DJ Basin Crude Pipeline Growth and Valero Memphis Refinery Supply Evolution

Elevation Midstream's binding season for DJ South gathering expansion using underutilized capacity. Valero's Memphis refinery diversifies crude sourcing through Diamond Pipeline and ETC connect.

Leveraging Underutilized Capacity: Elevation Midstream’s New DJ South Crude Open Season

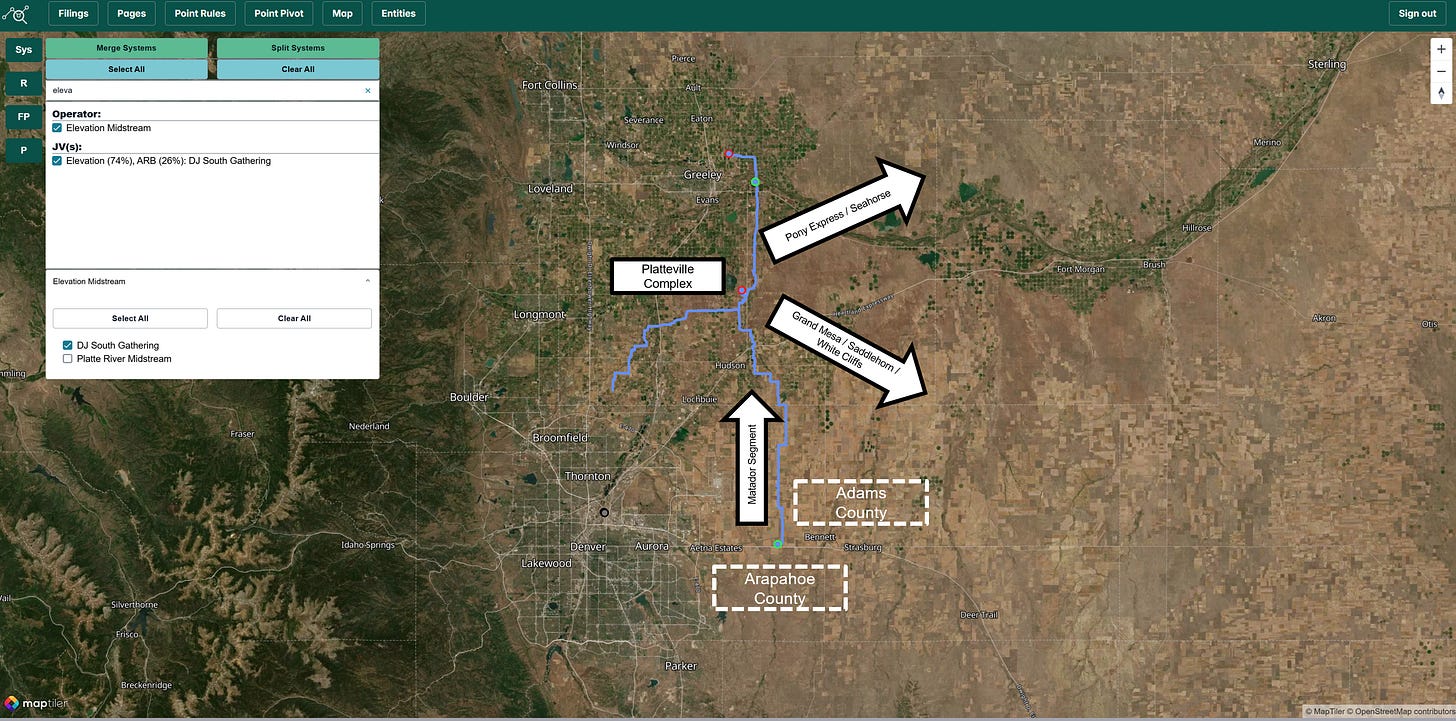

Elevation Midstream, a Denver-based energy infrastructure company operating in Colorado’s Denver-Julesburg (DJ) Basin, has recently closed a binding open season through its subsidiary, DJ South Gathering, LLC, to secure shipper commitments for a new crude oil gathering system. The proposed project will transport crude oil from receipt points in Adams and Arapahoe Counties to delivery points at the Platteville Complex and Lucerne Station in Weld County. The project combines new pipeline construction with underutilized capacity on Elevation’s existing trunk line system, enabling efficient expansion with lower capital costs compared to competitors facing higher utilization.

