Plainview Weekly: Dakota Access and Offshore Flows (9/22-9/28)

Dakota Access Pipeline Losing Market Share and Chevron and Williams Benefit from Ballymore

Questions: Email Us - matthew.lewis@plainview-energy.com

Update - 11:51pm CST. This article was updated to remove a story on Kinder Morgan Camino Real gathering system which overstated gathered volume growth due to a tabulation error.

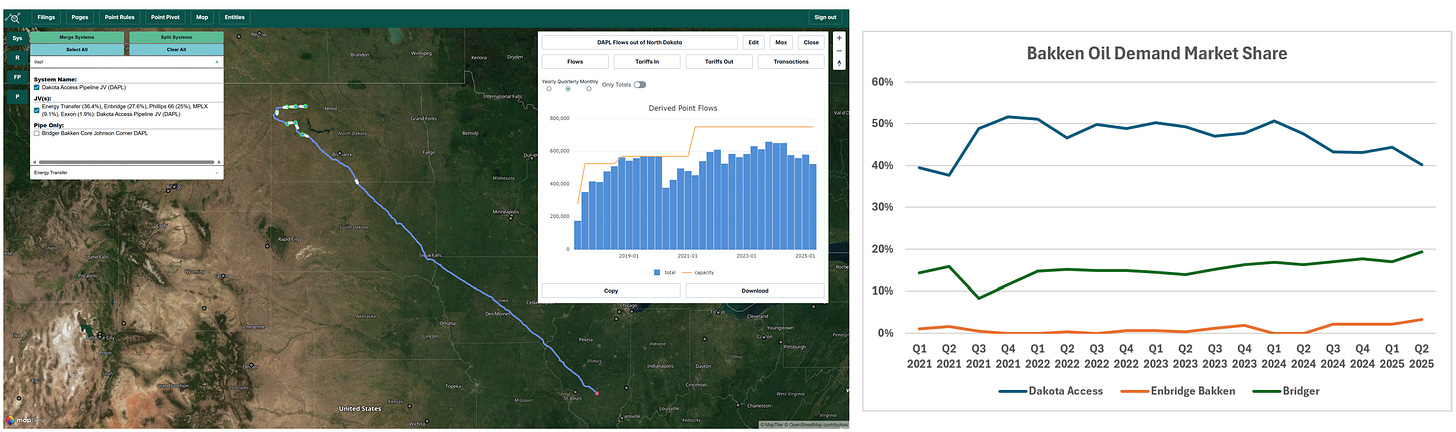

Dakota Access Pipeline Market Share Decline in Bakken Crude Flows

The Dakota Access Pipeline has experienced a notable decline in volumes over the past couple of years, peaking at approximately 660,000 barrels per day in Q4 2023 before falling to about 525,000 barrels per day in Q2 2025, amid a broader Bakken crude oil supply reduction of roughly 100,000 barrels per day during this period. Despite the regional downturn, competitors have captured market share: Enbridge’s Bakken Pipeline, which transports oil northward into Canada for integration with Enbridge’s mainline, has ramped up from near-zero volumes in 2023 to over 40,000 barrels per day in Q2 2025, benefiting from new committed shippers and discounted rates. Similarly, the Bridger Pipeline system, which delivers oil southward to the Guernsey area and onward to Cushing via the Pony Express Pipeline, increased from 170,000 barrels per day at the start of 2023 to over 250,000 barrels per day in Q2 2025, driven by system expansions, discounted rates, and narrow Cushing/Gulf Coast spreads. These gains have directly eroded Dakota Access volumes, highlighting shifting dynamics in Bakken egress options.

