Plainview Weekly: Permian Production Hits New Record but Pipeline Flows Decline? (9/29-10/5)

The Permian Growth Continues but Permian Pipelines Show Declines, Shell Whale Offshore Project Ramps Up

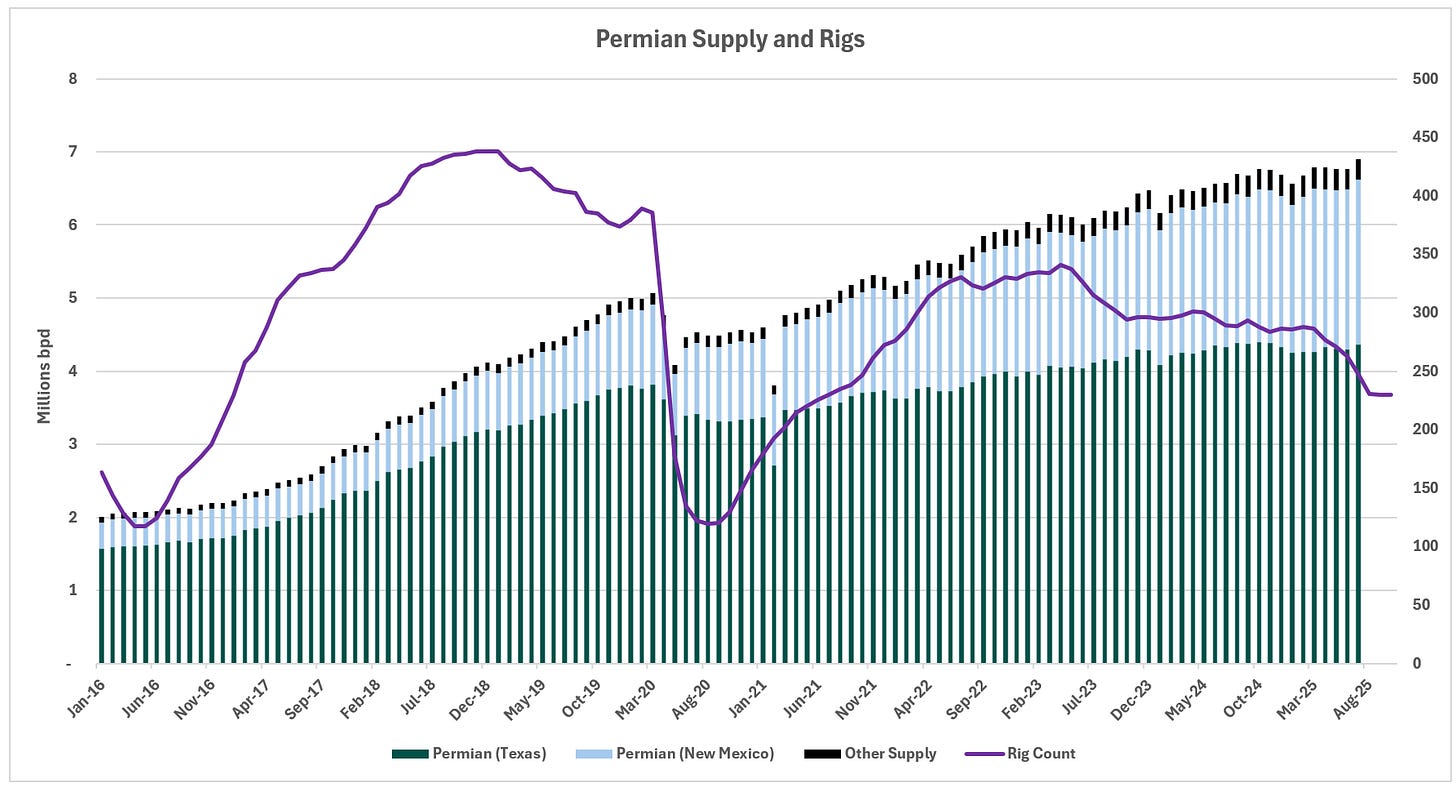

Permian Production Sets New Record, Bucks Trend of Falling Rig Counts

EIA production data released last week revealed a notable month-over-month increase in oil production in Texas and New Mexico. Plainview’s basin supply model, incorporating EIA state-reported data alongside Texas Railroad Commission and New Mexico state data, estimates Permian production rose by over 130,000 barrels per day, setting a new all-time record. These production gains persist despite a notable decline in rig counts over recent months, with Permian rig counts down more than 20% year over year. The continued increase in production amid reduced drilling activity is intriguing but not unprecedented, given the typical six-to-nine-month lag between rig reductions and their impact on output. Consequently, production is likely to plateau in the latter half of 2025 and into 2026, reflecting observed declines in Permian activity levels.