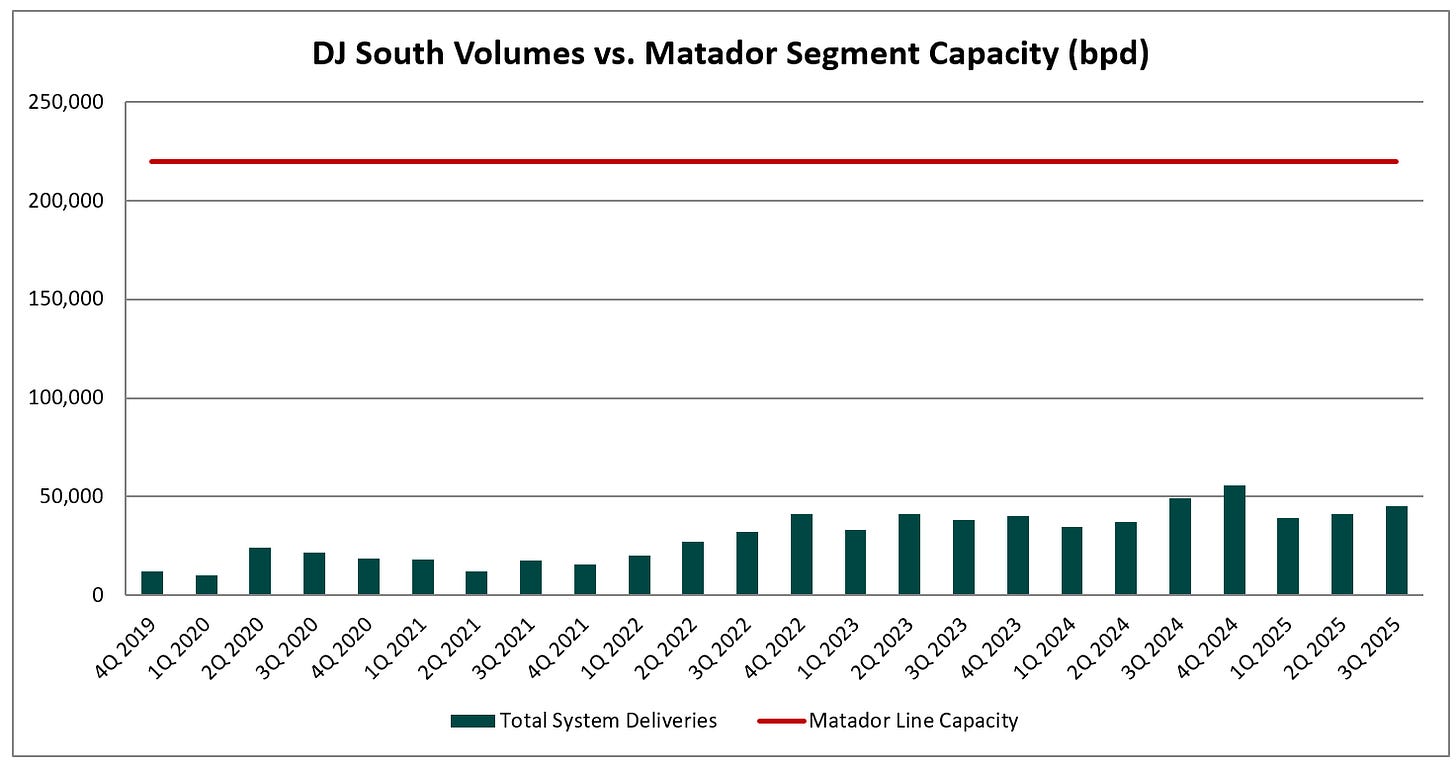

The underutilized trunkline referenced in the open season likely refers to the Matador segment (see figure above), which was constructed with a nameplate capacity of 220,000. However, DJ South’s total deliveries (including other segments) have remained well below the Matador line capacity, peaking at just under 60,000 barrels per day in late 2024 (see graph below). While underutilized capacity is typically not ideal from a financial perspective, it provides Elevation Midstream with a significant competitive advantage: the ability to construct short laterals to new production areas at a fraction of the cost required compared to a full-length pipeline buildout. The new gathering system is expected to become operational in the third quarter of 2026, pending sufficient shipper commitments from the open season.