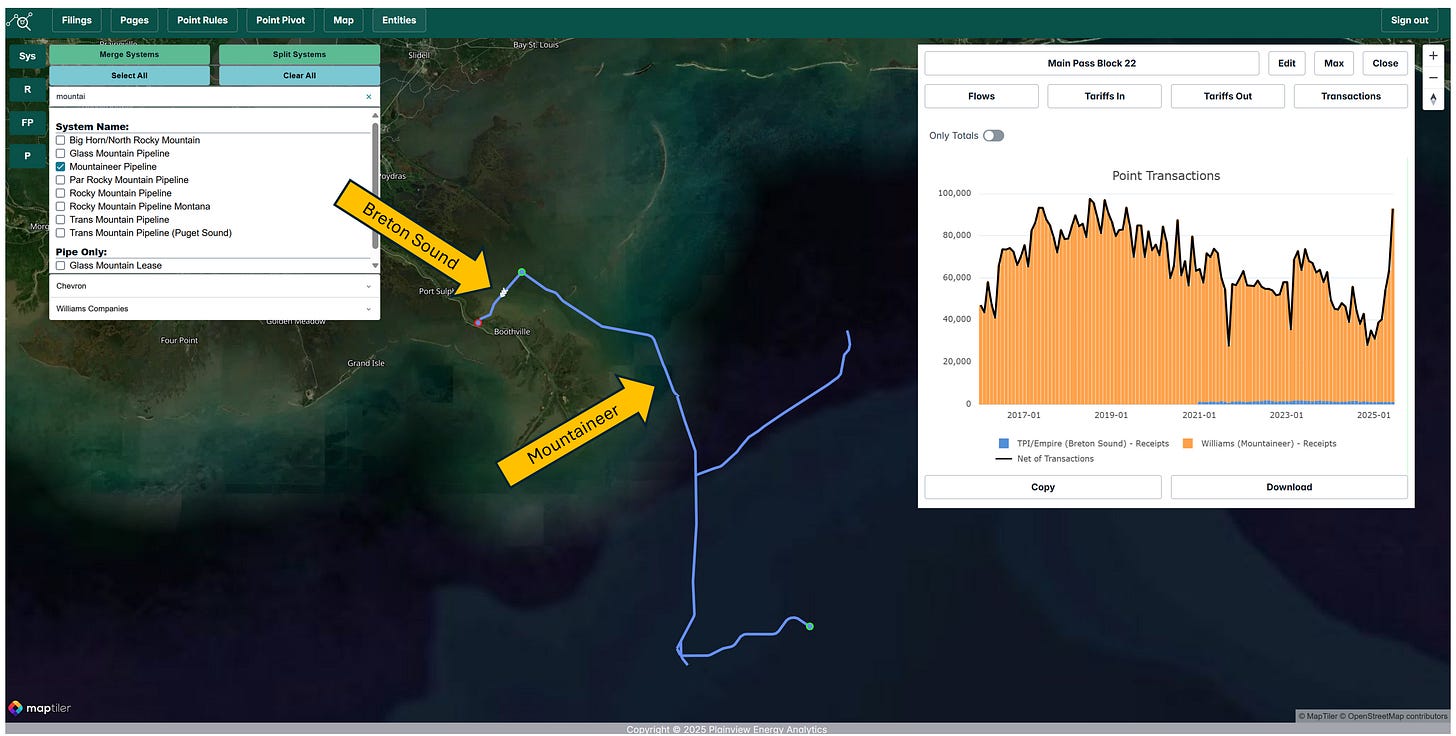

Chevron Ballymore Offshore Drives Breton Sound Pipeline Growth

Offshore production, transported via Williams’ Mountaineer pipeline system, flows into Chevron’s Breton Sound pipeline, which delivers it to Chevron’s Empire Terminal. Over recent months, volumes on Breton Sound have surged, rising from a low of 30,000 barrels per day to over 90,000 barrels per day by June and July. This increase is largely driven by Chevron’s Ballymore offshore project, which came online in April and is expected to reach a production capacity of approximately 75,000 barrels per day. Although current volumes appear slightly below this target, the ramp-up, particularly through July, indicates strong growth, with potential for further increases. This uptick has likely contributed to improved Q2 earnings for Williams’ Mountaineer system, with additional upside expected as Ballymore production continues to grow.

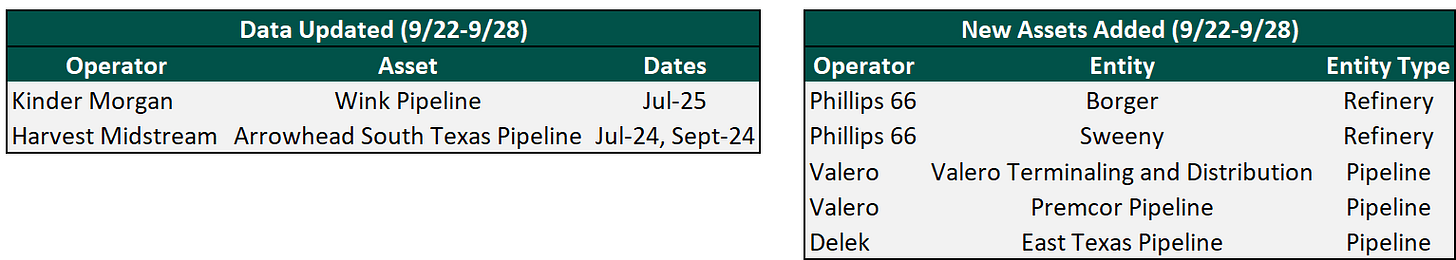

Flow/Transaction Updates and New Assets Under Coverage (9/22-9/28)

Plainview has over 200 assets with crude oil flow or transactional data on our platform and continues to add more each week. Data for existing assets under coverage are posted as soon as they become available. Below are the assets that were updated this week or newly added to coverage.

News that Caught our Eye (9/22-9/28)

None! Quiet week.