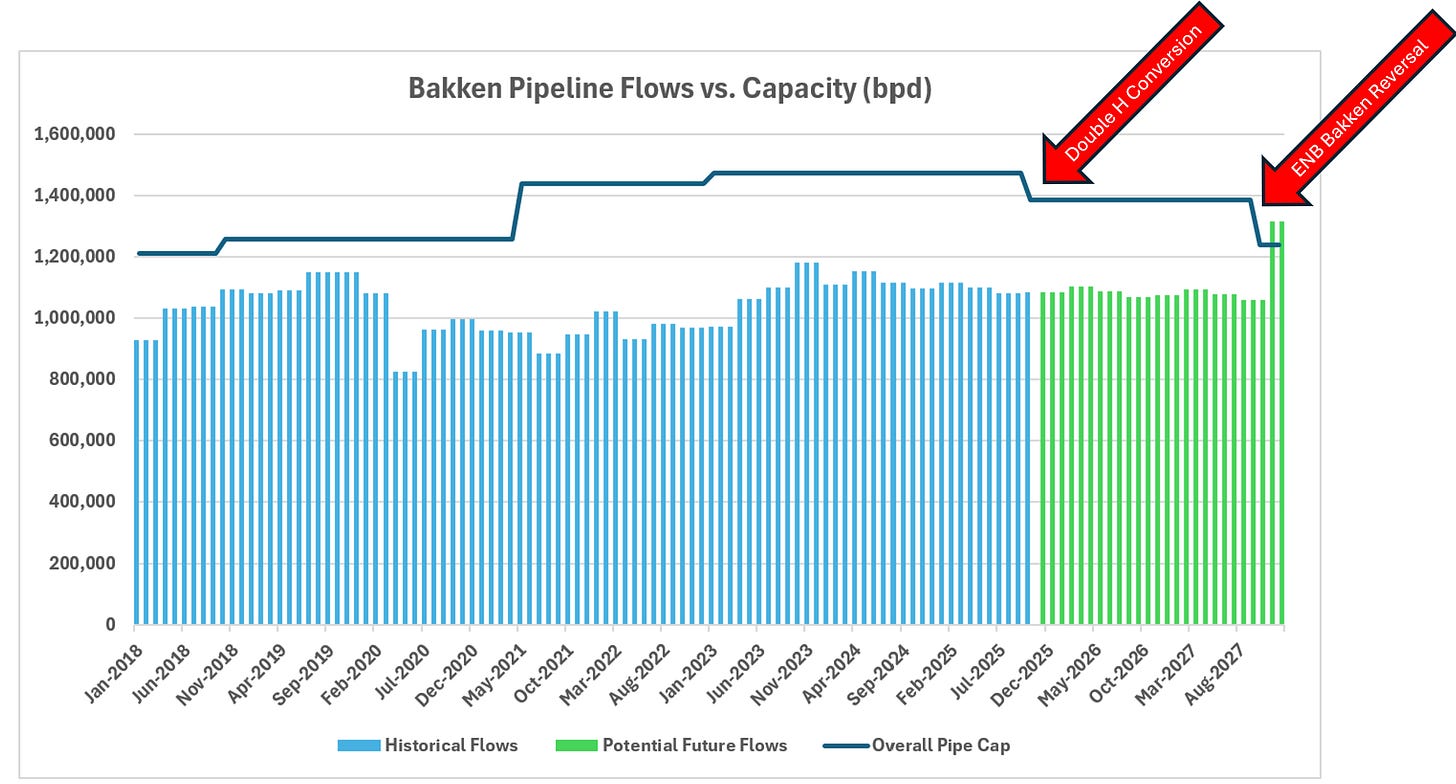

Enbridge has guided toward a final investment decision on its Mainline Optimization Phase 2 (MLO 2) project around mid-2026, with an in-service date targeted sometime in 2028. While specific details on the route, scope, and whether it involves brownfield or greenfield elements remain undisclosed, one potential configuration could involve reversing portions of Enbridge’s existing Bakken pipeline system. Currently, this system transports light sweet crude north from Berthold Station in North Dakota to connect with the Canadian Mainline. A reversal would redirect flows south from the Canadian Mainline into the Bakken region. Then, an additional reversal on Enbridge’s North Dakota system (either Line 82 or 87) could move barrels westward toward Stanley Station, ultimately enabling access to the Dakota Access Pipeline (DAPL) and onward south to markets in the US Midwest and beyond.

This approach could add up to 250,000 barrels per day of new Canadian supply capacity into the Bakken region while reducing existing Bakken egress capacity by approximately 145,000 barrels per day. The net result would push total pipeline supply beyond available egress, creating a significantly tighter market for shippers in the basin. Such constraints could lead to wider differentials between Bakken crude prices and broader US benchmarks, increasing pricing pressure until additional capacity comes online. Incremental relief may come from Bridger, which has hinted at a near-term expansion, as well as from DAPL itself, which is expandable and permitted to transport over 1 million barrels per day.