Valero Memphis Refinery Shifts Crude Supply Dynamics with Diamond Pipeline and ETC Optionality

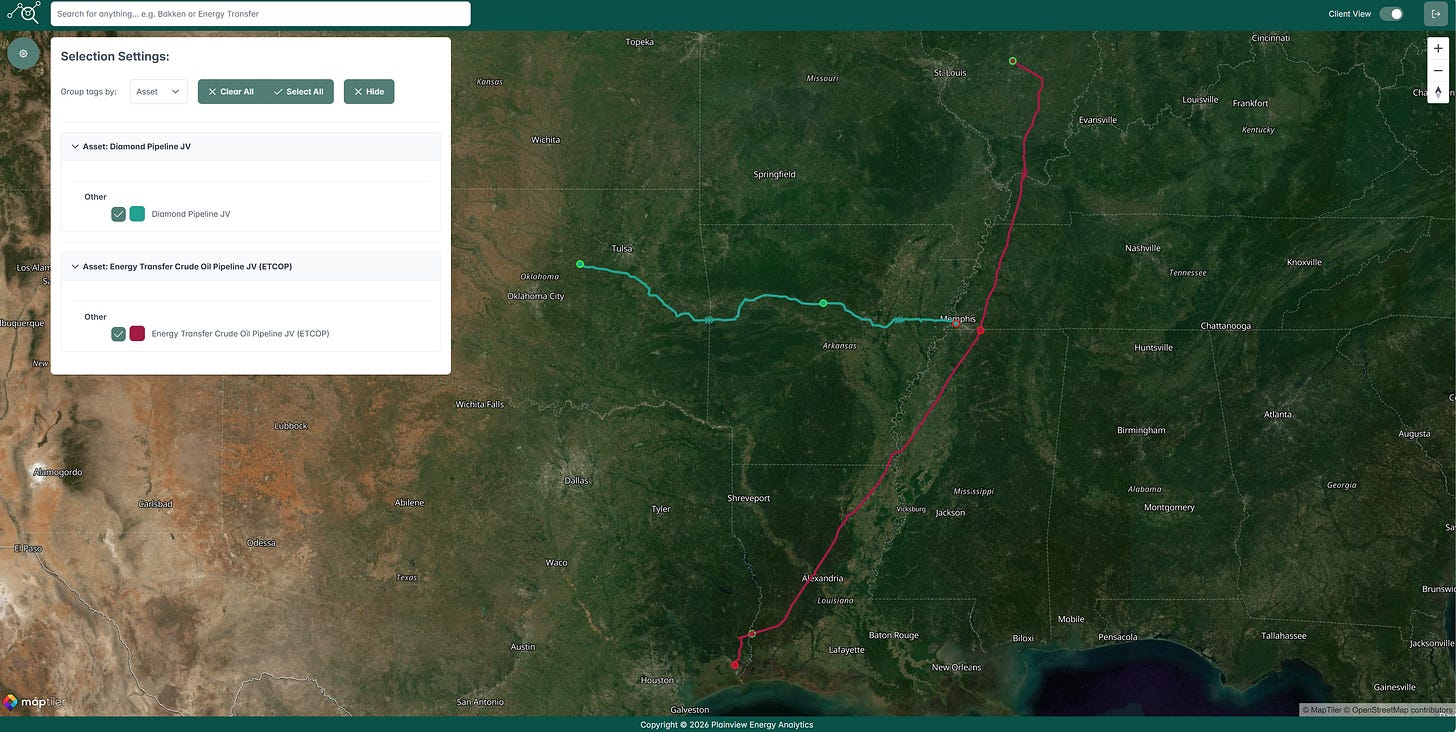

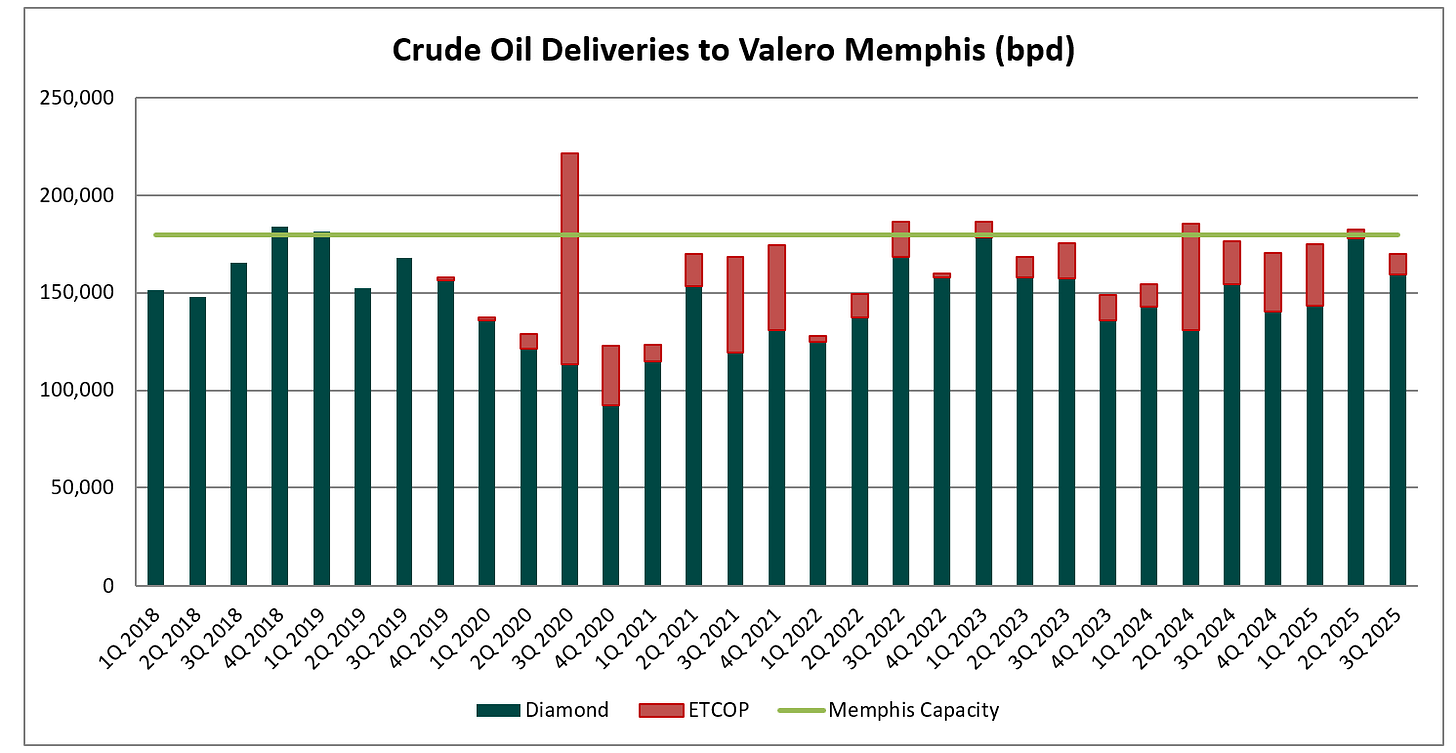

Valero’s Memphis refinery, with a nameplate capacity of 180,000 barrels per day, historically relied primarily on the northbound Capline pipeline for crude supplies originating from Louisiana and the Gulf Coast. The shale revolution reversed traditional pipeline flows, prompting Valero and Plains All American to construct the Diamond Pipeline in 2017. This direct line from Cushing, Oklahoma, has since become the refinery’s primary supply source, delivering an average of approximately 145,000 barrels per day and enabling more consistent access to light sweet crudes from the Midwest and Bakken regions.