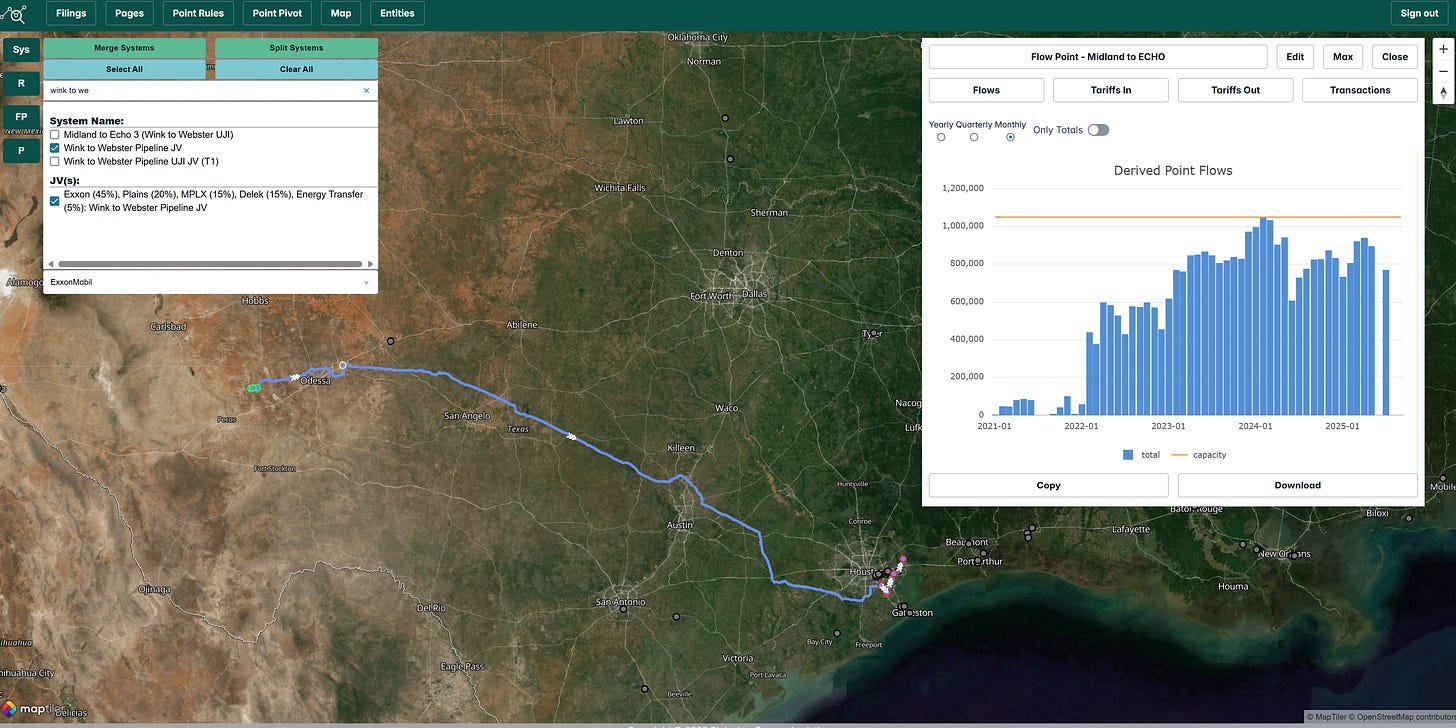

Wink to Webster Joins EPIC Pipeline in Reporting Significantly Lower July Throughputs

EIA data indicate higher Permian oil production in July 2025, yet major egress pipelines like EPIC and Wink to Webster reported significant volume declines, approximately 130,000 barrels per day for EPIC compared to June and nearly 100,000 barrels per day below typical 2025 levels for Wink to Webster, creating a notable mismatch in supply and basin outflows. While some pipelines, such as Gray Oak, have released figures, others, including Plains’ Cactus I and II, Longhorn, BridgeTex, and Energy Transfer’s Permian Express, remain unreported for July, potentially absorbing excess volumes.

Possible explanations for the supply/flow mismatch include inaccuracies in EIA survey-based production estimates, which may overstate production; errors in pipeline reporting to the Texas Railroad Commission, which are subject to later corrections; or shifts in market share where unreported pipelines aggressively captured more throughput. Additional factors could include increased in-basin storage filling tanks or seasonal upticks in Cushing-bound flows on Basin, Sunrise II, or Centurion pipelines to midcontinent refineries. Midland to ECHO 3 volumes on the Wink to Webster undivided joint interest remain at capacity, ruling out issues there.