Wyoming Oil Production Decline 2025: Output Falls 8% from June Peak Amid Rig Cuts and Low Prices

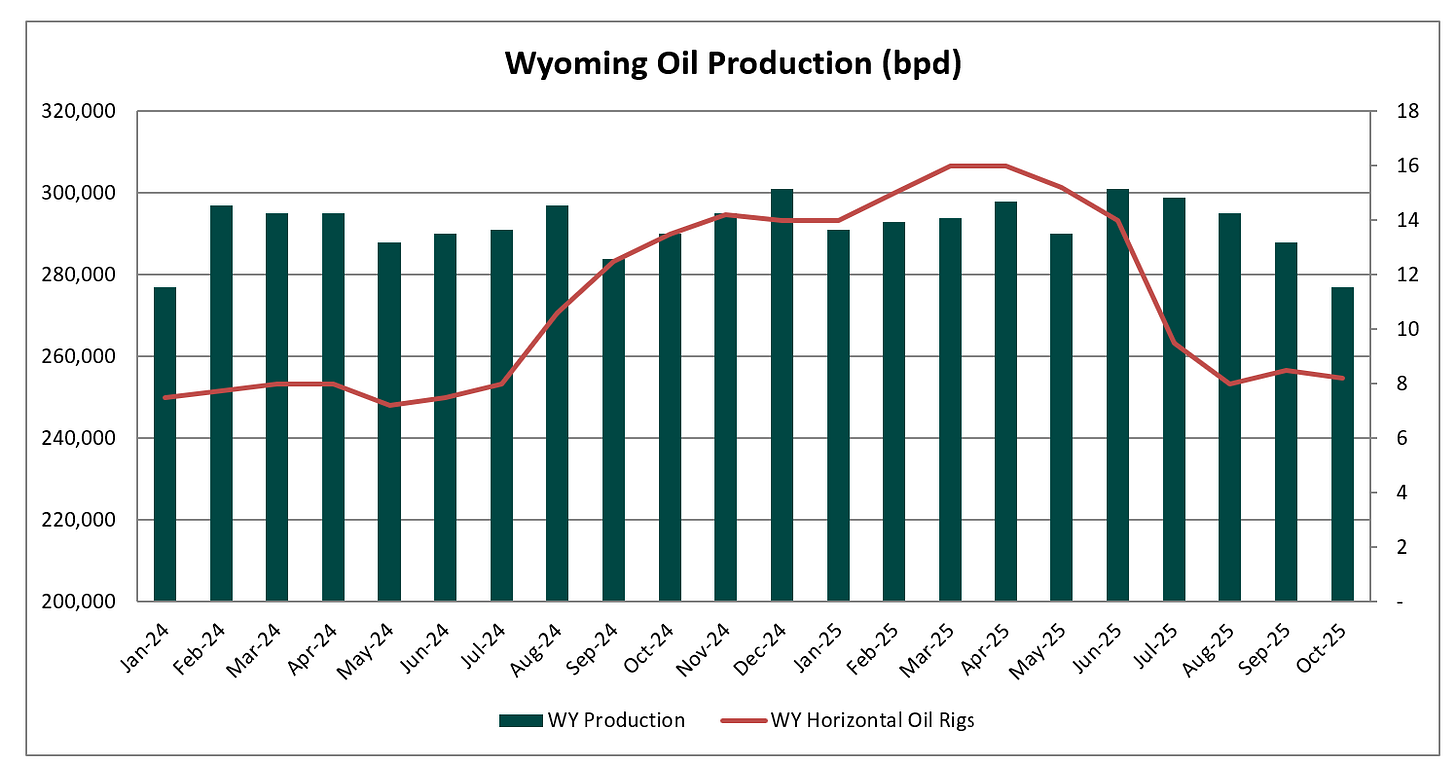

Recent EIA production data indicates a notable decline in Wyoming crude oil output, with production falling about 24,000 barrels per day since its June 2025 peak, representing an 8% drop. Year-over-year, volumes have decreased by 13,000 barrels per day, or roughly 4% from October 2024 levels. This marks the largest decline among major U.S. oil basins tracked, surpassing even the Bakken and DJ-Niobrara plays over the comparable periods. The downturn aligns with a sharp reduction in rig counts, which began in mid-2025 amid falling oil prices and have since been nearly halved, reflecting reduced drilling activity in response to weaker economics.