In late 2019, Energy Transfer added a delivery point to Valero’s short-haul Collierville pipeline via the ETCOP system, providing a secondary option that has averaged around 20,000 barrels per day. This connection enhances crude slate flexibility, allowing the Memphis refinery to access Bakken barrels or other grades sourced from Patoka, Illinois. Although throughput dipped slightly after the COVID-19 pandemic, the refinery has since recovered and now operates at or near full capacity, benefiting from diversified supply routes and improved optionality.

Flow/Transaction Updates and New Assets Under Coverage

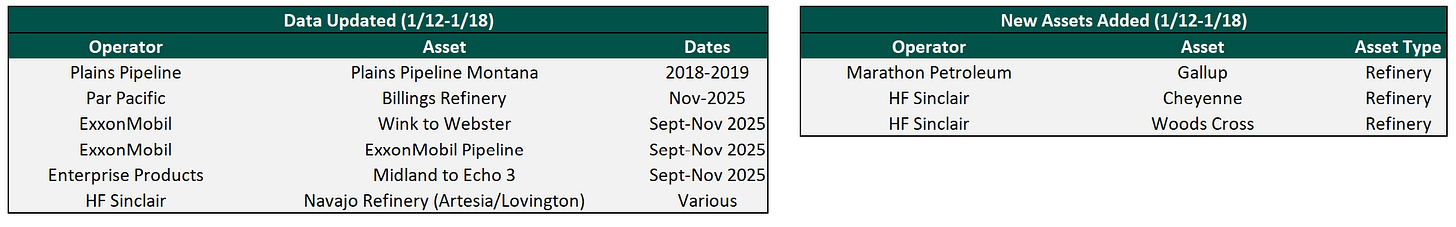

Plainview has over 300 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.