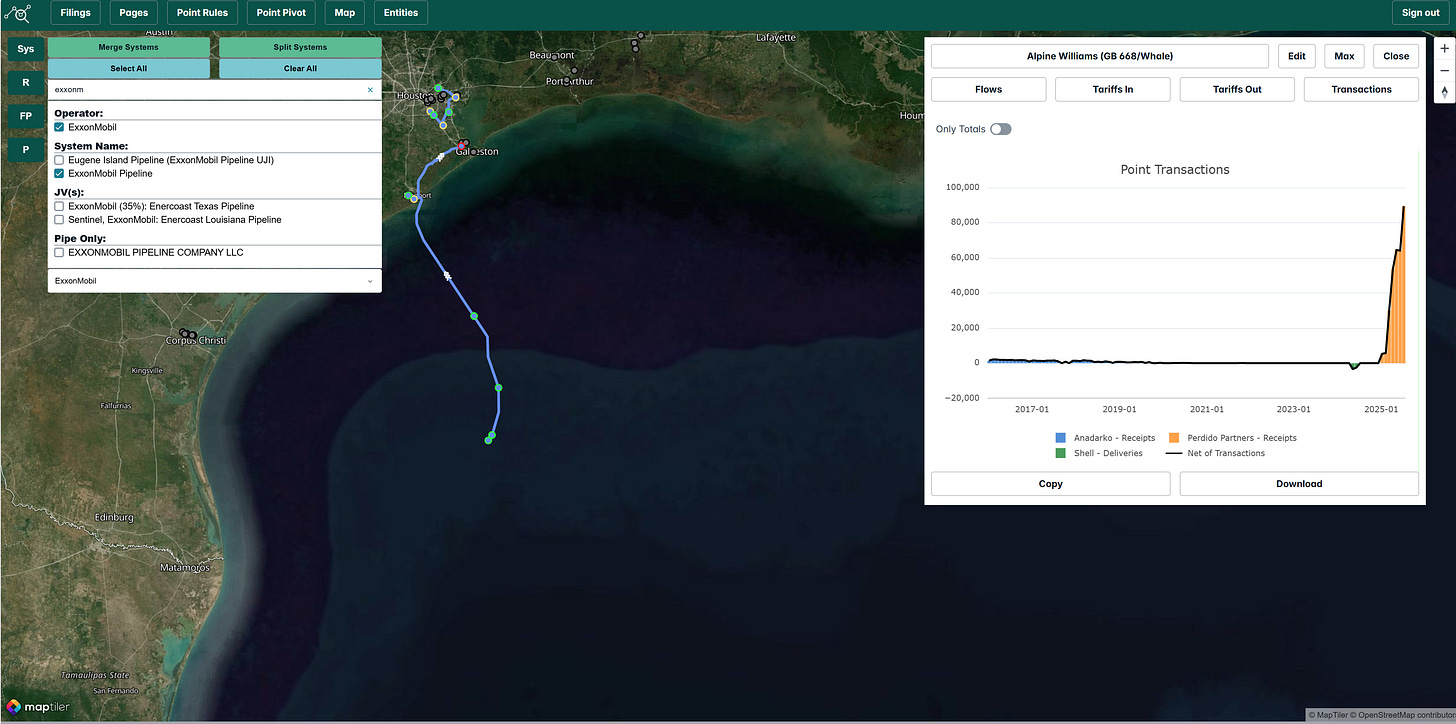

Williams and Exxon Offshore Pipeline Flows Spike as Shell’s Whale Project Ramps Up

Shell’s Whale project in the offshore Gulf of Mexico appears to be nearing its estimated peak throughput. Volumes from the project reached nearly 90,000 barrels per day in July 2025, according to data reported from ExxonMobil’s HOOPS pipeline, approaching Shell’s guided peak throughput of approximately 100,000 barrels of oil equivalent per day. Oil volumes from the project are transported via Williams’ newly built Whale Pipeline, which has a capacity of 140,000 barrels per day and interconnects with ExxonMobil’s HOOPS pipeline to deliver oil onshore to the Texas Gulf Coast areas of Galveston and Freeport.

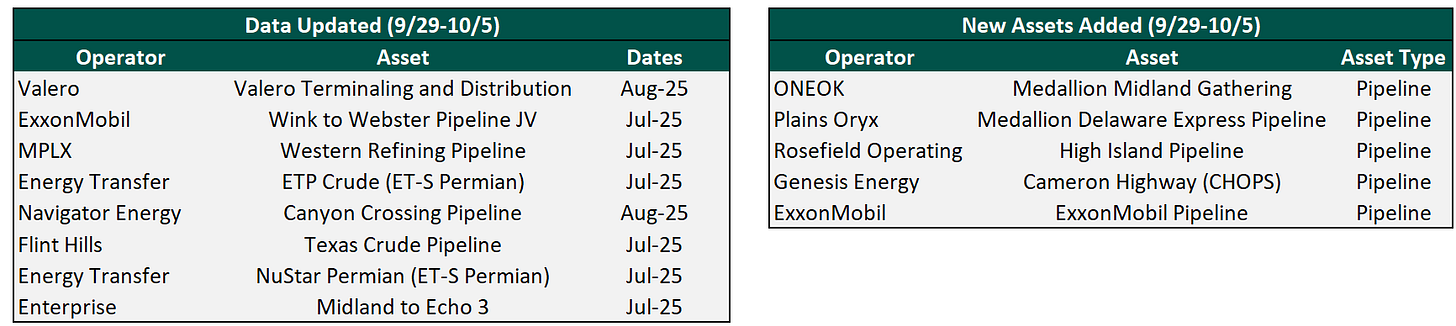

Flow/Transaction Updates and New Assets Under Coverage

Plainview has over 200 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye

BP Makes FID on Tiber Offshore Project

OPEC Considers Large Boost in Oil Output