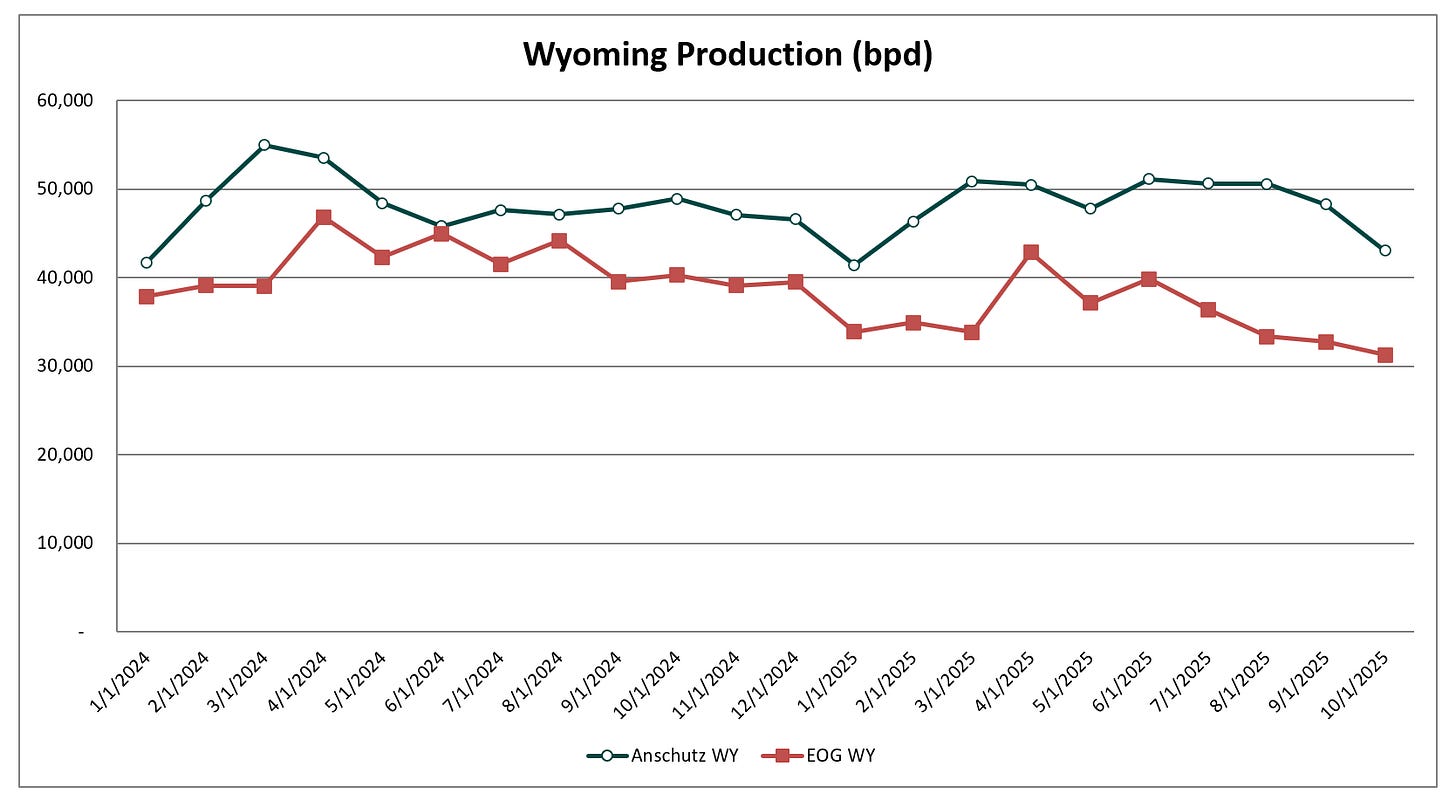

Operator-level data from the Wyoming Oil and Gas Conservation Commission highlights the two largest producers in the state, Anschutz Exploration Corporation and EOG Resources, as the primary drivers of the decline, each seeing production fall by approximately 8,000 barrels per day since mid-2025, with significant year-over-year reductions as well. While weather and completion timing can introduce short-term variability, the sustained drop in activity signals that the Powder River Basin may face further reduced output if oil prices remain below $60 per barrel, keeping rig counts near 2025 lows and limiting new development.

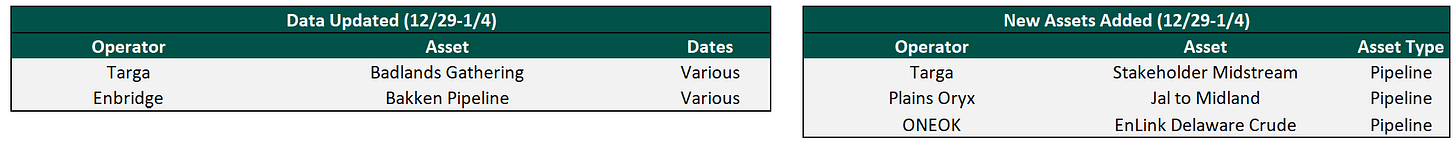

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

Trump admin sends tough private message to oil companies on Venezuela